ETH short-term calls explode amid bullish relief across the market. Assessing…

- ETH bulls make a splash after whales ease up on their promote strain.

- Brief-term focus because the market eases off latest FUD.

Ethereum [ETH] bulls are again on high in a shock transfer after interfering with a pullback that had the markets involved about weak demand.

Nevertheless, present market information recommended that the continued upside is perhaps restricted. Understanding the explanations for the rally might assist gauge the power of the present bull run.

Is your portfolio inexperienced? Take a look at the Ethereum Revenue Calculator

ETH and a lot of the crypto market gained bullish momentum following stories that one other financial institution was liable to collapse. Extra so, the value surge was backed by a wave of short-term calls which can provide some insights into what to anticipate.

Prior to now hour, ETH has seen over $20 million in Block name possibility trades, with a excessive proportion of short-term calls being purchased, primarily in large whale strikes. With APR28 approaching, the probability of IV declines within the subsequent few days is extraordinarily excessive. By @GreeksLive

— Wu Blockchain (@WuBlockchain) April 26, 2023

The above findings recommended a excessive chance that the rally is perhaps short-lived for the reason that short-term calls have been targeted on short-term earnings. However this doesn’t essentially assure that costs is not going to lengthen their upside within the short-to-mid-term.

Assessing the probability of a robust ETH rally

ETH’s upside will largely depend upon whale exercise. So what are ETH whales at the moment as much as?

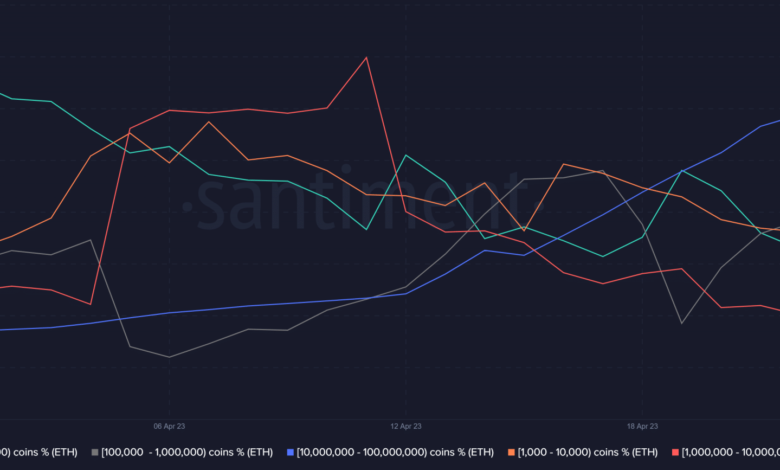

Provide distribution confirmed a slowdown in promote strain, particularly from some whale classes. This included addresses holding between 10,000 and 100,000 ETH.

This might be thought of noteworthy as a result of the aforementioned class controls a lot of the circulating provide therefore it has the largest affect on value actions.

Supply: Santiment

The potential upside can also be restricted by some whales which have been taking earnings within the final 24 hours. As well as, ETH change flows indicated that change inflows maintained a dominant place over change outflows.

Supply: CryptoQuant

The surge in short-term calls mirrored the spike in funding charges within the final 24 hours. This confirmed that there was robust demand for ETH within the derivatives section.

We additionally noticed a drop in leverage in the previous few days attributable to liquidations and market uncertainty. Nevertheless, the demand for leverage registered a small bounce again within the final 24 hours indicating a return of confidence.

Supply: CryptoQuant

A fast take a look at the value motion…

ETH exchanged fingers at $1,953 at press time, which represented an 8.29% upside within the final two days. The bullish wave facilitated a wholesome bounce after a short interplay with the 50-day transferring common.

Supply: TradingView

Real looking or not, right here’s Ethereum’s market cap in BTC’s phrases

ETH’s MFI maintained a downward development within the final two days regardless of the sharp bounce again within the final two days. This lends credence to the expectations of a restricted upside.

Nevertheless, traders also needs to word that the surprising can also occur simply as has been the case with the sudden pivot. ETH and different high cryptos could proceed rallying larger if one other banking contagion ensues.