Dogwifhat Rally Imminent? Whale Buys 9.50 Million WIF

Regardless of the continual value decline in Dogwifhat (WIF), the favored Solana-based meme coin is gaining vital consideration from crypto lovers. Lately, the favored blockchain-based transaction tracker Onchain Lens shared a publish on X (previously Twitter), revealing {that a} newly created pockets withdrew 9.47 million WIF tokens value $6.90 million from Binance.

Whale Buys 9.50 Million WIF Meme Coin

Such a considerable WIF withdrawal means that this whale might need identified one thing concerning the meme coin, particularly as its value continues to fall and this newly created pockets made such transactions.

$6.60 Million Price WIF Outflow

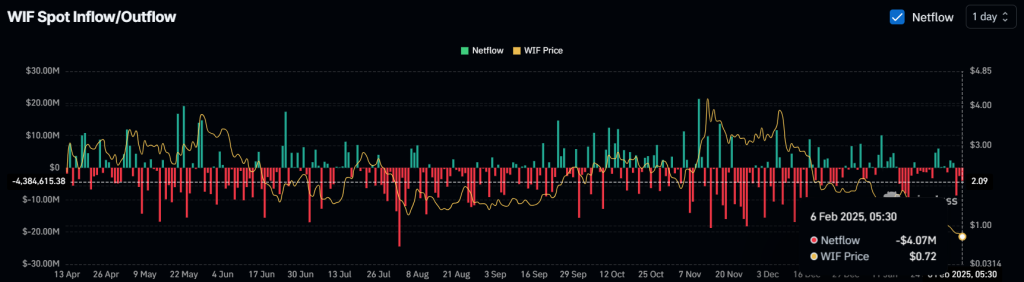

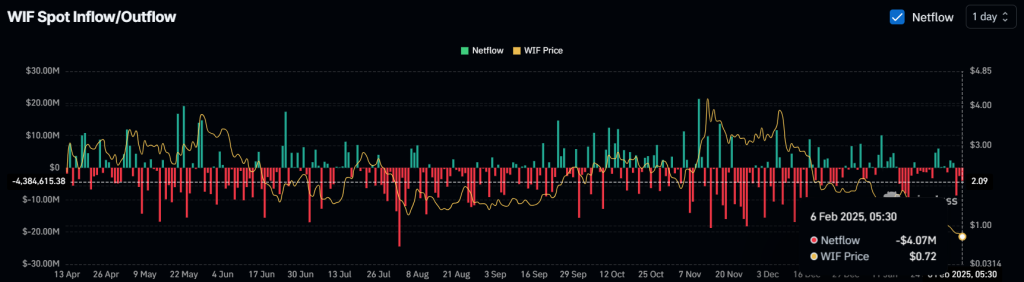

Apart from this, some long-term holders and traders have additionally been accumulating the meme coin, as reported by Coinglass. Knowledge from the spot influx/outflow metrics revealed that exchanges have been witnessing steady WIF outflows for the final three days after a interval of inflows. Nonetheless, previously 48 hours, exchanges have seen an outflow of $6.60 million value of WIF meme cash.

This large outflow from exchanges signifies potential accumulation by whales and long-term holders, suggesting they is likely to be seizing the present market sentiment and value drop to purchase a big quantity of WIF meme cash. This accumulation may create potential shopping for strain as soon as the sentiment shifts.

Present Value Momentum

Regardless of these transactions and up to date whale exercise, WIF’s value stays unchanged. At present, the meme coin is buying and selling close to $0.72 and has dropped over 8% previously 24 hours. Throughout the identical interval, its buying and selling quantity declined by 8%, indicating decrease participation from merchants and traders in comparison with earlier days.

Merchants Robust Curiosity in Brief Positions

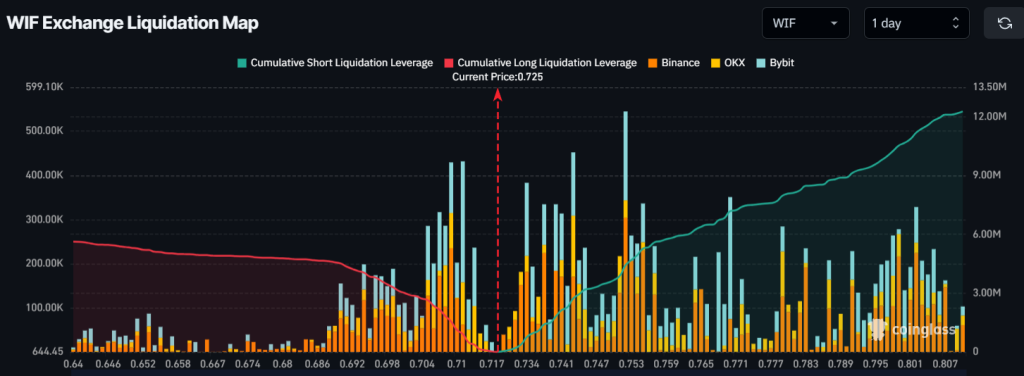

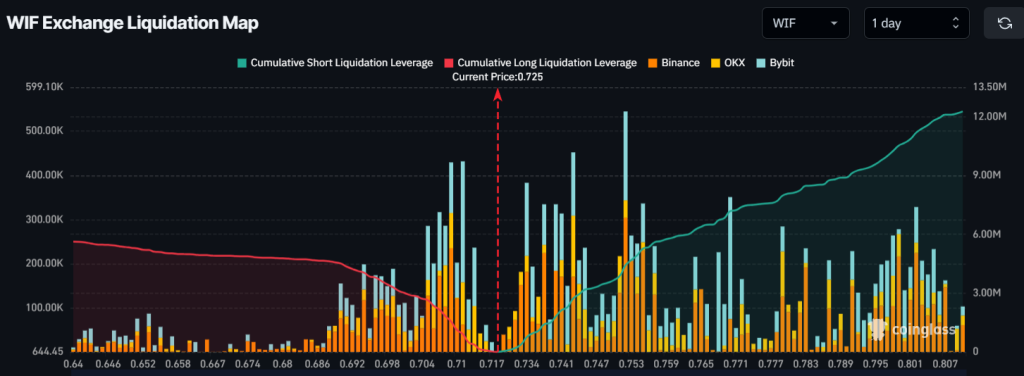

This bearish market sentiment and steady value decline have been attracting notable curiosity from merchants briefly positions. At press time, merchants holding brief positions are dominating the market.

Knowledge reveals that merchants holding lengthy positions are over-leveraged at $0.709, with $1.55 million value of lengthy positions. Conversely, at $0.752, merchants holding brief positions are over-leveraged, holding $4.45 million value of brief positions.

This large brief place means that brief sellers are capitalizing on the present market sentiment to liquidate lengthy positions.