ETH Derivates Volume Have Flatlined Despite Spot Ethereum ETFs Approval, What’s Going On?

ETH derivatives quantity means that Ethereum buyers have little confidence within the Spot Ethereum ETFs, sparking an enormous rally for the second-largest crypto token by market cap. This growth comes amid the upcoming launch of those funds, that are anticipated to begin trading next week.

Ethereum Futures Premium Highlights Little Confidence In ETH’s Value

In keeping with data from Laevitas, Ethereum’s fixed-month contracts annualized premium at the moment stands at 11%, suggesting that crypto merchants aren’t bullish sufficient on ETH’s value. Additional knowledge from Laevitas reveals that this indicator has but to maintain ranges above 12% this previous month.

Associated Studying

That is shocking contemplating that the Spot Ethereum ETFs, which might launch subsequent week, are anticipated to spark a value surge for Ethereum. Crypto analysts like Linda have predicted that ETH might rise to as excessive as $4,000 due to the inflows these Spot Ethereum ETFs might witness.

Nonetheless, crypto merchants should not satisfied that Ethereum’s reaching such heights is more likely to occur, at the least not quickly sufficient. A believable rationalization for this lack of extreme bullishness is that Ethereum’s value might proceed to commerce sideways for some time, due to the $110 million day by day outflows that analysis agency Kaiko projected might circulation from Grayscale’s Spot Ethereum ETF.

Furthermore, this appears doubtless following the final S-1 filings by the Spot Ethereum ETF issuers, which confirmed that Grayscale has the very best charges. The asset supervisor plans to cost a administration payment of two.50%, whereas the very best payment amongst different Spot Ethereum ETF issuers is 0.25%.

Grayscale had accomplished one thing related with its Spot Bitcoin ETF, setting its management fee at 1.5%, whereas the opposite Spot Bitcoin ETF issuers had administration charges ranging between 0.19% and 0.39%. That transfer is believed to have been one of many the explanation why Grayscale’s Bitcoin ETF witnessed vital outflows following the launch of the Spot Bitcoin ETFs.

Making A Case For Ethereum’s Inevitable Value Surge

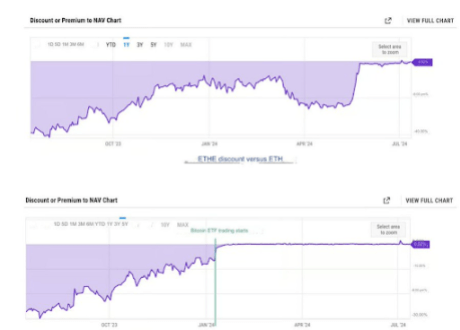

Crypto analyst Leon Waidmann has made a bullish case for ETH’s value and defined why Ethereum buyers needs to be extra bullish. He famous that the low cost between Grayscale’s Ethereum Belief (ETHE) and ETH’s value has considerably narrowed because the Spot Ethereum ETFs were approved earlier in Could.

Associated Studying

Waidmann acknowledged that this has given ETHE buyers ample time to exit their positions with out vital reductions in comparison with Grayscale’s Bitcoin Trust (GBTC). One more reason GBTC is believed to have skilled such outflows was due to buyers who had been taking income from having invested within the belief at a discounted price to Bitcoin’s spot value.

Nonetheless, not like GBTC and different Spot Bitcoin ETFs, ETHE and different Spot Ethereum ETFs didn’t begin buying and selling instantly after approval. Subsequently, Waidmann believes that whoever supposed to revenue from the low cost between ETHE and ETH’s value should have already accomplished so prior to now. As such, Grayscale’s ETHE shouldn’t witness the identical quantity of profit-taking as Grayscale’s GBTC did after it started buying and selling.

Featured picture created with Dall.E, chart from Tradingview.com