Ethereum bulls have a tough battle ahead: Will these key levels help?

- Information of holders in/out of the cash offered beneficial insights into the place Ethereum may halt its downtrend.

- Two community metrics confirmed elevated promoting strain behind ETH in current weeks that has not but let up.

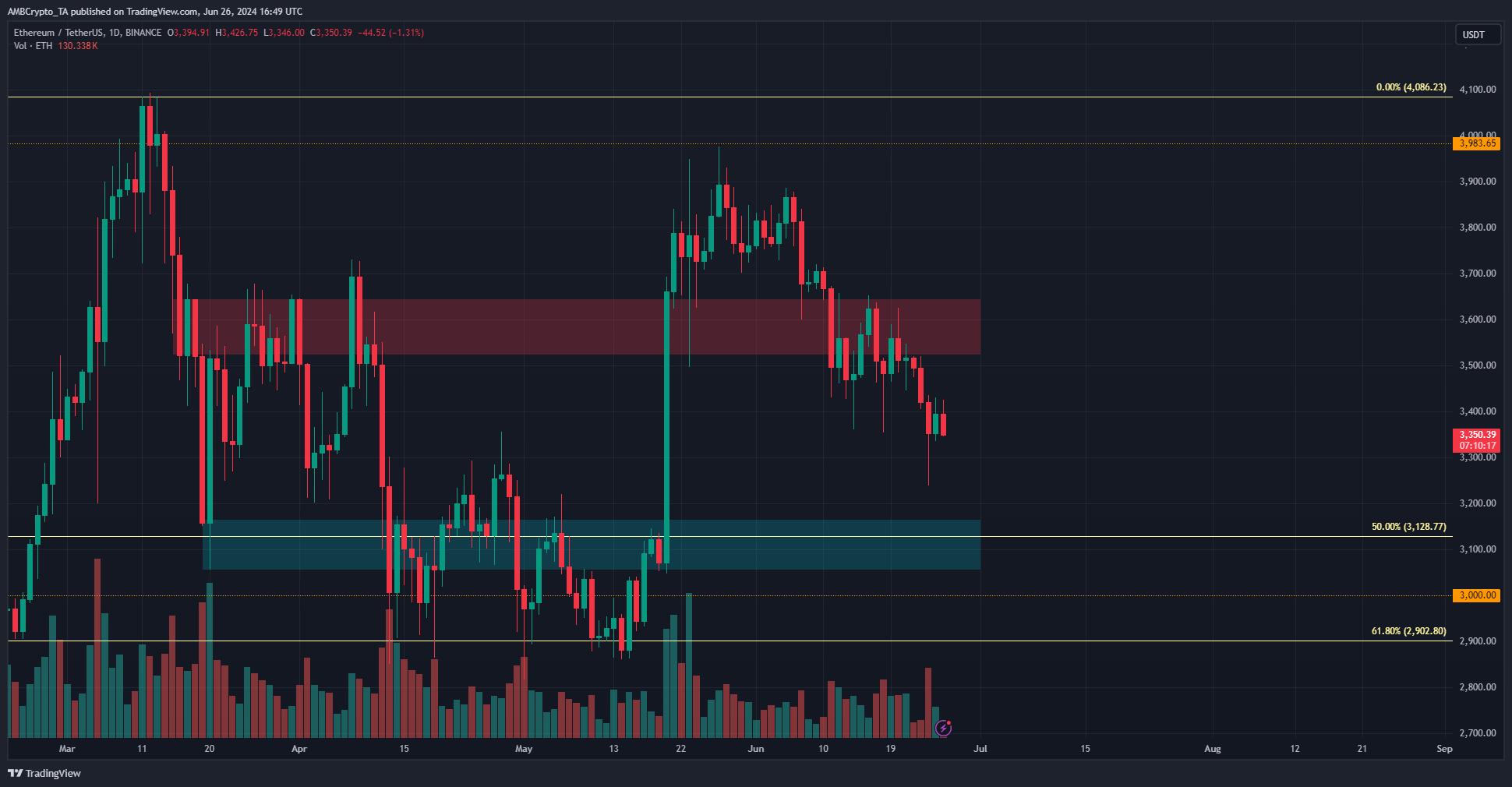

Ethereum [ETH] bulls have been in a pickle after failing to defend the $3.6k demand zone earlier this month.

The $3600-$3650 area had served as resistance again in March and the primary half of April however was breached and flipped to assist in late Might.

Supply: ETH/USDT on TradingView

The Ethereum ETF hype was constructing for July, however with Bitcoin [BTC] set to face promoting strain from miners and Mt. Gox and a common lack of demand, ETH bulls may need an uphill battle forward.

A value drop towards the following assist zone is anticipated- however the place will the correction possible halt?

Main assist and resistance zones

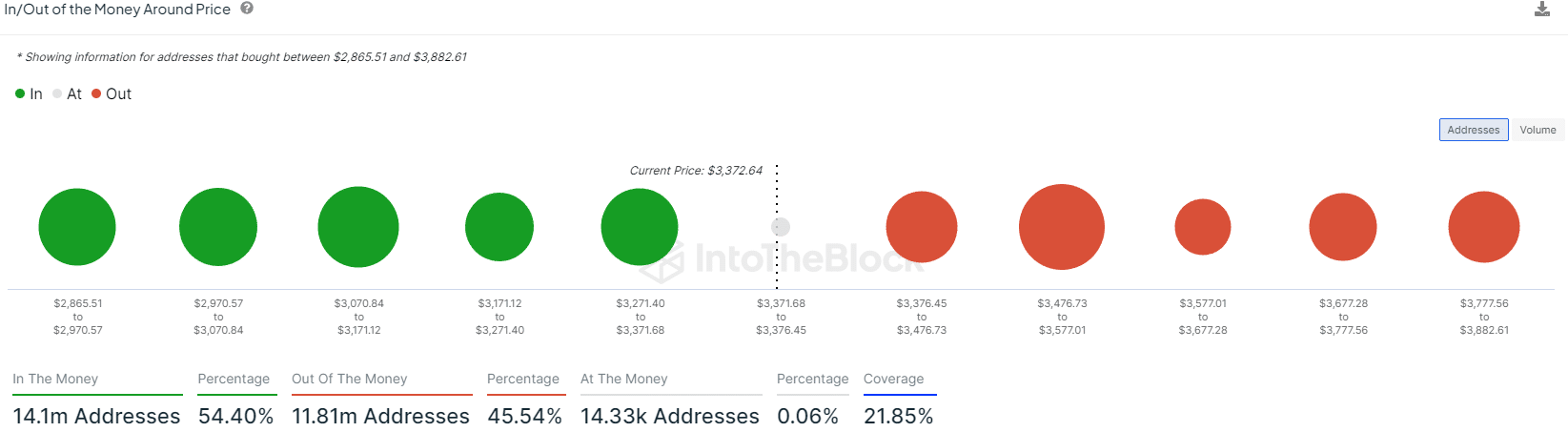

Supply: IntoTheBlock

AMBCrypto noticed that the in/out of cash across the value knowledge from IntoTheBlock confirmed a considerable amount of ETH was purchased within the $2970-$3171 zone, amounting to 2.28 million Ethereum.

As the worth approaches this stage, the quantity of holders on the cash would improve, which implies this area can be onerous to interrupt down.

Equally, any value bounce would wrestle to climb above $3.5k, since most of the holders can be close to breakeven at that value and would look to promote as a result of fearful situations.

Subsequently, within the coming weeks, the $3.1k and $3.5k ranges are those to be careful for.

Energetic tackle rely displays positively on community well being

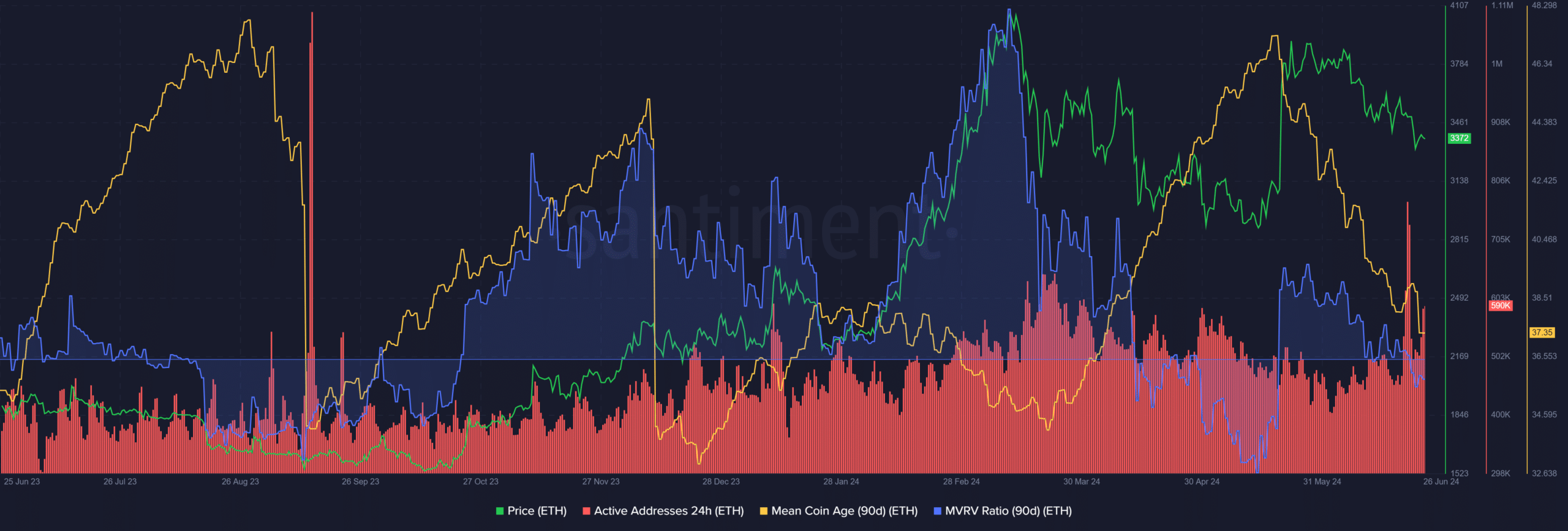

Supply: Santiment

The day by day lively addresses have trended upward in June despite the fact that costs have fallen decrease. Rising lively addresses is an efficient signal for community utilization. However the different metrics have been bearishly biased.

Is your portfolio inexperienced? Try the ETH Revenue Calculator

The imply coin age has dramatically trended downward over the previous month. This confirmed token motion throughout the community and distribution. The MVRV ratio additionally fell under zero to focus on holders at a loss.

Collectively, they have been a robust signal of additional bearishness. The MCA has to start trending increased to trace at value restoration.