Ethereum can rally to $6K only if ETH holds THIS support

- ETH’s short-term outlook reveals indicators of a bullish reversal across the $3,000 psychological stage.

- On-chain metrics recommend promoting stress, however most ETH holders stay in revenue.

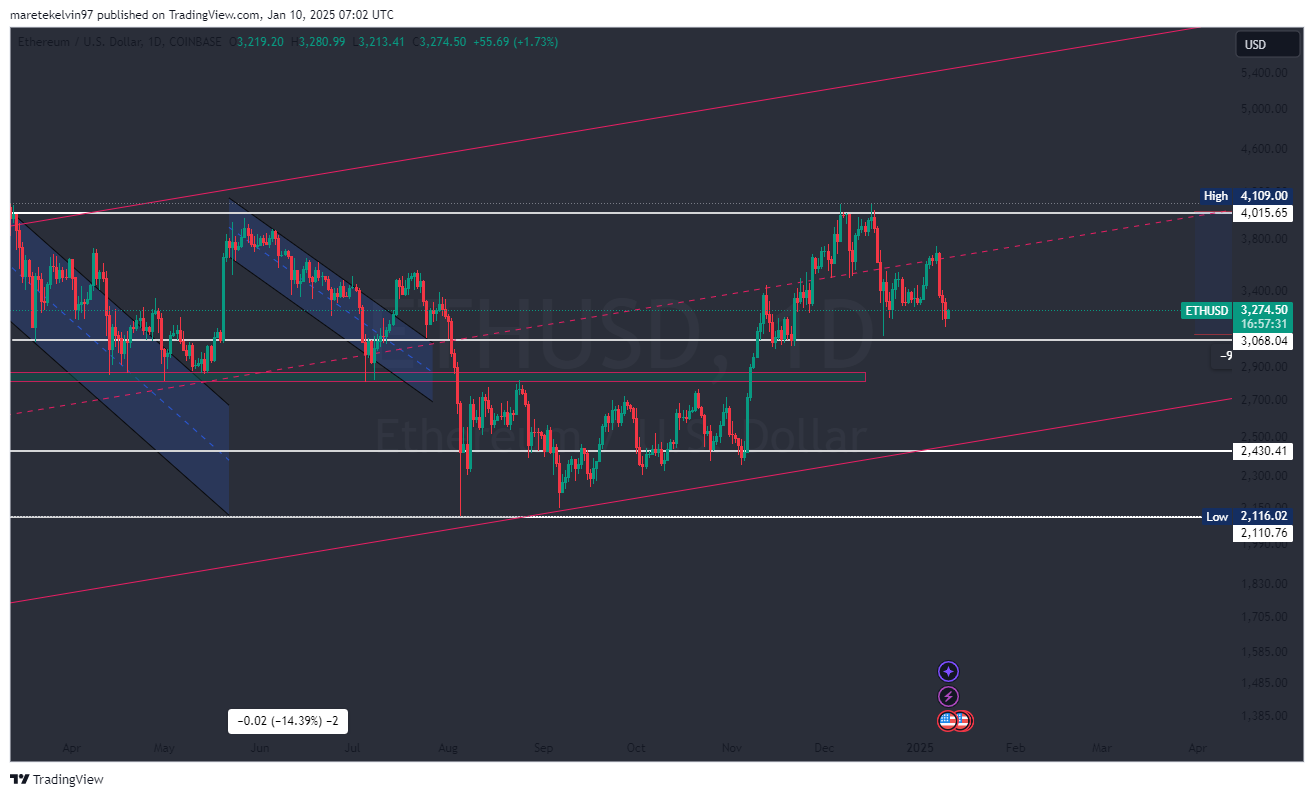

Ethereum [ETH] was additionally hit by the latest altcoin correction, dipping over 20% after being rejected on the $4,000 resistance stage.

Nevertheless, this downtrend might not be important, as Ethereum’s technical patterns and on-chain metrics present blended alerts of a possible worth restoration or additional volatility.

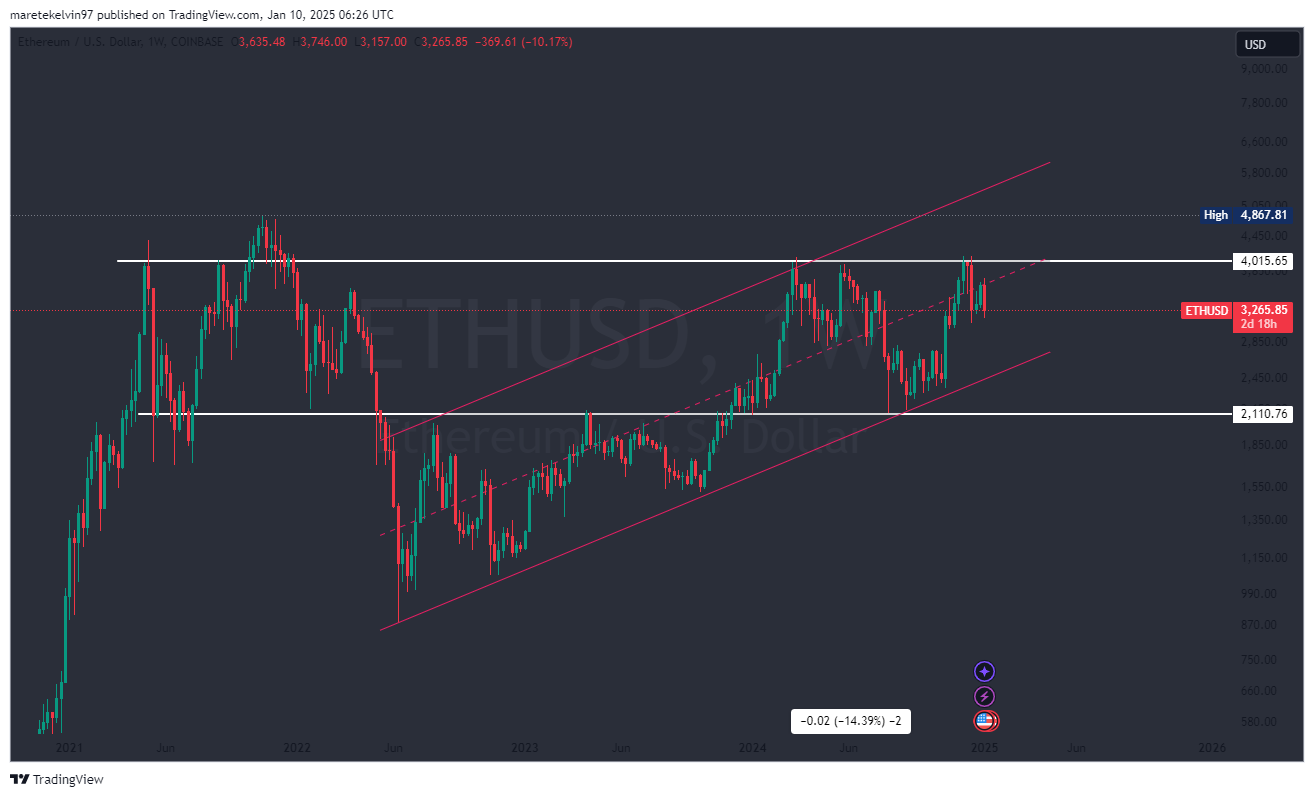

ETH approaching key assist at $2.8k

On the weekly chart, Ethereum’s worth motion reveals consolidation in a bullish flag sample—a sample that always precedes a breakout. The latest dip has introduced ETH near the decrease boundary of this ascending flag at $2,800.

If this stage holds robust, it may act as a springboard for an enormous upward rally. A profitable rebound right here might push Ethereum towards its subsequent key goal of $6,000.

Nevertheless, failure to take care of this assist may expose ETH to additional draw back.

Supply: TradingView

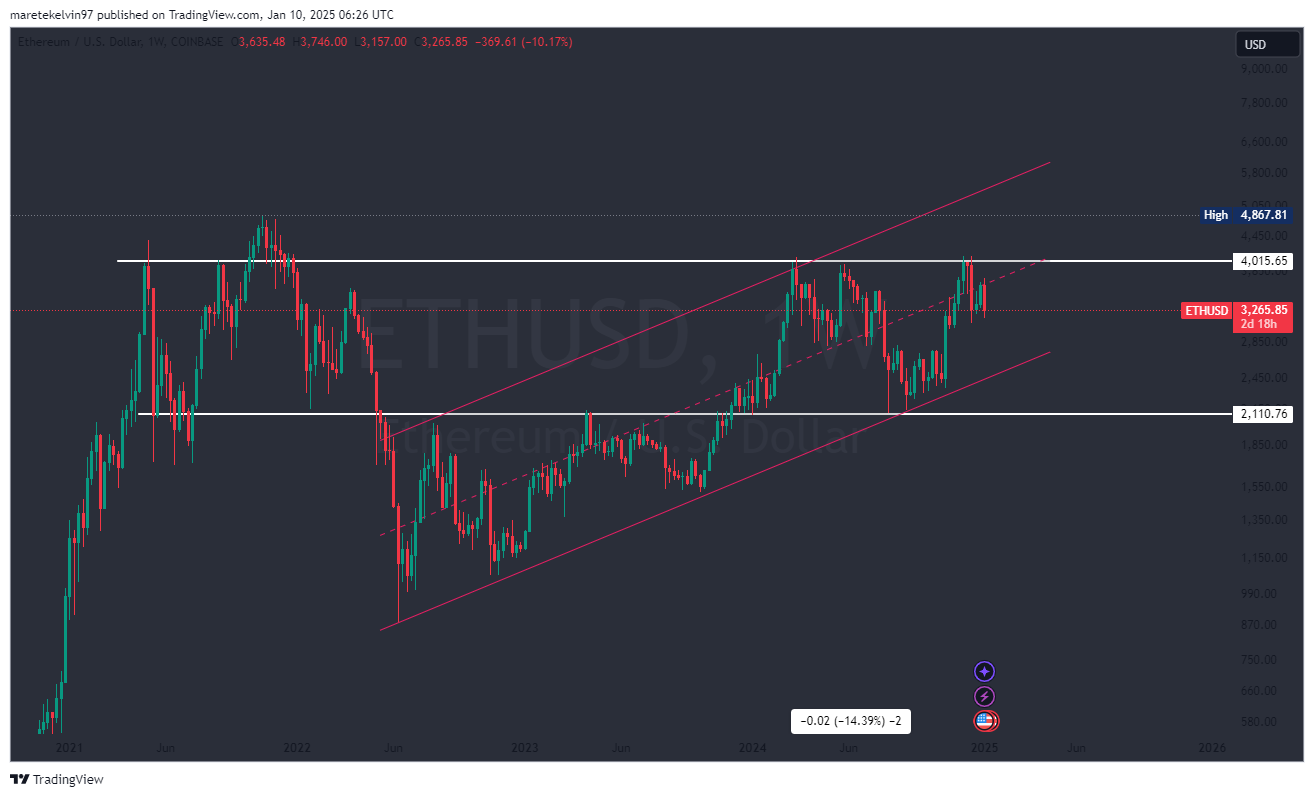

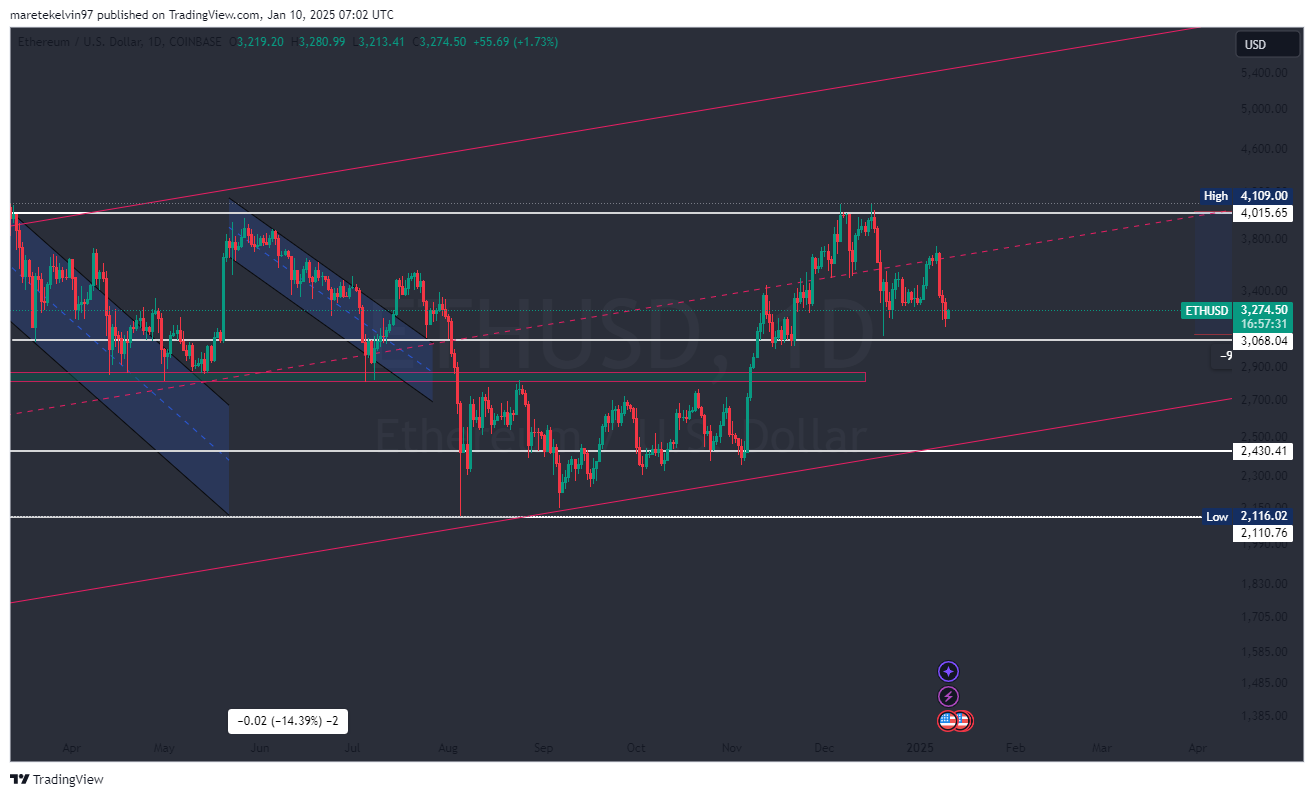

Indicators of a short-term reversal at $3,000

Zooming all the way down to the each day chart, Ethereum’s worth motion signifies a possible short-term bullish reversal.

The $3,000 psychological stage seems pivotal, as ETH buying and selling exercise has elevated barely over the past 24 hours.

Supply: TradingVew

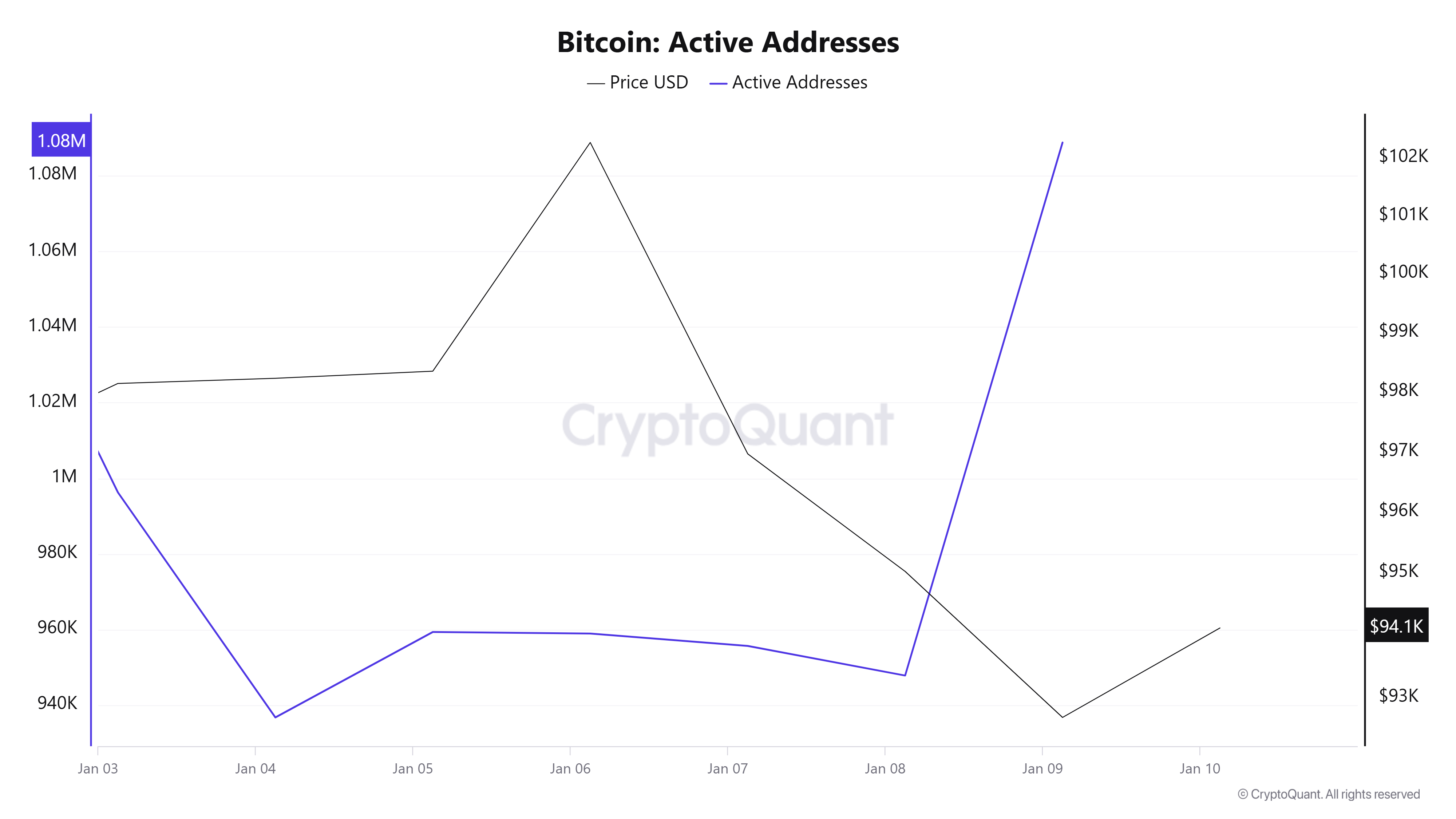

CryptoQuant knowledge helps this, exhibiting a pointy surge in lively addresses throughout the identical interval. Elevated community exercise typically alerts renewed curiosity, probably stabilizing costs or sparking an upward transfer.

Supply: CryptoQuant

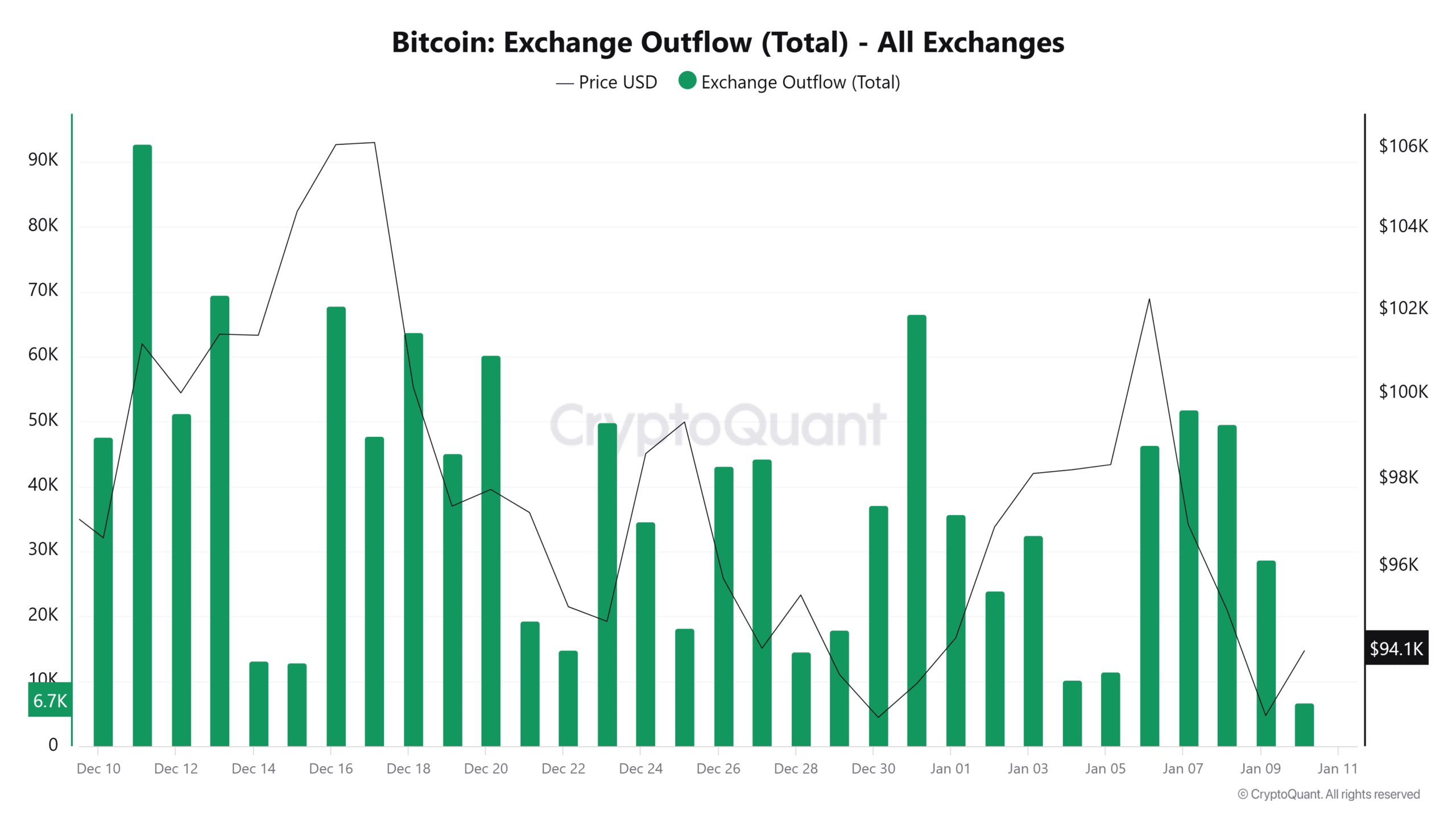

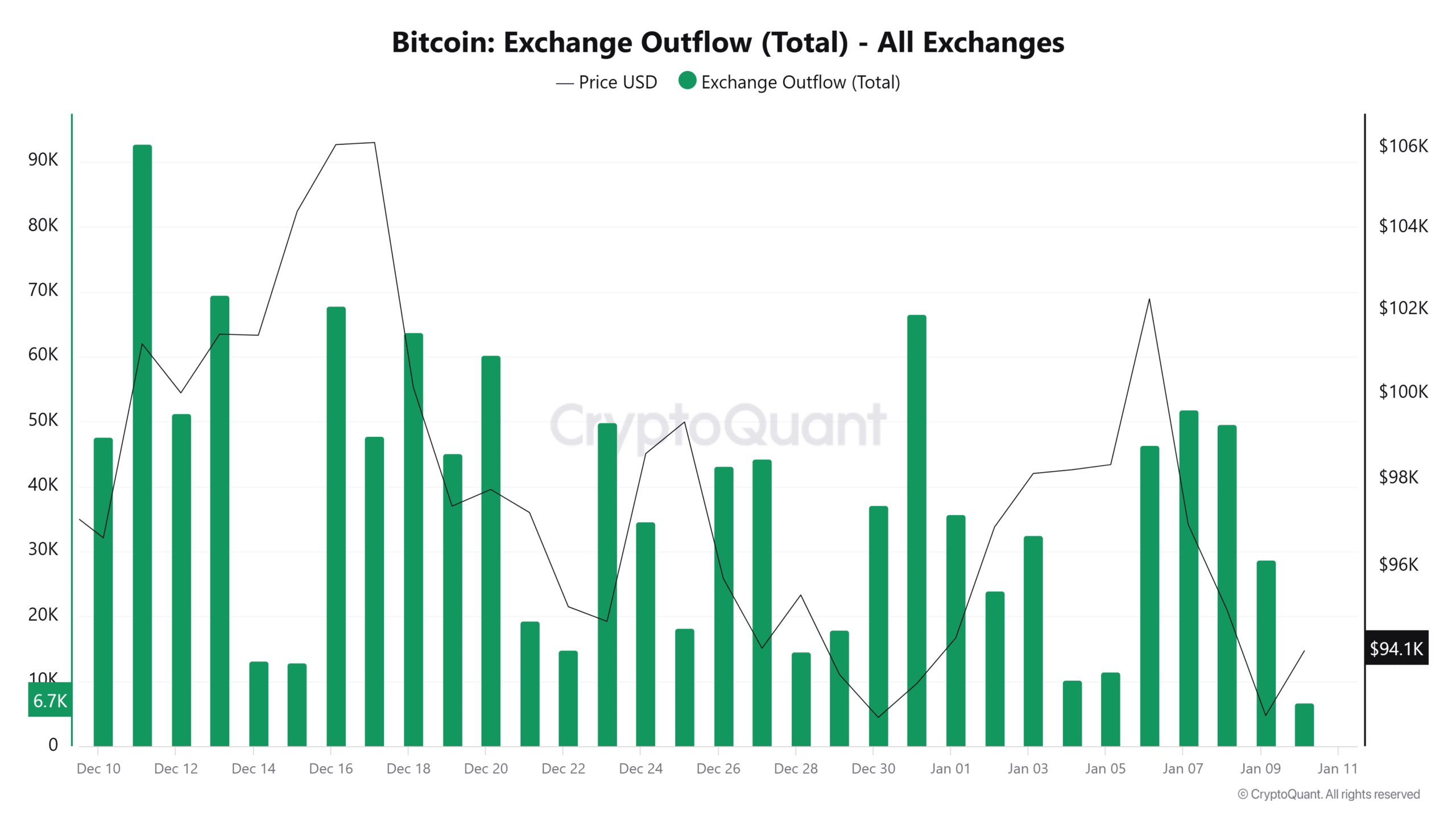

Rising trade outflows point out profit-taking

Whereas short-term alerts are comparatively bullish, the on-chain metrics inform a unique story for the long run.

In accordance with CryptoQuant, ETH’s trade outflows spiked within the final 24 hours, indicating growing promoting stress as buyers ebook income across the $3K psychological stage.

Traditionally, these outflow cycles alternate between peaks and dips, and the present upswing may signify an accumulation of sell-side exercise.

Supply: CryptoQuant

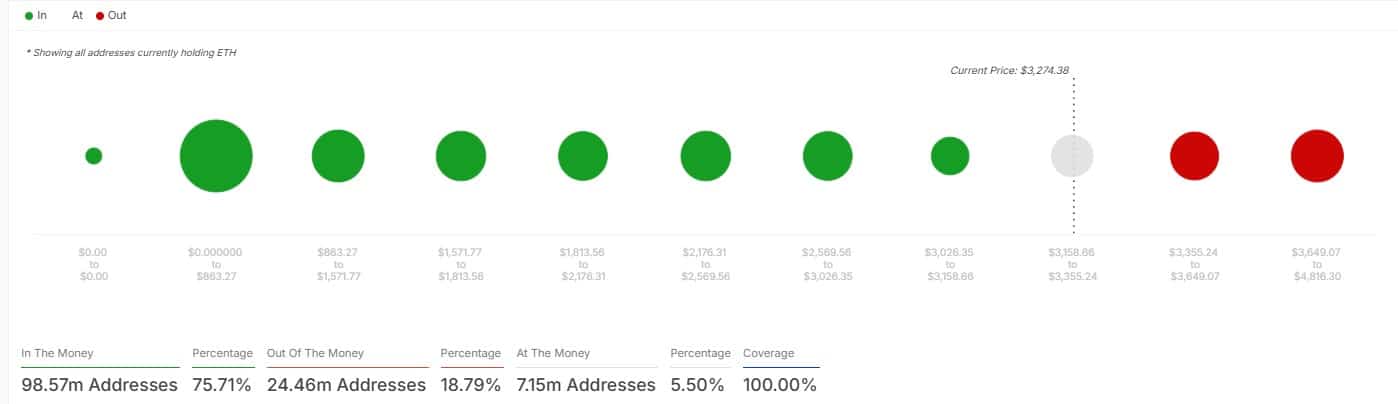

ETH holders stay worthwhile regardless of…

Regardless of short-term corrections, most ETH holders stay in revenue. Knowledge from IntoTheBlock reveals that 76% of all addresses holding ETH are worthwhile at present worth ranges. This mirrors the boldness amongst long-term buyers and signifies a powerful basis for Ethereum’s potential steady rally.

Supply: IntoTheBlock

Learn Ethereum’s [ETH] Value Prediction 2025–2026

The short- and long-term worth motion of Ethereum hinges on a few key ranges. The $2.8K flag assist stage may pave the way in which for a major rally if it holds, whereas elevated community exercise across the $3K psychological stage helps a bullish outlook.

With most holders nonetheless in revenue, ETH long-term trajectory stays optimistic.