Ethereum breaks key price level – Is ETH’s rally just getting started?

- ETH traded above the realized worth, displaying long-term holder income and an institutional-driven rally

- Binance leads ETH quantity as institutional buys present renewed confidence post-Pectra improve

Ethereum [ETH] has crossed a vital threshold – its market worth has moved above its realized worth, displaying a shift in sentiment amongst long-term holders.

Nowhere is that this extra obvious than on Binance, the place rising buying and selling volumes and elevated profit-taking level to renewed conviction, deeper liquidity, and Ethereum’s reassertion of market management.

ETH long-term holders at the moment are in revenue

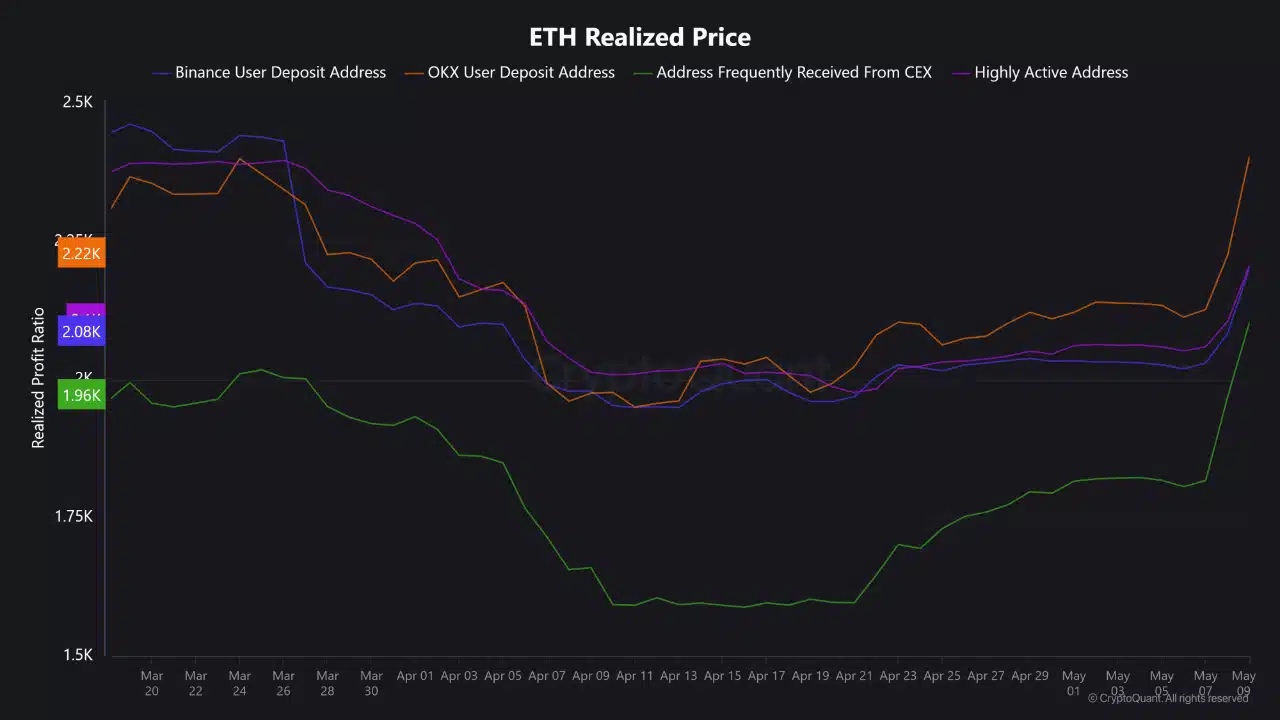

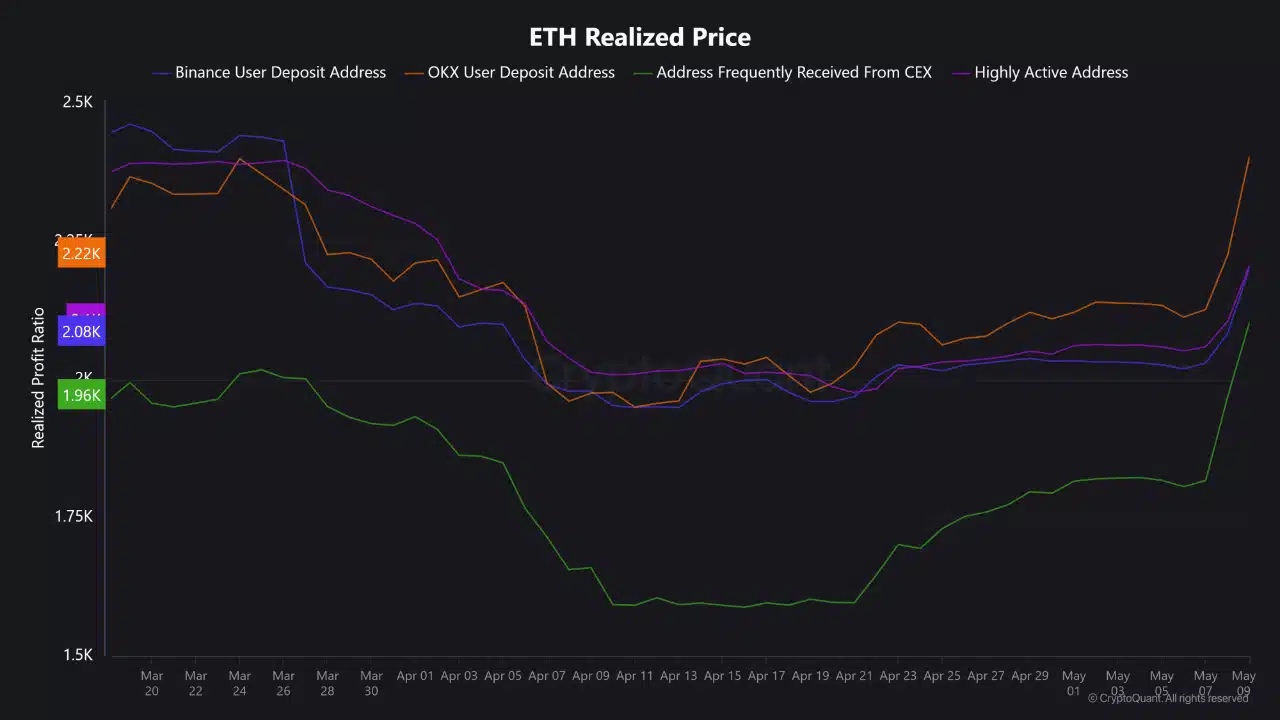

On the time of writing, Ethereum was buying and selling above its realized worth of $1,900. The common ETH holder, particularly these in accumulation addresses, was in revenue.

This acts as a marker of long-term investor confidence. When worth climbs above realized worth, traditionally, it correlates with stronger conviction amongst holders and a shift in dealer psychology.

Supply: CryptoQuant

The chart reveals that accumulating wallets started buying under $1,900, and present costs verify these positions. This threshold flip usually alerts renewed capital inflows, particularly from establishments and swing merchants aiming to capitalize on momentum.

Since this breakout happens regardless of weak retail participation, it means that bigger buyers are driving the transfer.

Moreover, it reinforces that ETH’s rally is backed by strategic accumulation, relatively than pure hypothesis.

Binance takes the lead

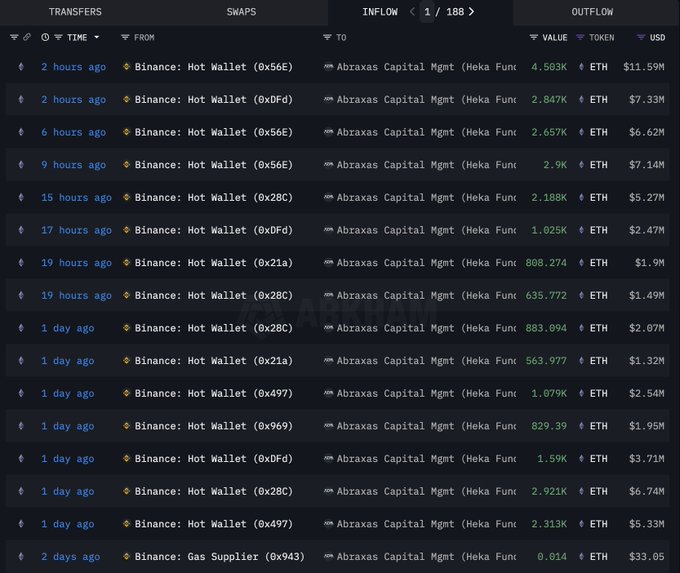

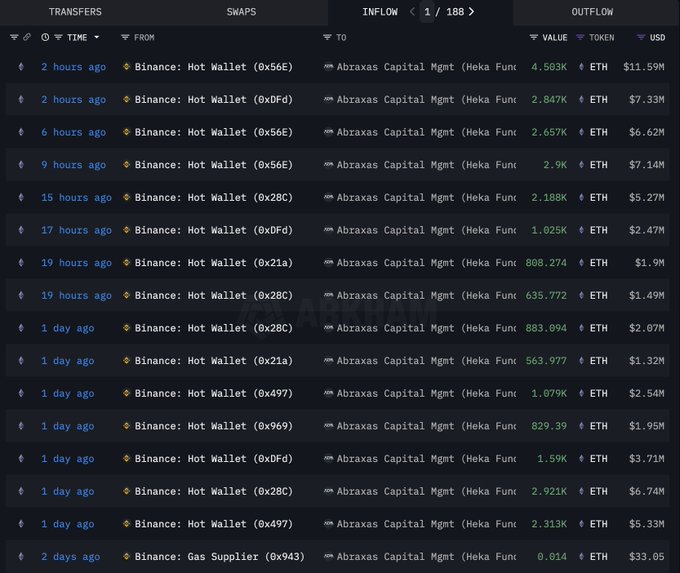

Latest influx and outflow exercise confirms Binance as the middle of ETH buying and selling. The alternate recorded the best ETH transaction quantity amongst all platforms, with outflows notably outpacing inflows in the course of the worth rise.

Supply: CryptoQuant

The information illustrates that Binance customers accrued closely throughout ETH’s dip, and at the moment are realizing features as worth recovers above their common entry. Importantly, this dynamic doesn’t replicate market weak spot – it reveals strategic rebalancing on a platform recognized for top liquidity.

An example is Abraxas Capital’s aggressive accumulation of ETH by way of Binance not too long ago.

Supply: X

Ethereum’s worth outlook

Ethereum’s surge to $2,600 aligns with the launch of the Pectra improve, which has possible added momentum to the current bullish wave.

Nonetheless, technical indicators present a short-term cooldown could comply with. The RSI has breached the overbought threshold, now sitting above 80 – a degree traditionally related to pullbacks.

Supply: TradingView

In the meantime, the MACD supported upward momentum, suggesting any correction may very well be transient or shallow.

With ETH buying and selling at $2,518 at press time, market construction stays bullish, however the subsequent 24-48 hours might convey consolidation as merchants digest each the rally and the improve information.