Ethereum bulls have a decision to make as ETH drops below $3.8K

- Shopping for strain on ETH remained excessive in the previous few days.

- Technical indicators supported the potential of a worth improve.

Because the market situation remained bearish, Ethereum [ETH], like most different cryptos, additionally witnessed corrections.

The newest pullback has now grow to be a take a look at for the bulls, because the king of altcoins was failing to breach the $3.9k resistance.

Ethereum bulls beneath strain

ETH witnessed a greater than 3% worth correction within the final 24 hours, pushing its worth beneath $3.okay. On the time of writing, the king of altcoins was buying and selling at $3,760.02 with a market capitalization of over $452 billion.

Whereas the token’s worth dropped, the Ethereum Basis made a transfer. Spot On Chain just lately posted a tweet revealing that the Ethereum Basis simply bought 100 ETH for 374,334 DAI.

This introduced their whole ETH sale in 2024 to 4,366 ETH for $12.21 million at a mean worth of $2,796.

To see whether or not this promoting pattern was dominant out there, AMBCrypto checked different datasets.

Fortunately, not all buyers had been promoting their holdings, which may assist bulls to kickstart a restoration and permit ETH to cross $3.9k once more.

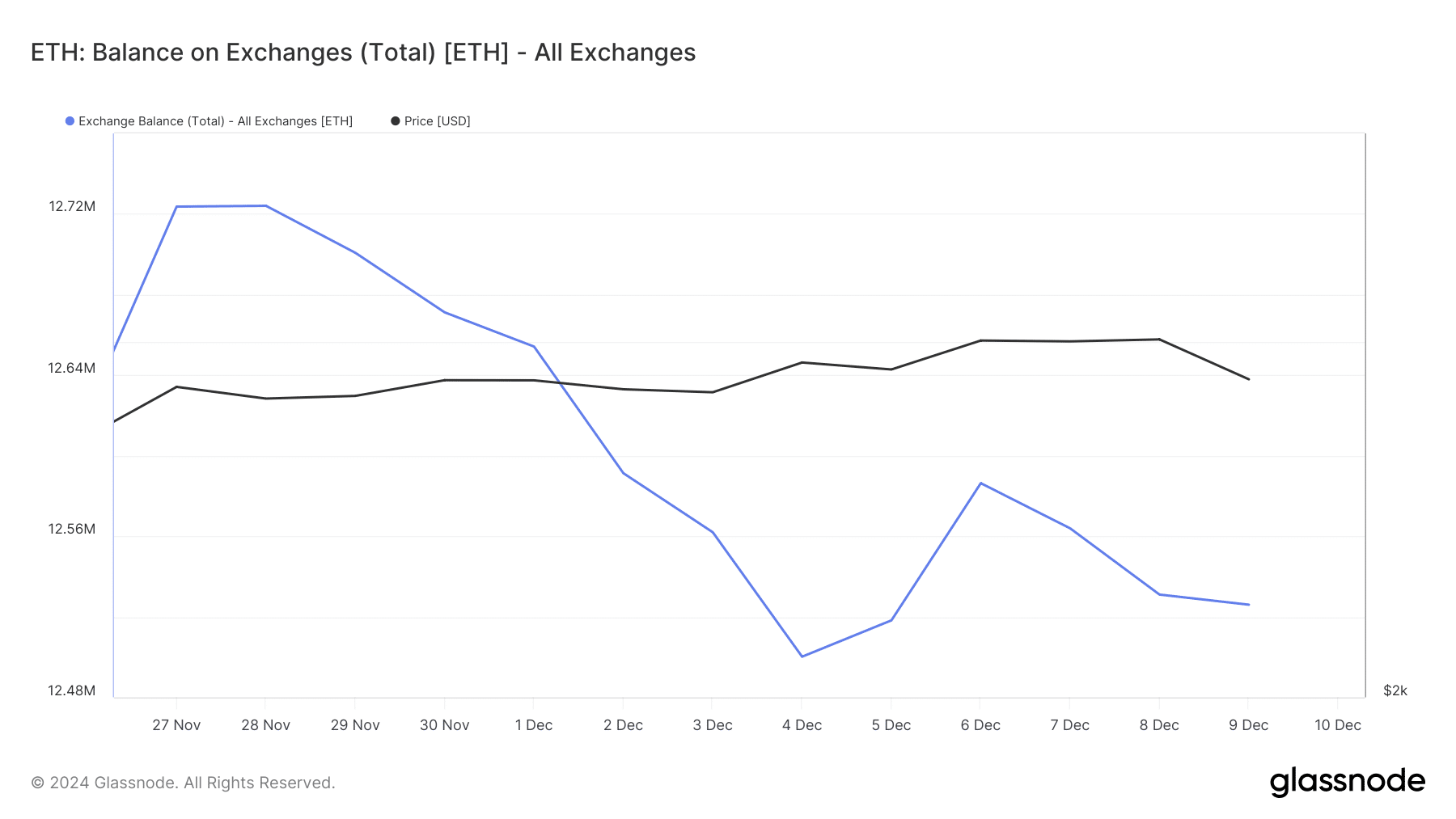

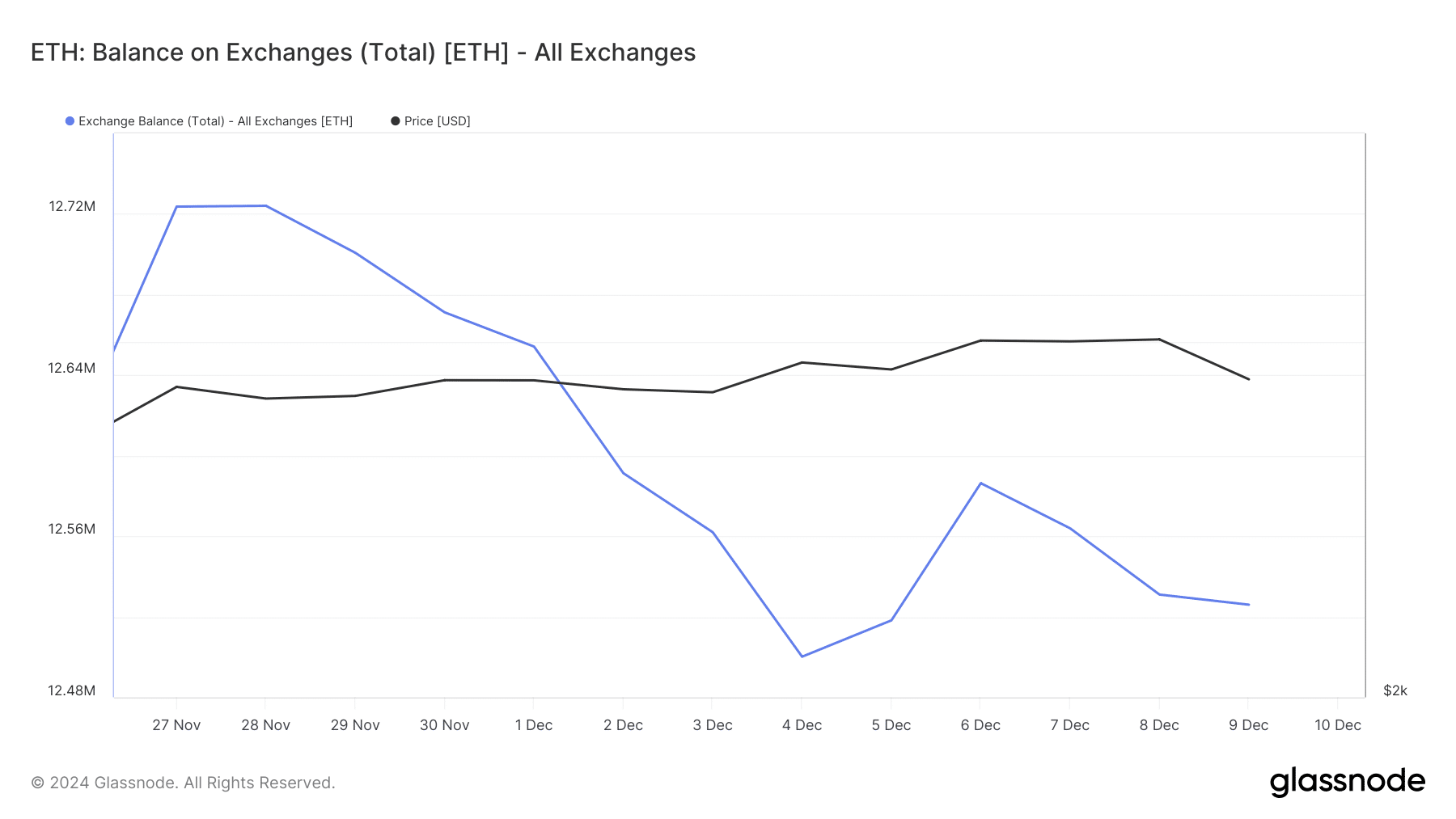

This pattern was evident from the decline in ETH’s stability on exchanges over the past two weeks.

Supply: Glassnode

Hyblock Capital’s data revealed that after a spike, ETH’s promote quantity declined to 9.6. For starters, a quantity nearer to 0 signifies much less promoting strain, whereas a price nearer to 100 hints at excessive promoting strain.

Nevertheless, the whales selected to maneuver the opposite means round. As per CFGI.io’s data, whale sentiment reached 61.5%—an indication of excessive whale actions for promoting.

Will ETH bulls reverse the bearish pattern?

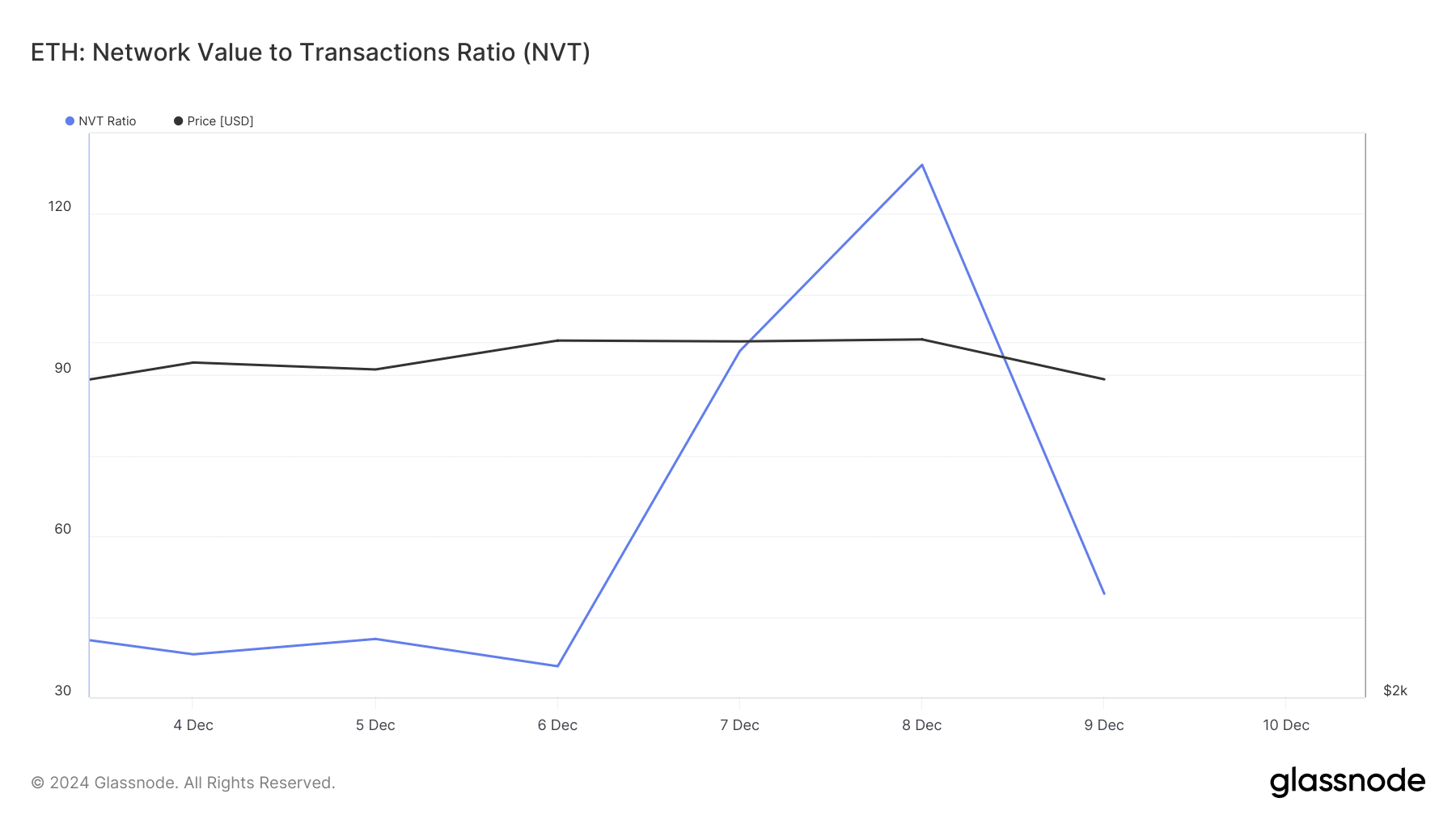

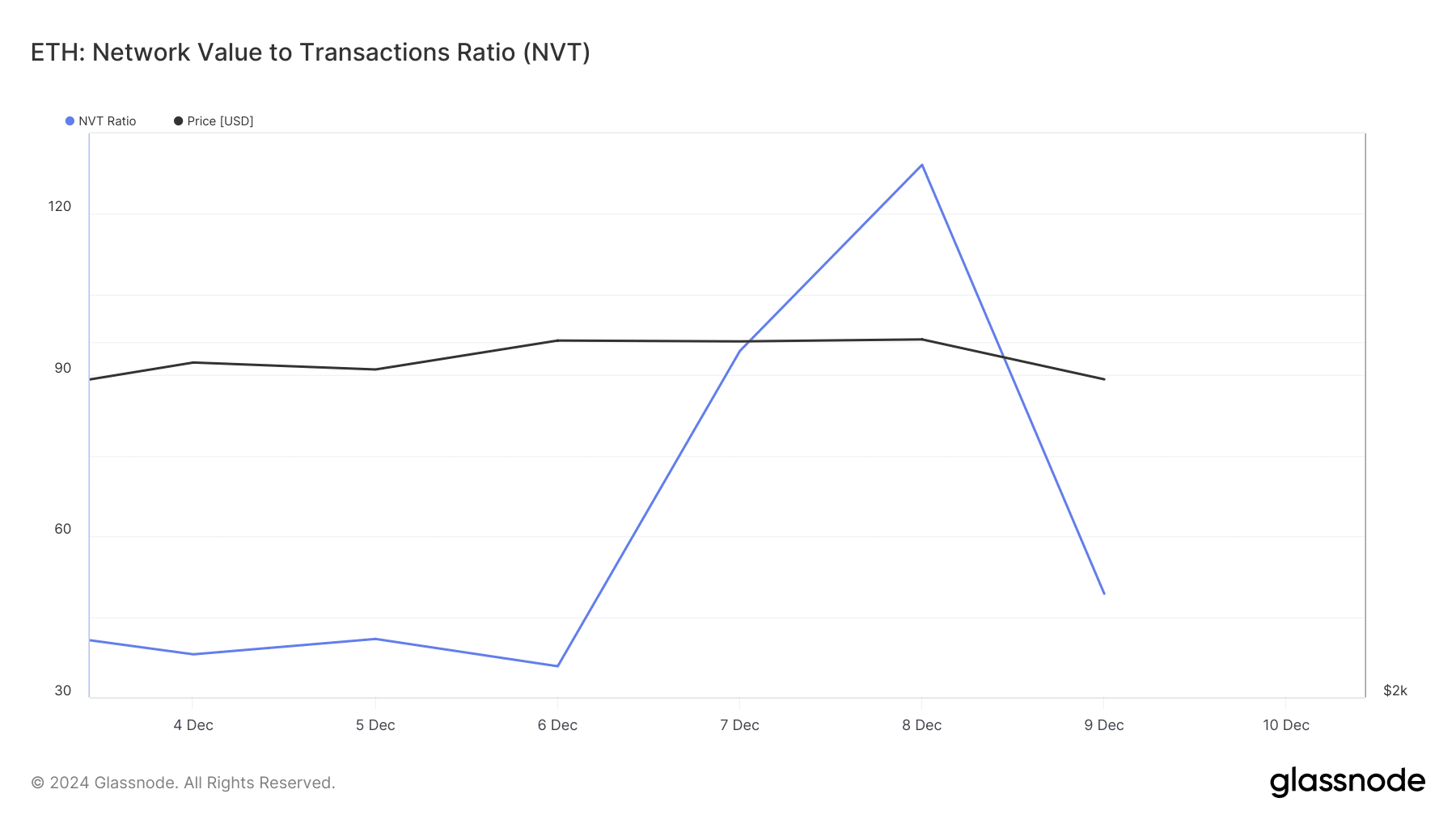

Although whales determined to promote, ETH bulls would possibly nonetheless handle to push the token’s worth up. Ethereum’s NVT Ratio registered a decline within the final e days.

Each time the metric drops, it implies that an asset is undervalued, suggesting a worth rise within the coming days.

Supply: Glassnode

Other than this, AMBCrypto additionally discovered that ETH’s Long/Short Ratio elevated within the 4-hour timeframe.

This meant that there have been extra lengthy positions out there than quick positions, which often hints at rising bullish sentiment round a token.

Just a few of the technical indicators additionally recommended that Ethereum bulls might make a comeback. As an example, the technical indicator Relative Power Index (RSI) registered a slight uptick.

Learn Ethereum’s [ETH] Value Prediction 2024–2025

The Chaikin Cash Move (CMF) additionally moved up. An increase in CMF signifies that purchasing strain is rising and that the market or asset could also be getting into an uptrend.

Subsequently, Ethereum bulls would possibly efficiently move the take a look at and assist ETH’s worth transfer up once more within the near-term.

Supply: TradingView