Ethereum continues to be a leader in DeFi activities

- Greater than $22 billion value of cryptos have been locked within the Ethereum community at press time.

- Ethereum noticed a pointy bounce in DEX volumes.

Ethereum [ETH] maintained its place because the numero uno sensible contracts’ community throughout final week, in accordance with an X (previously Twitter) publish by blockchain analytics protocol 0xScope.

Is your portfolio inexperienced? Try the ETH Revenue Calculator

Ethereum leads in DeFi

The proof-of-stake (PoS) blockchain was the expansion driver of crypto whole worth locked (TVL), attracting over 75% of all funds deposited for numerous decentralized finance (DeFi)-related actions.

Observe that Ethereum already boasts of a well-developed ecosystem for decentralized purposes (dApps) and sensible contracts. In truth, it was the primary protocol to make use of sensible contracts ever.

In line with DeFiLlama, greater than $22 billion value of cryptos have been locked in Ethereum as of this writing, greater than the mixed worth of funds locked inside subsequent 10 networks on the listing.

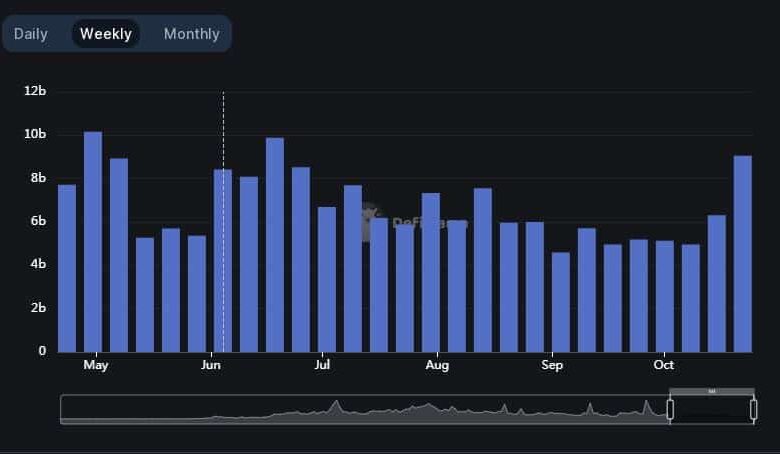

Equally, Ethereum recorded a pointy bounce in decentralized alternate (DEX) volumes. Final week, over $9 billion in offers have been settled on the community, the most important in a single week since mid-June.

Supply: DeFiLlama

Community visitors jumps

The heightened exercise on the Ethereum chain was additional evidenced by the dramatic rise in customers throughout final week. On common, roughly 320k customers accessed the community within the final seven days.

Furthermore, with the speedy inflow of customers, the transaction depend rose, in flip driving the transaction charges. Greater than $6 million in charges have been collected on the community on 25 October, the very best in practically two months.

Supply: DeFiLlama

Whales bullish on ETH?

In the meantime, a crypto whale confirmed massive urge for food for ETH cash. In line with knowledge by Lookonchain, the whale with tackle czsamsunsb.eth borrowed 100 Wrapped Bitcoin [WBTC] from main lending protocol Aave [AAVE]. This quantity was then exchanged for 1526 in ETH.

Furthermore, they extracted 2374 ETH from crypto alternate Binance. Quickly after, they deposited 16,313 ETH, or practically $29 million at going market costs, on high lending protocols to earn curiosity.

Learn Ethereum’s [ETH] Value Prediction 2023-24

These moved advised that the influential whale was betting massive on ETH’s subsequent strikes.

On the time of publication, the second-largest crypto exchanged arms at $1785.62, having mopped weekly income of 5.63%. Whereas not as massive as Bitcoin [BTC], these good points have been held tightly by Ethereum.