Ethereum at crucial $2.6k support – Can ETH bears beat the bulls?

- Ethereum was buying and selling at a key help zone at $2.6k.

- Coinalyze information confirmed slight bullishness, but it surely won’t be sufficient to propel an ETH rally.

Ethereum [ETH] confirmed a barely extra bullish outlook on-chain, and trade netflow traits confirmed extra constant accumulation for ETH than Bitcoin [BTC]. But, the $2.6k area was a stiff resistance zone.

A current report famous a high-value transaction of $32 million value of Ethereum transferred to Coinbase, which might be the following wave of promoting. Will the bulls be compelled to retreat as soon as extra?

The OBV spiral didn’t assist the bullish case

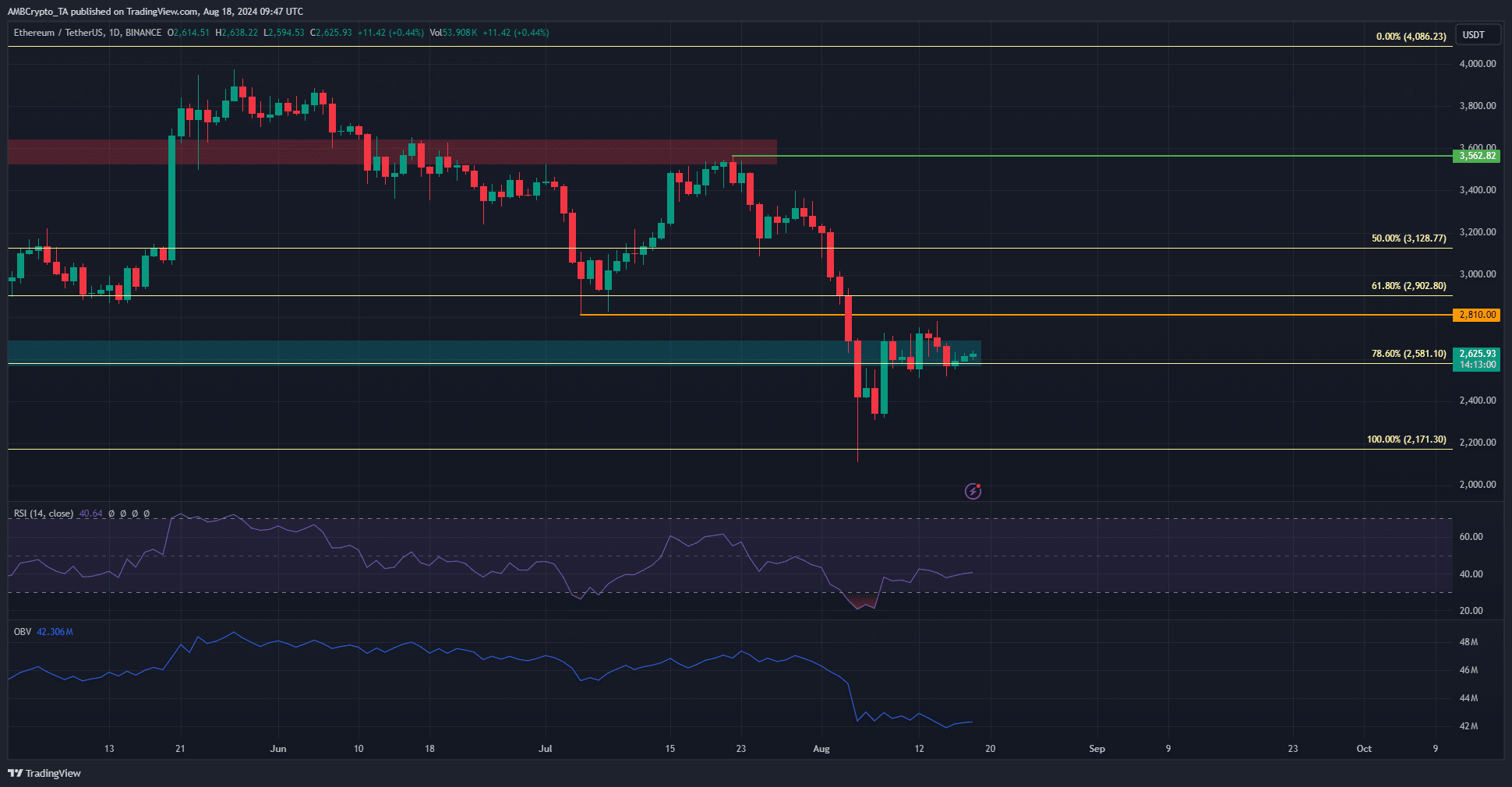

Supply: ETH/USDT on TradingView

The 1-day timeframe confirmed a robust bearish market construction for ETH. Moreover, the OBV was in a gentle downtrend. Regardless of the value bounce from $2.2k, the OBV has set decrease highs over the previous ten days.

This was a robust signal that the token doesn’t have the demand essential to provoke a rally.

Any value strikes increased would doubtless be unsustainable till the OBV modifications trajectory to point shopping for strain out there.

Don’t count on a fast rally but

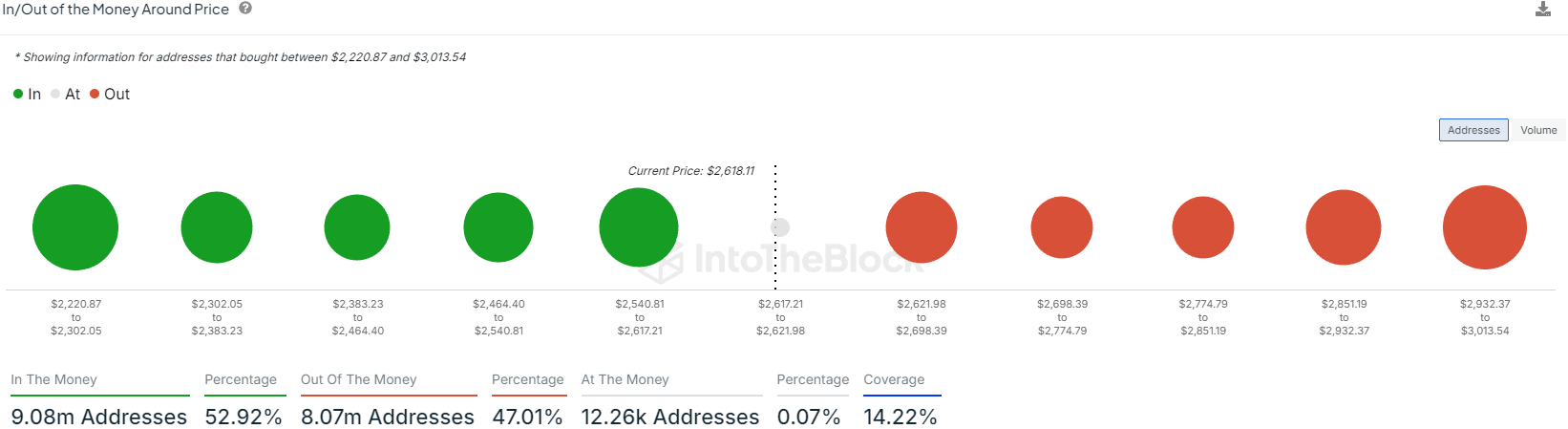

Supply: IntoTheBlock

The in/out of the cash round value confirmed the $2540-$2617 was a robust help zone. The resistances above, stretching as much as $2.9K, have been smaller however nonetheless sizeable.

The worth bounce above $2.6K meant a slight majority of the addresses that purchased in August have been within the cash.

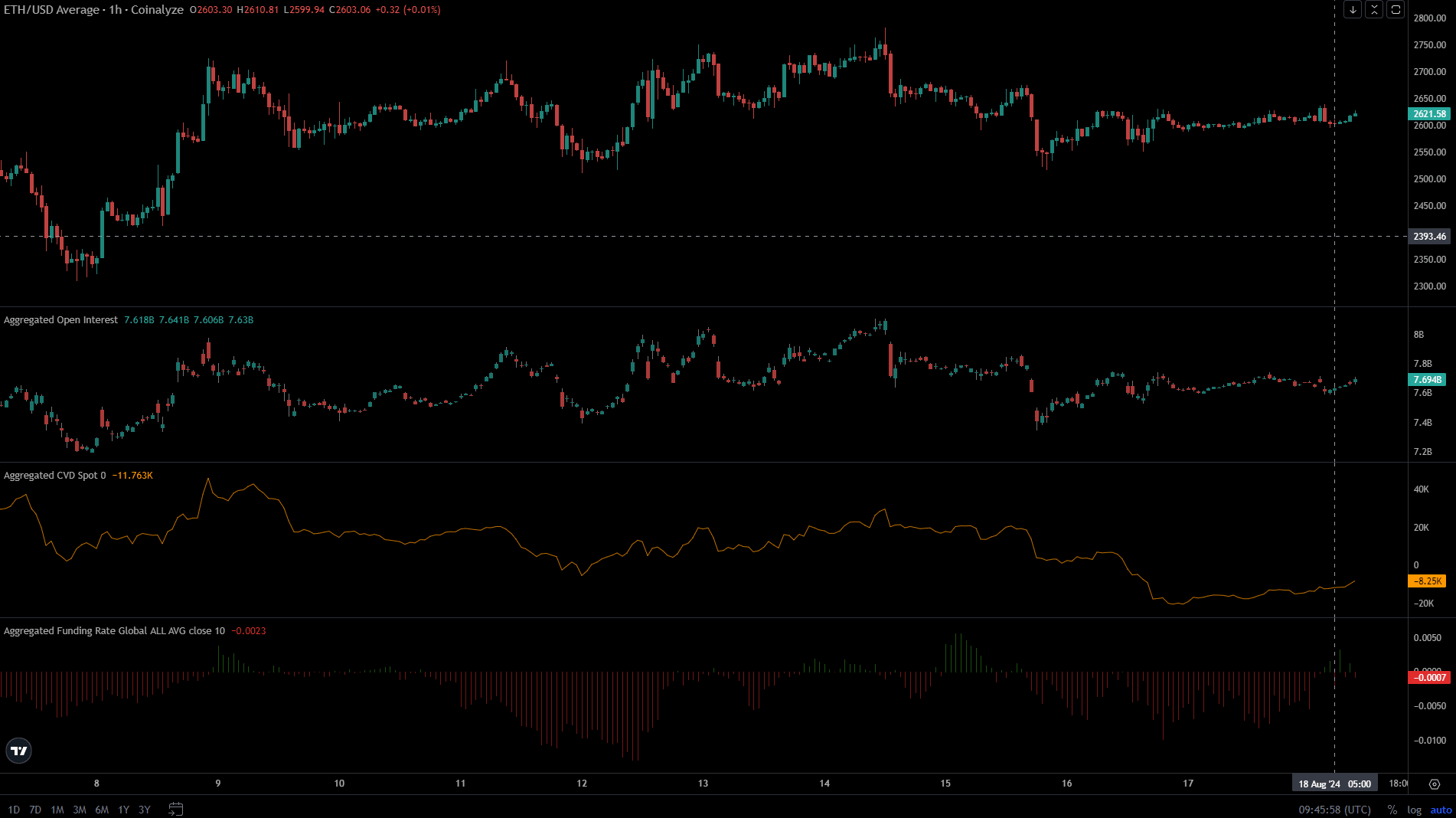

Supply: Coinalyze

The destructive Funding Fee was on the verge of shifting, exhibiting bullish speculator numbers have been rising. The rising spot CVD additionally underlined an elevated confidence.

Is your portfolio inexperienced? Try the ETH Revenue Calculator

The Open Curiosity didn’t see a big uptick, and confirmed sentiment has been impartial to barely bullish up to now week.

Consumers have been able to go lengthy on every notable value bounce, however the Ethereum sellers have been in a position to maintain on.

Disclaimer: The knowledge introduced doesn’t represent monetary, funding, buying and selling, or different varieties of recommendation and is solely the author’s opinion