Ethereum could take ‘months to be deflationary’ – What about ETH’s bull run?

- ETH’s inflationary state endured as issuance remained 3X the burn charge.

- Analysts had been bullish on ETH post-ETF approval, however short-term drop couldn’t be overruled.

Ethereum’s [ETH] inflationary state debate has been re-ignited once more on ‘Crypto Twitter’ amidst ETH ETF approval hypothesis.

Notably, Bitwise’s Chief Funding Officer (CIO) Matt Huogan reavaled that Ethereum’s issuance at the moment stood at roughly $10 million per day.

“Whole ETH issuance is ~$10 million per day. That’s earlier than you think about the burn.”

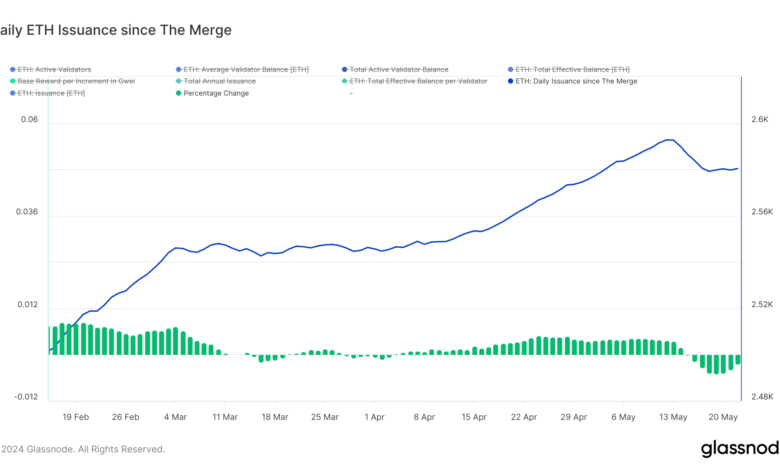

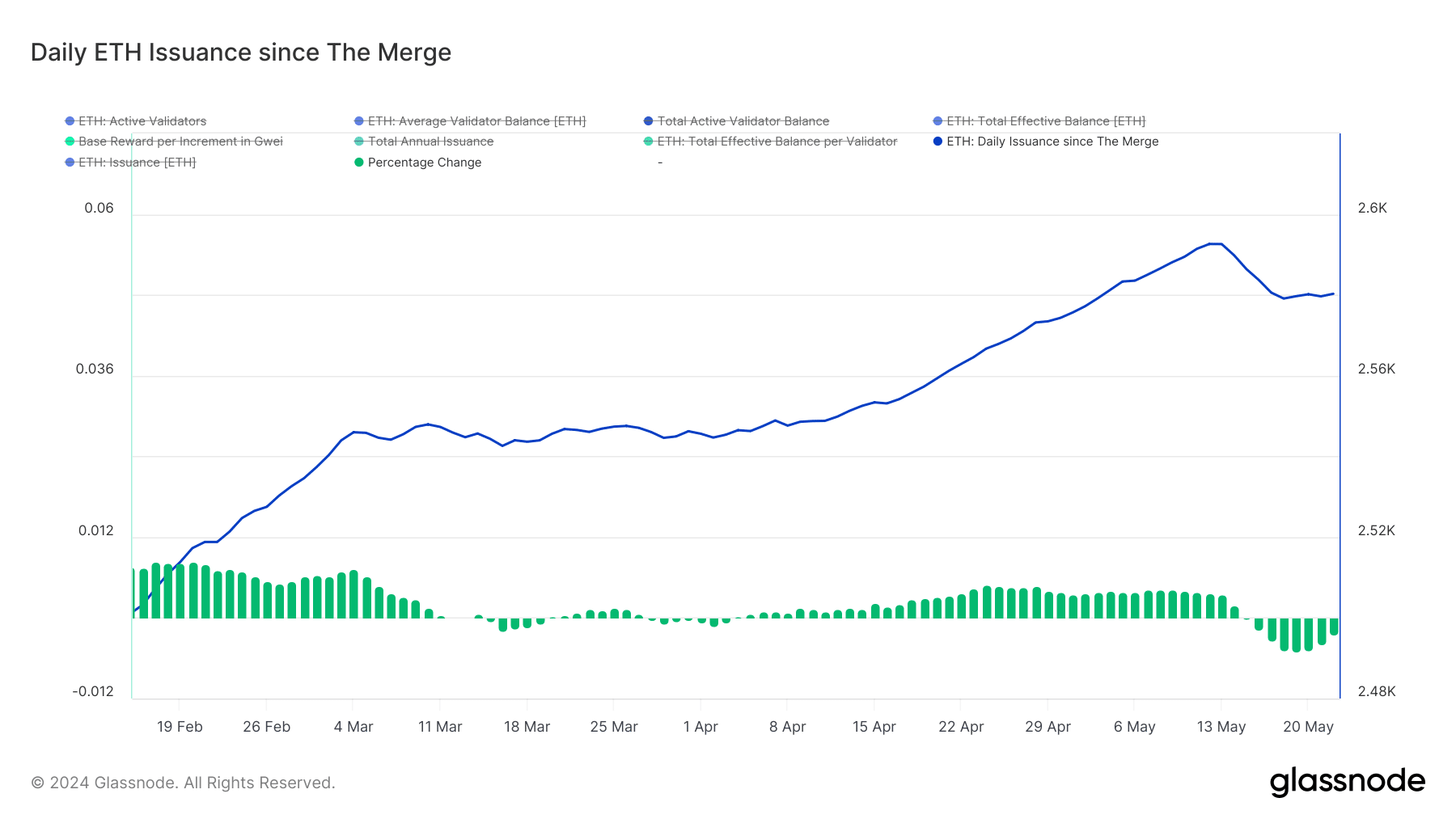

A spot verify on Glassnode confirmed Hougan’s declare. Per the crypto clever knowledge supplier, day by day issuance on the community on the twenty second of Could was 2.58K ETH.

Primarily based on press time market costs of $3.7K, that translated to $9.5 million.

Supply: ETH Day by day Issuance

Ethereum misplaced its deflationary standing following the Dencun improve, as ETH’s burn charge (the tempo of eradicating ETH from provide) trailed the issuance charge.

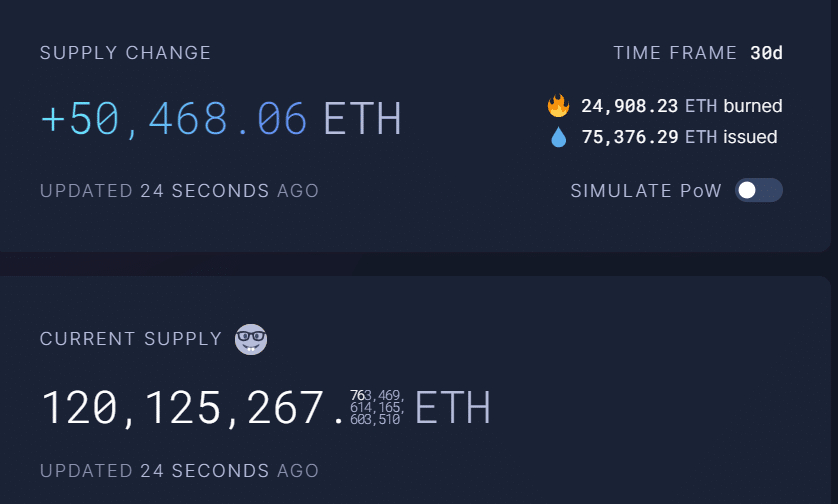

Within the final 30 days, the community’s ETH issuance was 3X greater than the burn charge. An analogous development was noticed on the 7-day chart as properly.

Supply: Extremely Sound Cash

It meant that there was extra ETH provide that might derail additional worth prospects.

After The Merge in 2022, ETH’s issuance attained a deflationary standing, prompting BitMEX founder Arthur Hayes to discuss with it as a floor for ‘ETH’s bull run.’

One of many Ethereum educators, Adriano Feria, noted that it might take ETH ‘months to be deflationary’ once more.

ETH to rally 75% post-ETF approval affirmation?

Nonetheless, the ETF approval catalyst might outweigh the inflationary standing and entrance an enormous run.

In line with Bernstein, a personal funding agency, ETH might rally 75% to $6,600 after the approval, citing BTC’s worth motion in January after the ETF launch.

Crypto asset buying and selling agency, QCP Capital, shared an analogous sentiment, albeit with various nuances primarily based on ETH funding charges and quantity adjustments.

In line with the agency’s latest Telegram update, ETH’s worth might stabilise within the brief time period and rally within the mid-term.

‘ETH Perp funding went from 50% to flat in 12 hours, with June forwards nonetheless yielding 15%, presumably reflecting diminished short-term hypothesis however sustained medium-term bullishness.’

This meant that merchants within the futures market anticipated ETH to rise within the coming weeks. Nevertheless, QCP Capital underscored that ‘short-term draw back volatility’ may very well be probably.

That mentioned, Ethereum whales have been positioning accordingly for the ETF hypothesis, which means the $4K stage may very well be breached if approval is confirmed.

On the time of writing, ETH consolidated under $3800, 22% down from its final cycle’s all-time excessive of $4,867.