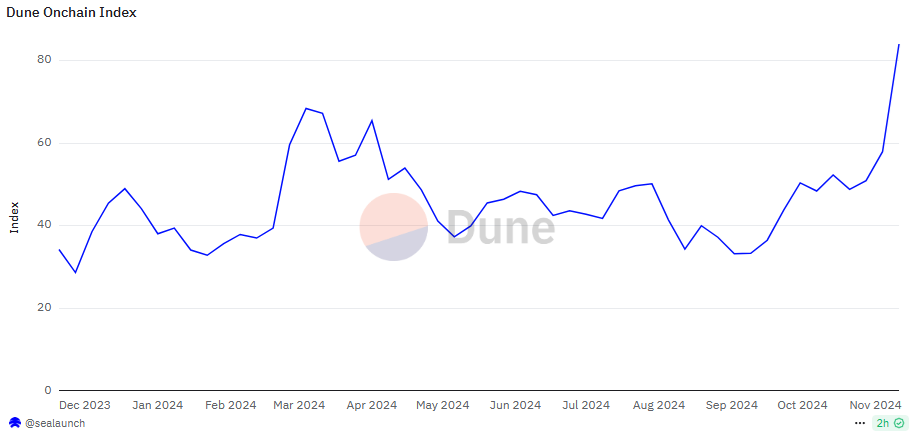

Dune on-chain index points to all-time high in crypto adoption

The Dune index, monitoring on-chain exercise and consumer profiles, factors to a brand new all-time excessive of crypto adoption. The exercise hinges on high chains, together with Bitcoin (BTC), and factors to each pockets development and token turnover.

The Dune index factors to an all-time excessive crypto adoption, after a relentless development development since September. The index expanded from an area low of 33 factors to 84 factors, coinciding with the all-time excessive of Bitcoin (BTC) above $99,600. On-chain information of crypto adoption surpassed the market peak in March, and mirrored probably the most profitable weeks of the bull market within the final quarter. The index factors to probably the most helpful networks and the commonest makes use of for crypto.

The Dune index of crypto adoption reached a brand new all-time excessive of 84 factors after new Solana and Bitcoin value data. | Supply: Dune Analytics

The whole Dune index hinges on chains that obtain an optimum mixture of charges, switch volumes in greenback phrases, and the variety of on-chain transactions. The normalized index reveals which chains have livelier financial exercise. The index weighs the worth and charges greater than uncooked transactions, as some chains have low-quality volumes. In consequence, Dune filters out a few of the chains which report excessive visitors, however with out enough app exercise or worth transfers.

In This fall, the main chains driving adoption had been Solana, Bitcoin, and Ethereum. TRON was in fourth place, although with a in another way centered ecosystem. The index fluctuates for every chain, relying on present situations. A number of the former leaders misplaced their footprint within the index, with outflows from Arbitrum, Avalanche, and Base.

Solana turns into the largest internet gainer primarily based on its Dune index

The Dune index additionally measures the success of particular chains. Solana had the largest index change, underscoring its rise because the go-to chain for the largest influx of latest customers. On a weekly foundation, Solana additionally had internet good points in adoption, whereas most different high L2 and different networks noticed their utilization index slide. Solana additionally achieved 3,442% development of its on-chain charges as a result of demand for quick DEX swaps.

Base had the second-highest yearly development, however stalled within the brief time period. One of many causes for the decrease adoption is the commentary that L2 chains didn’t actually faucet the meme token development. Technically, virtually all L2 chains had been able to carrying meme tokens. Base was particularly outfitted, even holding an on-chain summer time to drive meme tokens for enjoyable. Within the brief time period, Gnosis had the strongest month-on-month development, because of the influx of curiosity into prediction markets.

Whereas Solana had important on-chain exercise and charges, Bitcoin and TRON had been leaders when it comes to the share of internet transfers. Within the case of BTC, transfers are bigger and extra helpful. TRON has a distinct consumer profile and is getting a lift from USDT transactions. Each chains achieved a lot larger greenback quantity transfers, whereas Solana and Base carried a number of low-value transactions.

Solana is but to outperform Ethereum in absolute phrases of worth locked, market capitalization, or obtainable liquidity. Nevertheless, the chain confirmed the mandatory situations for a lot wider adoption and consolidated liquidity. Compared, the Ethereum ecosystem had a wider distribution of apps and variations, resulting in consumer confusion and fragmented markets.

Ethereum nonetheless carries the majority of worth transfers

L2 chains have elevated their adoption, however not as a lot as anticipated. Within the Ethereum ecosystem, the principle chain nonetheless carries greater than 66% of financial exercise. The remainder is break up between the highest L2, with negligible contributions from area of interest chains.

The Dune index stays sturdy for Arbitrum, Base, Optimins, Celo, and Mantle, with no important adoption from the likes of Zora, ZKEVM, or ZKSync. These chains continued to say no after the preliminary hype across the airdrop intervals.

The Ethereum ecosystem peaked in March 2024, on the time the L2 narrative was extra broadly hyped. Regardless of development up to now month, the Ethereum ecosystem is but to get better its all-time excessive. The Dune index is the best for Ethereum, with a lot decrease values for its whole L2 ecosystem. Ethereum’s index additionally had the strongest development, whereas different chains didn’t speed up their adoption. Regardless of the on-chain index, ETH costs failed to interrupt out of their typical vary. ETH traded round $3,300, persevering with to mark new all-time lows towards BTC.

From Zero to Web3 Professional: Your 90-Day Profession Launch Plan