Ethereum Breaches $2,200, Investors Expect $3,000 This Week

The value of Ethereum (ETH) has risen sharply right this moment, hitting a new 2023 high of $2,250 because the cryptocurrency market continued to pattern greater towards a profitable year-end.

The latest strong upward trend in Ethereum aligns with Bitcoin’s steady try to interrupt above $41,000, which it did right this moment. As of the time of writing, the worth of bitcoin was $41.437.

Analysts say the approval of a BlackRock spot ether instrument would lead to an inflow of institutional capital into Ethereum, the second-largest cryptocurrency community globally.

Ethereum’s Worth Surge

The newest charts present an upward trajectory that has many analysts and traders upbeat in regards to the cryptocurrency hitting the coveted $3,000 barrier within the upcoming weeks or months.

As this transpired, a vital on-chain commerce statistic reveals that, simply 24 hours previous to the newest value breakout, Ethereum 2.0 stakers made an sudden $330 million transfer.

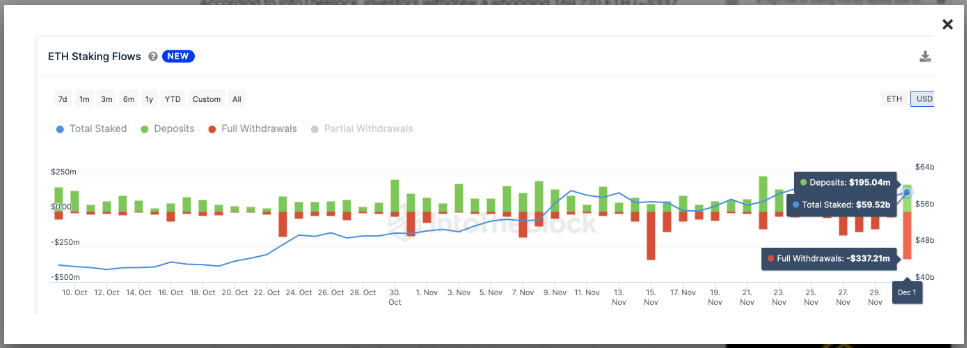

ETH Staking Flows. Supply: IntoTheBlock

On December 2, traders pulled out a large 169,220 ETH (about $337 million) from ETH 2.0 beacon chain Proof of Stake contracts, in keeping with IntoTheBlock.

Curiously, because the Ethereum Shapella Improve enabled withdrawals in April 2023, that is the second-highest staking withdrawal quantity.

Resilient Rebound And Bullish Market Indicators

In the present day, when the worth of Bitcoin broke past the coveted $41,000 barrier, the cryptocurrency market is beginning to really feel extra optimistic once more.

The value of ETH recovered from the psychologically crucial $2,000 threshold in response to this optimistic change, exhibiting an 8% weekly enhance to its present buying and selling value of $2,250.

Ethereum at present buying and selling at $2,244.7 territory on the each day chart: TradingView.com

The basic signal of a bull market is a sequence of upper lows and better highs, which is what we observe once we take a look at Ethereum’s each day chart. The 50-day and 100-day shifting averages served as dynamic resistance, however the value has now overcome each.

“On the idea of decrease yields, cryptocurrency has been going pleasantly greater, together with Gold,” crypto information agency Amberdata said in a publication on Sunday.

In a be aware, Lucy Hu, Senior Analyst at Metalpha, said that there’s rising market expectation for a fee discount within the coming yr.

Investor optimism on the potential for Bitcoin ETF purposes from vital asset administration companies can be rising.

She states:

“That is an official declaration of a bull run, and there could also be further value will increase within the upcoming weeks.”

In the meantime, legal guidelines may additionally have an effect on Ethereum’s value sooner or later; though favorable developments might encourage funding, harsher legal guidelines might present dangers. Vital components additionally embody investor sentiment and the state of the financial system.

It’s unclear if ETH will overtake Bitcoin in market valuation; this can rely upon issues like adoption charges and community enhancements. Proper now, Bitcoin is within the lead with a far bigger market capitalization.

(This website’s content material shouldn’t be construed as funding recommendation. Investing entails threat. If you make investments, your capital is topic to threat).

Featured picture from Shutterstock