Ethereum Could Be Set To Explore New Highs As On-Chain Metrics Light Up

Este artículo también está disponible en español.

On-chain knowledge reveals metrics associated to community exercise have spiked for Ethereum not too long ago, one thing that might pave manner for an extra rally.

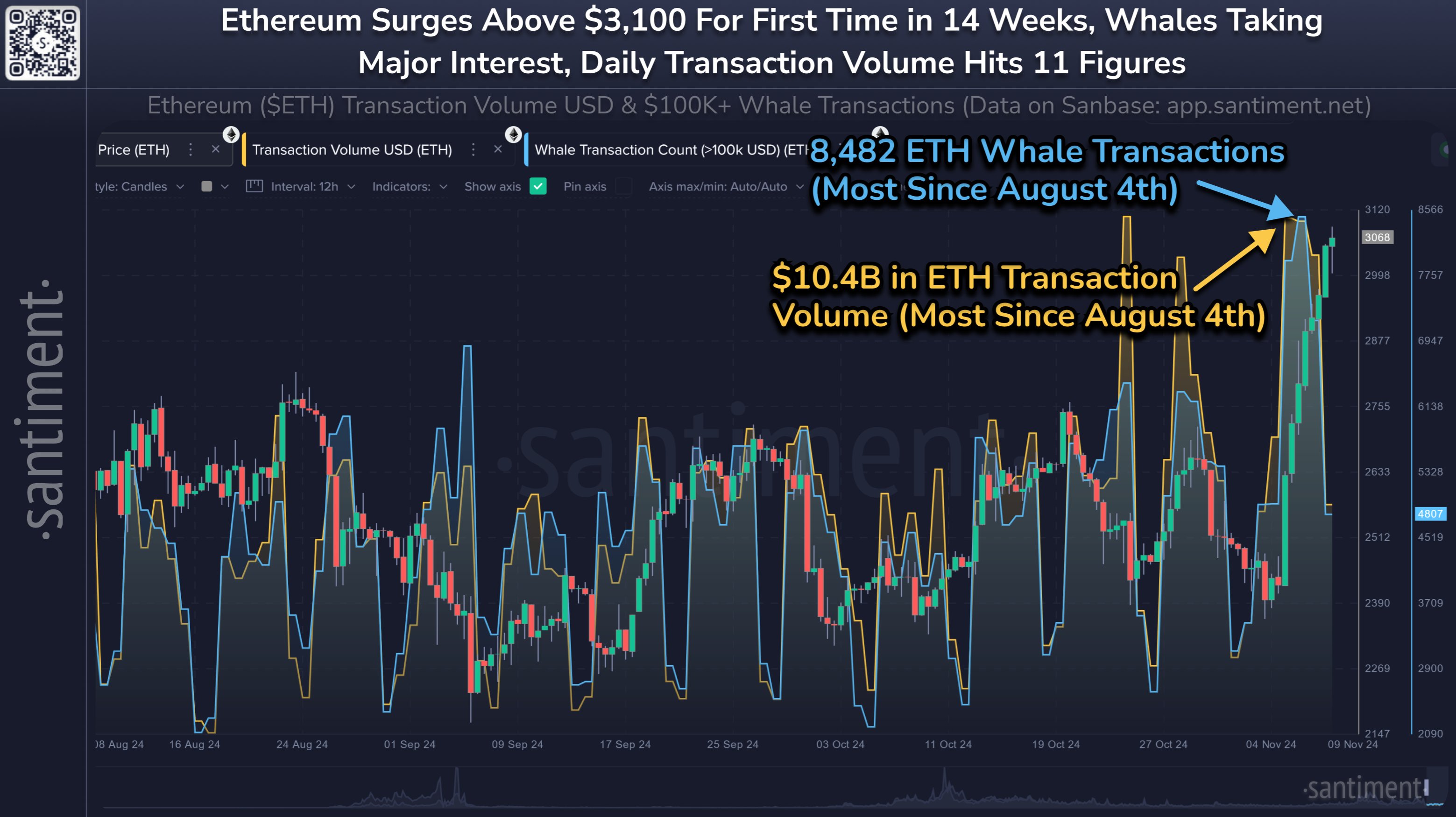

Ethereum Transaction Quantity & Whale Switch Rely Have Spiked Not too long ago

In response to knowledge from the on-chain analytics agency Santiment, Ethereum has seen an uplift in two activity-related metrics. The indications in query are the Transaction Quantity and the Whale Transaction Rely.

The primary of those, the “Transaction Quantity,” retains monitor of the full quantity of the cryptocurrency (in USD) that customers on the ETH community are shifting throughout the community with their transactions.

Associated Studying

When the worth of this metric is excessive, it means the ETH blockchain is processing the switch of a lot of cash proper now. Such a development suggests the traders actively spend money on asset buying and selling.

Then again, the low indicator implies the curiosity within the cryptocurrency might at the moment be low because the holders are solely shifting round a low quantity of ETH.

Now, here’s a chart that reveals the development within the Transaction Quantity for Ethereum over the previous few months:

As displayed within the above graph, the Ethereum Transaction Quantity has registered a pointy surge not too long ago, implying curiosity within the asset has elevated alongside the worth rally.

This may very well be thought of a constructive improvement for the cryptocurrency, as an rising community exercise is usually required for rallies to be sustainable.

Up to now, some value strikes have kicked off sharply, however the Transaction Quantity didn’t register a lot of a rise on the similar time. Such strikes typically died out earlier than lengthy.

The chart additionally incorporates the information for the opposite metric of relevance right here, the “Whale Transaction Rely.” This indicator measures the full quantity of ETH transfers valued at greater than $100,000.

Transactions of this scale are assumed to be coming from the whale entities, so the Whale Transaction Rely displays the exercise stage of the big-money traders.

From the graph, it’s obvious that this indicator has additionally spiked for Ethereum not too long ago, which means that the current enhance within the quantity isn’t only a signal of curiosity from the smaller traders but additionally the humongous palms.

Naturally, it’s inconceivable to say primarily based off these indicators alone, whether or not the traders are shopping for or promoting, as all kinds of transactions look the identical from their view. As a result of ETH has seen a pointy rally not too long ago, this exercise has in all probability been for accumulation to this point.

Associated Studying

The analytics agency explains,

Anticipate any development from Bitcoin, throughout this bull run, to see earnings redistribute into Ethereum and doubtlessly push it towards its personal all-time excessive whereas its community exercise seems to be very wholesome.

ETH Worth

After observing a surge of greater than 27% over the past seven days, Ethereum has damaged past the $3,150 stage.

Featured picture from Dall-E, Santiment.internet, chart from TradingView.com