Ethereum could reach $12K, but only if THESE conditions are met

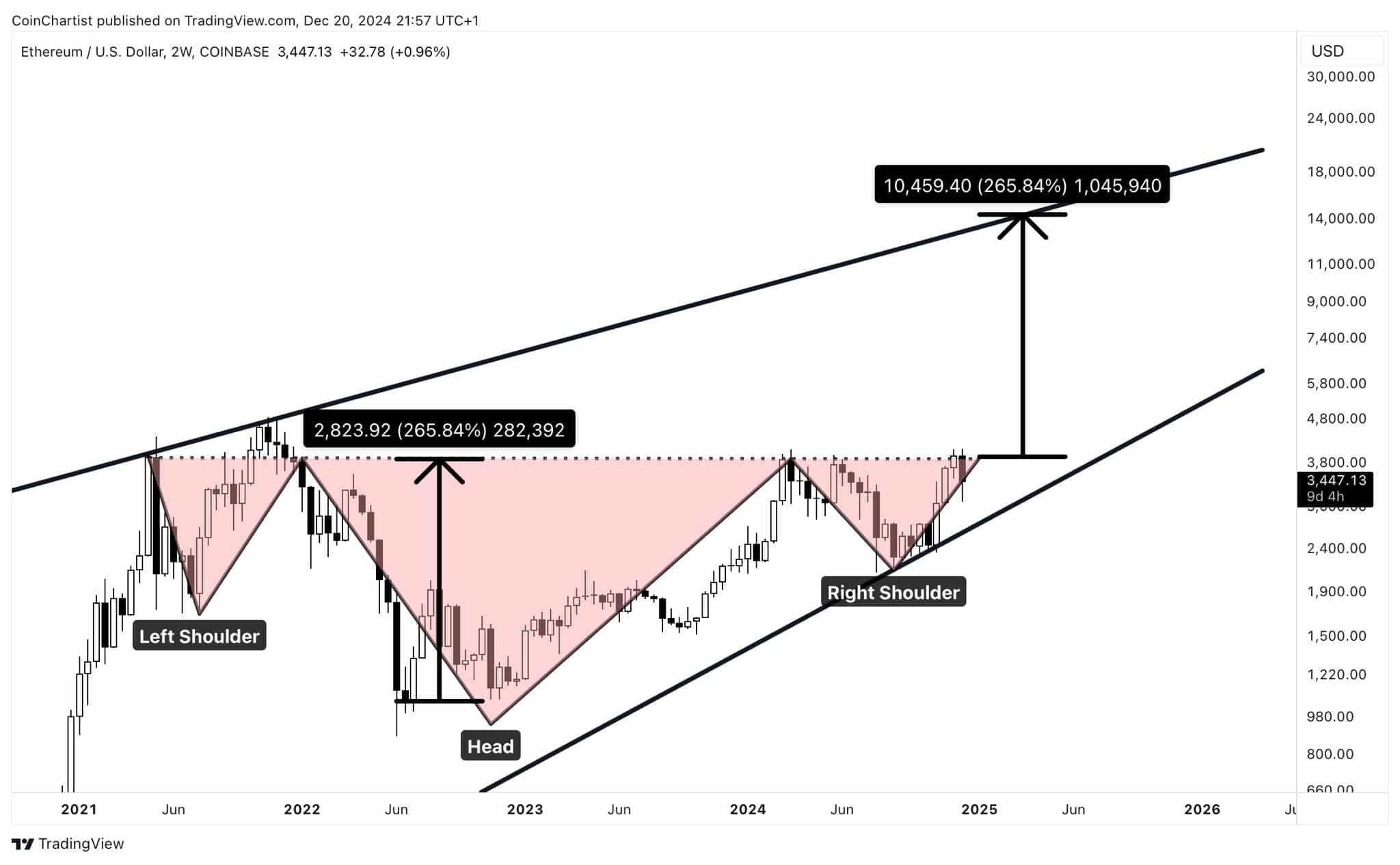

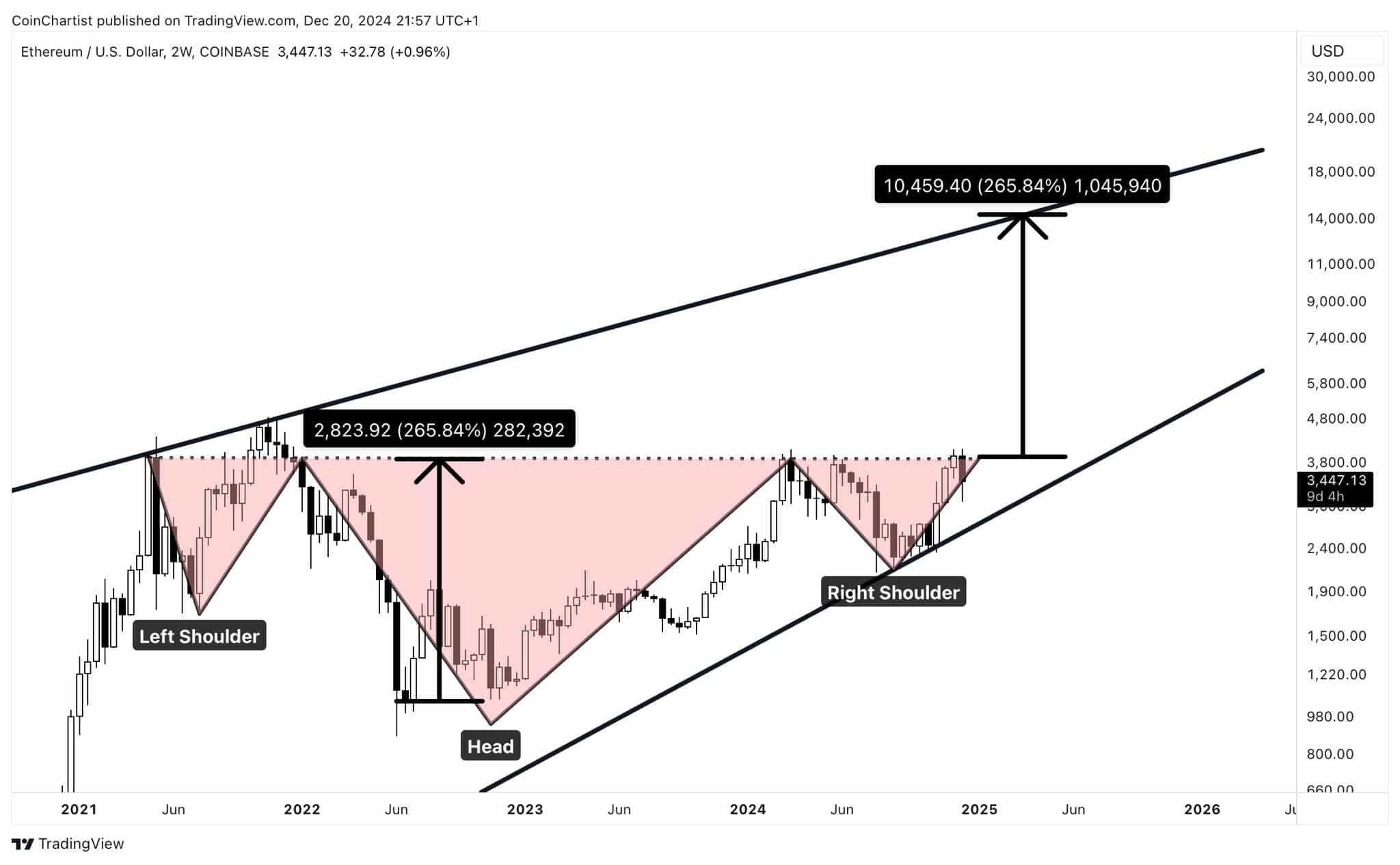

- ETH has fashioned an inverse head-and-shoulders sample, usually seen as a bullish indicator that might drive good points.

- Liquidity inflows and a gradual discount in alternate provide have elevated the probability of an ETH rally.

After weeks of market declines—together with an 8.87% drop during the last seven days—Ethereum [ETH] has begun to get better. The asset posted a 2.41% acquire previously 24 hours, reflecting renewed curiosity from merchants.

Evaluation by AMBCrypto highlights a number of market components suggesting that ETH’s current uptick might mark the beginning of a broader upward pattern.

ETH reveals double bullish indicators

ETH is presently buying and selling inside an ascending channel, a sample related to upward value motion. Inside this construction, the asset has additionally fashioned an inverse head-and-shoulders sample, one other bullish indicator.

A breakout above the neckline—a resistance degree—of this inverse head-and-shoulders sample might propel ETH considerably increased.

Based mostly on the gap between the pinnacle and neckline, a profitable breakout could yield a 265.84% enhance, pushing the asset’s value to $12,000.

Supply: X

On the time of writing, the bi-weekly chart reveals the current downturn out there was attributable to a rejection on the neckline. Nevertheless, the each day chart suggests this setback could be reversed, as ETH reveals indicators of restoration via current good points.

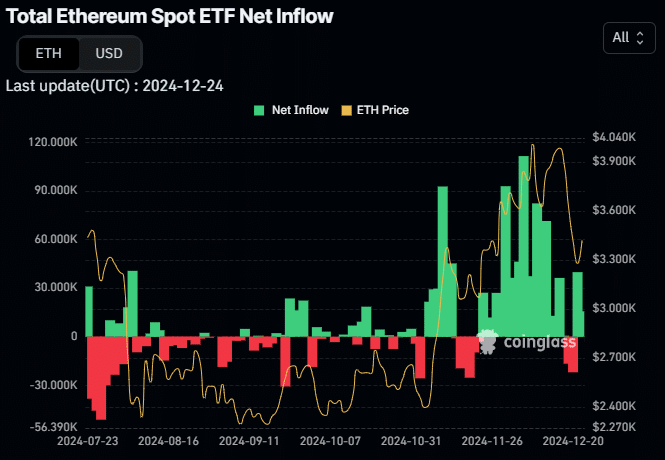

Rising liquidity stream into ETH

Demand for ETH from institutional and conventional traders has surged over the previous two days. This enhance comes after a interval of sustained promoting exercise amongst these market members.

Information from ETH spot Alternate-Traded Funds (ETFs) reveals that conventional traders bought $54.54 million price of ETH within the final two days, contributing to the asset’s current each day good points.

Supply: Coinglass

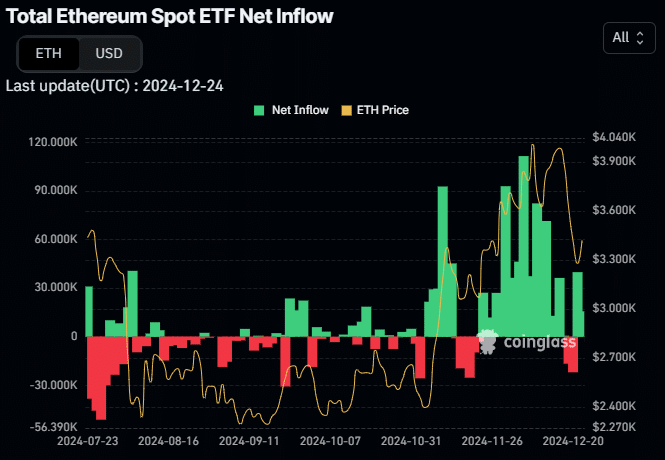

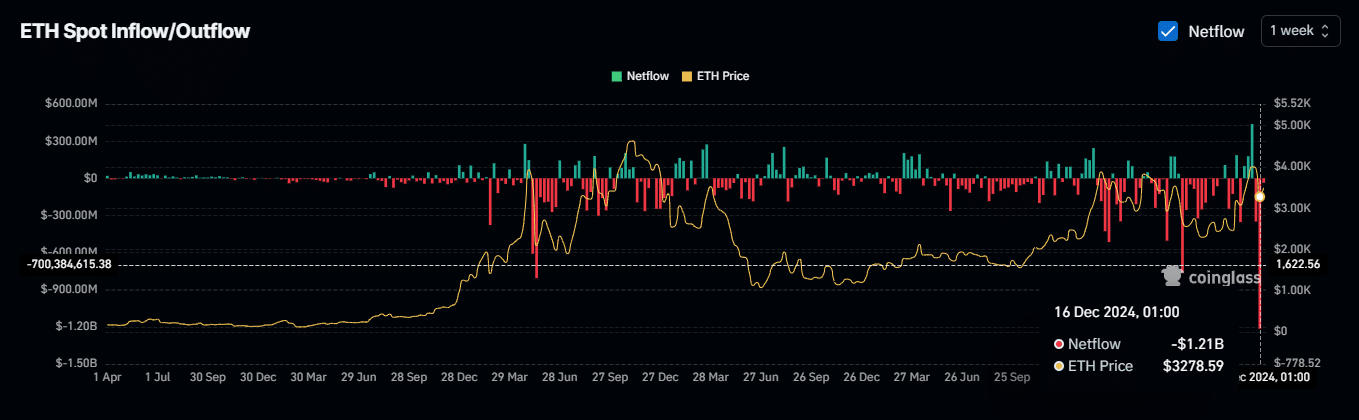

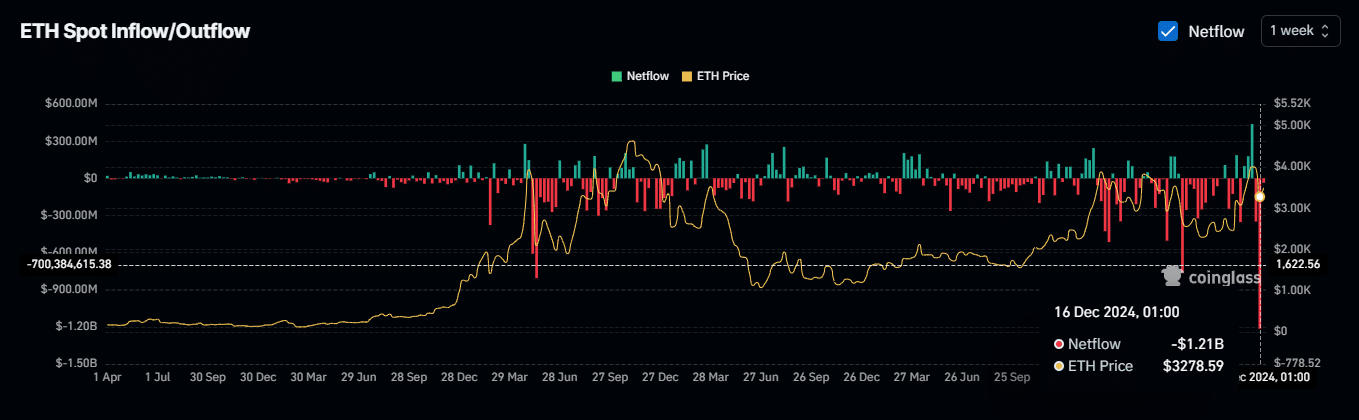

Moreover, following final week’s record-breaking internet outflow of $1.2 billion—the biggest alternate withdrawal for ETH since its inception—the pattern continues. Because the begin of the week, one other $35.93 million price of ETH has been withdrawn from exchanges.

A constant decline within the quantity of ETH accessible on exchanges, mixed with sustained destructive alternate netflows, might create a provide squeeze as rising demand meets shrinking availability.

Supply: Coinglass

Funding fee on the rise

Lengthy merchants within the derivatives market are aligning with the bullish outlook, as a number of purchase contracts for ETH have been opened. On the time of writing, the funding fee stands at 0.0089%, indicating a current shift into optimistic territory.

Learn Ethereum’s [ETH] Worth Prediction 2024-25

A optimistic funding fee, as seen with ETH, means that consumers (longs) are dominant and are paying periodic charges to keep up equilibrium between the spot and futures costs.

If this optimistic pattern persists, it might help ETH in breaching the present neckline resistance. This might pave the way in which for a sustained rally and probably setting a brand new excessive close to the $12,000 degree.