EigenLayer Founder Reiterates Support For Ethereum, Why Is ETH Struggling?

Este artículo también está disponible en español.

Regardless of scalability and excessive fuel charges dealing with Ethereum, the founding father of EigenLayer, a liquidity restaking platform, insists the community is superior, particularly towards Solana. Solana is the third most dear good contracts platform, trailing Ethereum and the BNB Chain. Through the years since launching, it has been wolfing down extra market share from Ethereum, cementing its place.

Is Ethereum Superior To Solana?

Whereas the prominence of Solana is obvious, Sreeram Kannan, the founding father of EigenLayer, argued in a put up on X that Solana prioritizes low latency and international node synchronization over different core options.

Associated Studying

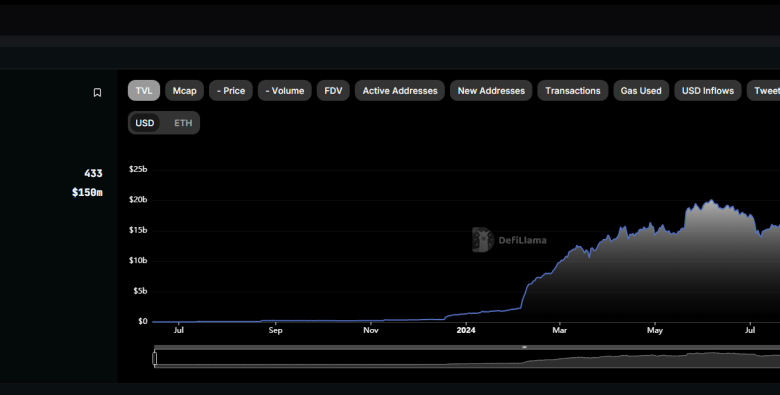

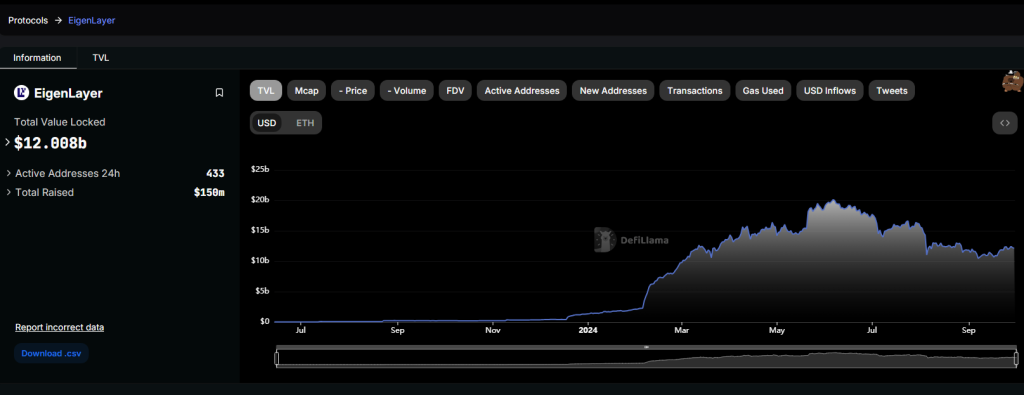

Alternatively, Ethereum took a special method, emphasizing the necessity for stability and decentralization. Accordingly, in Kannan’s view, the primary good contracts platform affords a extra complete answer than its competitor. At the moment, EigenLayer manages over $12 billion value of property on Ethereum, based on DeFiLlama.

Though Kannan acknowledges the effectivity of Solana, the founder nonetheless picks out some limitations now that the platform is constructing a world state machine. On the prime of the record is the blockchain’s sacrifice of programmability and verifiability.

In the meantime, the EigenLayer lead thinks Ethereum is excelling, particularly on efficiency, thanks partly to the success of rollups and the ensuing wild adoption. This off-chain answer offers immediate affirmation and is extra performant than web2 functions.

On the similar time, Ethereum is programmable, enabling EigenLayer so as to add extra options like an arbitrary decentralization of verifiable duties. Because of this, the liquidity restaking platform, Kannan provides, has enabled cloud-scale programmability.

Layer-2 Platforms Thriving: Why Is ETH Struggling?

The co-founder of Celestia, Mustafa Al-Bassam, additionally appreciates what Ethereum brings to the desk and is absent or underdeveloped in different networks. In a put up on X, Al-Bassam stated the primary good contracts platform is “underrated.”

Associated Studying

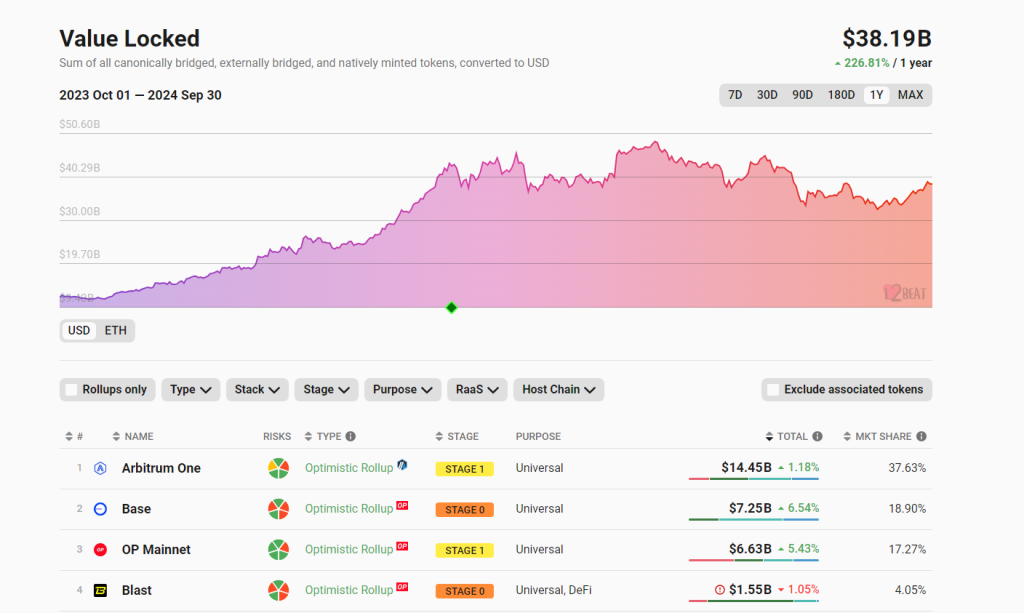

Particularly, the co-founder lauded the thriving rollup ecosystem in Ethereum, saying it’s “by far the biggest and most profitable.” As of September 30, L2Beat information reveals that the layer-2 ecosystem in Ethereum manages over $38 billion, with Arbitrum and Base among the many largest platforms.

Whilst Base and different Ethereum layer-2 platforms draw exercise, ETH, the native forex, is struggling for momentum. The each day chart reveals bulls have but to interrupt above $2,800, though assist stays at $2,400.

Dwindling upside momentum has been partly blamed on the proliferation of layer-2 scaling options. The community turns into inflationary as extra exercise is re-routed off-chain, and enhancements like Dencun are activated to make layer-2 transactions even cheaper. Taking a look at Ultra Sound Money, fewer ETH are usually not being torched.

Characteristic picture from DALLE, chart from TradingView