Ethereum: Buy signal for ETH? Double-bottom on price chart says…

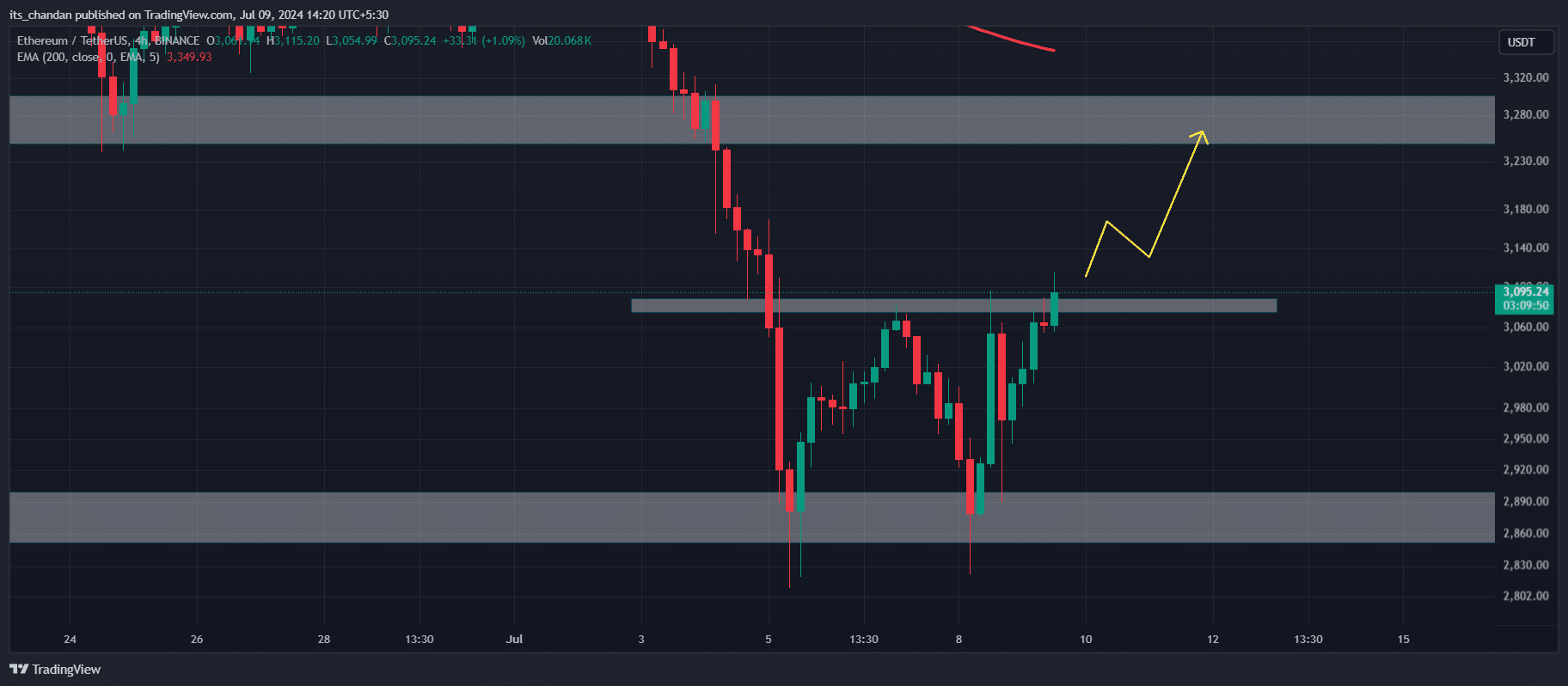

- A bullish double-bottom worth motion sample has been noticed on Ethereum within the 4-hour timeframe.

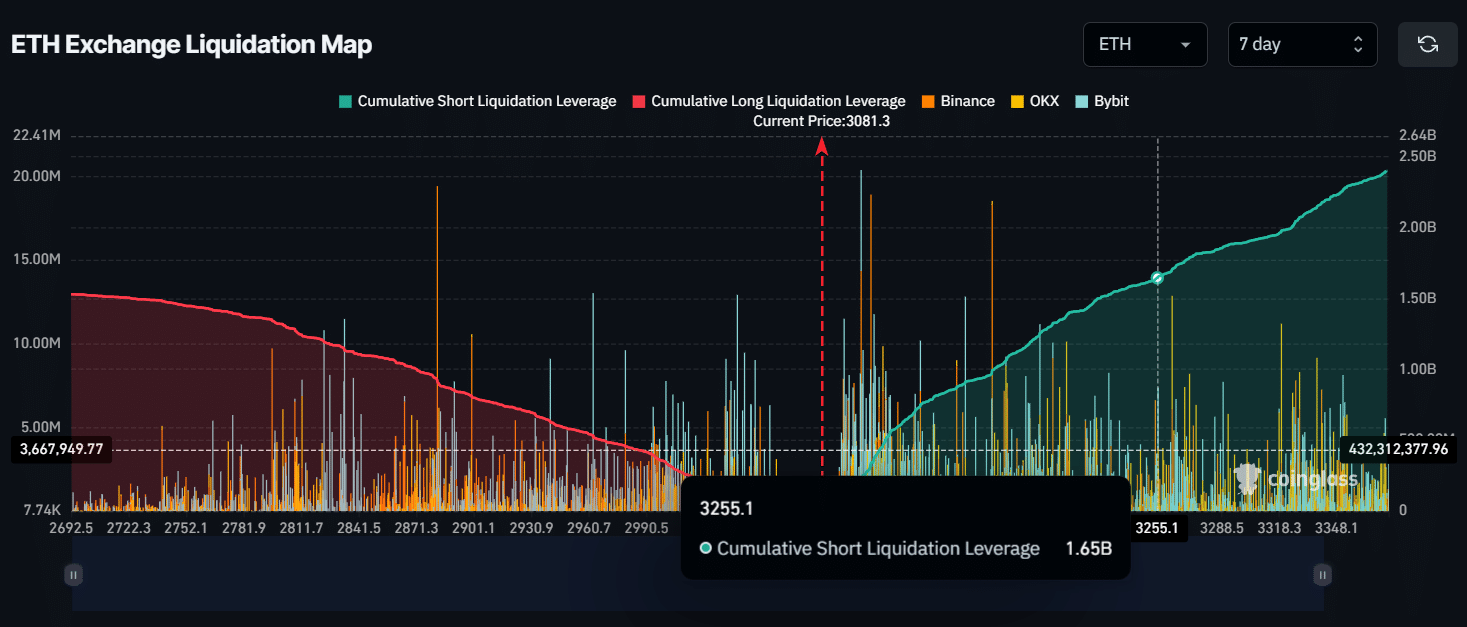

- Quick sellers are usually not anticipating ETH to achieve the $3,250 degree, if it does attain this degree, $1.65 billion price of quick positions will liquidate.

The world’s second-biggest cryptocurrency Ethereum [ETH] has skilled a worth surge of over 5.5% following the latest replace on spot Ethereum ETF (Trade Traded Fund) in the US.

After this ETF replace, the general crypto market turned inexperienced and investor sentiment shifted positively.

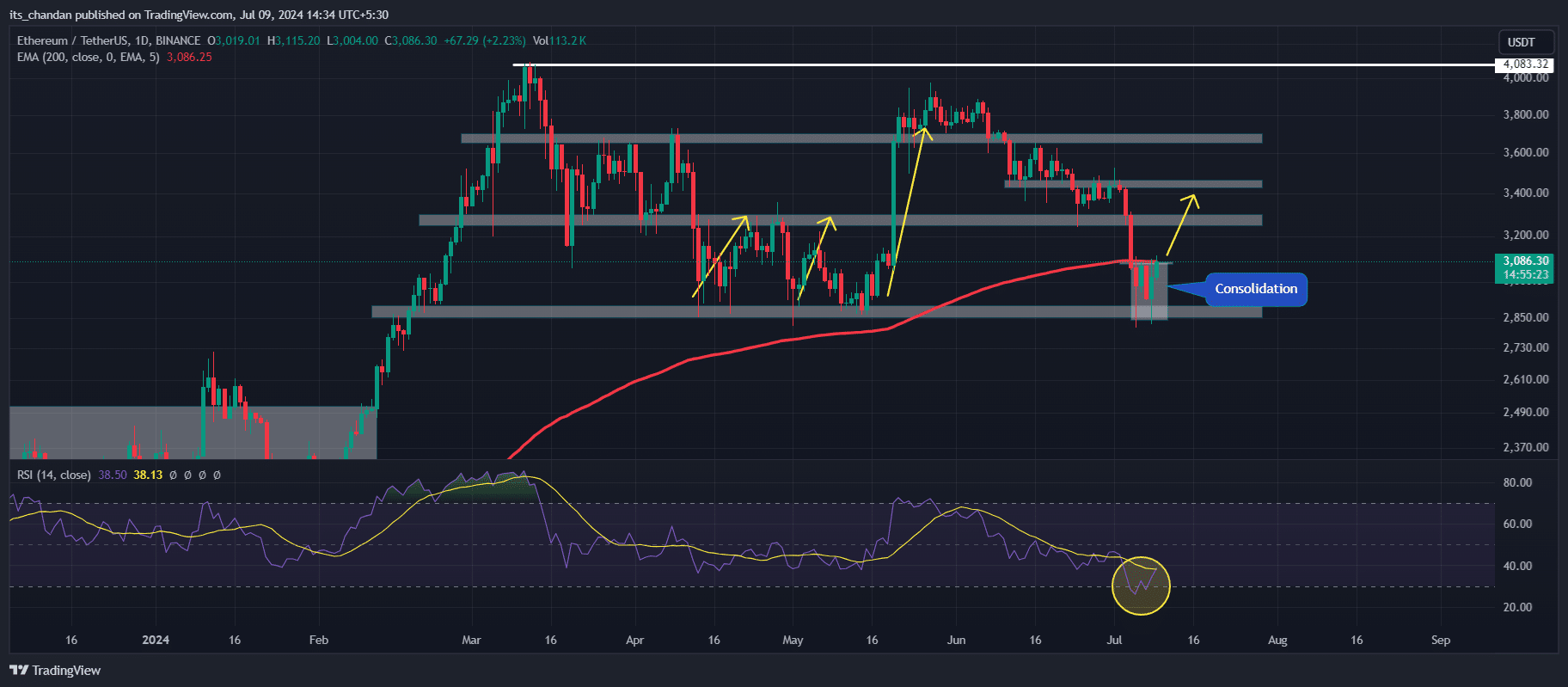

With this spectacular worth momentum within the final 24 hours, ETH has simply reached close to the 200 Exponential Shifting Common (EMA). Moreover, it is only one candle away from bullishness as it’s lagging barely behind 200 EMA.

Ethereum bullish double backside breakout

Based on skilled technical evaluation, ETH was trying bullish because it shaped a double-bottom worth motion sample in a 4-hour timeframe and at a neckline close to the $3,085 degree.

If it provides a breakout and 4-hour candle closing above the neckline, there’s a excessive risk for ETH to hit the $3,250 and $3,300 ranges.

Supply: TradingView

Moreover, this bullishness within the Ether chart can be getting help from the Relative Power Index (RSI), which is within the oversold space and alerts a possible restoration.

Regardless of this bullish double-bottom sample, ETH has been consolidating inside a good vary between the $2,850 and $3,080 ranges for the final 5 days.

Nevertheless, this consolidation is going down at an necessary help degree, and a breakout or breakdown from this consolidation zone might trigger a big worth momentum in both path.

Supply: TradingView

Ether’s robust help degree and liquidation space

Nevertheless, ETH has reached this degree greater than 4 instances since April 2024. No matter market situations, ETH costs have persistently bounced again to both the $3,250 degree or the $3,670 degree, as proven by historic knowledge on a every day chart.

This time merchants anticipate the same worth surge from this degree.

Following the ETF replace, ETH’s Open Curiosity (OI) surged by greater than 5.5%, indicating that investor and dealer curiosity and confidence have returned, in keeping with knowledge from an on-chain analytic agency CoinGlass.

In the meantime, merchants liquidated a notable $59.94 million of their positions, out of which bulls have liquidated $23.75 million of lengthy positions and quick sellers liquidated a notable $36.16 million of quick positions, as per CoinGlass knowledge.

If ETH hits the $3,250 degree within the coming days, almost $165 billion of quick place will liquidate. During the last seven days, quick sellers have been anticipating that ETH gained’t attain the $3,250 degree, as per the most recent liquidation knowledge from CoinGlass.

Supply: CoinGlass

Learn Ethereum’s [ETH] Value Prediction 2024-2025

At press time, ETH was shifting close to the $3,075 degree and it skilled a 5.5% worth surge within the final 24 hours.

If we have a look at the efficiency of ETH over an extended interval, it has misplaced almost 10% of its worth. Whereas, within the final 30 days, ETH is down by 16%.