ENA’s price faces key resistance at $0.5 – Will bulls break through?

- Ethena had a bearish construction on the day by day chart

- OBV moved previous native highs, but it surely appeared unlikely that the worth might comply with

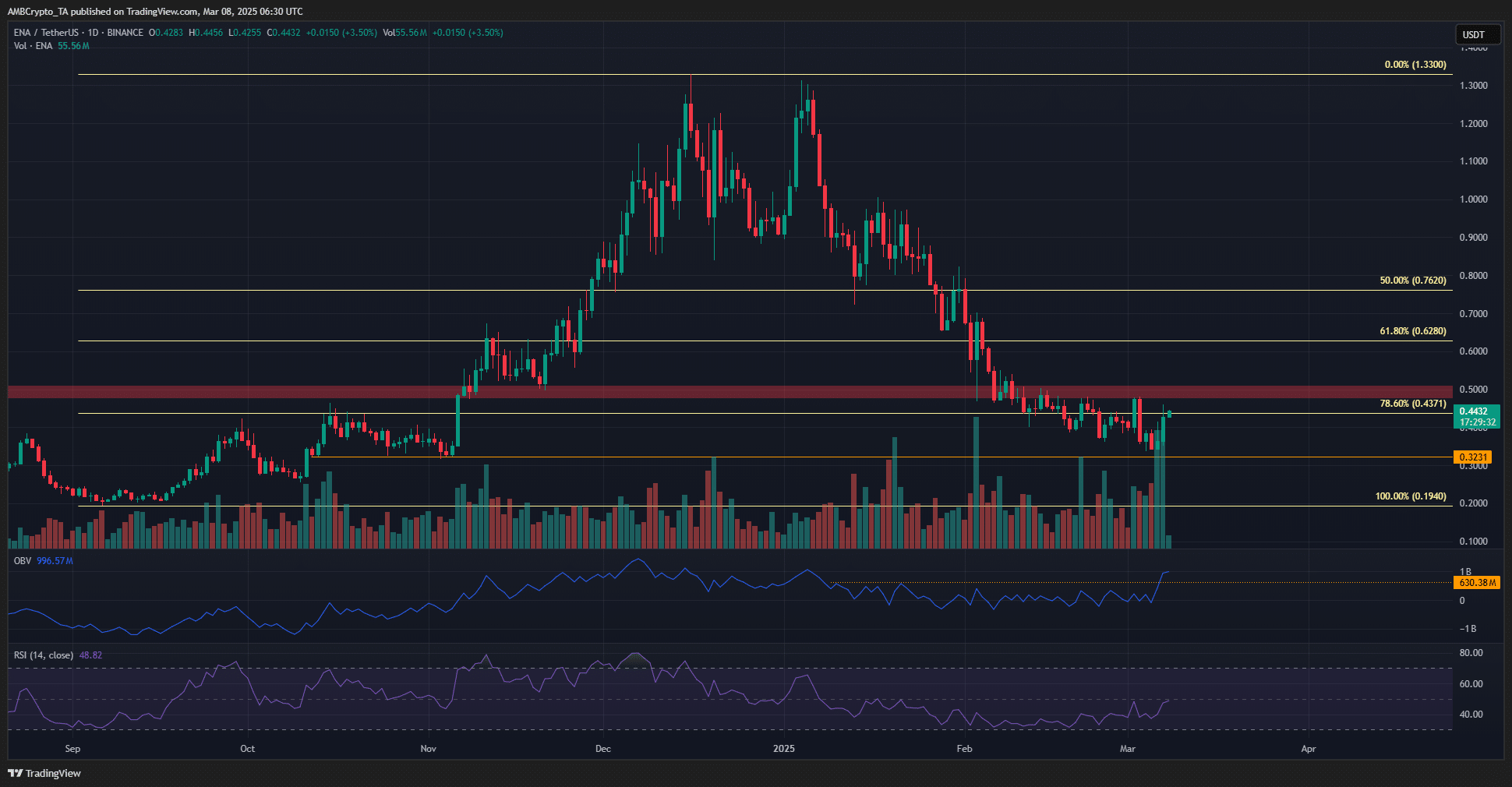

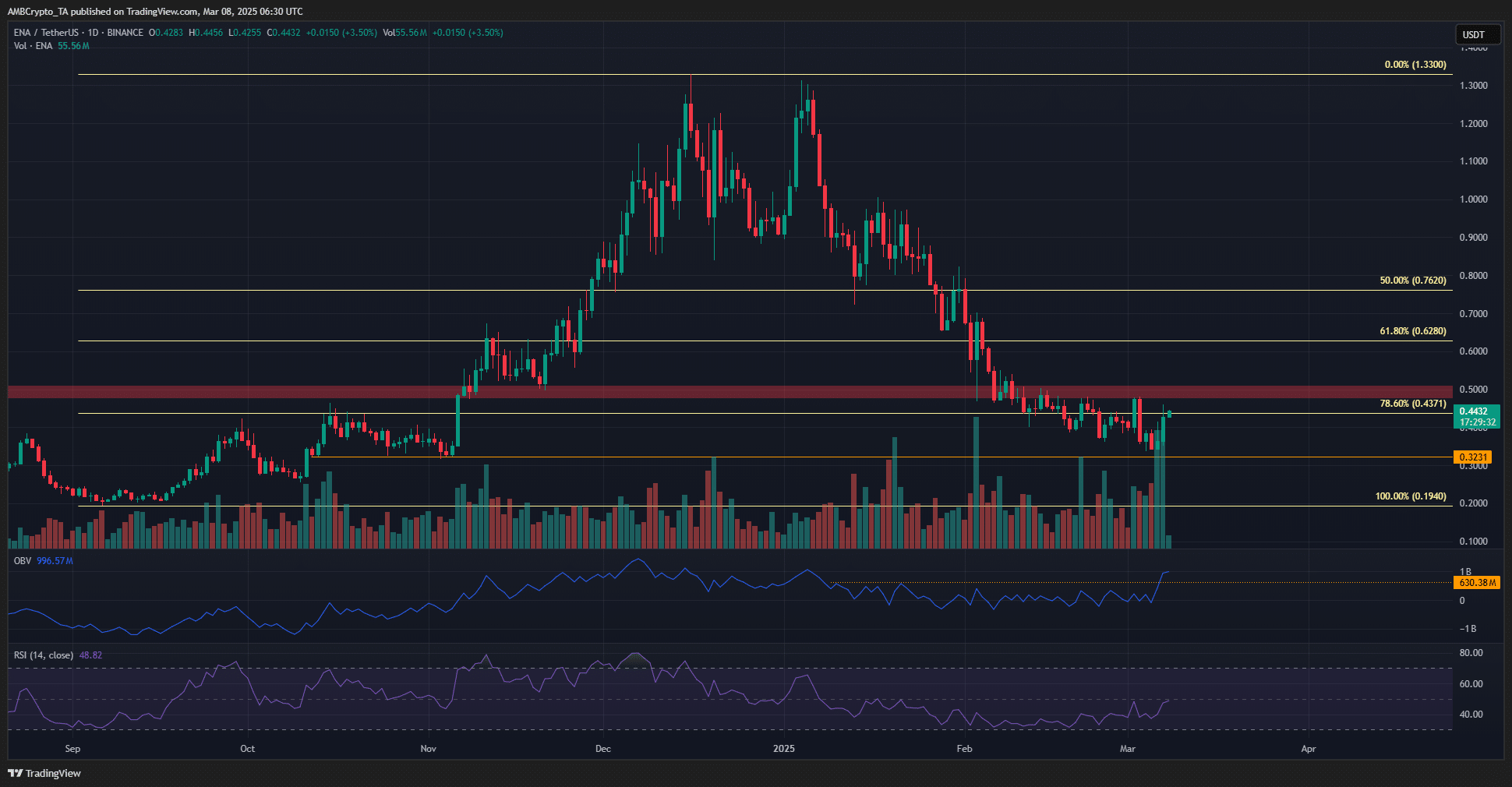

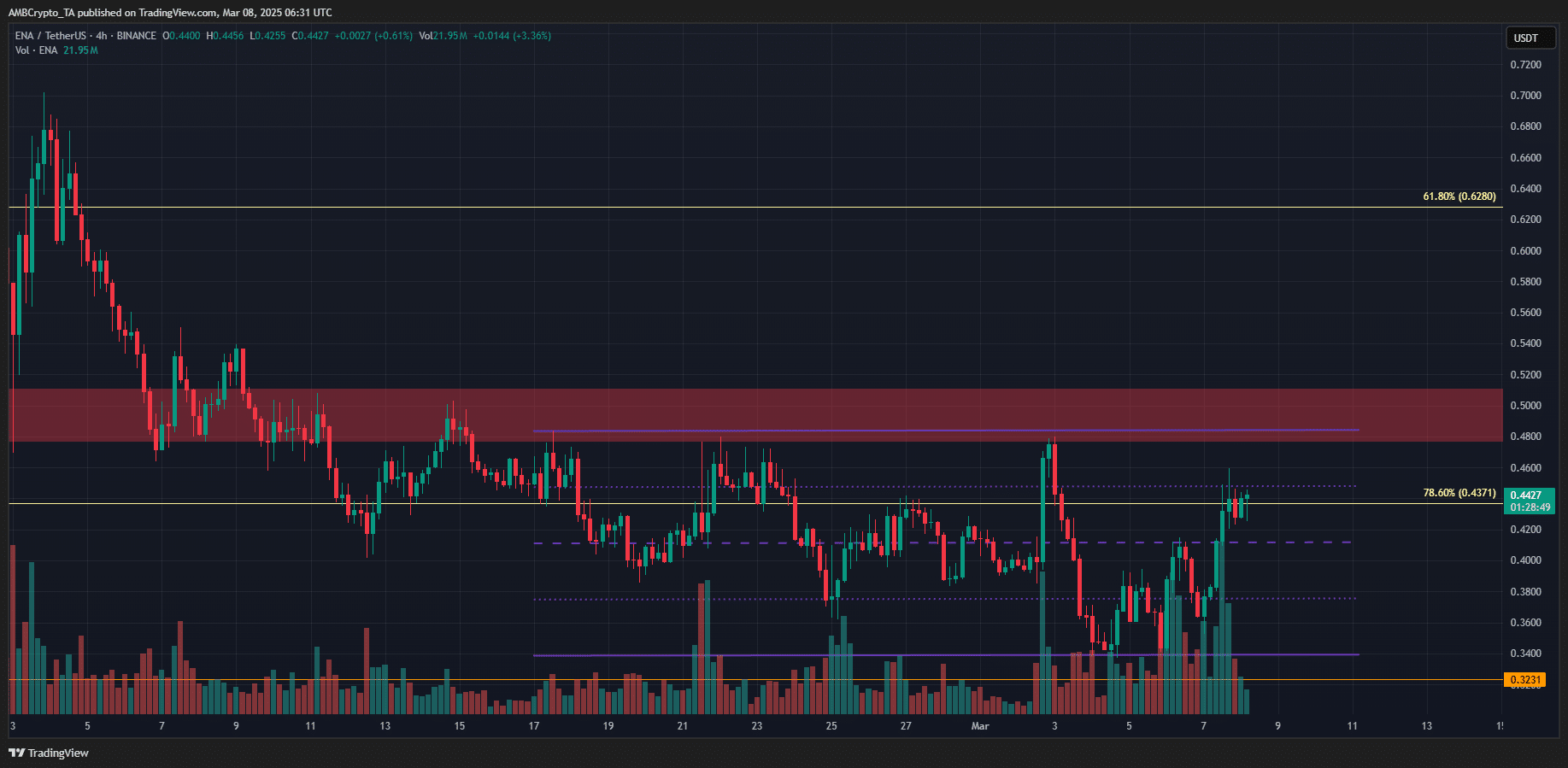

Ethena’s value [ENA] fell beneath the $0.5 assist zone in February, however its decline appeared to have halted at press time. In truth, only recently, a variety formation beneath the $0.5 resistance was noticed. This might current merchants with worthwhile alternatives.

Bitcoin’s [BTC] volatility might even have an element to play. The world’s main crypto visited the $92.8k resistance on Thursday, 6 March, and confronted rejection as soon as once more. Will ENA additionally see a downward trajectory over the weekend?

ENA consumers seem to have the higher hand now

Supply: ENA/USDT on TradingView

The market construction on the day by day chart was bearish. The value has solely made decrease highs and decrease lows in 2025. The latest decrease excessive was at $0.48, and a day by day session shut above that might trace at a market construction shift.

The buying and selling quantity has been excessive over the previous couple of days, with the identical mirrored by the amount bars beneath the worth. This inflow of quantity brought about the OBV to interrupt out past the final two months’ native highs.

At press time, the RSI was testing impartial 50 as resistance too, displaying a possible momentum shift across the nook. Collectively, they hinted at a bullish transfer on the charts.

Supply: ENA/USDT on TradingView

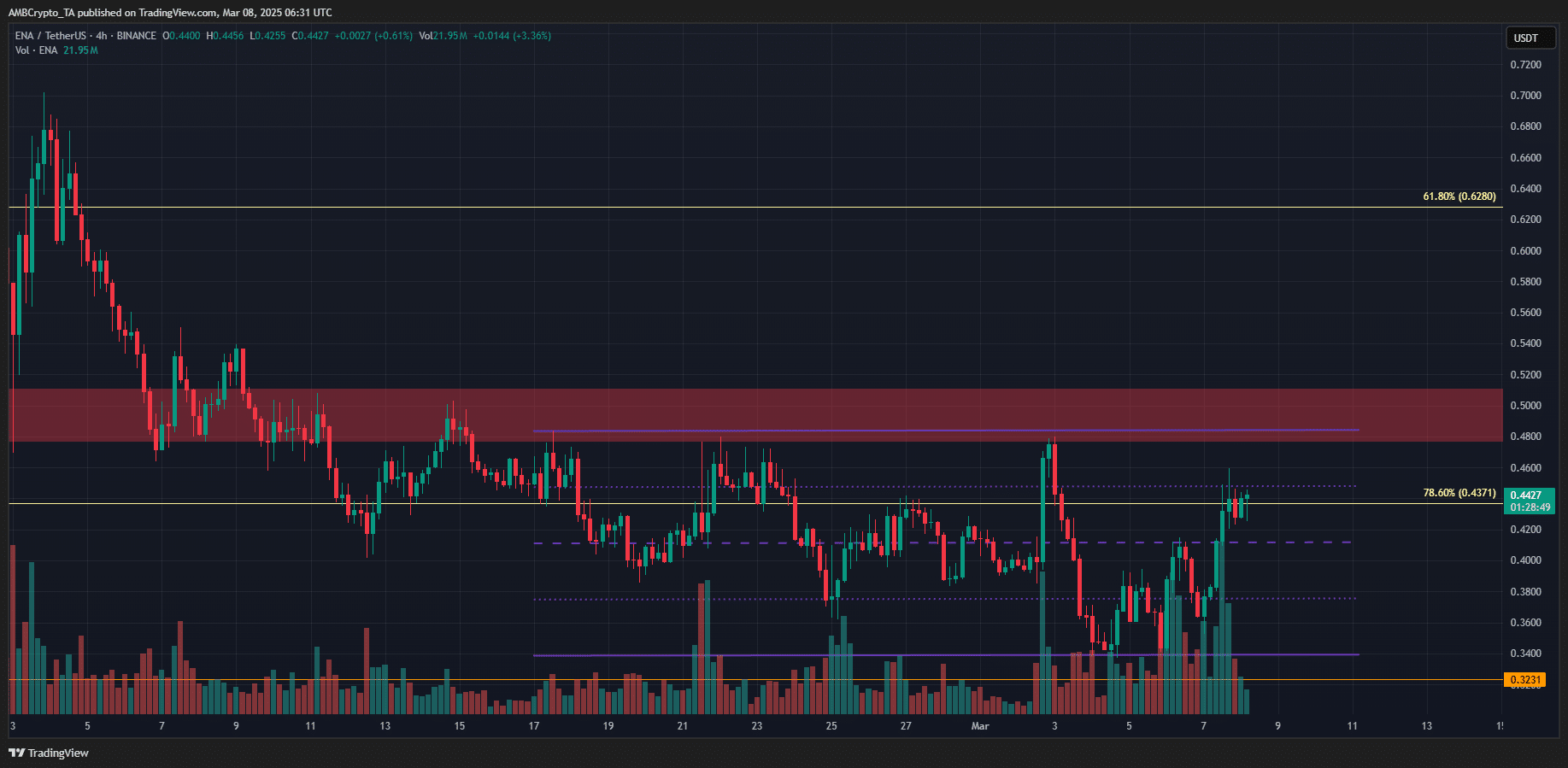

Zooming into the 4-hour chart, we will see a variety formation (purple) with the highs inside the $0.5 resistance zone. At press time, ENA bulls have been wrestling with the vary’s 25% stage at $0.448.

Even when they handle to beat it, a breakout past $0.5 could not but be at hand. Regardless of the OBV breakout, merchants ought to stay bearish and look to promote the retest of $0.48-$0.5. This, as a result of the upper timeframe bias remained bearish.

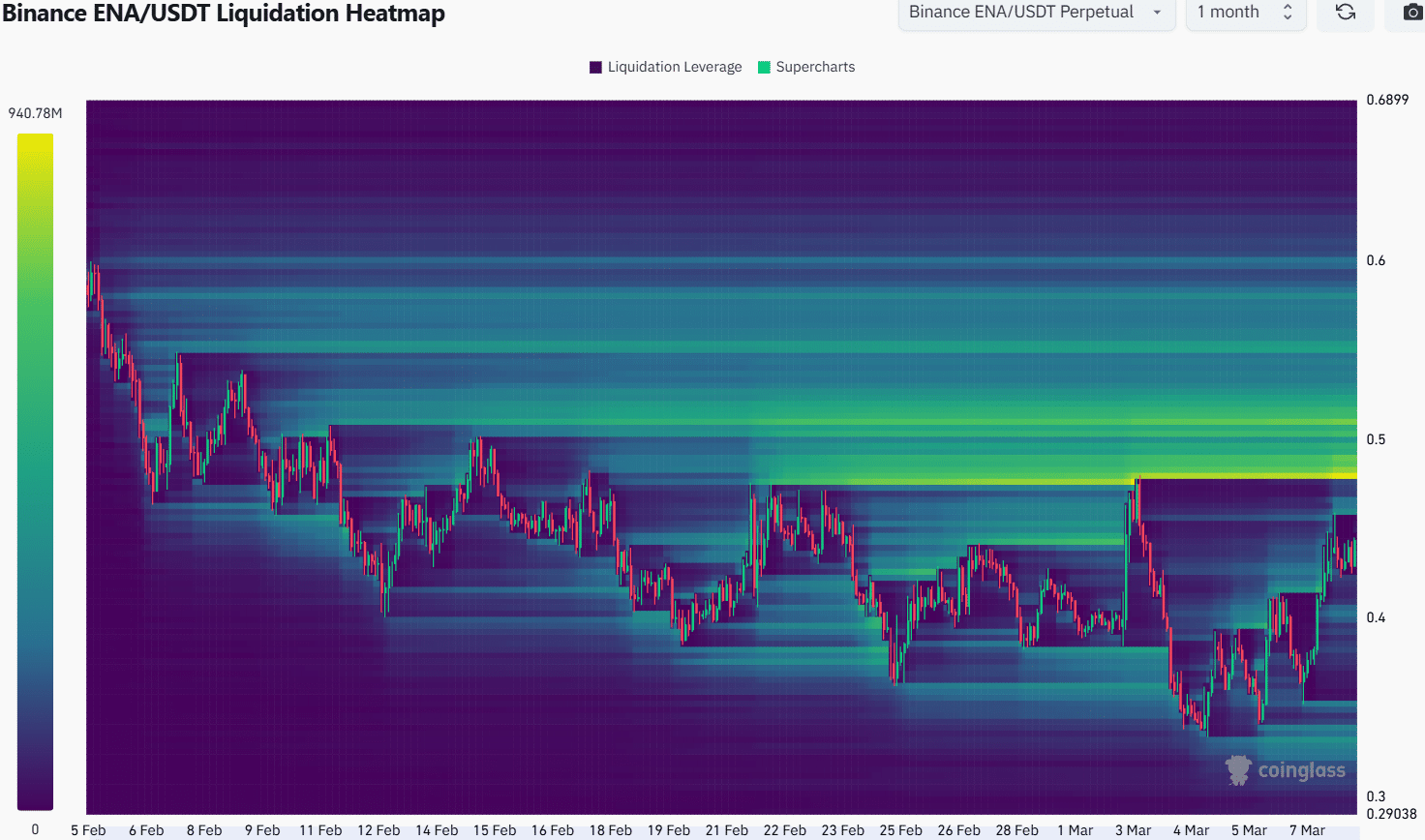

The previous month’s liquidation heatmap highlighted the $0.48-$0.515 as a robust magnetic zone. Due to this fact, it could be extremely seemingly the worth would take a look at this area quickly, as value is drawn to liquidity. These liquidity clusters additionally shaped prime reversal areas.

Swing merchants can use a transfer past $0.515-$0.52 to arrange a stop-loss, in the event that they have been trying to promote. A transfer past $0.52 would invalidate the bearish thought laid out right here. The mid-range stage at $0.412 and the lows at $0.34 can be the bearish targets.

Disclaimer: The data introduced doesn’t represent monetary, funding, buying and selling, or different kinds of recommendation and is solely the author’s opinion