Bitcoin Drops Again, Though Analysts Say The Move Isn’t Unusual

Bitcoin’s newest slide has pushed costs into territory not seen to date this 12 months, with the market briefly buying and selling close to the low $75,000 space.

Associated Studying

Losses have piled up over latest months, leaving the asset effectively beneath its document peak and stirring recent debate about whether or not the broader uptrend has stalled.

The drop didn’t occur in isolation, although, and the timing factors to wider strain throughout threat property moderately than a crypto-only shock.

Bids Cluster Under $73k

Order books present thicker purchase curiosity clustered in a variety that stretches from about $71,500 down towards $64,000. In accordance with market feeds, that demand is seen however tentative.

When many bids sit on alternate books they’ll gradual a fall, however they’ll additionally disappear shortly if sellers speed up.

Liquidations have amplified the slide: pressured closures of leveraged longs have been reported within the hundreds of thousands and such occasions can create brief, violent drops even the place elementary demand stays.

This mannequin exhibits present bitcoin worth motion remains to be sitting inside historic norms at $74,000.

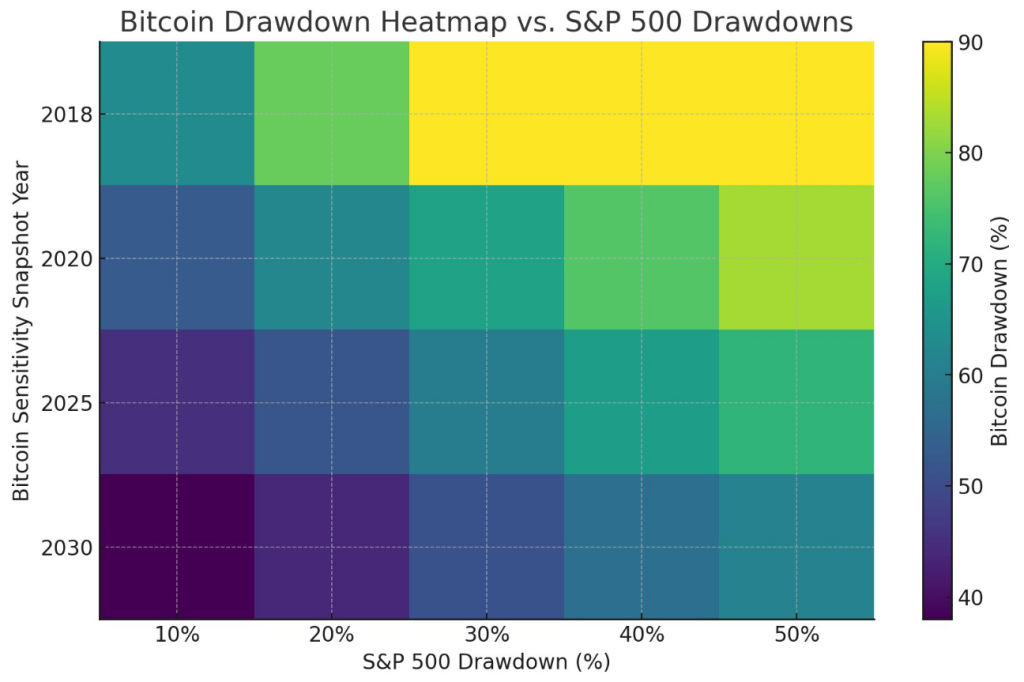

Bitcoin is down ~40% from its October excessive whereas U.S. equities stay close to all time highs, with the S&P 500 down lower than 10%. Beneath these circumstances, a doable ~45% bitcoin… https://t.co/E8oiOKD3VE

— Joe Burnett, MSBA (@IIICapital) February 3, 2026

Nothing Out Of The Strange

In accordance with Joe Burnett, vp of Bitcoin technique at Attempt, the latest downturn nonetheless matches inside patterns seen in prior market cycles.

Burnett mentioned Bitcoin hovering across the mid-$70,000 vary displays a drawdown dimension that has appeared earlier than during times of speedy adoption and worth discovery.

He added that swings of this scale have a tendency to indicate up when an asset remains to be being priced by the market, moderately than when it has settled right into a steady buying and selling vary.

Tech Shares Drag On Danger Urge for food

The pullback in US tech names, significantly these tied to AI infrastructure, has been cited by a number of market watchers as a linked trigger.

NVIDIA and Microsoft had been among the many greater drags on main indices, and stories be aware that weak sentiment round earnings and high-cost AI build-outs has left buyers extra cautious.

When massive progress shares wobble, buyers typically trim different dangerous positions too, and crypto has been swept up in that movement.

Associated Studying

Retail dip-buying was seen on some exchanges, and institutional spot purchases had been reported as effectively.

In accordance with Burnett, a forty five% drawdown is near historical swings, which suggests volatility like this has precedents. That view doesn’t take away ache for merchants, but it surely does place the drop into an extended sample moderately than labeling it terminal.

Featured picture from Unsplash, chart from TradingView