ETH vs BTC: Can Ethereum outpace Bitcoin in the next market rally?

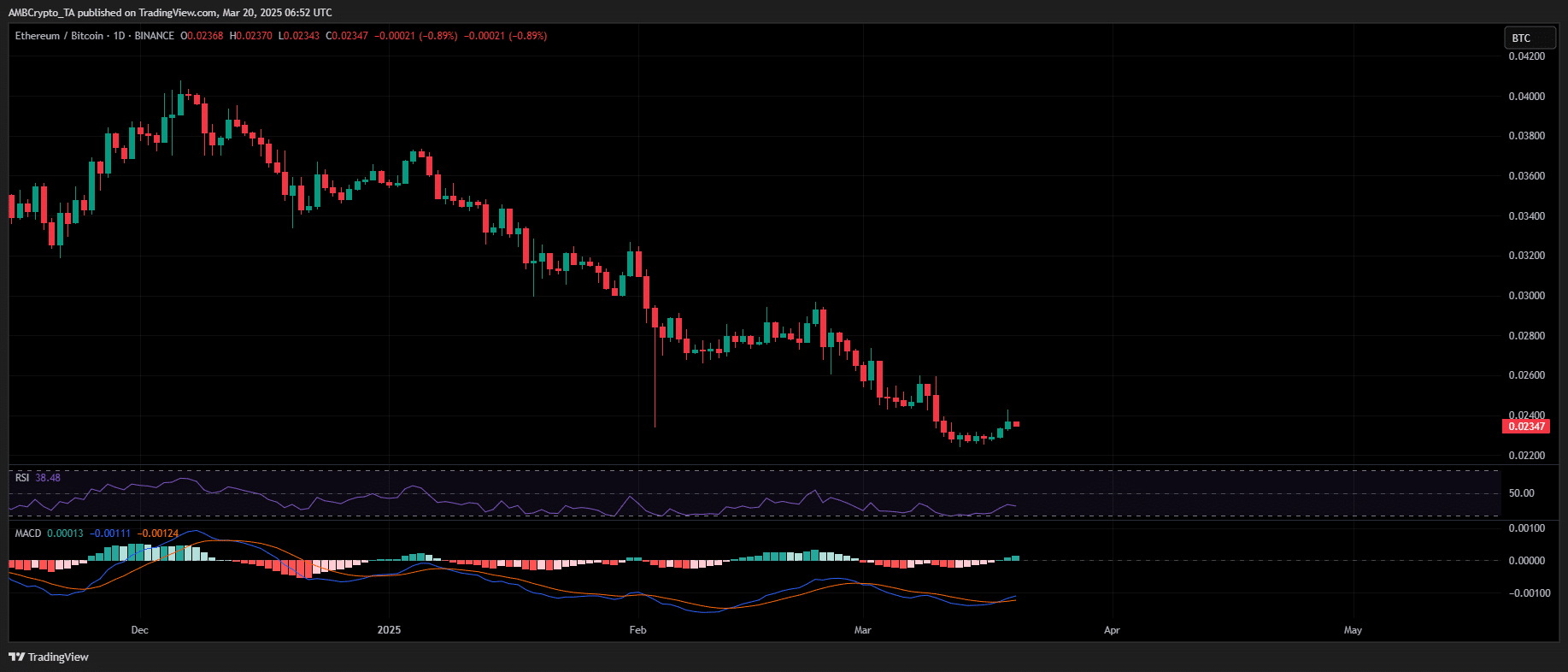

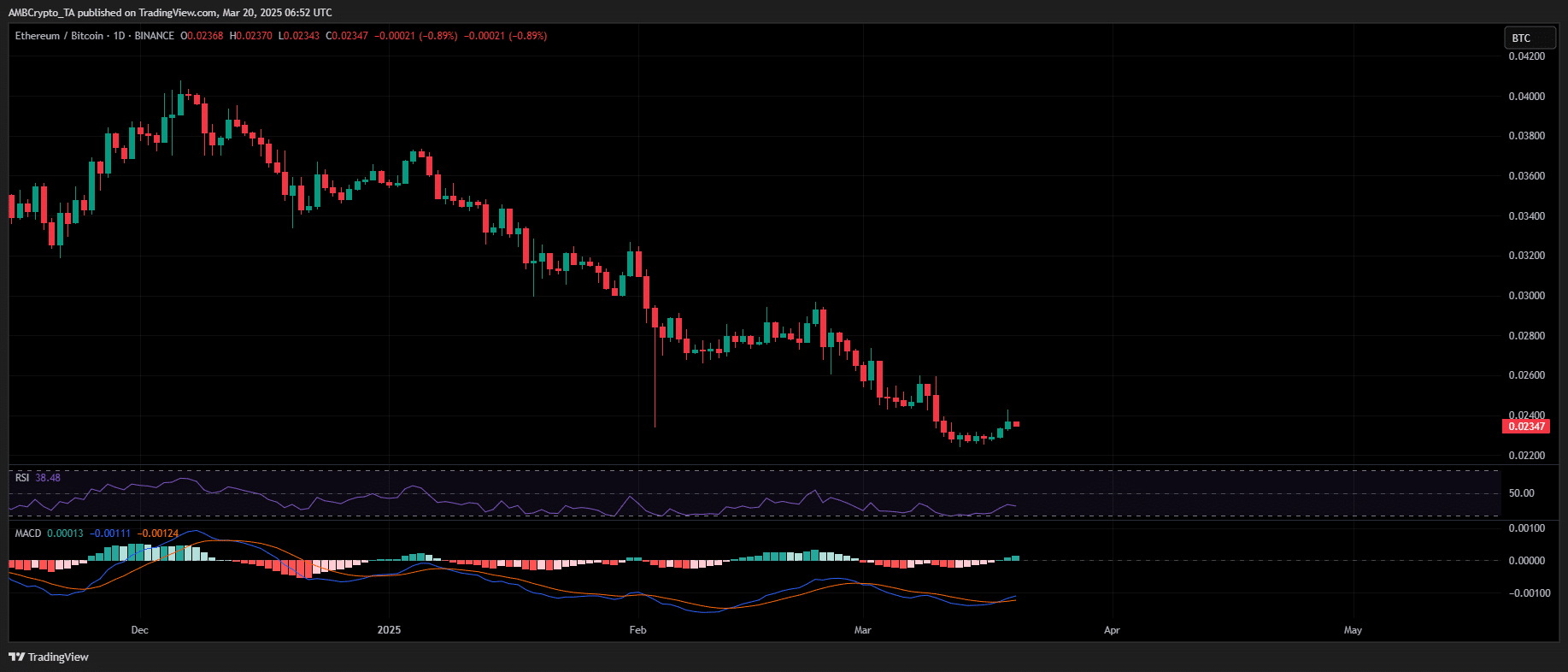

- ETH/BTC is a powerful indicator of a development reversal in Ethereum’s favor towards Bitcoin.

- Quantity indicators verify vendor exhaustion—will it translate to a worth improve?

Following the current Federal Open Market Committee (FOMC) assembly, which signaled a slowing economic system, each Bitcoin [BTC] and Ethereum [ETH] have efficiently reclaimed important resistance ranges.

This growth raises whether or not ETH, at the moment at a five-year low towards BTC within the ETH/BTC pair, might outpace Bitcoin in an impending market rebound.

Market dilemma: Execution or hypothesis?

Amid considerations concerning the financial impression of tariffs, the Federal Reserve maintained the borrowing price at 4.25%-4.5%, unchanged since December.

Nonetheless, markets surged on ‘hypothesis’ that the Fed would possibly implement two price cuts this yr as a substitute of 1. With inflation exhibiting signs of easing and labor market pressures intensifying, the central financial institution could also be compelled to undertake a extra accommodative coverage.

The anticipation of elevated liquidity and coverage easing sparked a pointy rally in threat property.

On the time of writing, Bitcoin climbed 5.02%, decisively breaking by means of the $85k resistance stage, whereas Ethereum gained 6.45%, reclaiming the $2k mark after a chronic interval of consolidation.

Moreover, the 1-day ETH/BTC MACD indicator turned bullish as buying and selling quantity reached a two-week-high, suggesting a possible shift in favor of Ethereum.

Supply: TradingView (ETH/BTC)

Nonetheless, holding this sample stays unsure. With out clear coverage “execution”, post-FOMC volatility has surged. This makes it more durable to verify these resistance zones as sturdy assist ranges.

ETH vs. BTC: Who dominates the subsequent market restoration?

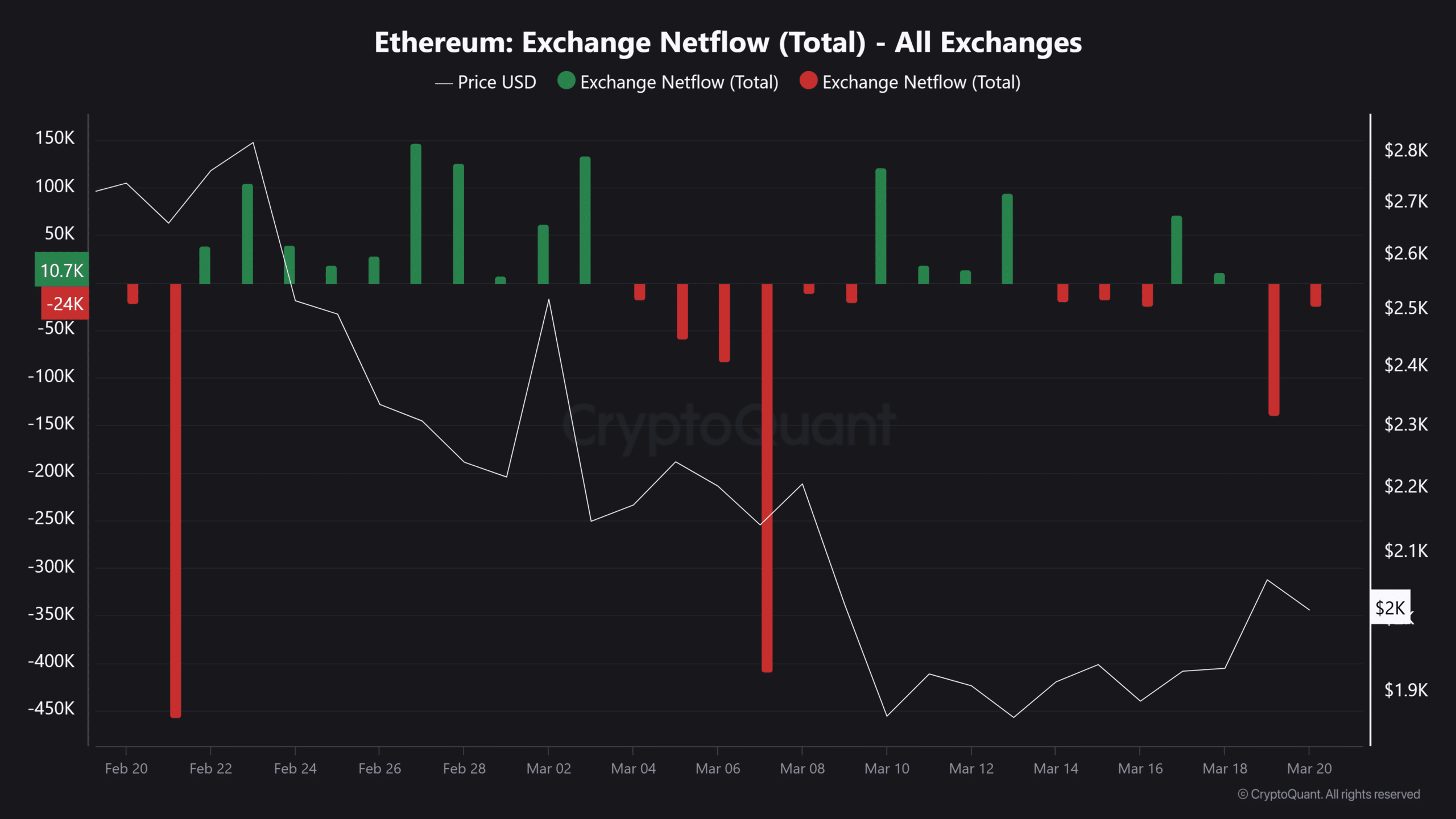

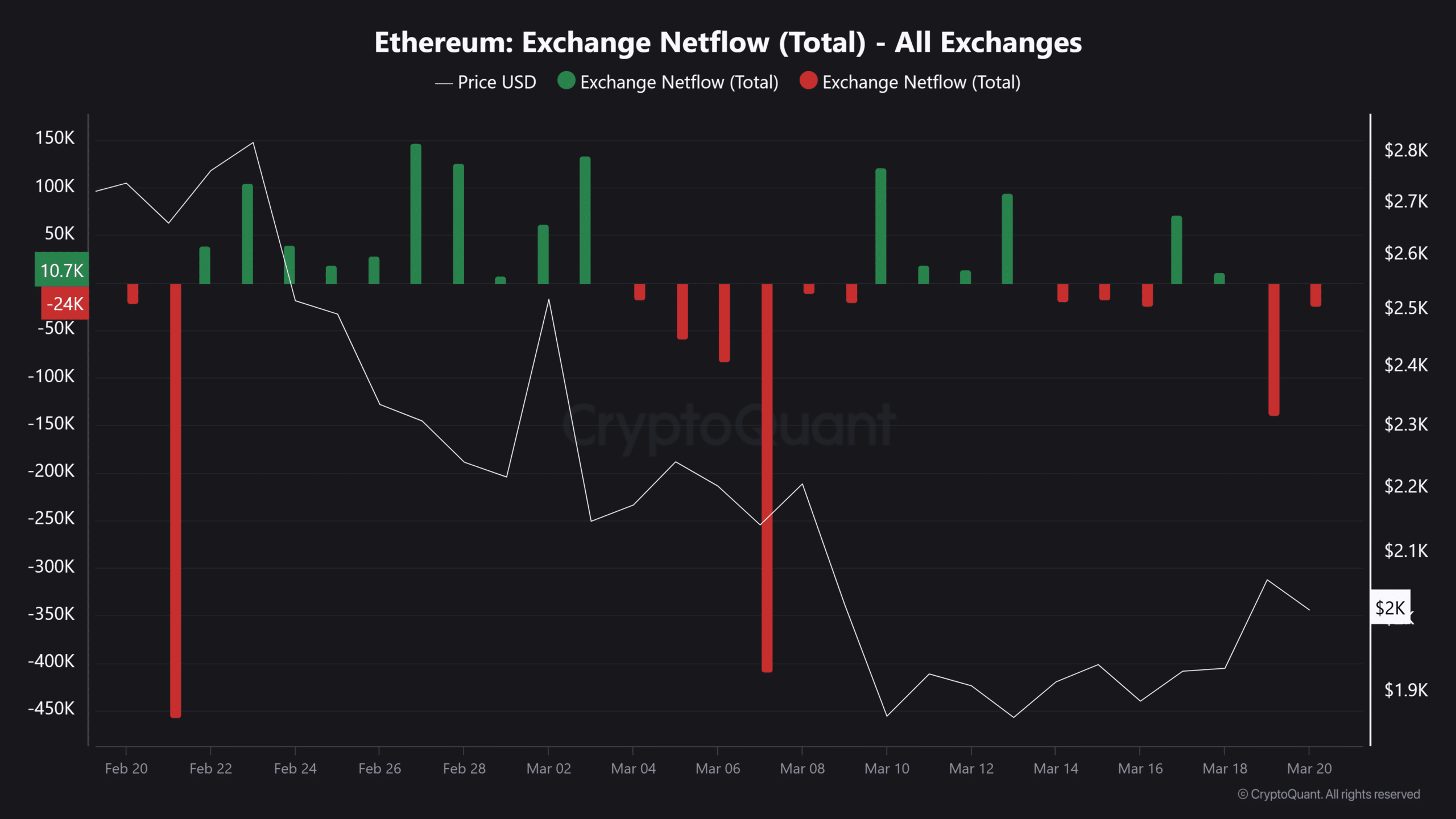

Fundamentals are key to confirming this development. As ETH reclaimed the $2k stage, massive capital inflows hinted at a possible backside formation.

On-chain knowledge confirms that Donald Trump’s World Liberty Monetary has resumed ETH accumulation. The fund moved 25 million USDC to a brand new multi-sig pockets and executed a 4,468 ETH ($10 million) buy at $2,238.

Concurrently, retail demand surged at $2,059, triggering the biggest ETH change outflow in over two weeks – 139k ETH shifting off exchanges.

Supply: CryptoQuant

In the meantime, BTC ETFs recorded 4 consecutive days of internet inflows, reinforcing its present market worth as a powerful “dip-buying” zone.

Nonetheless, for Ethereum to ascertain dominance, ETH/BTC should break key resistance at $0.025, backed by a sustained capital rotation from BTC into ETH.

At the moment, Bitcoin’s sturdy fundamentals proceed to drive long-term holding sentiment, whereas Ethereum’s restoration hinges on reclaiming the $2.5K resistance.

With no confirmed breakout, speculation-driven volatility persists, leaving the broader market rebound unsure. Failure to carry key assist might see Ethereum threat dropping the important $2k assist stage.