dogwifhat: How WIF risks deeper correction amidst bullish pattern

- The asset dangers shedding its present assist stage throughout the bullish sample it’s buying and selling in, doubtlessly resulting in a deeper correction.

- Metrics reveal lively participation from each lengthy and quick merchants, however with a transparent path.

dogwifhat [WIF] has been predominantly bearish, with a month-to-month market efficiency of -43.11%. Nevertheless, there are indicators that the downtrend could pause within the coming buying and selling periods.

Earlier than any rally materializes, WIF is prone to expertise a further worth drop from its present stage. The current 14.69% decline over the previous 24 hours could lengthen additional.

WIF stays bullish however dangers a short-term drop

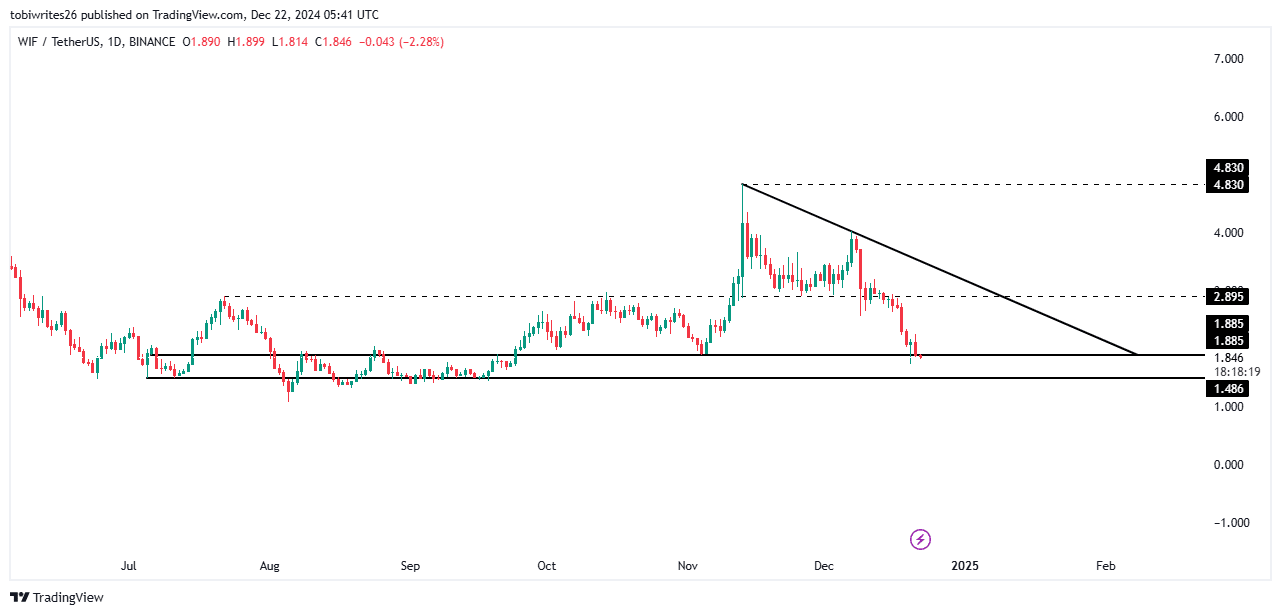

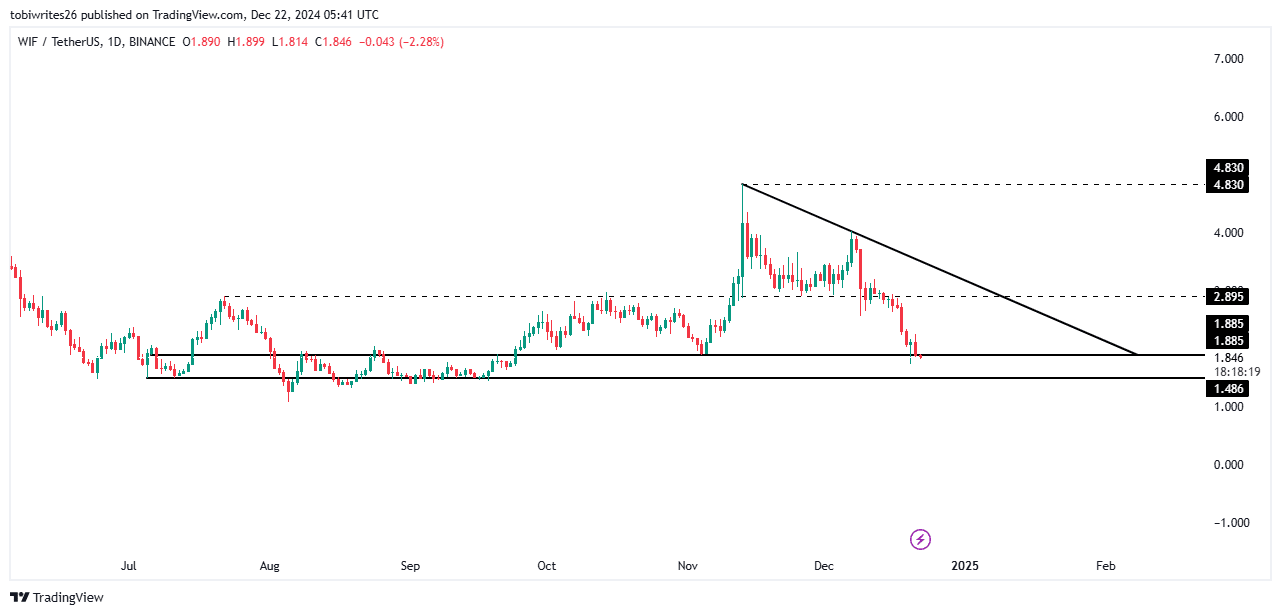

On the chart, WIF has fashioned a bullish sample. It has now traded right down to the assist stage of this construction at 1.885, which might sometimes set off a bounce. Nevertheless, important shopping for exercise at this stage has but to materialize.

If the 1.885 assist fails to carry, WIF is prone to lose energy and fall into a spread. The following potential assist lies at 1.486, the place the asset could discover the mandatory momentum for a bounce.

Supply: Buying and selling View

As soon as a bounce is initiated, WIF will face two key resistance ranges on its path to a rally. The primary is at 2.895, adopted by the higher boundary of the bullish sample. Overcoming these hurdles may see WIF establishing its subsequent excessive at $4.830.

A drop in WIF’s worth is imminent

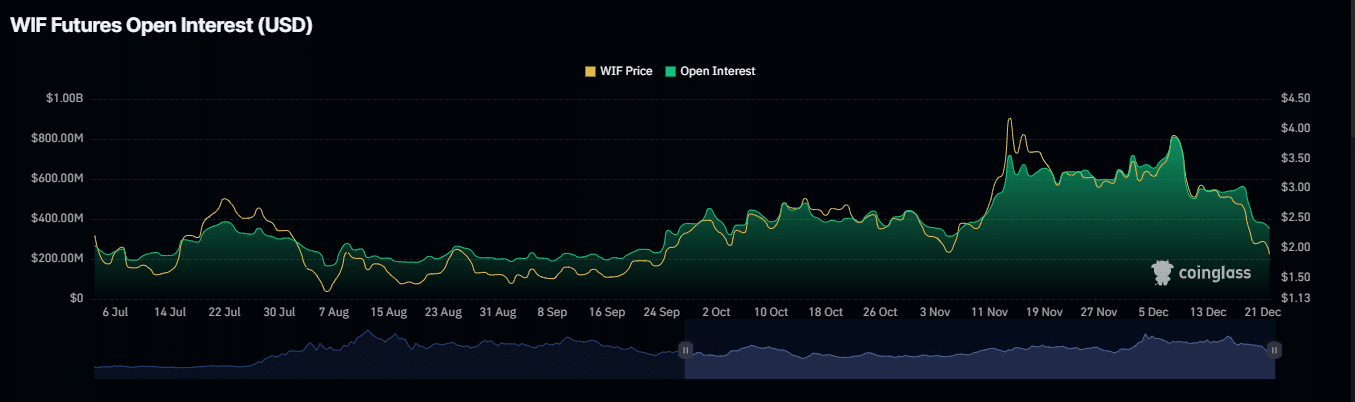

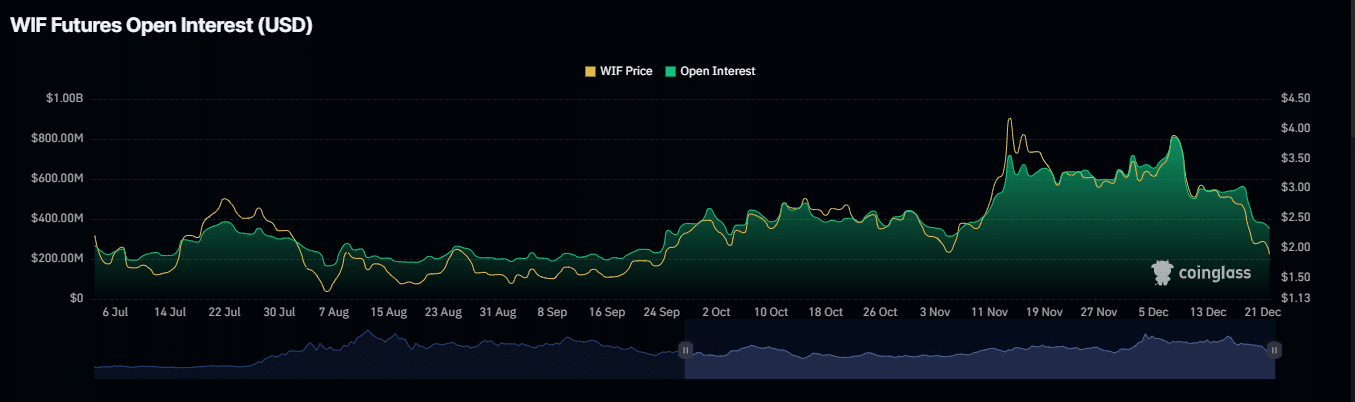

The Open Curiosity (OI) of WIF has been steadily declining. On the time of writing, OI has fallen to $360.94 million, marking an 11.25% lower.

This decline in OI is pushed by spinoff merchants actively closing their positions because the asset’s worth continues to drop. Consequently, WIF’s market capitalization has decreased by 14.29% to $1.88 billion, whereas buying and selling quantity has plunged by 44.16% to $496.58 million.

Supply: Coinglass

Moreover, there was a shift in market sentiment, with quick contracts outnumbering lengthy contracts. The present long-to-short ratio stands at 0.89, indicating that there are extra quick positions than lengthy ones.

When this ratio stays under 1, it means bearish dominance out there.

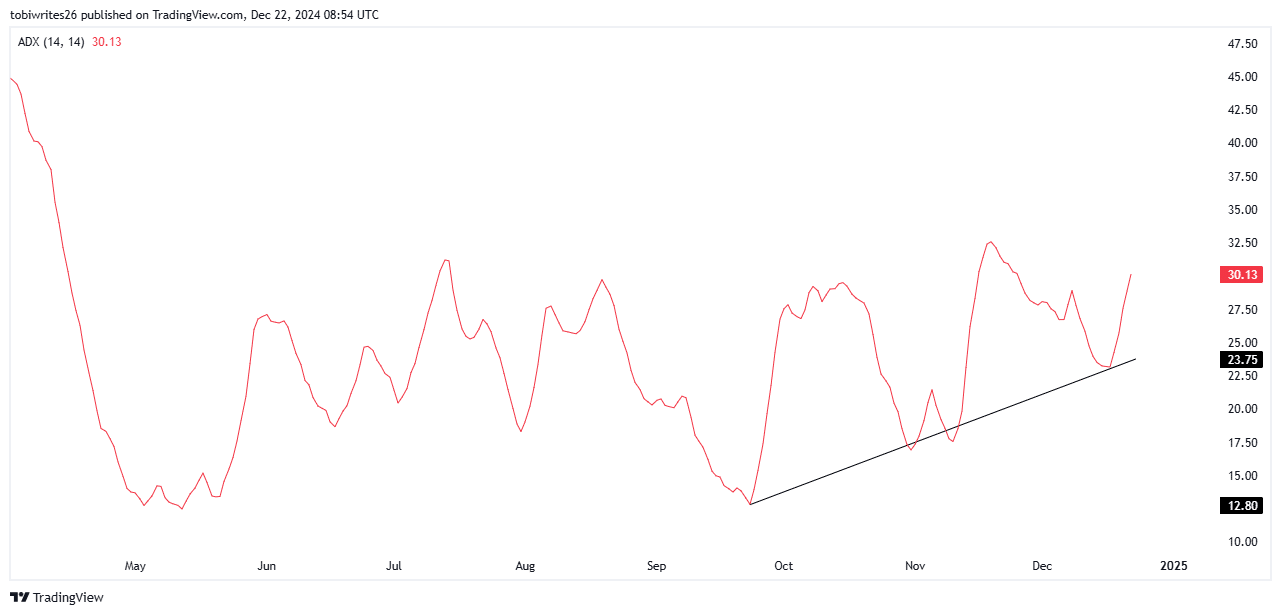

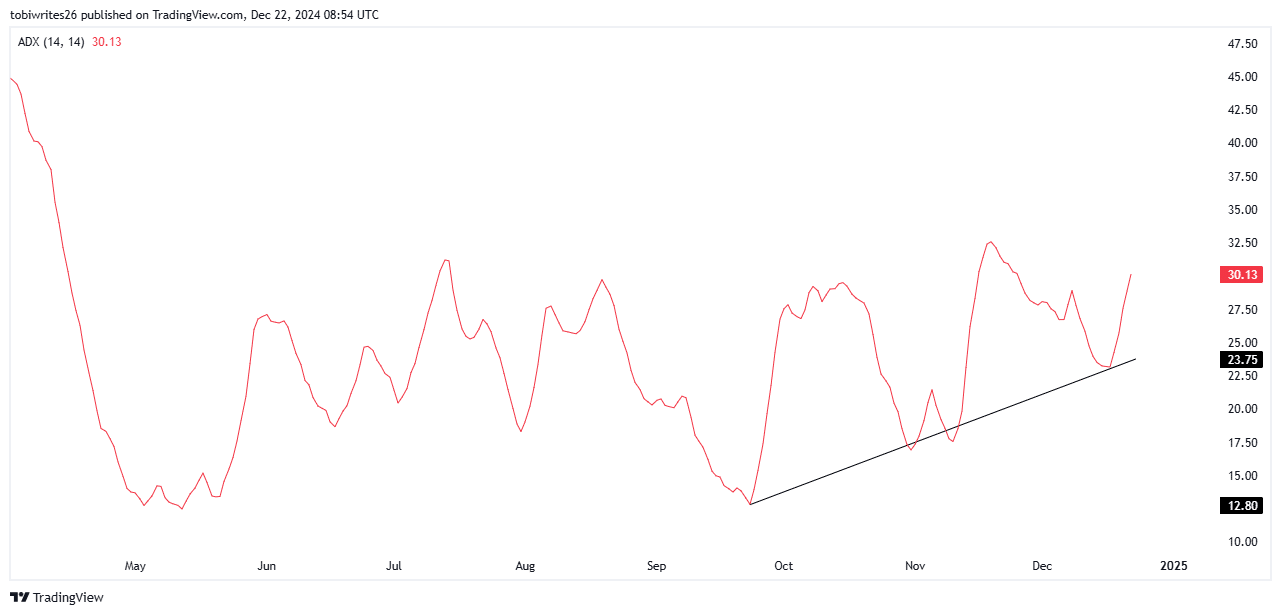

Additional supporting the probability of a worth drop is the Common Directional Index (ADX), which at present reads 30.19, an indication of a robust bearish development. An growing ADX throughout a worth decline signifies that the bearish momentum is intensifying.

Supply: Buying and selling View

With these metrics aligning, the asset’s worth is anticipated to fall under its present assist stage.

Bullish energy stays excessive regardless of a minor drop forward

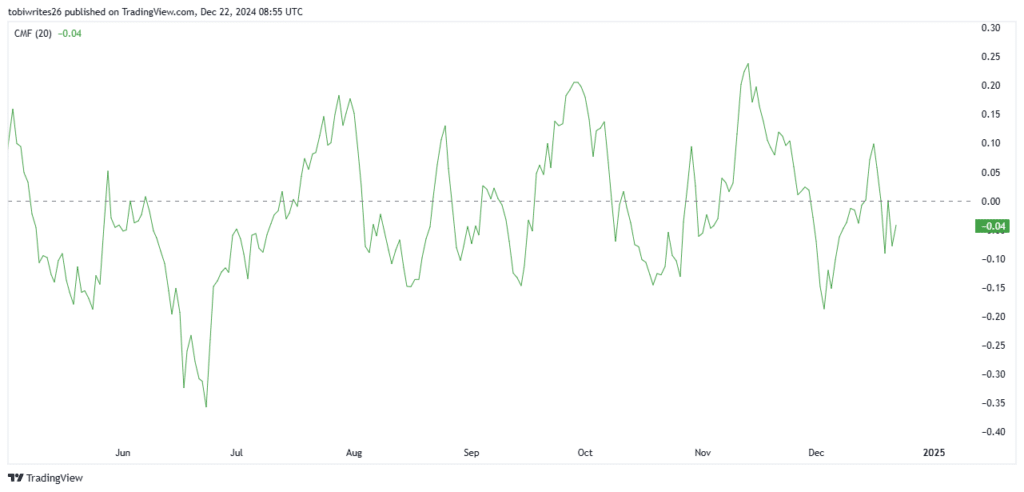

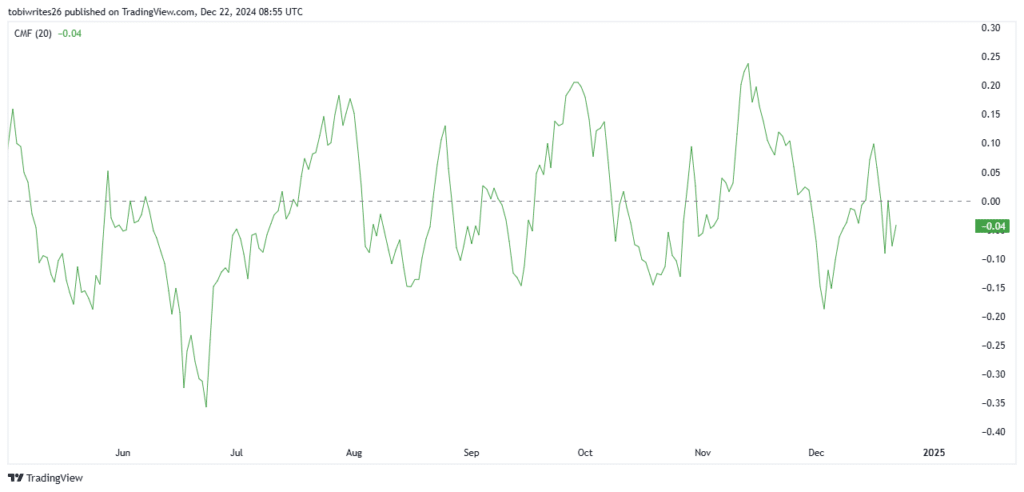

Bullish sentiment persists out there, supported by the Chaikin Cash Circulation (CMF), which is trending upward and nearing the zero-line threshold.

When the CMF traits larger, it signifies that purchasing quantity exceeds promoting quantity, with a possible reversal to the upside being shut. If the CMF crosses above the impartial zero line, it may drive the worth larger.

Supply: Buying and selling View

The present motion of the CMF suggests ongoing accumulation on the assist stage. Nevertheless, this accumulation could briefly weigh on the worth, inflicting a minor dip earlier than the bullish momentum intensifies.

Learn dogwifhat’s [WIF] Value Prediction 2024–2025

As well as, spot merchants are more and more transferring their WIF holdings to personal wallets for long-term storage. At current, roughly $5.50 million price of WIF has been moved on this method.

Whereas WIF maintains its total bullish outlook, a slight drop in worth stays possible within the quick time period.