Ethereum – All the reasons why ETH’s price might enjoy a bullish December

- Ethereum ETFs simply recorded their highest single-day inflows, surpassing Bitcoin ETFs

- ETH is perhaps on the verge of a significant rally after hikes in Alternate Reserves and Open Curiosity

Bitcoin and Ethereum ETF approvals earlier this yr had been little question important milestones for institutional liquidity. Whereas Bitcoin has maintained dominance by way of inflows, Ethereum ETF every day inflows simply pulled off a lead for the primary time in historical past.

Based on the latest ETF data, Ethereum ETF inflows peaked at $332.9 million on Friday. In the meantime, Bitcoin had $320 million price of ETF inflows throughout the identical buying and selling session. This can be a noteworthy consequence as a result of it was the primary time that Ethereum ETFs outperformed Bitcoin ETFs by way of inflows.

In truth, Friday additionally recorded the very best single day inflows. Friday recorded not solely the very best inflows reported in November, but additionally throughout its complete historical past since Ethereum ETFs first began buying and selling.

Is Ethereum on the verge of a significant breakout?

Is the truth that Ethereum ETFs’ every day inflows outperformed Bitcoin ETF inflows an indication that ETH is heading for a significant rally? Properly, Bitcoin dominance has been declining, which can clarify why Ethereum has been receiving extra investor consideration. Nevertheless, that’s not all.

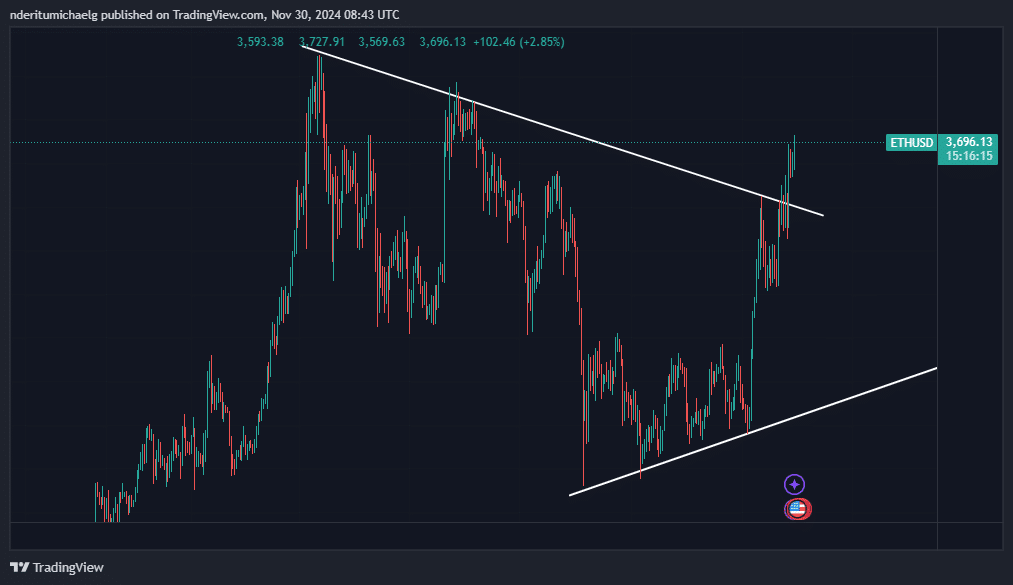

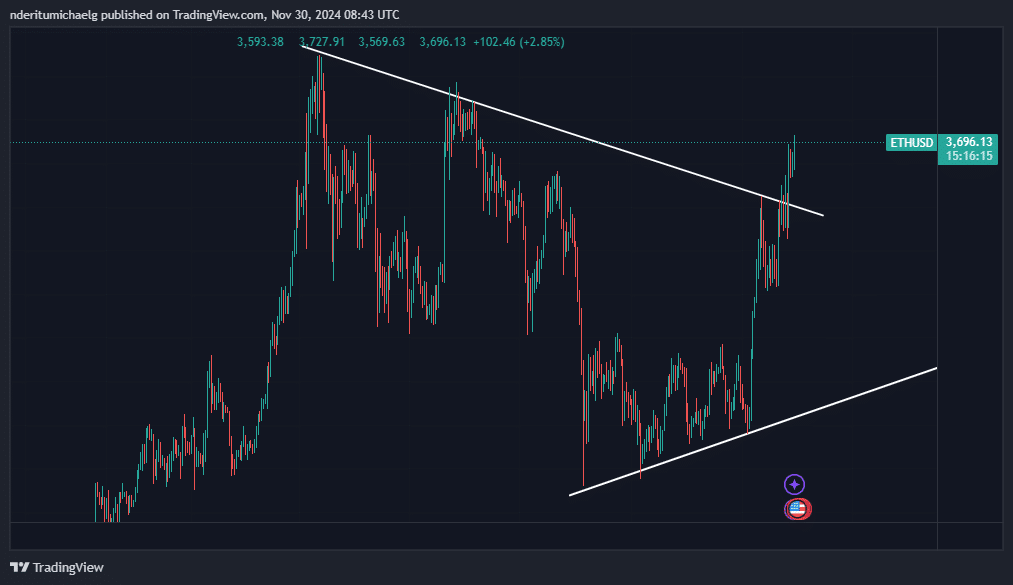

ETH gained a number of bullish momentum in the course of the week, confirming a breakout from its long-term wedge sample. The identical breakout additionally highlighted a long-term bull flag for the cryptocurrency. These components, mixed, steered that ETH may very well be on the verge of a bullish December.

Supply: TradingView

On the time of writing, the altcoin was valued at $3,694. Sustained demand after a breakout from the descending resistance line may very well be an indication of rising bullish optimism.

Moreover, there appeared to be a number of different indicators that aligned with the aforementioned findings. For instance, ETH’s Open Curiosity peaked at $24.08 billion on 28 November – Its highest stage, ever.

supply: Coinglass

The brand new Open Curiosity report confirmed that sturdy ETH derivatives demand was at play, alongside ETFs demand.

Alternate Reserves’ information additionally confirmed rising confidence amongst ETH holders. In truth, figures for a similar grew by about 750,000 cash within the final 30 days, bringing the overall reserves on exchanges to round 19.72 million ETH.

Supply: CryptoQuant

Ethereum’s Alternate Reserves at the moment are at ranges final seen in April 2024. The cryptocurrency has to date achieved 2 months of constructive alternate reserves for the primary time this yr.

This can be a signal of the shifting sentiment amongst ETH holders and will allude to declining ETH promote strain on the charts. If this is so, ETH may quickly be heading to cost ranges above $4,000 and past.