ETH ETFs are finally listed on NYSE

- NYSE cleared the itemizing of Bitwise and Grayscale ETH ETFs.

- Nonetheless, the prevailing market sentiment confirmed uncertainty.

For the final two months, the market has been eagerly awaiting the launch of Ethereum [ETH] ETFs. Because the SEC’s inexperienced mild, hypothesis has affected the ETH market with elevated volatility.

After the launch of Bitcoin [BTC] ETFs six months in the past, Ether ETFs are actually getting into the market with excessive expectations inside the crypto group.

NYSE clears Bitwise, Grayscale ETH ETFs

On the twenty second of July, the NYSE confirmed the itemizing and registration of the widespread shares for the 2 funds.

The NYSE approval got here after CBOE introduced the preparation for the lack of 5 spot ETH Alternate-traded funds.

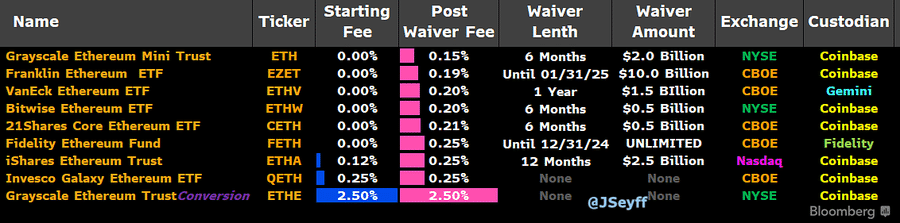

Based on the CBOE record, Grayscale and Bitwise had been listed with post-waiver charges of 0.15% and 0.20%. Additionally, Coinbase will act as the 2 ETFs’ custodians.

The approval and clearance of ETH ETFs have paved the best way for institutional buyers to entry and put money into BTC and ETH, the 2 largest cryptos by market cap.

Supply: X

Predictions of inflows

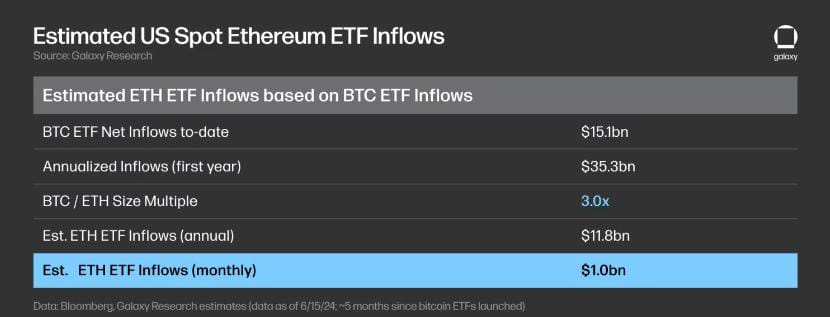

With the launch of ETH ETFs, market hypothesis and predictions are excessive relating to the anticipated funds. On their evaluation, Perfumo estimated a $750 million to $1 billion influx each month over the following six months.

Citigroup estimated round $4.7 billion to $5.4 billion over the following six months. Nonetheless, Bitwise is extra optimistic, estimating $15 billion in ETH ETF influx by Could 2025.

Though the launch of ETFs paves the best way for institutional buyers, the BTC ETFs market is basically dominated by retail merchants. The market expects the identical development to proceed with Ether exchange-traded Funds.

Supply: Galaxy

Affect on worth charts

As of this writing, ETH was buying and selling at $3437.57 following a 1.75% decline within the final 24 hrs. Its market cap has declined by the identical share on every day charts to $412.8 billion, in accordance with CoinMarketCap.

Nonetheless, Ether’s buying and selling quantity has surged by 30% on every day charts to $19.5 billion.

Supply: Coinglass

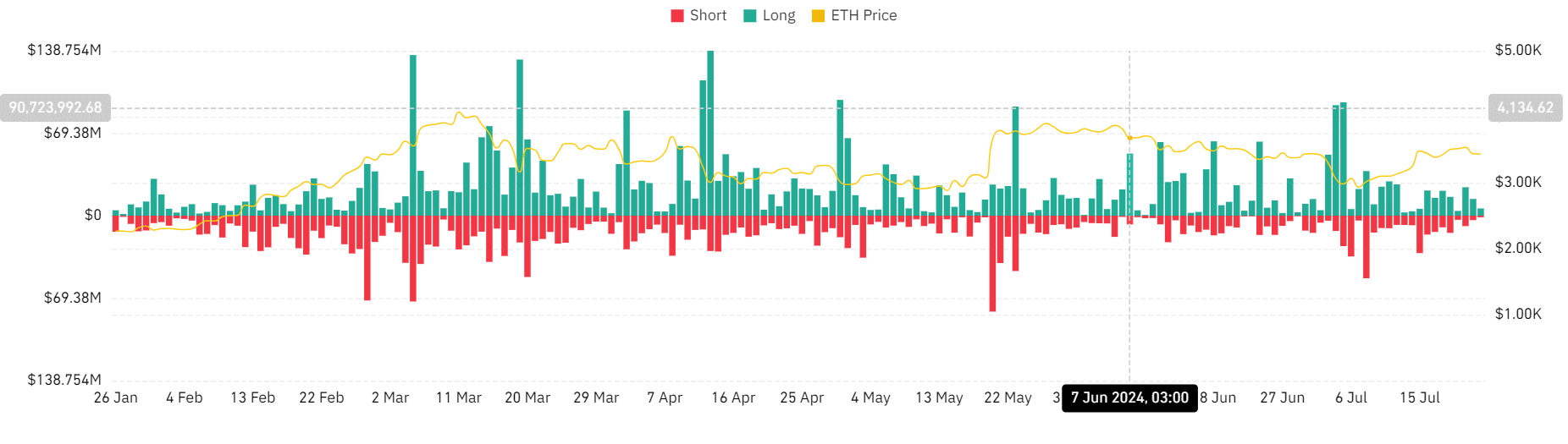

Based on AMBCrypto’s evaluation, ETH was experiencing excessive volatility regardless of the confirmed launch of ETFs.

Taking a look at Coinglass, Ether skilled excessive liquidation charges for lengthy positions, a bearish sign. At press time, lengthy positions had been at $6.04 million, with brief positions at $1.34 million.

This confirmed that buyers had been pressured to shut their positions at a loss with out opening new positions.

Equally, lengthy place holders had been unwilling to pay premium to carry their positions, suggesting a insecurity within the altcoin’s future path.

Supply: Tradingview

The Directional Motion Index confirmed this uncertainty, with the detrimental index at 21.53, which sat above the optimistic index of 19 at press time.

The chart indicated that the optimistic index had been declining for the previous week and shutting in the direction of impartial on a downtrend.

Learn Ethereum’s [ETH] Value Prediction 2024-25

Subsequently, regardless of the confirmed Ether ETFs, the market stays unsure and will expertise extra volatility till the costs stabilize.

Nonetheless, it’s essential to notice that BTC costs gained over 50% after the launch of ETFs, reaching an all-time excessive of $73k. Ethereum can also be more likely to take the identical path, with 8% features within the brief run.