Ethereum climbs 8%: A profitable week for THESE investors

- ETH short-term holders see revenue.

- ETH has damaged resistance for the primary time in weeks.

Ethereum [ETH] has been highlighted as one of many standout performers over the previous week, with its market capitalization rising by over 14%.

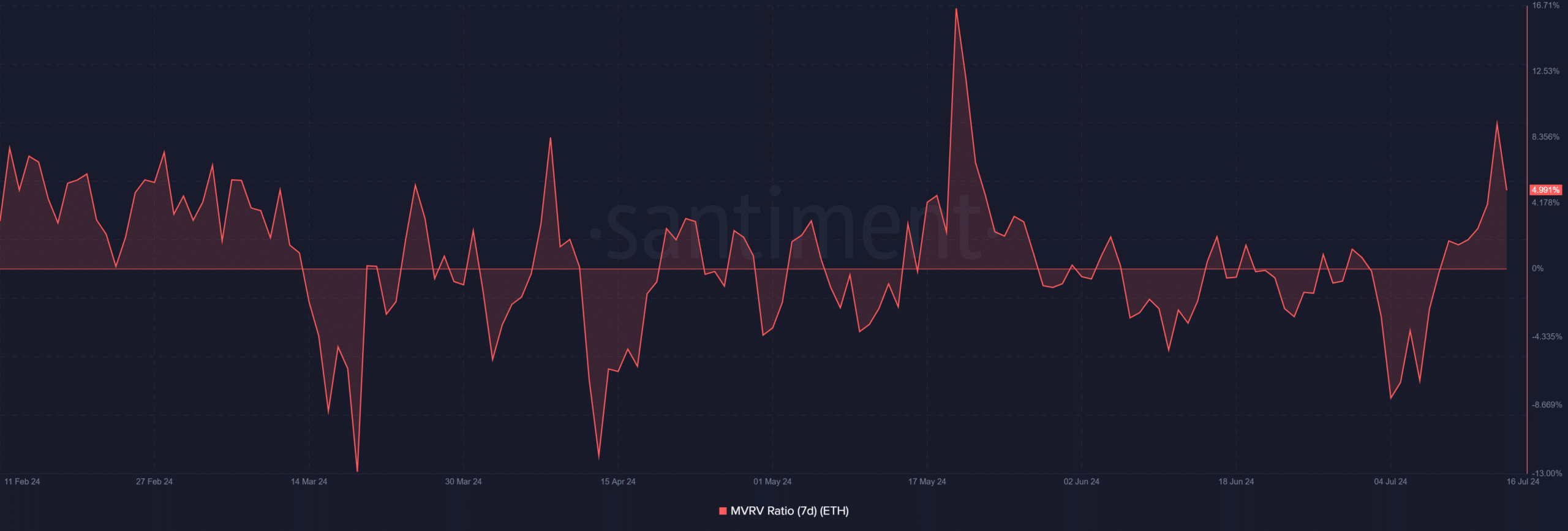

Moreover, the seven-day Market Worth to Realized Worth (MVRV) ratio indicated that consumers who entered the market throughout this era now maintain their investments profitably.

Ethereum exhibits engaging developments

Evaluation of knowledge from Santiment indicated that buyers who bought Ethereum throughout its latest dip are actually seeing substantial returns. The info revealed that ETH and several other different property skilled a big enhance in market capitalization.

Particularly, ETH’s market cap grew by over 14%, enhancing its worth for holders. This enhance underscored the profitability for individuals who purchased in at decrease costs.

It additionally highlights its attractiveness as an funding throughout unstable market phases.

How ETH trended

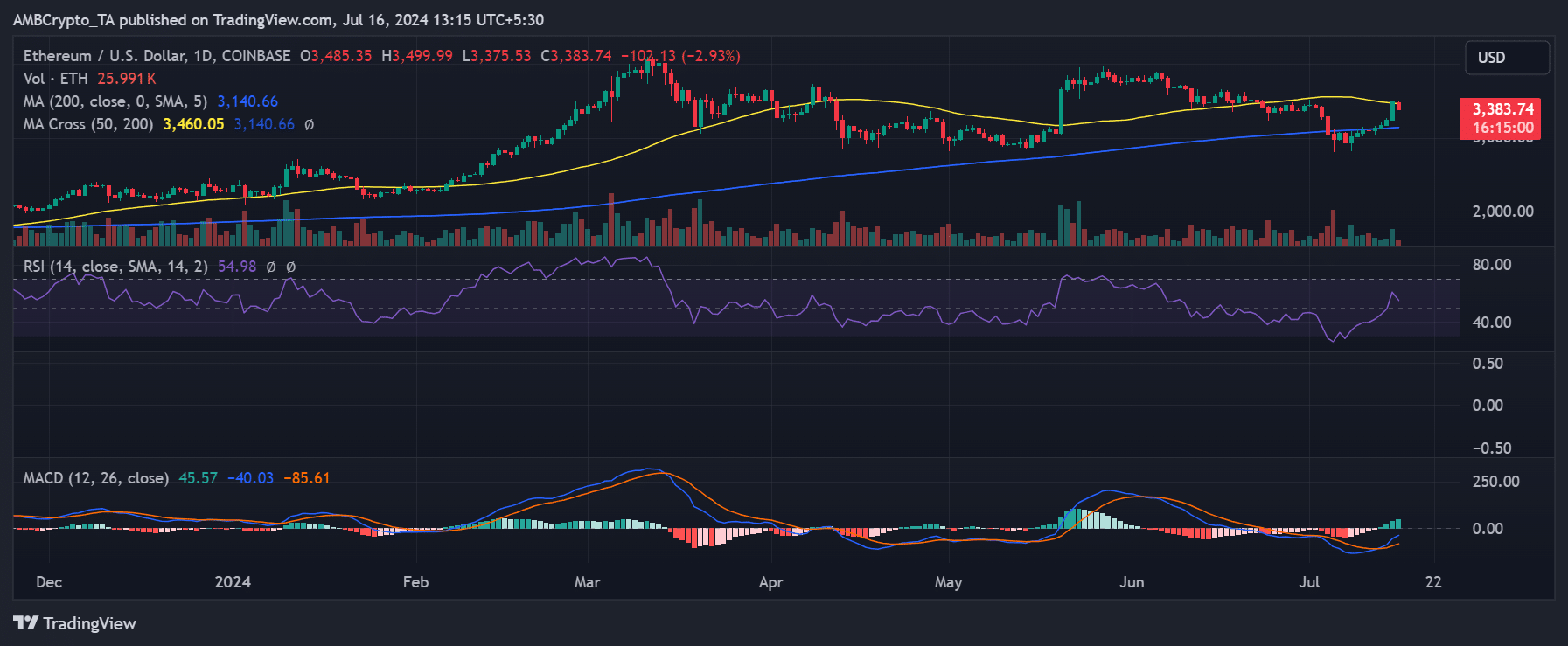

Evaluation of Ethereum on a every day timeframe, as reported by AMBCrypto, confirmed a marked uptrend on fifteenth July.

The value of ETH elevated by 8%, transferring from roughly $3,246 to shut at round $3,485. This surge pushed its worth simply above its short-moving common (yellow line), which had beforehand acted as a resistance degree.

Supply: TradingView

The breakthrough above this short-moving common is important because it signifies Ethereum was capable of overcome instant resistance, suggesting a possible for additional good points.

Nonetheless, as of the most recent observations, it was buying and selling with an almost 3% decline at round $3,380.

Though it remained barely above the yellow line, a continued decline may push it again under this pivotal resistance-turned-support degree. The continuing buying and selling exercise close to this essential juncture will decide its short-term worth trajectory.

Quick-term holders see revenue

The evaluation of Ethereum’s seven-day Market Worth to Realized Worth (MVRV) ratio indicated that short-term holders are realizing important income.

Based on the info from Santiment, the MVRV ratio was round 5.6% as of this writing. This ratio, nevertheless, has seen a decline from over 9% famous on fifteenth July, coinciding with a downturn in ETH’s worth.

Supply: Santiment

Regardless of this latest decline, the MVRV ratio remained worthwhile for holders. This means that those that invested extra just lately are nonetheless profiting even with the worth pullback.

Learn Ethereum (ETH) Worth Prediction 2024-25

The MVRV ratio initially moved into the revenue zone round ninth July and continued to rise till the latest drop. This motion suggests a typically bullish sentiment amongst latest consumers.

Nonetheless, the present downturn warrants monitoring to gauge the potential for sustained profitability or additional corrections.