ETH staking hits new highs as traders expect this outcome

- The whole ETH staked rose 18% for the reason that Shapella improve.

- Greater than 60% of the stakers have been in losses since they staked their ETH.

The much-awaited Shapella Improve, which went reside on the Ethereum [ETH] mainnet greater than two months in the past, has begun to advance in the direction of its aim of boosting ETH staking.

Is your portfolio inexperienced? Take a look at the Ethereum Revenue Calculator

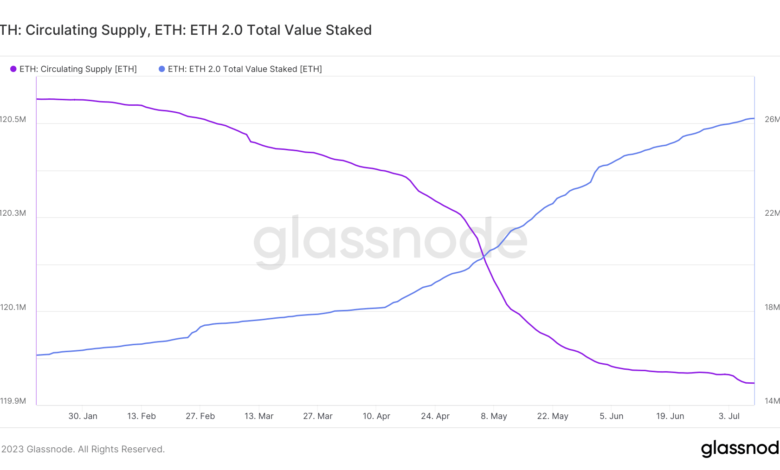

In keeping with on-chain analytics agency Glassnode, the whole ETH locked on the biggest proof-of-stake (PoS) community surged previous 26 million on the time of writing. This represented a powerful 18% soar from the day Shapella Improve was executed.

Supply: Glassnode

New validators come onboard

Staking, which was thought of to be a dangerous proposition owing to withdrawal ambiguity, acquired a lift after the Shapella Improve permitted customers to unstake their ETH. This confidence led them to restake their ETH after an preliminary burst of withdrawals.

On the time of publication, the whole quantity staked accounted for practically 21% of ETH’s whole circulating provide.

Nevertheless, the rise in staking was not solely on account of deposits from present stakers. Extra information revealed that there was a large development within the variety of new addresses depositing 32 ETH to the Ethereum good contract. Whereas the tempo has evidently slowed down for the reason that preliminary pleasure, it’s nonetheless greater than the 2022 common figures.

Supply: Glassnode

Staking turns into profitable

A doable motive behind the persistence with staking may very well be that a number of stakers have been underwater. As per information fetched from a Dune dashboard, about 66% of the stakers have been in losses since they locked their ETH on the community.

Nearly all of this staking occurred on the value ranges of $1,600 and $3,500, in the course of the peak of the 2021 bull run. Nevertheless, on the time of publication, ETH’s market value was $1,866.24, as per CoinMarketCap.

Supply: Dune

Therefore, it made extra sense, particularly for skilled stakers, to hunt for yield alternatives in staking and look ahead to ETH’s subsequent bull run, slightly than unstake and promote their holdings at losses.

Learn Ethereum’s [ETH] Value Prediction 2023-24

Trade provide shrinks

The technique was additionally mirrored within the quickly dwindling provide of ETH on exchanges. As per information given beneath, ETH’s liquid provide accessible for buying and selling fell to a seven-year low at press time. This indicated that buyers have been extra within the HODL and stake coverage, thereby strengthening ETH’s narrative as a long-term funding possibility.

Supply: Glassnode