Ethereum alert: $87M ETH moves to exchange – Is a major sell-off coming?

- Ethereum may attain $3,600 and $4,000 if market sentiment stays unchanged.

- Regardless of the large ETH deposits to Binance, Ether stays bullish.

Amid the bullish market sentiment, a considerable Ethereum [ETH] transaction by a whale has gained widespread consideration from the crypto neighborhood.

On-chain analytic agency Lookonchain made a put up on X on twenty ninth July stating {that a} large whale has moved a notable 25,800 ETH value $87 million to Binance.

Whale strikes 25,800 ETH to Binance

In accordance with the put up on X, the whale purchased 26,721 ETH from Binance at a mean value of $3,457 between thirty first Might and twenty fifth July of this 12 months.

With the current deposit, this whale has deposited a notable 26,660 ETH at a mean value of $3,376 between seventeenth July and twenty ninth July.

This transfer has raised concern amongst buyers and merchants. In the meantime, the rationale for this large deposit stays unclear.

At any time when the market sees such notable deposits to exchanges, there’s a excessive likelihood that the value might probably decline or have an effect available on the market.

Nevertheless, information reminiscent of Complete-Worth Locked (TVL) and Open Curiosity (OI) recommend that this notable ETH deposit won’t impression the ETH value.

In accordance with an on-chain analytic agency Defillama and CoinGlass, Ethereum’s TVL and OI have risen by 3% and 6.2% respectively, within the final 24 hours.

Ether technical evaluation and key ranges

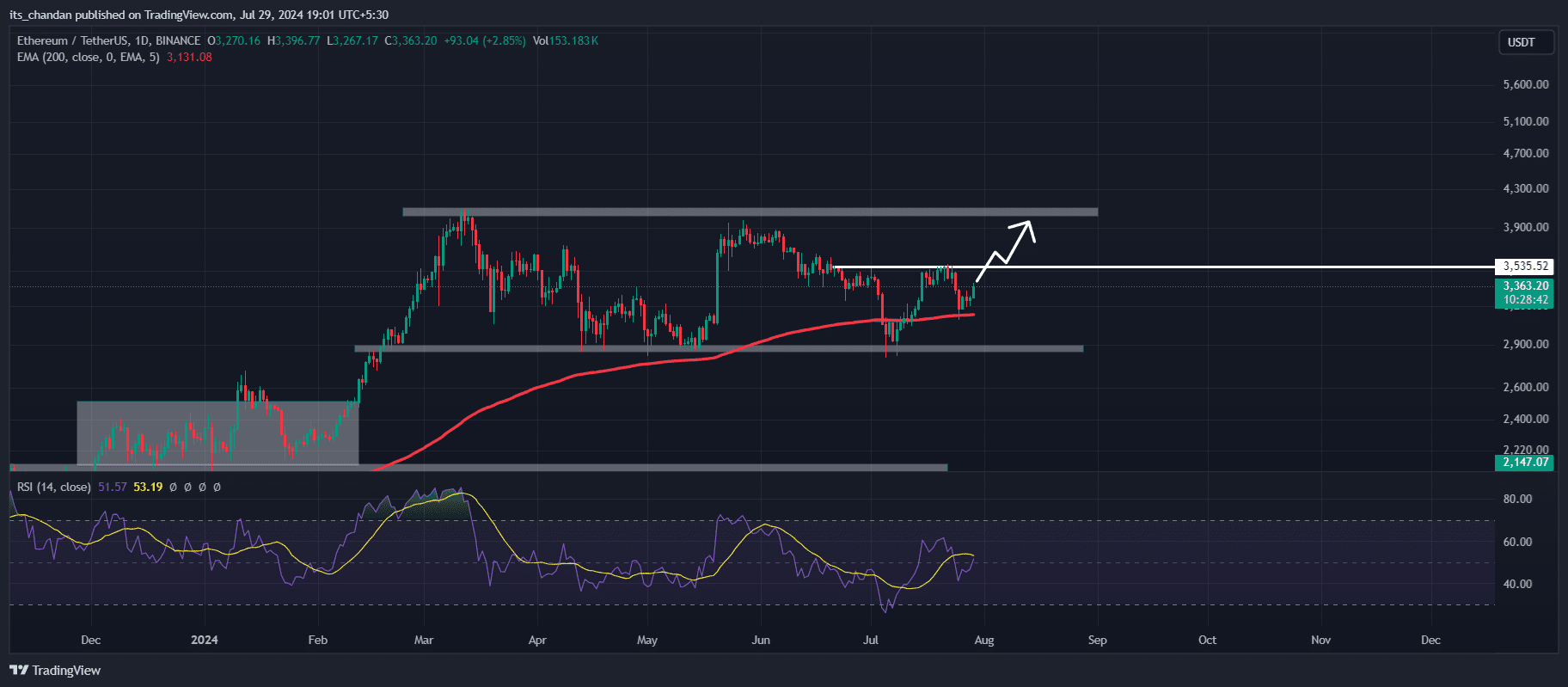

In accordance with knowledgeable technical evaluation, ETH appears to be like bullish because it strikes above the 200 Exponential Shifting Common (EMA) on each the 4-hour and each day time-frame.

Moreover, the Relative Energy Index (RSI) additionally signifies bullishness for ETH because the RSI worth stays beneath the overbought space.

Supply: TradingView

By analyzing the ETH chart utilizing value motion and technical indicators, there’s a excessive likelihood that ETH may attain $3,600 and $4,000 if the market sentiment stays unchanged.

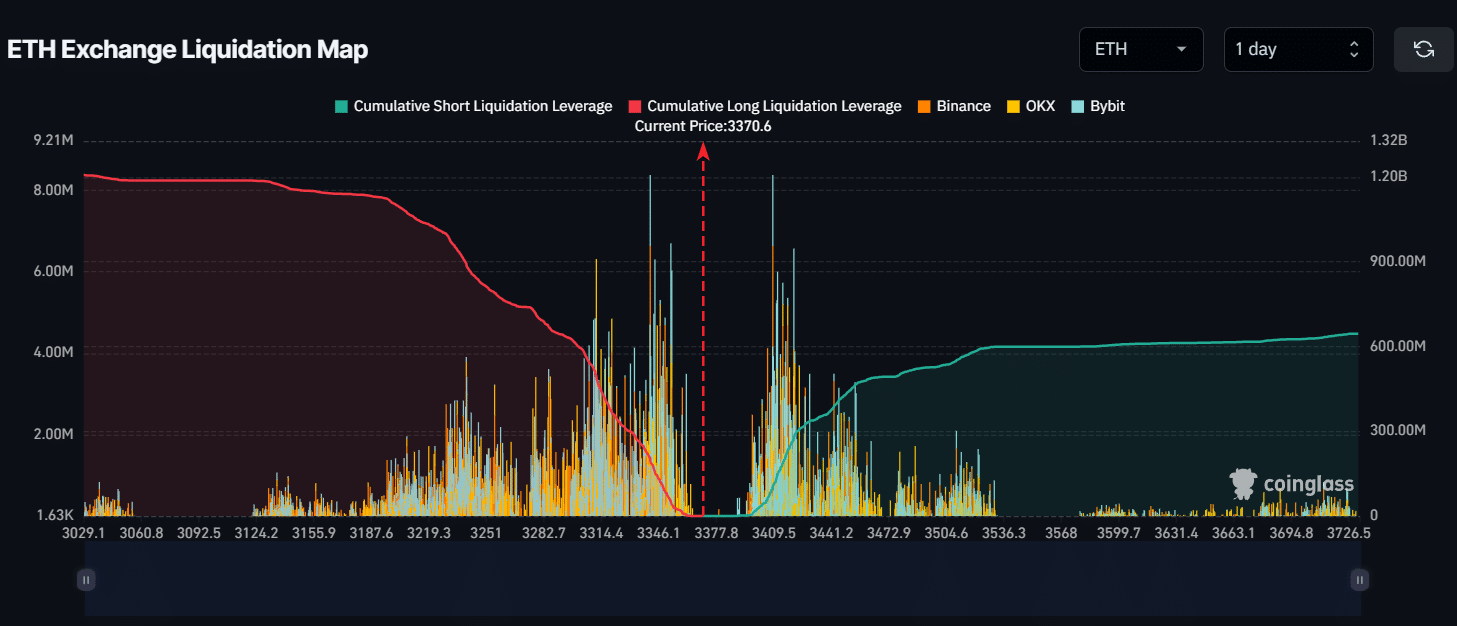

ETH’s main liquidation stage

Nevertheless, the most important liquidation ranges are $3,340 on the decrease aspect and $3,410 on the upper aspect, in line with CoinGlass information. If market sentiment adjustments and the ETH value falls to the $3,340 stage, $188 million value of lengthy positions shall be liquidated.

Supply: CoiGlass

Conversely, if the ETH value rises to the $3,400 stage, $87 million of brief positions shall be liquidated. This information from CoinGlass means that bulls at the moment have a stronger presence than bears available in the market.

Learn Ethereum (ETH) Worth Prediction 2024-25

As of writing, ETH is buying and selling close to the $3,380 stage and has skilled a value surge of over 3.5% within the final 24 hours.

Nevertheless, buying and selling quantity has declined by 20% throughout the identical interval, suggesting decrease participation from buyers and merchants.