Ethereum apes its 2021 pattern – Will ETH replicate its gains?

- Ethereum is simply getting began to ape its 2021 sample.

- Quick-term liquidity zones emerged at $2.8K — $3K and $2.5K as promoting stress in Futures market decreased.

Ethereum’s [ETH] charts from 2021 and 2025 revealed a tantalizing narrative for potential future worth motion. In 2021, ETH skilled an explosive rise, climbing from sub-$500 ranges to peak round $4,500.

This meteoric rise was characterised by a big breakout after a consolidation interval that started in late 2020.

Quick-forward to 2025, and the sample reveals similarity, with ETH presently hovering round $2,000 after a notable decline from greater ranges.

The 2021 ascent started after ETH held help close to $500, resulting in a rise in shopping for stress and bullish sentiment, ultimately pushing costs to new highs.

In 2025, ETH has proven resilience at a key help stage above $2500, mirroring the early phases of its 2021 trajectory. If ETH follows the same path, it might replicate previous positive aspects, doubtlessly reaching $26,000 by the tip of 2026.

Supply: X

Conversely, if Ethereum fails to maintain the $2,000 help, it might point out a weakening of purchaser momentum, presumably resulting in additional declines.

Traders ought to think about each the potential for a bullish replication of 2021 and the potential for continued decline that may forestall the same consequence.

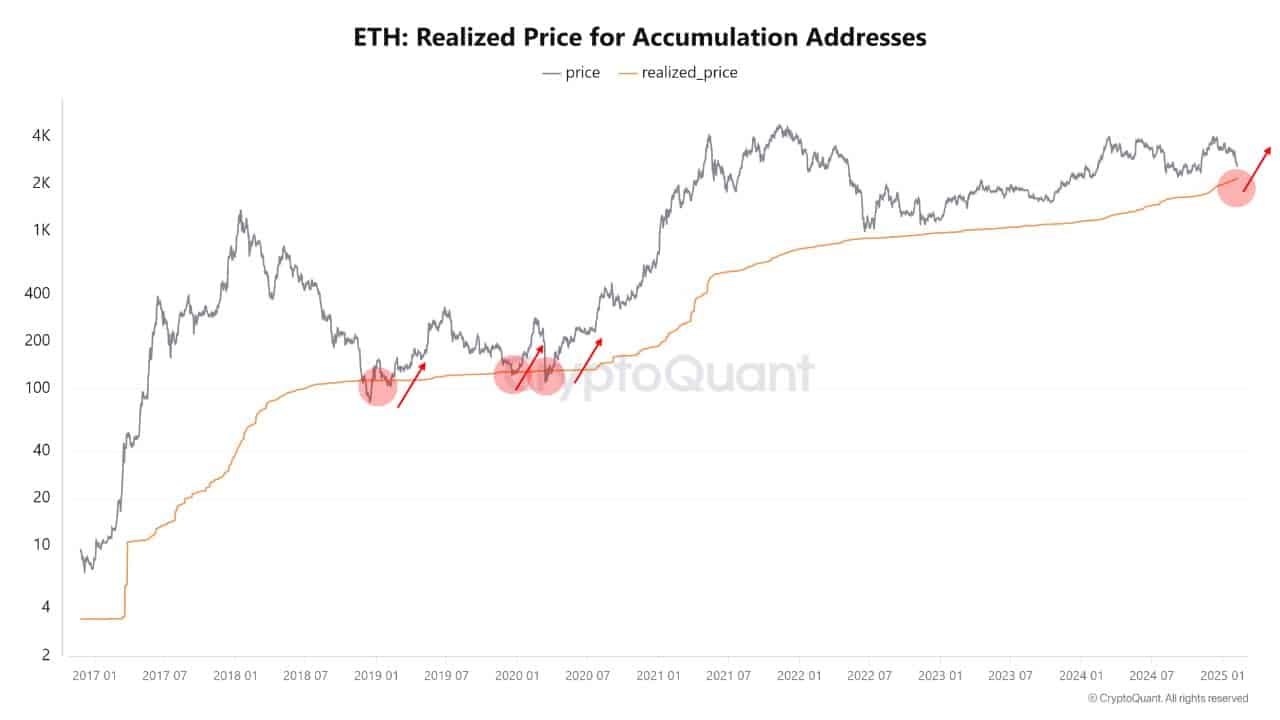

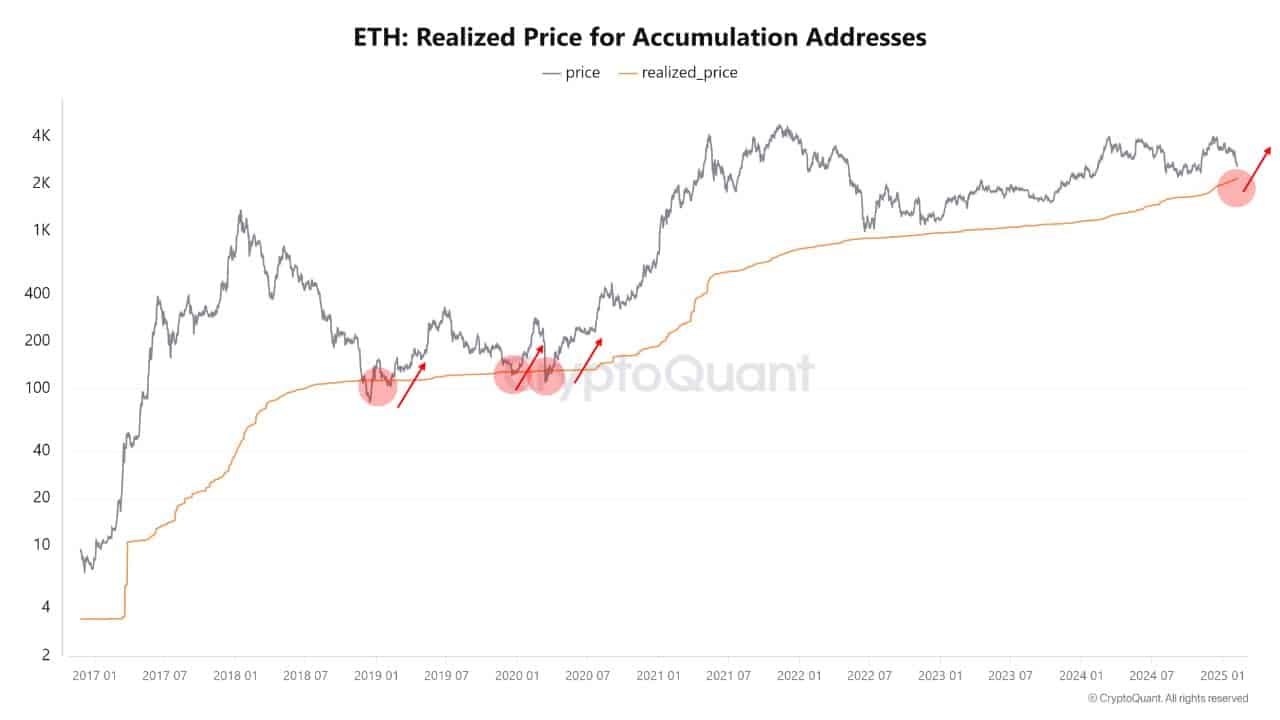

Everlasting holders rise as promoting stress declines

With ETH’s displaying potential to copy its 2021 positive aspects, its realized worth of $2.2k is properly beneath the market worth of $2.6k, indicating undervaluation with the realized worth appearing as robust help.

The MVRV ratio barely above 1 additional emphasizes potential for appreciation.

Development in quantity of everlasting holders who’ve purchased ETH and by no means bought is quickly growing, mirroring Bitcoin’s traits, suggesting resilience in opposition to promoting pressures from exiting whales.

Supply: CryptoQuant

Moreover, decreased promoting stress within the Ethereum’s Futures market, in comparison with earlier highs when ETH reached $4k, indicated sustained shopping for curiosity regardless of worth declines.

These collectively recommend ETH might doubtlessly echo its previous rise, although outcomes depend upon ongoing market sentiment and stability.

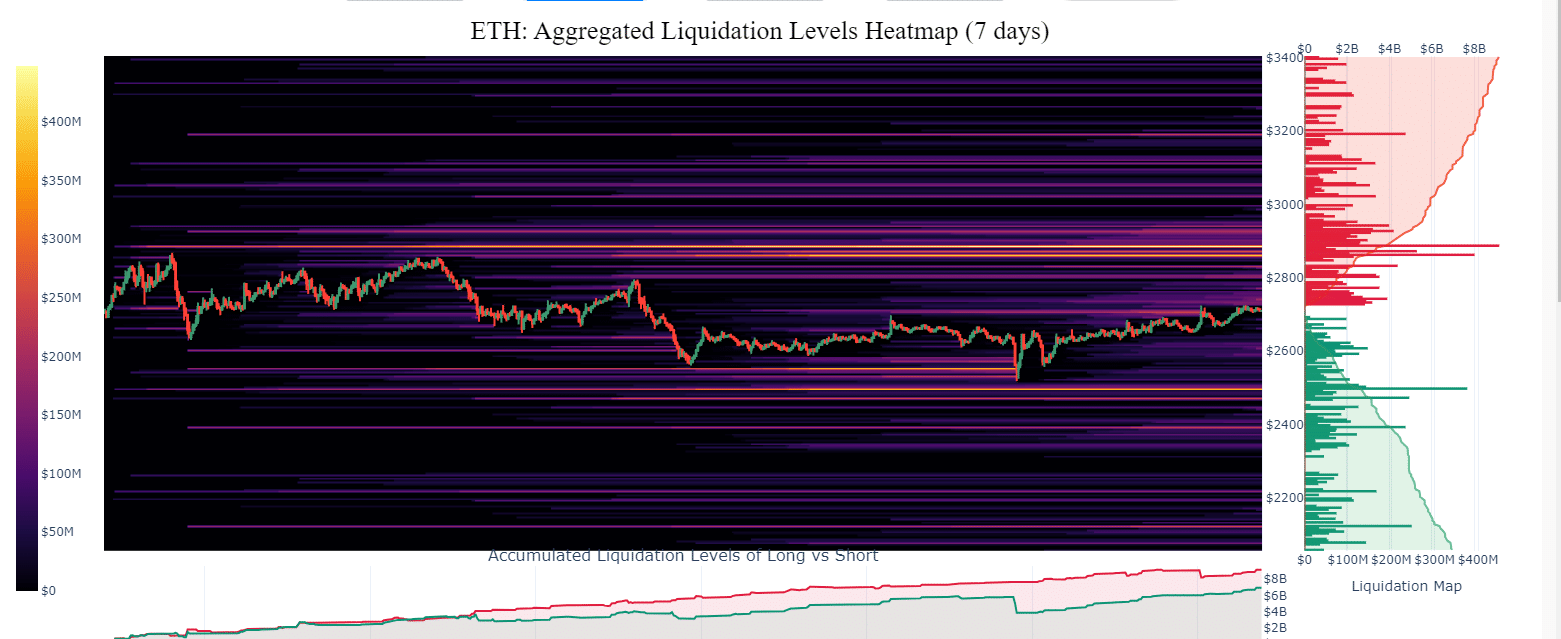

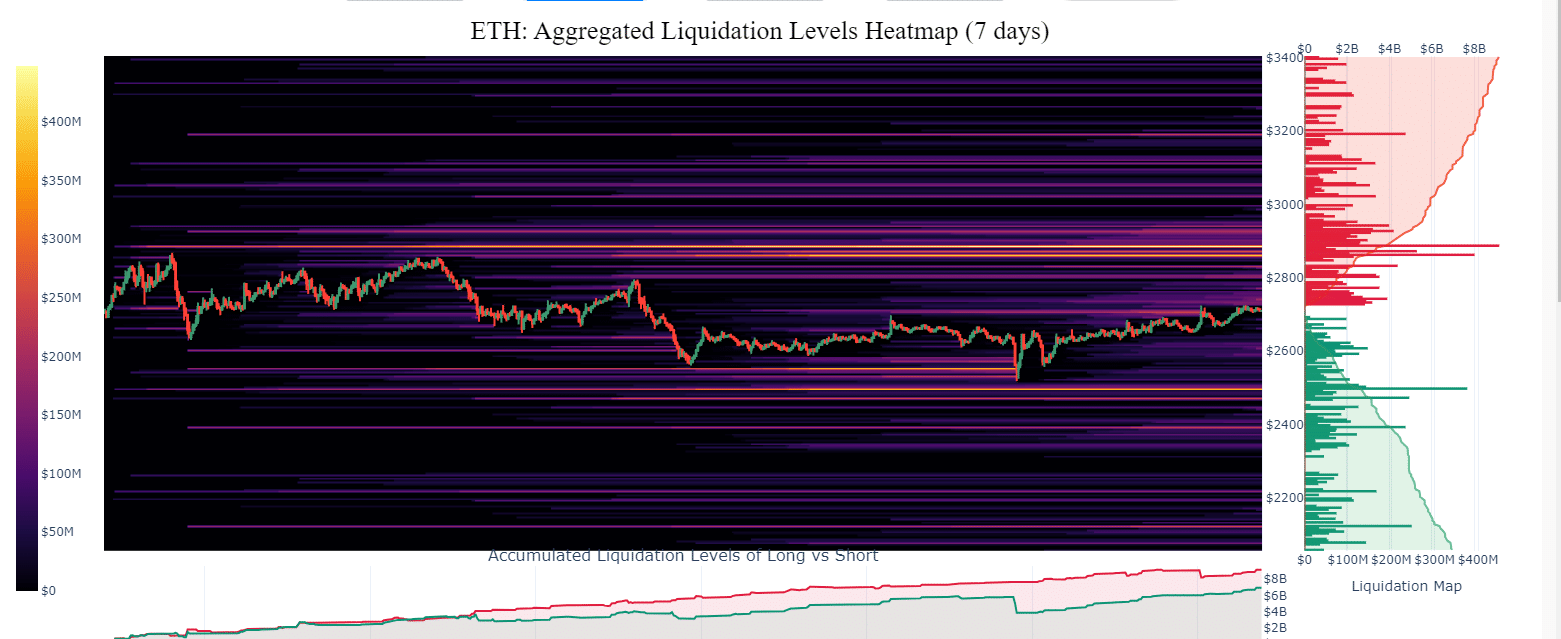

Ethereum’s short-term liquidity zones

The Ethereum liquidity heatmap indicated that the $2.5k to $3k zones are essential for each help and resistance.

Traditionally, these ranges have both propelled ETH upwards upon help or capped positive aspects when appearing as resistance.

The focus of liquidations between ranges, $2800 to $3000, urged this vary was pivotal for ETH’s short-term actions.

Supply: X

A secure maintain above $3k might echo the 2021 surge, whereas dropping beneath $2.5k would possibly undermine bullish momentum.

These dynamics want shut monitoring, as they might dictate Ethereum’s capability to reflect previous performances or diverge from them.