Ethereum bears outnumber bulls as short positions soar

- ETH brief positions have climbed to their highest stage this 12 months.

- Continuous distribution amongst each day merchants places the coin prone to additional decline.

Quick positions opened in opposition to main altcoin Ethereum [ETH] throughout cryptocurrency exchanges reached their highest stage to this point this 12 months, a day after the numerous liquidity exit of 17 August.

How a lot are 1,10,100 ETHs price as we speak?

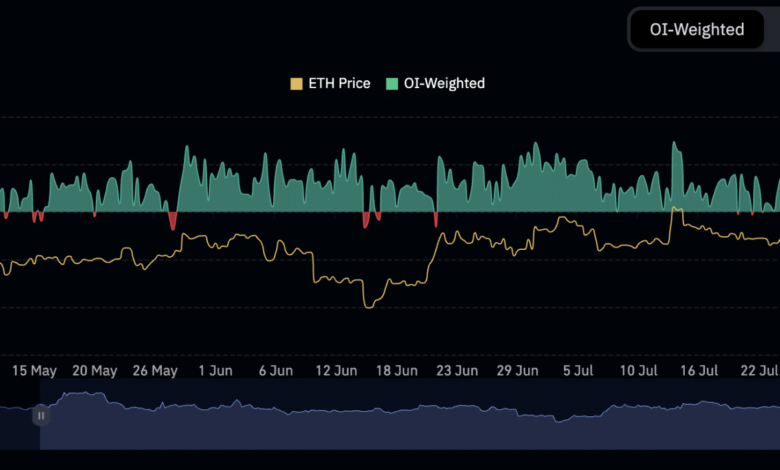

In line with information from Coinglass, Ethereum’s funding charges plummeted to -0.0273% on 18 August and have since been damaging.

Supply: Coinglass

Curiously, whereas the coin’s worth declined, ETH’s social dominance, noticed on a seven-day shifting common, rallied to its highest level since February. This confirmed a spike in dialogue across the alt, typically previous a bounce in an asset’s worth.

Opining on the potential of a worth uptick, on-chain information supplier Santiment famous:

“The spiked dialogue fee & excessive stage of shorts to be liquidated might trigger a wholesome rebound.”

🧐 #Ethereum #FUD is kind of excessive, as slumping costs have brought on the jaded crowd to guess in opposition to the #2 market cap #crypto asset. Nonetheless, for affected person #hodlers, the spiked dialogue fee & excessive stage of shorts to be liquidated might trigger a wholesome rebound. https://t.co/y1gEszs6WL pic.twitter.com/gegn3cdEcY

— Santiment (@santimentfeed) August 22, 2023

However is the coin at the moment arrange for this to happen?

Elevated sell-off amid low profitability

Ethereum’s statistically constructive correlation with Bitcoin [BTC] brought on its worth to be affected by final week’s deleveraging occasion. Buying and selling at $1,643 at press time, the value per Ether coin dropped by 10% within the final week, in accordance with information from CoinMarketCap.

On a each day chart, ETH holders started to exit buying and selling positions when costs fell on 17 August—elevated sell-offs amongst each day merchants since brought on key momentum indicators to plummet to oversold lows at press time.

For instance, ETH’s Relative Energy Index (RSI) and its Cash Movement Index (MFI) have been 26.10 and 15.07, respectively, on the time of writing.

Likewise, the coin’s On-Steadiness Quantity (OBV) started its descent on the identical day. At 24.03 million at press time, it has since fallen by 1%. When an asset’s OBV declines, it signifies that the shopping for stress on the coin is lowering.

It additionally signaled a decline within the asset’s buying and selling quantity. This, coupled with a worth decline, as is the case right here, instructed important bearish circumstances, making it tough for the value to rebound.

Supply: BNB/USDT on Buying and selling View

Because the alt’s worth fell, its transactions additionally turned much less worthwhile. For instance, ETH’s Market Worth to Realized Worth (MVRV) ratio dropped from 16.18% on 16 August to five.23% at press time.

Real looking or not, right here’s ETH’s market cap in USDT phrases

Though the ratio remained constructive, the plummeting worth confirmed a relentless lower within the variety of ETH traders that recorded earnings after they bought their cash.

Likewise, the coin’s ratio of each day on-chain transaction quantity in revenue to loss dwindled up to now few days. At 0.75 at press time, this confirmed that, on common, the transaction quantity related to earnings is decrease than that related to losses.

Supply: Santiment