Ethereum ‘breaks’ 14-day streak, but is $3000 really on the cards?

- If ETH’s value falls to $2,705, almost $323 million value of lengthy positions shall be liquidated

- In keeping with one professional, Ethereum’s market cap will surpass Bitcoin’s market cap throughout the subsequent 5 years

The broader cryptocurrency market recorded a major rally after the potential rate of interest lower announcement by the Fed Chair. Ethereum (ETH) was no completely different, with the world’s second-largest cryptocurrency by market capitalization breaking its 14-days of consolidation zone and turning bullish.

Ethereum’s breakout and upcoming ranges

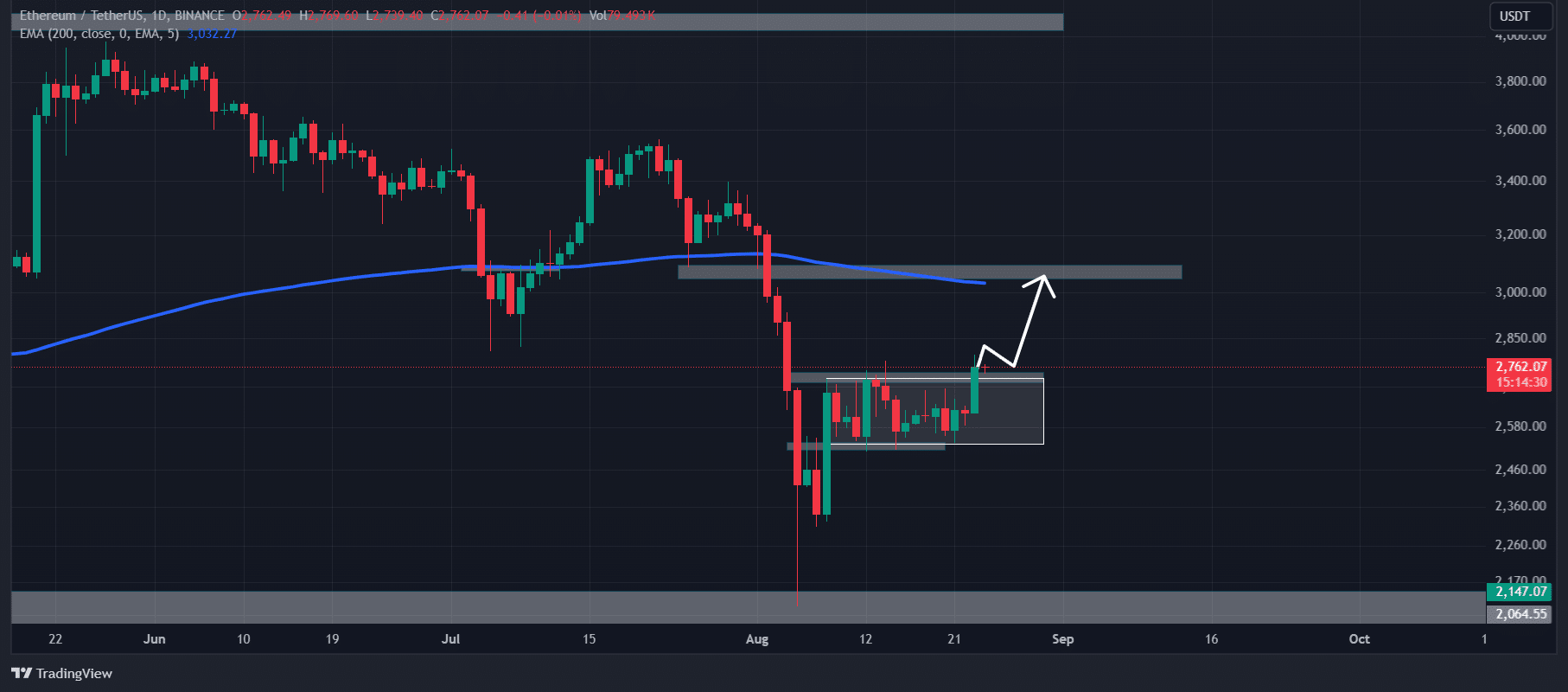

Between 8 and 23 August, ETH had been consolidating in a good vary between the $2,730 and $2,725 ranges. Following the Fed Chair’s price lower announcement, nonetheless, it broke of this zone and closed a each day candle above $2,760.

Supply: TradingView

This breakout and candle closing above the zone may sign a bullish outlook for ETH. This, regardless of it buying and selling under the 200 Exponential Shifting Common (EMA).

Primarily based on the worth motion and technical evaluation, there’s a excessive risk that the altcoin’s value might soar to $3,000 – Its subsequent resistance stage.

At press time, ETH was buying and selling close to the $2,760 stage, following a hike of over 3.5% in 24 hours. In the meantime, its buying and selling quantity rose by 40% over the identical interval. This can be a signal of upper participation from merchants following the breakout and price lower announcement.

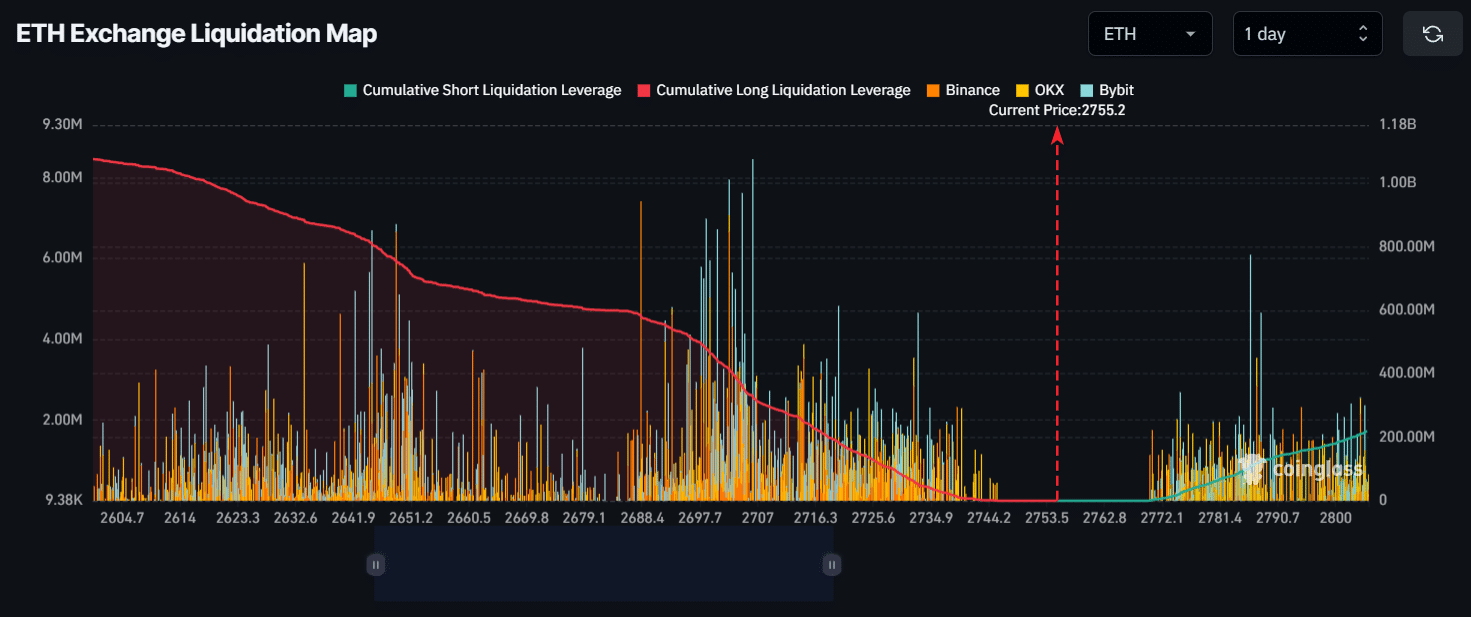

Ethereum’s main liquidation ranges

On the time of writing, the main liquidation ranges had been close to $2,705 on the decrease aspect and $2,786 on the upper aspect. That is the case as merchants are extremely leveraged at these factors, in keeping with the on-chain analytics agency CoinGlass.

Supply: CoinGlass

If the sentiment stays bullish and ETH’s value rises to $2,786, almost $111 million value of brief positions shall be liquidated. Conversely, if the sentiment shifts and the worth falls to $2,705, almost $323 million value of lengthy positions shall be liquidated.

Primarily based on leveraged positions, it’s clear that bulls are again out there. This can be a probably constructive signal for Ethereum and its holders.

Crypto professional’s views on ETH

Amid this bullish outlook, not too long ago, 1confirmation Founder Nick Tomaino shared one thing. He believes that Ethereum’s market cap will surpass Bitcoin’s market cap throughout the subsequent 5 years, which is roughly 4x. Within the put up on X, Nick mentioned,

“BTC has a transparent narrative (digital gold) that establishments have purchased into by now. Ethereum is the chain that probably the most gifted builders on this planet are constructing the decentralized web on and ETH is the digital oil that powers it.”

Because the launch of Spot Ethereum exchange-traded fund (ETF) in the US, the speed of adoption has considerably risen. Moreover, ETF merchants have additionally proven robust curiosity in it.