Envisioning A Staggering 2030 Valuation

A just lately launched report explores the longer term potential of blockchain know-how, notably specializing in the revival and rising affect of Solana (SOL) within the crypto market.

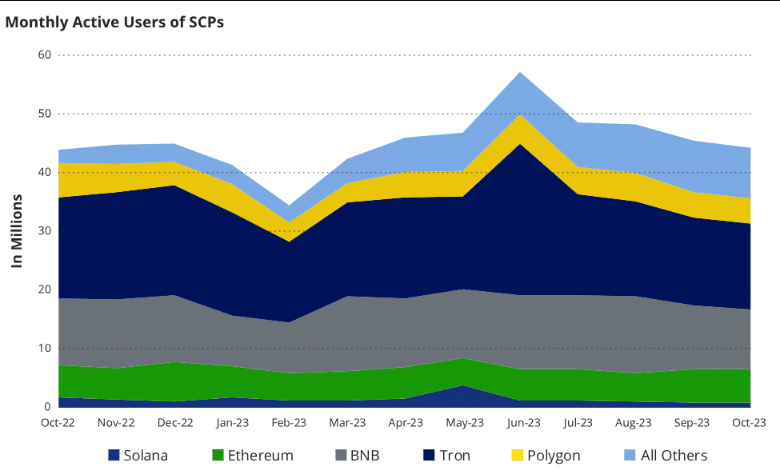

Asset and mutual fund supervisor VanEck disclosed one key driver of Solana’s affect is its developments in Good Contract Platforms (SCPs), outlined as methods that execute contracts on a blockchain with out requiring third-party involvement.

Though different SCP-compatible blockchains exist, akin to BNB Chain and Ethereum (ETH), Solana has notably dominated this sector. VanEck’s evaluation means that this sector, notably SCPs, is poised for important adoption sooner or later, positioning Solana as a distinguished participant within the blockchain trade.

Solana’s Dominance In Good Contract Platforms

Solana’s emergence as a dominant pressure within the SCP realm is bolstered by its excessive throughput and scalability, surpassing many present blockchain networks. Its skill to course of a excessive quantity of transactions rapidly and at a decrease price in comparison with some opponents has been a pivotal issue driving its affect and potential for widespread adoption.

Whole crypto market cap at the moment at $1.24 trillion. Chart: TradingView.com

Moreover, Solana’s ecosystem has seen a surge in decentralized purposes (dApps) and initiatives leveraging its infrastructure, additional solidifying its place as a lovely and viable platform for builders and customers alike. This rising adoption and technical superiority trace at a promising trajectory for Solana, suggesting it could stay a key participant within the increasing panorama of blockchain know-how.

The VanEck report underscored the plain dominance of Solana within the SCP sector. However regardless of these present alternate options, none have managed to rival Solana’s present supremacy throughout the area. VanEck additional highlighted the sector’s imminent surge in adoption, foreseeing a promising development trajectory by 2030.

Supply: VanEck

Nevertheless, the report additionally emphasised the need of a groundbreaking software for exponential enlargement. In accordance with VanEck, among the many contenders, Solana stands as probably the most becoming platform with the potential to fill this pivotal position, positioning itself because the doubtless candidate to steer the sector’s transformative development.

VanEck noticed that the blockchain internet hosting the groundbreaking software might expertise substantial advantages from the app’s generated exercise. The evaluation presents a situation the place Solana turns into the pioneering blockchain to assist a single software that brings on board over 100 million customers.

Over the previous week L1s have began to see a shift in sentiment.$SOL exercise for the month has translated to sharp elevated in DEX quantity exercise as TVL and customers have seen an uptick.

Is that this the beginning of a brand new pattern? pic.twitter.com/wfFyYlvBVS

— Artemis (@artemis__xyz) October 26, 2023

Artemis’s Evaluation: Solana’s Resurgence and Development

In the meantime, Artemis, an institutional digital asset knowledge platform, just lately highlighted Solana’s outstanding resurgence, underscoring the venture’s development. In an October 26 put up on X (previously Twitter), Artemis expressed being impressed by Solana’s efficiency, citing key metrics akin to Whole Worth Locked (TVL), decentralized change (DEX) quantity, energetic addresses, and transactions.

Notably, Artemis emphasised its expectations for the community’s future enchancment, particularly with its 100% uptime since March 2023. The collective constructive sentiments from each Artemis and the asset administration agency make clear Solana’s restoration and important potential, as detailed of their respective analyses.

On the time of writing, Solana (SOL) was trading at $32.83, up 3.5% within the final 24 hours and registered a good 7.8% improve within the final seven days, in keeping with figures by Coingecko.

(This web site’s content material shouldn’t be construed as funding recommendation. Investing includes threat. Once you make investments, your capital is topic to threat).

Featured picture from TechSAA