Elon Musk, Bitcoin, and the possibility of volatility

- The share of BTC provide in revenue fell from 71% to 61%.

- BTC was nonetheless underneath $26,000, however a number of metrics had been bullish.

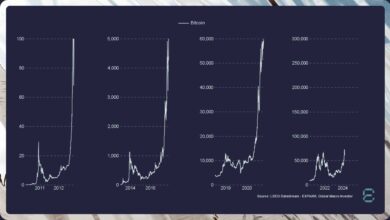

Over the previous couple of days, the crypto market witnessed a sudden downtrend, inflicting prime cash like Bitcoin [BTC] and Ethereum’s [ETH] worth to plummet. Not solely was the impact restricted to the market leaders, however altcoins with decrease market caps additionally felt the warmth.

Learn Bitcoin’s [BTC] Worth Prediction 2023-24

Why did Bitcoin’s worth sink?

Over the previous few weeks, BTC remained snug underneath the $30,000 mark. Nevertheless, buyers had been shocked on 17 August because the king coin witnessed a serious drop, pushing its worth under $26,000.

In line with CoinMarketCap, BTC was down by greater than 11% within the final seven days. At press time, it was buying and selling at $25,897.22 with a market capitalization of over $503 billion. Moreover, its buying and selling quantity additionally sank by over 38% within the final 24 hours.

Although there might need been a number of components at play that brought on the whole market to show pink, Lookonchain identified what might have been probably the most potent set off. Unsurprisingly, it was Elon Musk who ignited this episode.

Musk’s spacecraft engineering firm, SpaceX, had offered $373 million price of Bitcoin. This dump from SpaceX might need sparked worry amongst buyers, leading to a worth drop.

What occurred to the market prior to now 24 hours?

11 hrs in the past, the Wall Road Journal reported that SpaceX had offered $373M price of $BTC.

After that, $BTC dropped to $25,166.

9 hrs in the past, #Bloomberg reported that #SEC will approve the Ether-futures ETFs, and the decline stopped. pic.twitter.com/QO2Bvy2HHb

— Lookonchain (@lookonchain) August 18, 2023

The value decline had a bigger influence on BTC’s on-chain metrics. Glassnode’s latest analysis revealed that the proportion of BTC provide in revenue has simply fallen from 71% to 61%. This displays the ‘top-heavy’ market, which has turn out to be more and more worth delicate.

Furthermore, Bitcoin’s variety of UTXOs in loss simply reached a one-month excessive of 41,944,655.958. Not solely that, however whale exercise across the coin dropped as its variety of whales simply reached a 1-month low of 1,599.

📉 #Bitcoin $BTC Variety of Whales simply reached a 1-month low of 1,599

Earlier 1-month low of 1,602 was noticed on 16 August 2023

View metric:https://t.co/k1K8OK2tl3 pic.twitter.com/HHRKRCczqg

— glassnode alerts (@glassnodealerts) August 19, 2023

Bitcoin exhibiting indicators of restoration

Nevertheless, the market decline got here to a halt, due to the Securities and Change Fee (SEC). This occurred after the regulatory physique revealed its plans to approve Ethereum futures ETFs.

In line with a 17 August Bloomberg report, the SEC is unlikely to dam the product, which has seen quite a lot of functions from quite a few companies. Since then, BTC’s on-chain metrics have proven indicators of restoration, giving hope that the king of crytpos’ worth would possibly witness an uptick.

Is your portfolio inexperienced? Verify the Bitcoin Revenue Calculator

Notably, as per CryptoQuant, Bitcoin’s change reserve was reducing, suggesting that the coin was not underneath promoting strain. The coin’s aSORP was inexperienced, which meant that extra buyers had been promoting at a loss, signaling a potential market backside.

Furthermore, BTC’s Relative Energy Index (RSI) was in an oversold place. This might improve shopping for strain on the coin and, in flip, improve its worth.

Supply: CryptoQuant