Ethereum at a crossroads: Key indicators signal turning point

- Ethereum’s latest worth motion has revealed crucial help and resistance ranges that merchants ought to monitor.

- As ETH broke beneath the $3,593.46 help, Open Curiosity in Ethereum Futures contracts initially rose.

Ethereum [ETH], the second-largest cryptocurrency by market capitalization, has lately damaged beneath a key help degree, sparking considerations amongst merchants.

With Bitcoin [BTC] present process its personal correction, Ethereum has proven indicators of additional retracement.

Analysts are eyeing $2,809 as a possible accumulation zone earlier than a potential rebound. This setup suggests {that a} deeper correction would possibly happen earlier than the bullish momentum resumes.

Assist and resistance ranges

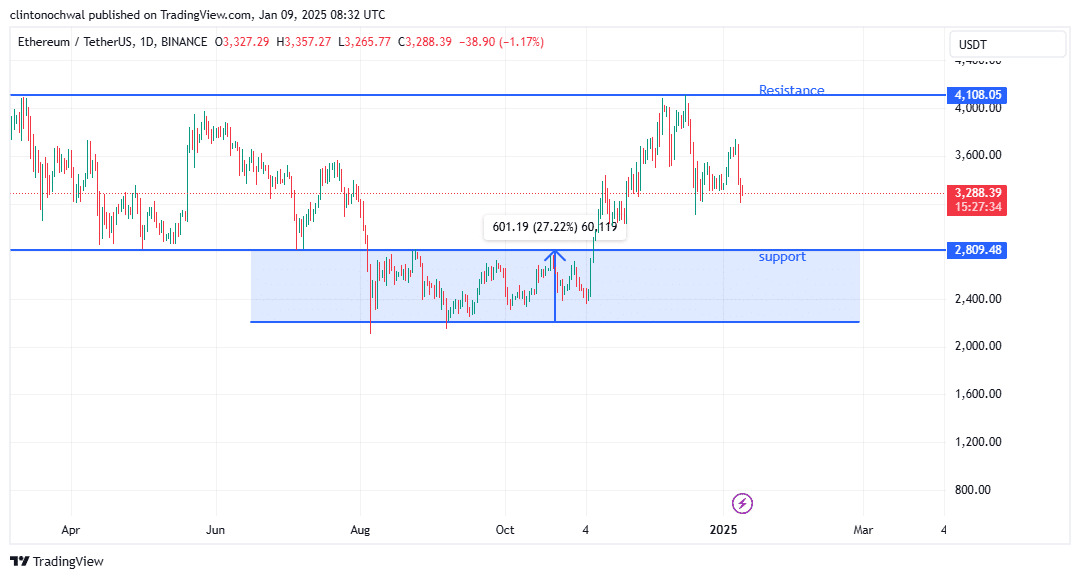

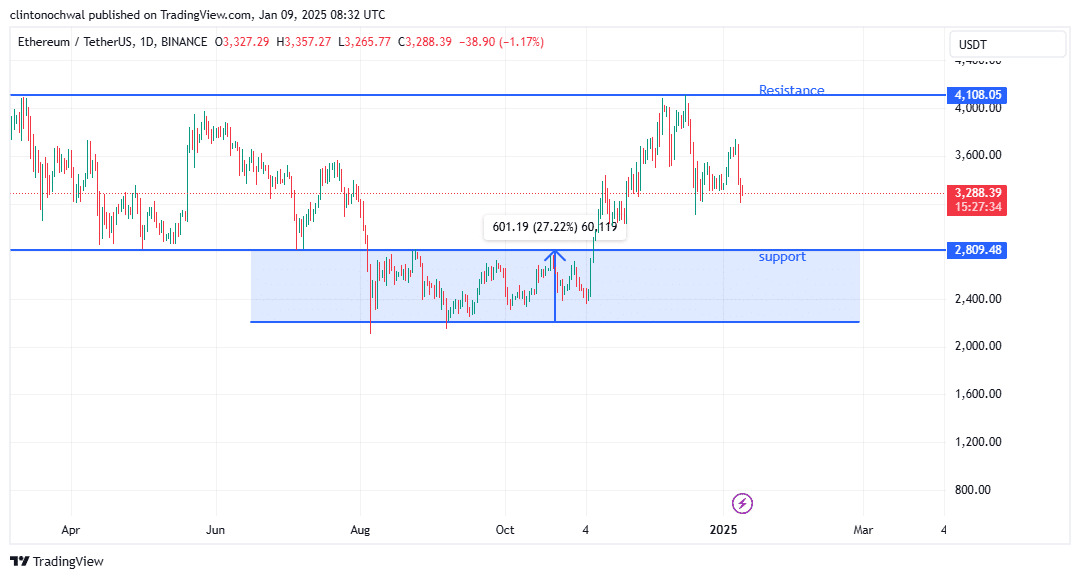

Ethereum’s latest worth motion has revealed crucial help and resistance ranges that merchants ought to monitor. On the 4-day timeframe, Ethereum’s worth motion remained outlined by key ranges of help and resistance.

There was a crucial help zone at $2,809.48, whereas the closest resistance stood at $4,108.05. These ranges are vital benchmarks for merchants monitoring potential reversals or continuations in ETH’s trajectory.

Supply: TradingView

The breakdown beneath $3,593.46 has confirmed bearish momentum, with the worth hovering close to $3,297.19 at press time.

This degree sat nearer to the mid-point between help and resistance, doubtlessly signaling a consolidation part earlier than the following important transfer.

If ETH exams the $2,809.48 help and holds, it might mark a powerful accumulation zone for long-term merchants. Conversely, failure to carry this degree may result in additional declines, probably triggering broader market bearishness.

Bears giving up?

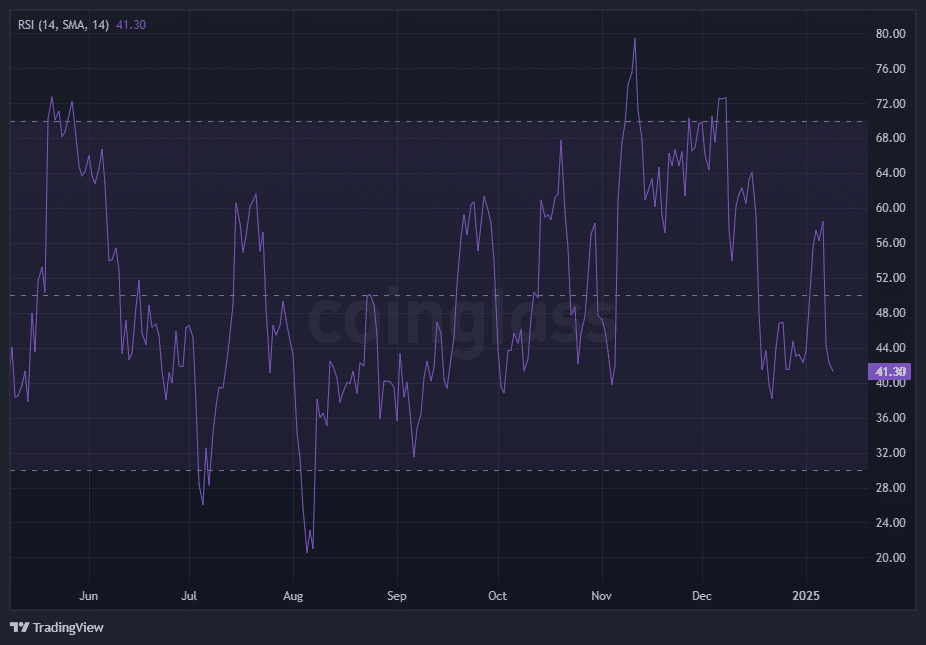

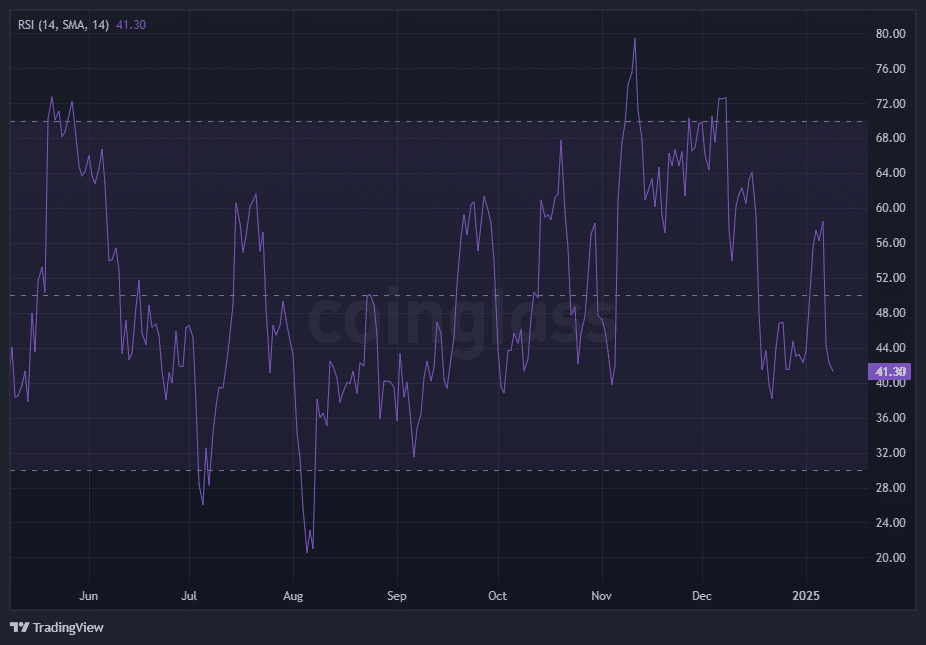

The Relative Power Index (RSI) supplies crucial insights into Ethereum’s present momentum and potential worth trajectory.

As proven within the chart, the RSI has been trending downward, reflecting growing promoting strain and waning bullish energy.

With the RSI approaching the oversold threshold of 30, the market is signaling potential exhaustion of the latest bearish momentum.

Supply: Coinglass

The RSI evaluation stays essential for understanding Ethereum’s momentum. Press time RSI ranges, reflecting the up to date worth motion, steered growing promoting strain.

As ETH tendencies nearer to $2,809.48, the RSI could dip additional towards the oversold threshold of 30.

This might sign a possible bounce or consolidation, relying on market sentiment.

Merchants ought to monitor for a decisive RSI rebound above 40, which may point out a restoration aligned with motion towards $4,108.05. Failure to take action would possibly end in ETH sustaining its bearish trajectory.

Ethereum: Assessing market sentiment

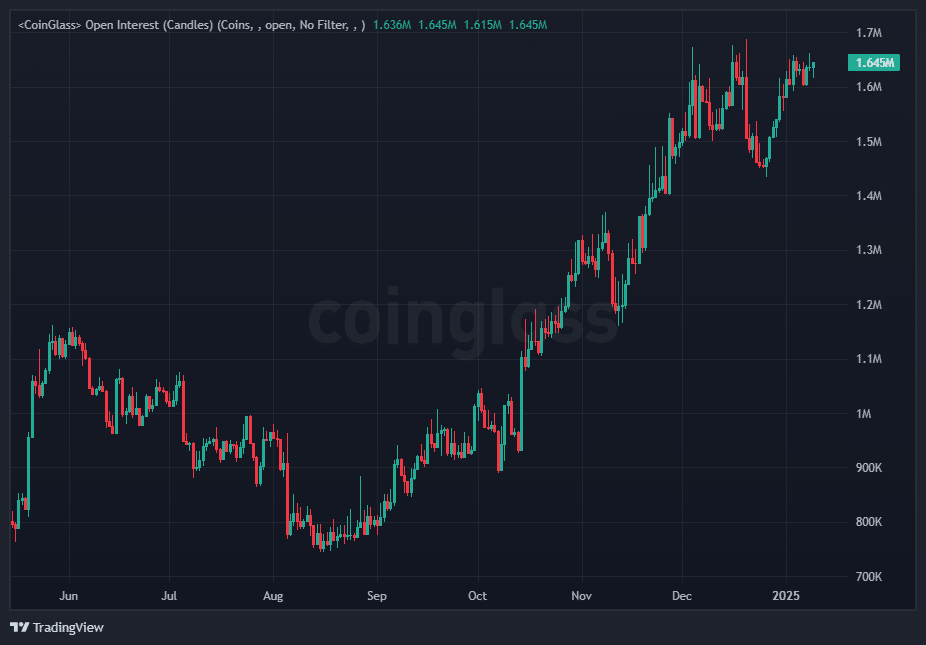

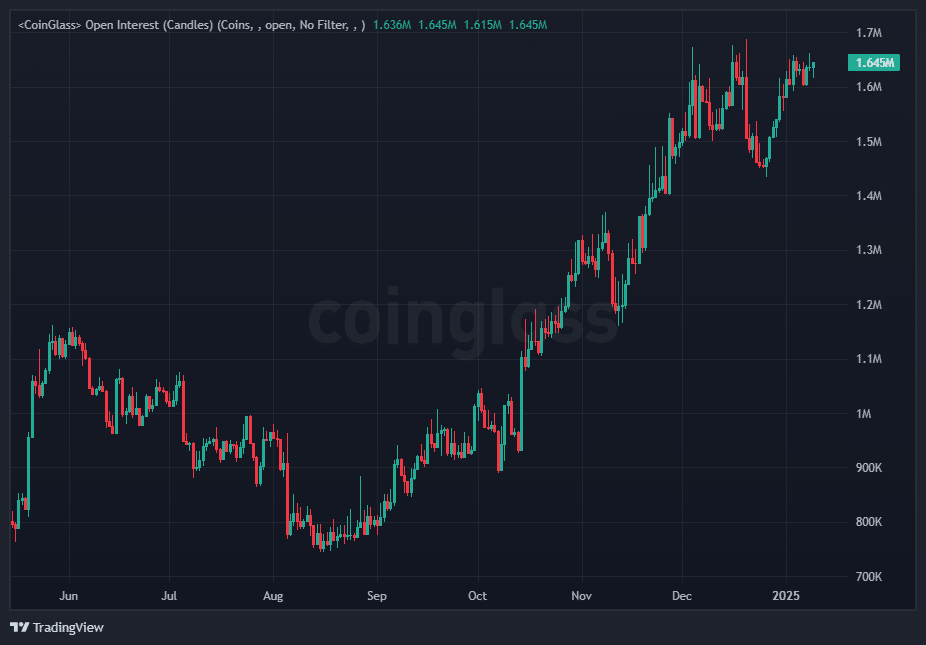

Open Curiosity, which displays the overall variety of excellent futures and choices contracts, serves as a key metric for gauging market participation and sentiment.

In Ethereum’s case, the latest worth decline has been accompanied by fluctuating ranges, revealing vital tendencies.

Supply: Coinglass

As ETH broke beneath the $3,593.46 help, Open Curiosity in Ethereum Futures contracts initially rose. This steered elevated speculative exercise as merchants positioned themselves for additional draw back.

Rising Open Curiosity throughout a worth drop typically alerts that bearish sentiment is intensifying, as extra market members anticipate continued declines.

Nevertheless, following the sharp correction to $3,318.41, Open Curiosity started to stabilize, hinting at decreased speculative strain and potential market indecision.

A major drop in Open Curiosity at this stage would possibly point out a cooling market, with merchants closing their positions and awaiting clearer alerts.

Conversely, renewed will increase in Open Curiosity, particularly close to the $2,807.13 help zone, may level to accumulation by long-term buyers or heightened speculative curiosity in anticipation of a rebound.

Learn Ethereum’s [ETH] Worth Prediction 2025–2026

As exterior elements like Bitcoin’s correction proceed to affect Ethereum’s efficiency, merchants ought to stay cautious and carefully monitor these key ranges and metrics.

A bounce from the $2,807.13 help may reignite bullish momentum, whereas failure to carry this degree would possibly result in deeper corrections.