Ethereum: $410M ETH liquidation looms as price nears key resistance

- A cluster of $410 million value of ETH may very well be liquidated.

- Ethereum worth motion and whale exercise are bullish.

Ethereum [ETH] has proven notable energy over the previous two weeks. As the most important altcoin by market capitalization and a key participant within the blockchain house, Ethereum’s efficiency considerably impacts the broader crypto market.

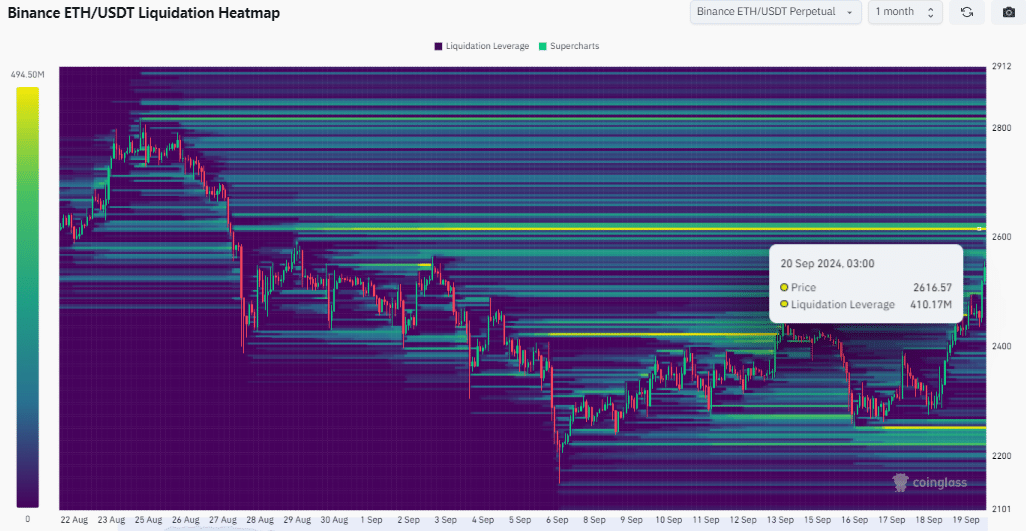

In keeping with information from Coinglass, $410.17 million value of ETH may very well be liquidated if it reaches the $2,616.57 worth stage. This was as a result of worth usually gravitates towards zones with excessive liquidity, the place bigger merchants, or “whales,” can execute trades at extra favorable costs.

These zones of concentrated liquidation ranges usually exert strain on the purchase or promote sides. With these elements in thoughts, the opportunity of Ethereum hitting the $2616.57 mark turns into extra seemingly because it seeks to choose up liquidity on this zone.

Supply: Coinglass

Can the highway to this large liquidation gas ETH to achieve $3000 after its current previous two weeks beneficial properties?

ETH worth motion reveals momentum

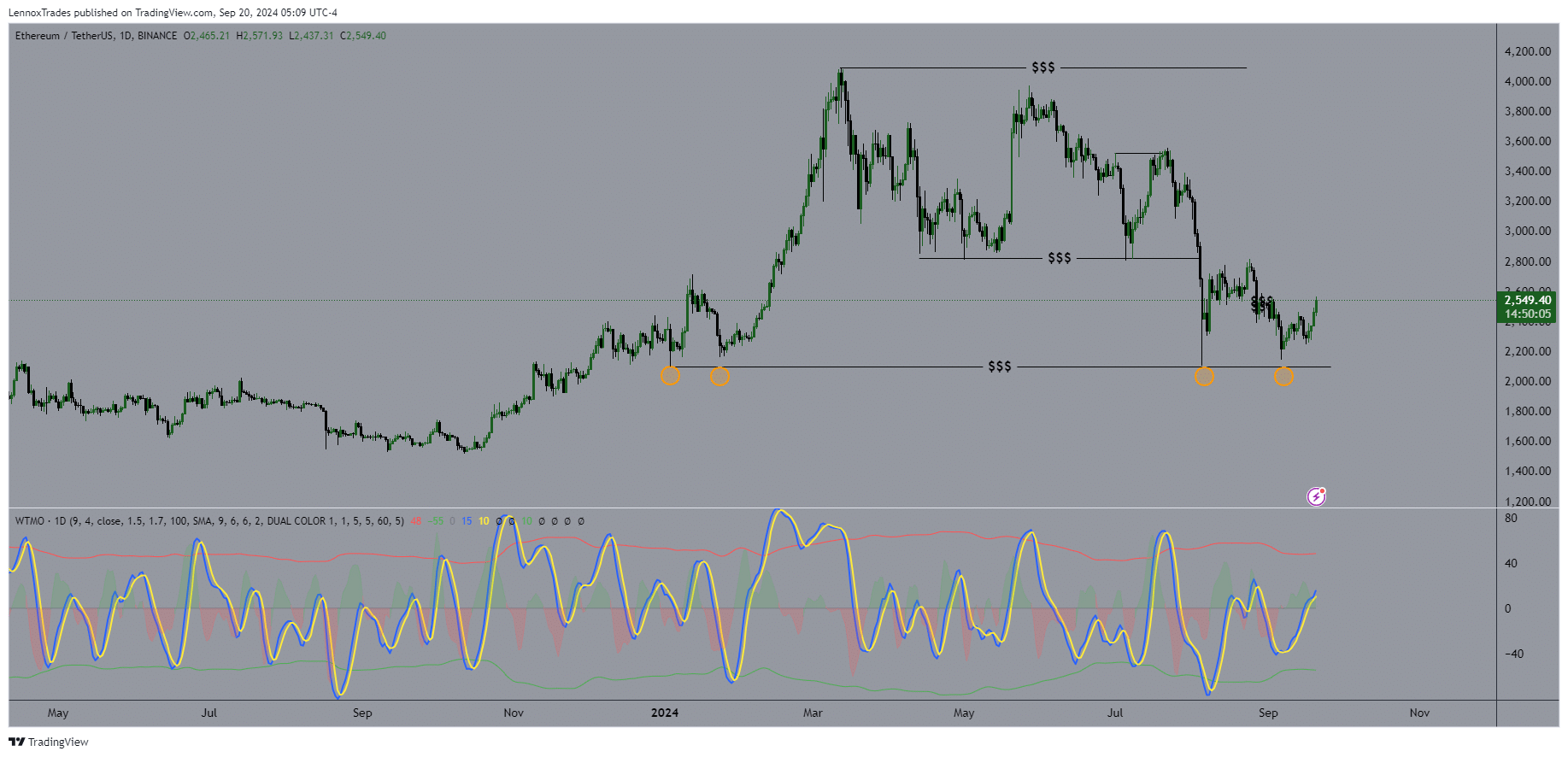

Analyzing Ethereum’s worth motion, particularly within the ETH/USDT pair, reveals a recurring sample on the day by day timeframe chart.

The Wave Pattern Momentum Oscillator (WTMO) reveals that when the lows of the oscillator align, ETH usually experiences rallies. This sample has resulted in worth surges of over 76.38% previously.

Presently, the liquidity zone above $2,616 presents a crucial magnetic stage. The coin has been steadily pushing greater for 2 weeks, regardless of 4 purple days, which had been shortly corrected.

Supply: TradingView

Worth is now aggressively approaching the $2,616 mark. If it breaks this stage, the liquidation of orders resting above it might gas even greater costs, presumably closing above $3,000.

Whale exercise fuels momentum

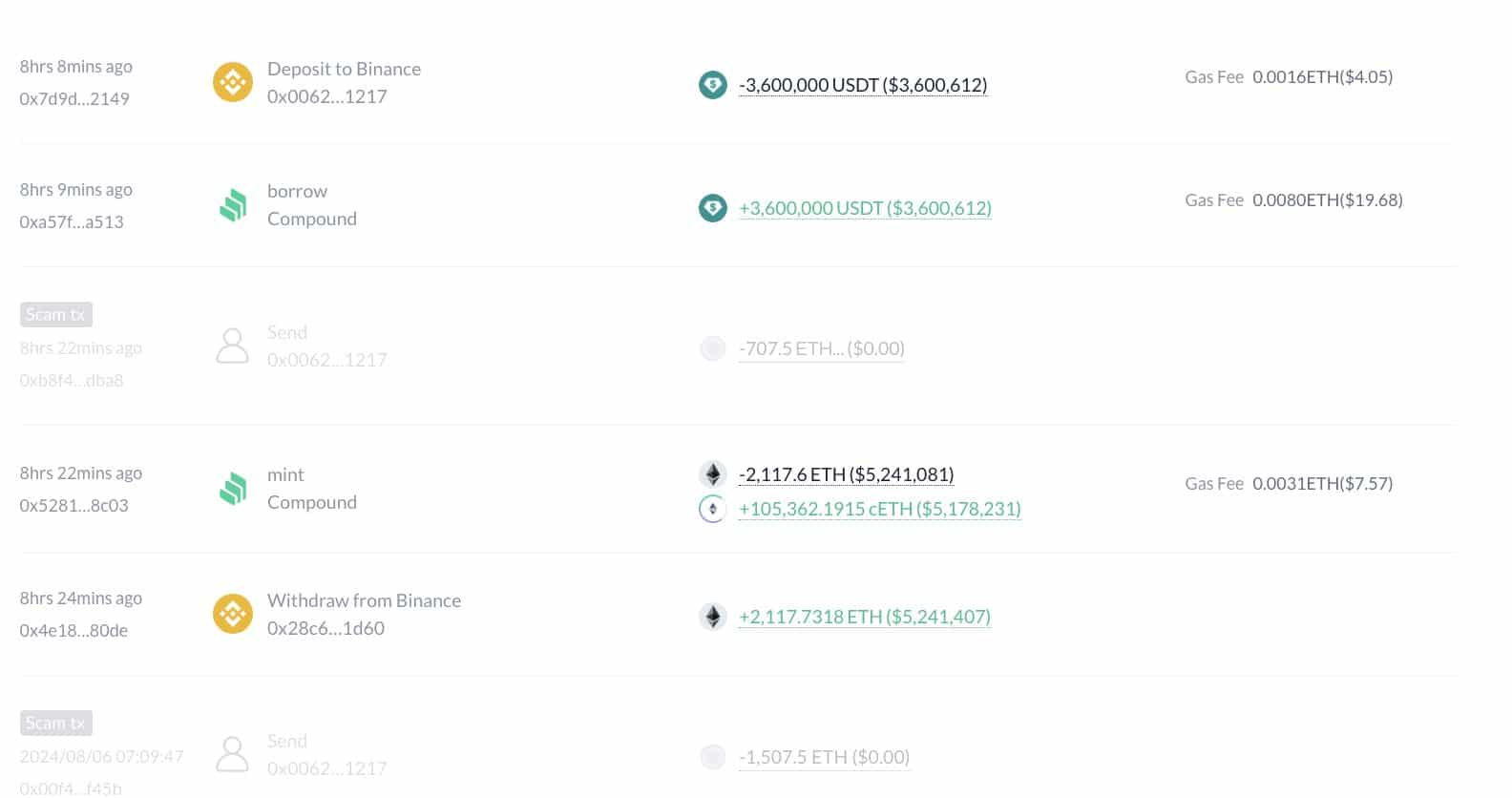

Whale exercise on the Ethereum community has additionally been on the rise, additional supporting the opportunity of greater ETH costs.

Lately, a whale bought 2,117.7 ETH value over $5.17 million after ETH costs rose. This whale went lengthy by means of round borrowing.

Nevertheless, the identical whale beforehand misplaced 6,078 ETH, value $14.7 million, when the market plummeted on August 5. Over the previous six months, the whale misplaced $13 million by going lengthy on ETH, successful just one out of 5 makes an attempt.

Supply: Lookonchain

Whereas this whale’s win charge is simply 20%, if extra whales enhance their holdings, it might push ETH past the $2,616 stage and even greater within the close to time period.

Ethereum’s future outlook

Lastly, Vitalik Buterin outlined Ethereum’s 2024 prospects in a video circulating on X, previously Twitter.

He emphasised Ethereum’s give attention to scaling, usability, and zero-knowledge (ZK) infrastructure, which is able to increase the vary of on-chain potentialities.

Learn Ethereum’s [ETH] Worth Prediction 2024–2025

Vitalik envisions these technological developments driving the creation of apps that might serve billions of customers.

With its sturdy basis and rising adoption, Ethereum is poised to play a major function in shaping the way forward for blockchain expertise.