Epic sats and pieces of paper: 5 crazy crypto auctions

Thousands and thousands of {dollars} have been spent on uncommon mementos from Bitcoin’s previous — with some auctions for NFTs breaking information.

Bitcoin’s now a young person — and which means there’s a rising urge for food for memorabilia from the cryptocurrency’s early days.

It’s like when an unsealed, first-generation iPod hits the market. Bidders go completely berserk and find yourself paying $29,000 for sentimental worth.

Right here, we’re going to take a look at 5 of the most important (and craziest) crypto-related auctions of all time.

Janet Yellen in 2017 | Supply: Bloomberg

1. The ‘Purchase Bitcoin’ signal

Being a digital asset, there aren’t all that many tangible mementos related to Bitcoin. An honorable exception is a single piece of paper.

Again in 2017, then Federal Reserve chair Janet Yellen was giving proof to Congress on the state of the financial system. In remarks that might have simply been from yesterday, she warned that the U.S. was a way off returning to its 2% inflation goal.

Within the background, a 22-year-old then swiftly scribbled “Purchase Bitcoin” on his authorized pad — and held it to the digital camera throughout Yellen’s testimony. Screenshots of the stunt rapidly went viral on social media, with BTC rallying to $2,398 (sure, we all know) because of this.

The ‘Purchase Bitcoin’ signal | Supply: Scarce Metropolis

Christian Langalis — in any other case generally known as “Bitcoin Signal Man” — informed the public sale web site Scarce Metropolis:

“It’s good to lastly liberate this quantity from my sock drawer and provide it again to the Bitcoin public. The message was subversive then, however now merely apparent: Bitcoin is flowing. Management is lifeless.”

Christian Langalis

Bidding lasted for greater than every week, with the grand finale hosted on the crypto-themed Pubkey Bar in New York Metropolis. It ended up promoting for 16 BTC, value about $1 million on the time of writing.

“One of the best and most underreported a part of the story concerning the man who purchased the well-known ‘Purchase Bitcoin’ notepad for 16 BTC is that he refused an Uber and took it house with him on the subway.

As quickly as he walked in and sat by himself within the nook of the room, I knew he was going… pic.twitter.com/RIRMyP5SbD

— PUBKEY (@PubKey_NYC) April 27, 2024

2. An epic sat

The rise of Ordinals now implies that a single satoshi, the smallest attainable denomination of 1 Bitcoin, could be numbered and even become an NFT.

Ordinals creator Casey Rodarmor says this additionally means some sats are considerably extra worthwhile than others — with various levels of rarity.

Sats have various ranges of rarity | Supply: Casey Rodarmor

Sats sitting within the “epic” tier embody the very first to be mined after a halving occasion.

Solely 4 of them presently exist — and after the mining firm ViaBTC was chosen so as to add the 840,000th block to the blockchain, it determined to promote the debut sat of this present cycle. The public sale was held on CoinEx, and went below the hammer for 33.3 BTC — roughly $2.1 million. The trade mentioned afterward:

“This epic satoshi symbolizes a historic second in Bitcoin’s historical past and holds important collectible and symbolic worth for Bitcoin fans, collectors, and cryptocurrency neighborhood buyers.”

CoinEx

The public sale has concluded efficiently, with the FIRST & ONLY epic sat promoting for 33.3 $BTC (≈$2,134,000). This public sale is not only a bidding occasion; it marked the neighborhood recognition, media consideration, & widespread embrace of #Bitcoin. A heartfelt because of all who assist us. pic.twitter.com/fCFz1YrH0I

— CoinEx World (@coinexcom) April 25, 2024

3. Extraordinary Ordinals

The mania surrounding NFTs was initially remoted to the Ethereum blockchain, however the rise of Ordinals now implies that Bitcoin has turn into the dominant community for gross sales.

Again in December 2023, the esteemed public sale home Sotheby’s held an public sale for BitcoinShrooms — with creator Shroomtoshi declaring:

“The BitcoinShrooms assortment is a pixelated recap of the primary 13 years of Bitcoin, a homage to the 8-bit fashion of artwork that expresses a slight nostalgia for the 90s.”

Shroomtoshi

Shroomtoshis | Supply: Sotheby’s

A choose few had been out there for bidding, every with an estimated worth of as much as $30,000. However urge for food far exceeded expectations — and so they offered for a grand complete of $450,000.

Whereas not as eye-watering as the worth of OG Ethereum NFTs when the market was at its frothiest, it’s nonetheless an indication that the digital collectibles house isn’t lifeless but.

One of many Shroomtoshis auctioned off | Supply: Sotheby’s

You may additionally like: Why did Binance ditch Ordinals — and can the market survive?

4. Beeple breaks information

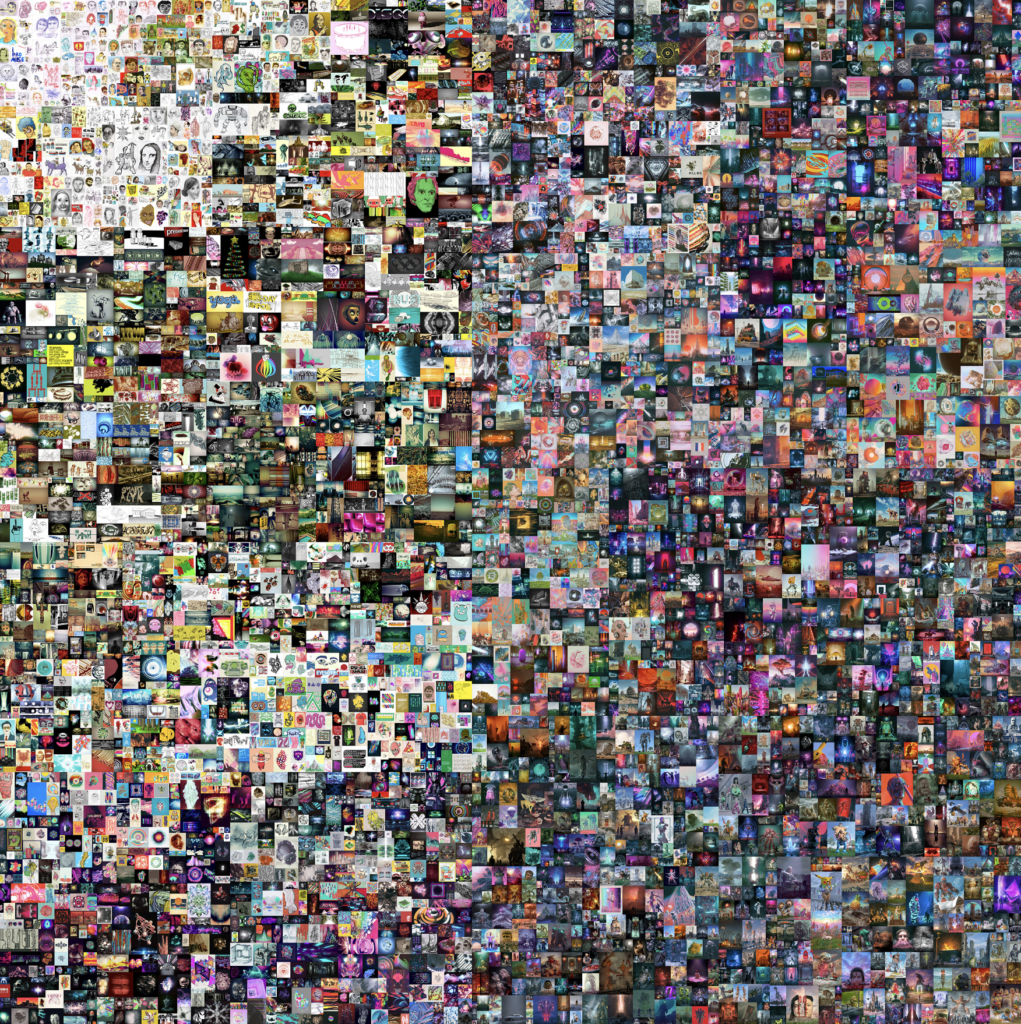

No rundown of the most important auctions in crypto’s historical past can be full with no nod to Beeple, who started sharing items of digital artwork every day in 2007.

The primary 5,000 had been then stitched collectively in a vibrant collage and minted as an NFT in 2021. What was the ultimate promoting worth on the Christie’s public sale home, we hear you ask? $69.3 million.

Everydays: The First 5,000 Days by Beeple | Supply: Christie’s

Not solely did Everydays: The First 5,000 Days smash information for essentially the most worthwhile piece of digital artwork in historical past, however Beeple turned the third most-valuable dwelling artist. Precisely predicting what the longer term held for NFTs, he informed Fox Information Sunday quickly afterward:

“I completely assume it’s a bubble, to be fairly trustworthy. I’m going again to the analogy of the start of the web. There was a bubble. And the bubble burst.”

Beeple

5. Actual-life Bitcoin

Final however not least, there have been some feverish auctions for Casascius cash of late — bodily BTC that was created within the early 2010s.

Inside every metallic coin is the non-public key to a set denomination of Bitcoin, successfully making it an extremely refined type of chilly storage.

Their rarity, and the actual fact they haven’t been produced in over a decade, means they typically command a lot greater costs than the worth of BTC they maintain.

A brass Casascius 1 Bitcoin minted in 2011 lately offered for $96,000 at Stack’s Bowers Galleries — breaking world information within the course of — whereas a silver one was flogged off for a cool $102,000.

You may additionally like: What’s subsequent for international finance?