ETH long term holders sells $89.72 million worth of Ethereum

- Ethereum long-term holders bought $89.72 million price of ETH.

- Market fundamentals prompt a possible value correction as transfers into exchanges spiked.

Prior to now 48 hours, the crypto market surged, with Bitcoin [BTC] hitting a brand new ATH of $75K. This upsurge pushed some altcoins to new highs.

Ethereum [ETH] reached a three-month-high, creating alternatives for profit-taking. Inasmuch, most long-term and dormant whales have come out to take income whereas maximizing their income.

Ethereum long-term whales dump

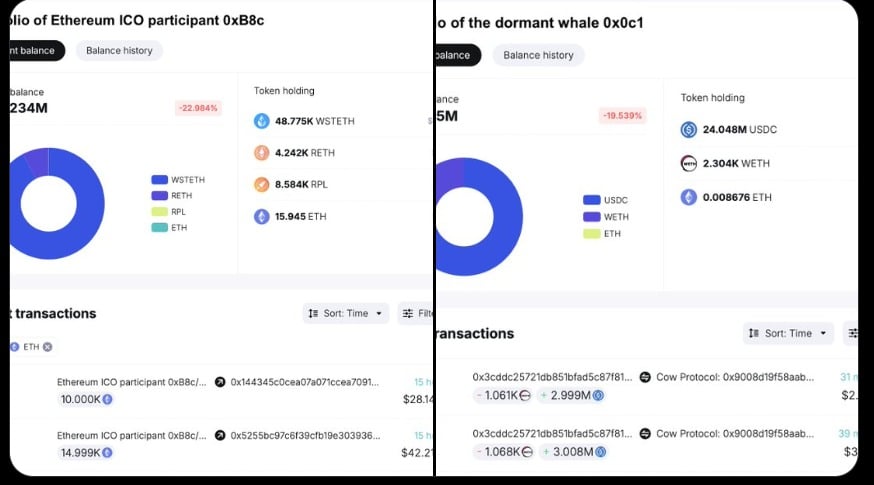

In accordance with a current report by SpotonChain, three ETH holders have began unloading, following value hikes over the previous 24 hours.

Supply: SpotonChain

As such, two ETH holders have unloaded 33,701 ETH price $89.72 million. This was adopted by a 13.75% surge in Ethereum value charts.

At press time, the primary ICO whale despatched 25,000 ETH valued at $2,627 per token, to Kraken, abandoning 64,450 ETH.

One other whale reappeared after eight and a half years to promote 8,701 ETH for twenty-four.05 USDC valued at $2,764 per token, abandoning 2,304 ETH price $6.48 million and making $30.48 million in revenue.

Following these two huge sell-offs, one other Ethereum whale with 12,001 ETH price $34.1 million ended an eight-year dormancy and started promoting on-chain.

The elevated whale exercise prompted fears of potential sell-offs that would push ETH costs in the direction of correction. It’s because, huge transfers into exchanges and promoting by whales trigger promoting stress, which negatively impacts costs.

Affect on ETH’s value charts?

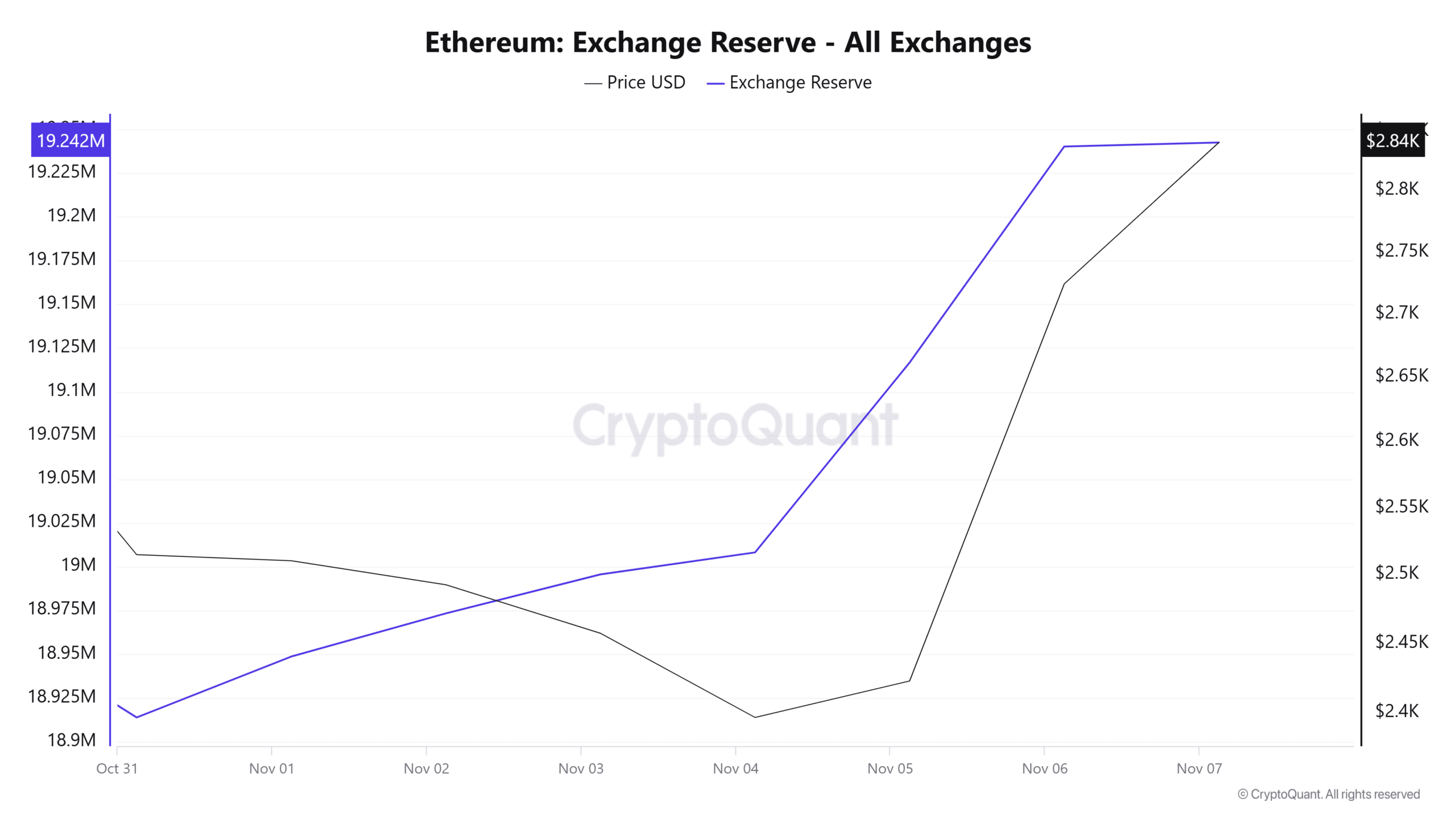

In accordance with AMBCrypto’s evaluation, ETH was experiencing an exponential surge in deposits into exchanges. Such a market state of affairs causes elevated provide, which additional threatens value stability.

Supply: Cryptoquant

For instance, Ethereum’s provide trade ratio has spiked over the previous week.

This implied that traders had been transferring their tokens into exchanges and making ready to promote, resulting in downward value stress.

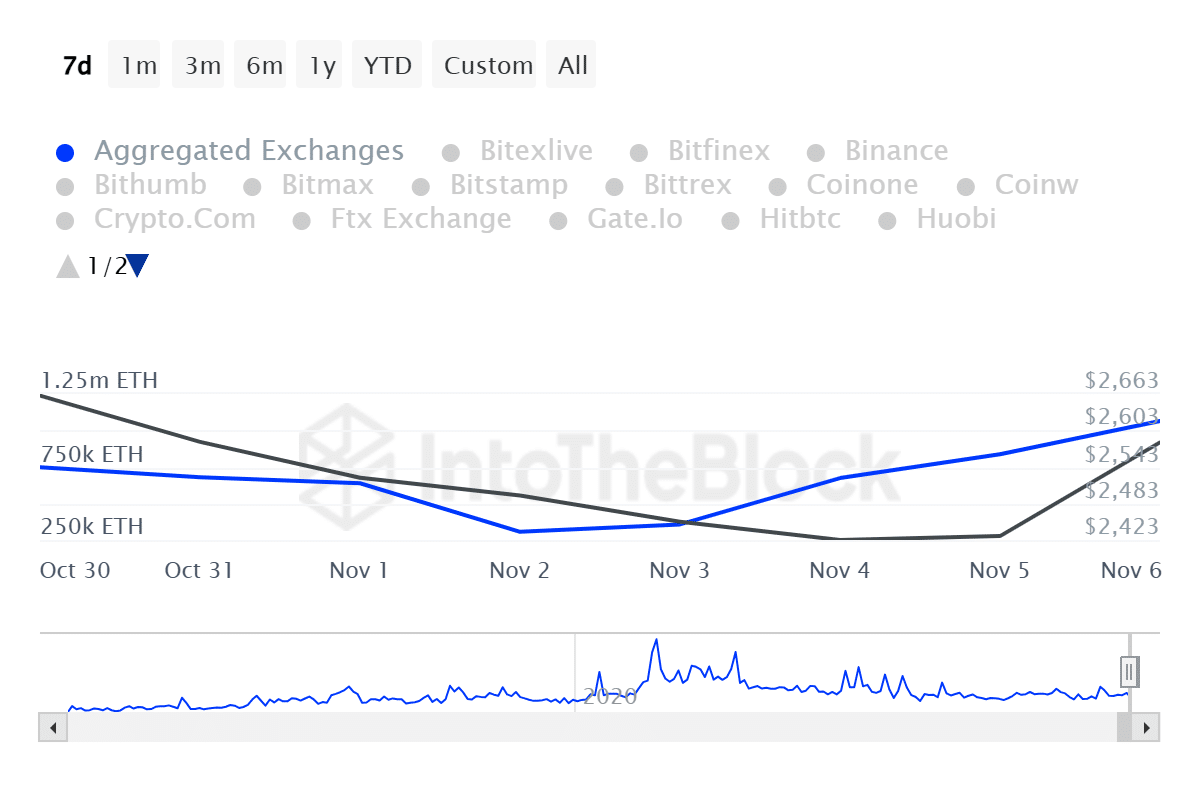

Supply: IntoTheBlock

Moreover, Ethereum’s influx quantity has surged over the previous week from a low of 306,020k to 1.07 million.

This prompt that as ETH costs have made a major restoration on value charts, most traders are making ready to promote to maximise income.

What subsequent for Ethereum?

Notably, ETH has skilled a powerful uptrend over the previous week.

In truth, on the time of writing, Ethereum was buying and selling at $2804. This marked an 8.11% rise in 24 hours, with the altcoin gaining 6.31% on weekly charts.

The current upsurge has put the altcoin to achieve a 3-month-high, signaling a powerful upward momentum.

Subsequently, if the bulls can proceed to carry the market, the altcoin might register extra positive aspects, reaching the $3000 resistance stage.

Learn Ethereum’s [ETH] Worth Prediction 2024–2025

Subsequently, for the uptrend to carry, the markets have to soak up the newest whale gross sales with out leading to larger losses.

Nonetheless, if the current whale dumps convey damaging impacts to the market, the altcoin might see a market correction earlier than trying one other uptrend.

Thus, if this dump displays on value charts, Ethereum might decline to $2670.