Here’s What Might Be Coming Next

- Ethereum’s worth has fallen by practically 9%, buying and selling at $2,460 after peaking at $2,696 only a day earlier.

- Analysts are divided on ETH’s subsequent transfer, with some predicting a possible rebound and others warning of additional draw back.

Ethereum [ETH] has mirrored Bitcoin’s [BTC] latest sharp decline, shedding practically 9% of its worth prior to now 24 hours.

This downturn has pushed ETH’s worth all the way down to $2,460, a notable drop from the $2,696 peak seen only a day earlier.

This market efficiency has sparked a flurry of research and hypothesis amongst cryptocurrency specialists, with various opinions on what may come subsequent for the second-largest cryptocurrency by market capitalization.

Main rebound or additional draw back subsequent?

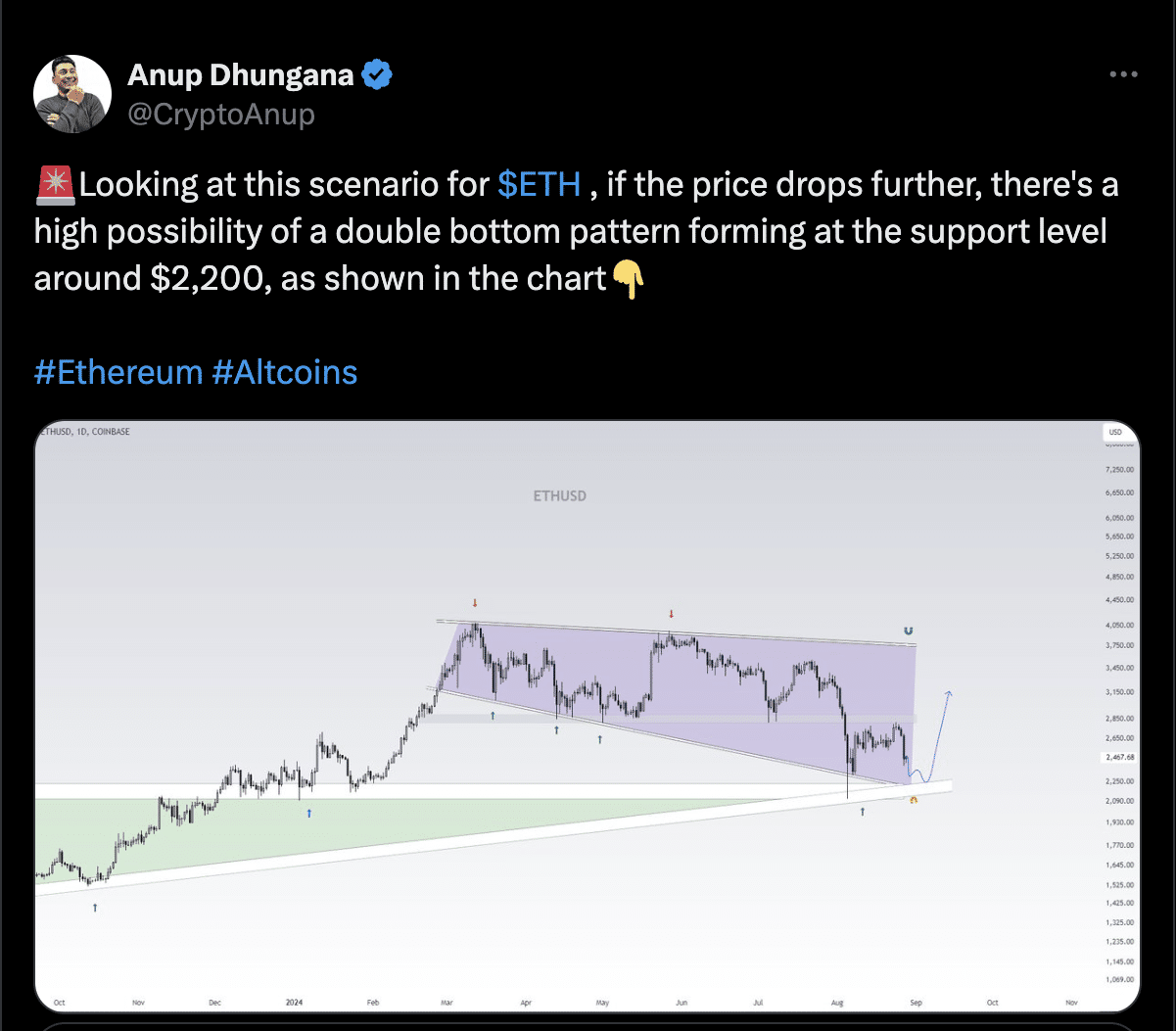

One distinguished crypto analyst, Anup Dhungana, highlighted the potential for additional draw back in Ethereum’s worth.

Dhungana urged that if the present downturn continues, Ethereum might kind a double backside sample on the $2,200 assist degree.

Supply: Anup Dhungana/X

This sample, typically seen as a bullish reversal sign, would recommend that Ethereum may discover a robust assist degree at this worth earlier than probably rebounding.

Nonetheless, this state of affairs is contingent on Ethereum not breaking by the $2,200 assist, which might result in additional losses.

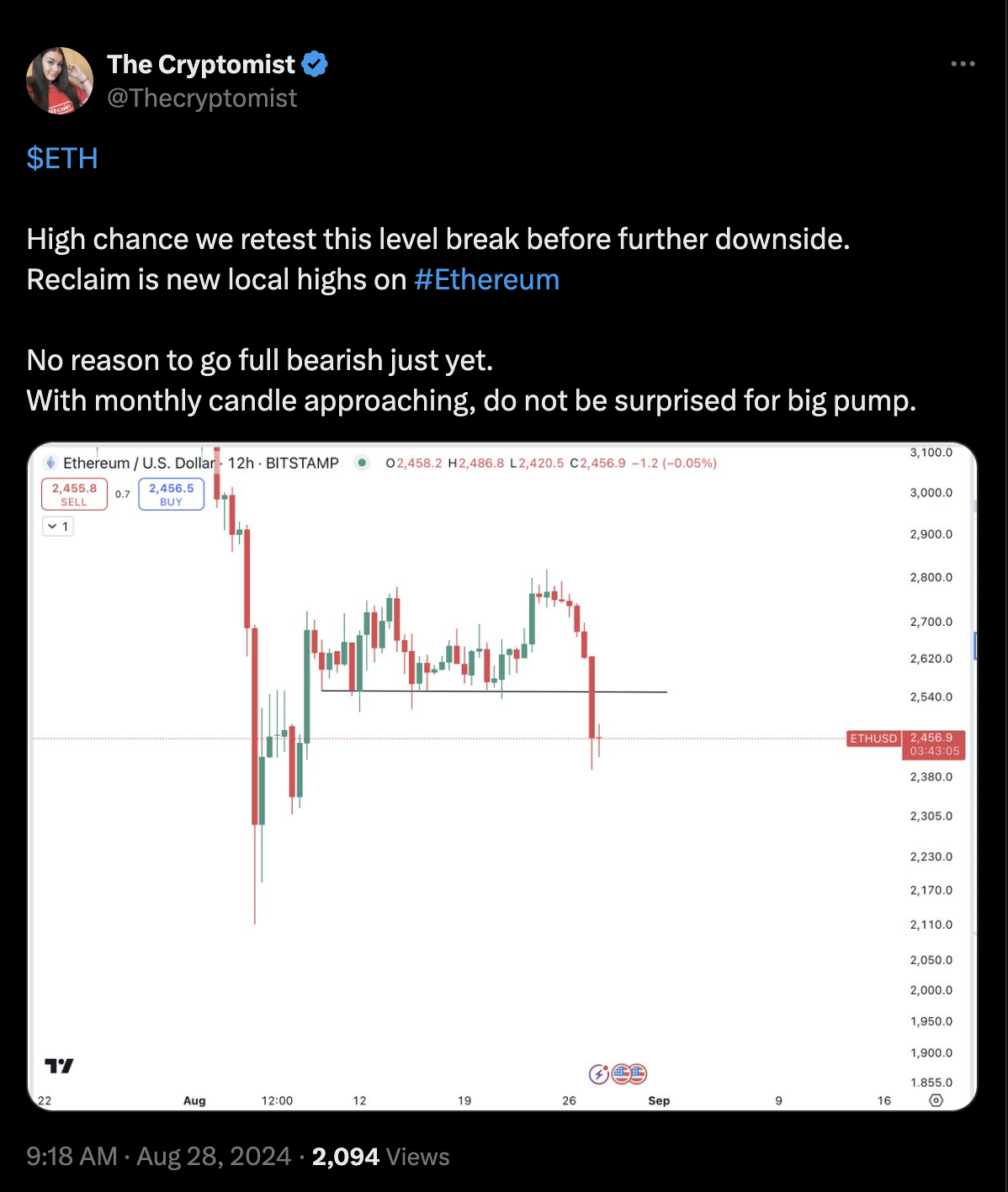

One other well-known analyst, generally known as ‘The Cryptomist’ on X (previously Twitter), offered a special perspective, cautioning towards turning overly bearish simply but.

The Cryptomist famous that whereas there was a excessive probability of Ethereum retesting its latest low, the upcoming month-to-month candle might carry a few vital pump in worth.

Supply: The Cryptomist/X

This viewpoint means that Ethereum may expertise a brief rebound earlier than any additional declines, notably because the market anticipates the shut of the month-to-month buying and selling interval.

What do Ethereum’s fundamentals recommend?

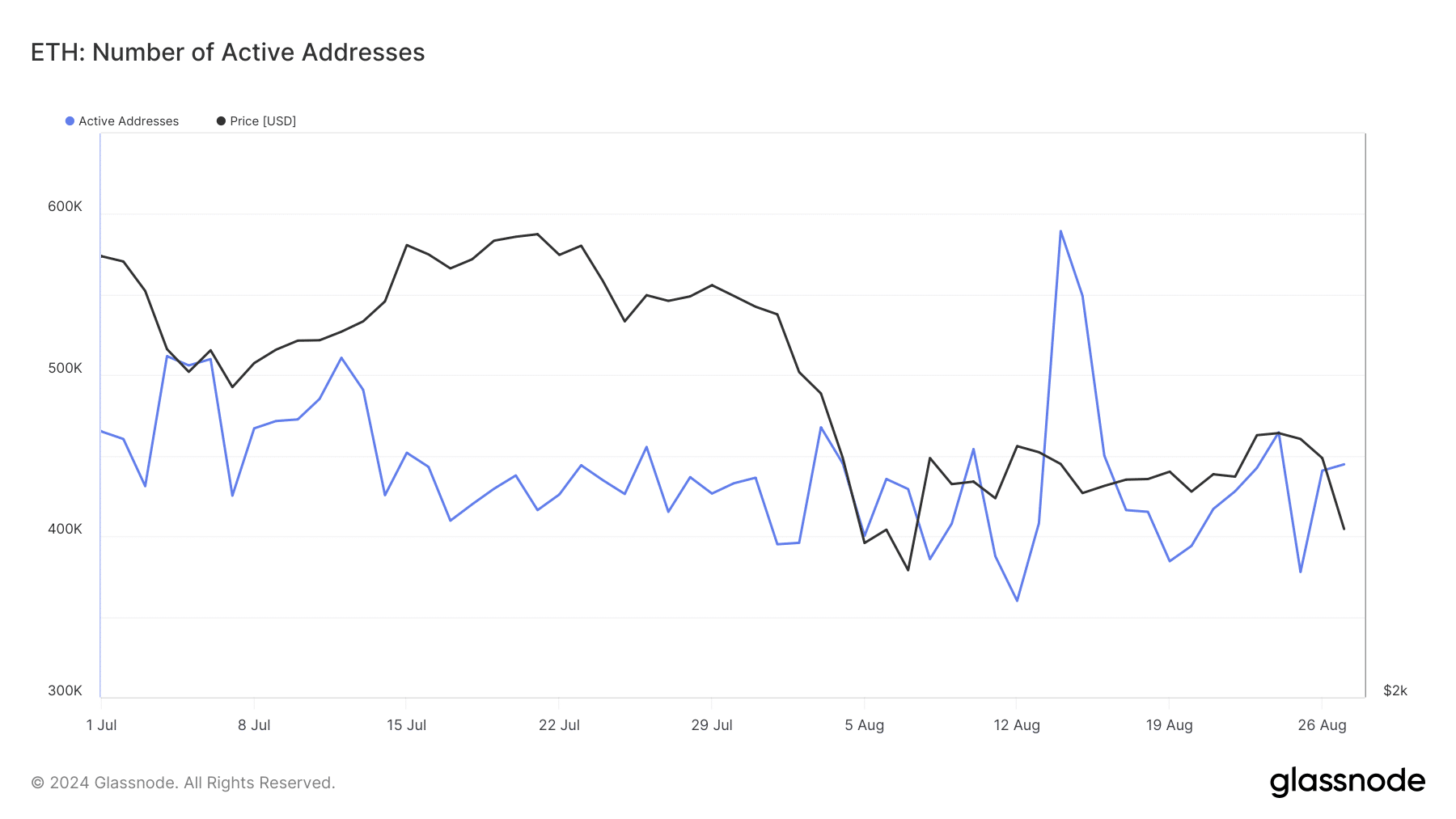

Past technical evaluation, Ethereum’s fundamentals have proven blended alerts. In response to data from Glassnode, Ethereum’s variety of energetic addresses has fluctuated over the previous month.

After a interval of consolidation, this metric spiked to 589,000 on the 14th of August.

Supply: Glassnode

Nonetheless, since then, the variety of energetic addresses has step by step declined, sitting at 444,000 at press time.

This lower in energetic addresses may point out a weakening in community exercise, which might exert downward strain on Ethereum’s worth as fewer contributors are partaking with the community.

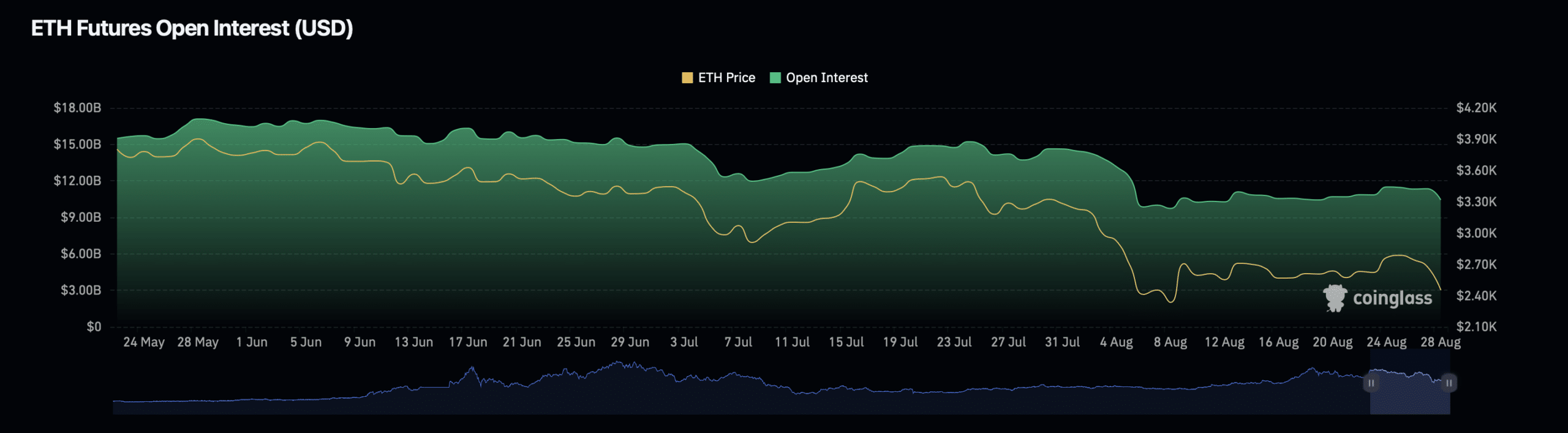

In distinction, Ethereum’s Open Curiosity data offered a extra advanced image.

Coinglass’ knowledge revealed that Ethereum’s Open Curiosity—a measure of the entire variety of excellent by-product contracts on the asset—has decreased by 7.42% over the previous day, bringing the press time valuation to $10.60 billion.

Supply: Coinglass

This decline in Open Curiosity usually means that merchants are closing positions, probably as a consequence of uncertainty or a insecurity within the short-term worth route.

Nonetheless, Ethereum’s Open Curiosity quantity has seen a big improve, rising by over 100% to achieve $38.97 billion.

Learn Ethereum’s [ETH] Value Prediction 2024 – 2025

This surge in quantity, regardless of the lower in Open Curiosity, indicated a heightened degree of buying and selling exercise, probably pushed by speculative strikes in response to the latest worth drop.

Excessive buying and selling volumes typically result in elevated worth volatility, which means Ethereum might expertise additional sharp actions within the close to time period.