Ethereum crash alert: Why ETH might plunge to $1800 soon

- Promoting strain on Ethereum was rising over the previous few days.

- The NVT ratio indicated that Ethereum was overvalued.

Ethereum [ETH] traders had been having a tricky time because the bears continued to dominate the market. In actual fact, the most recent information steered that it would take even longer for the bulls to regain management.

Let’s take a look at why it appeared probably for ETH bears to push the token’s worth down additional.

Ethereum troublesome future

CoinMarketCap’s data revealed that Ethereum bears pushed the token’s worth down by greater than 10% within the final seven days. The bearish development continued within the final 24 hours as ETH’s worth dipped by 1.6%.

On the time of writing, Ethereum was buying and selling at $2,486.34 with a market capitalization of over $299 billion.

As per IntoTheBlock’s data, 76.8 million ETH addresses remained in revenue, which accounted for 63% of the full ETH addresses.

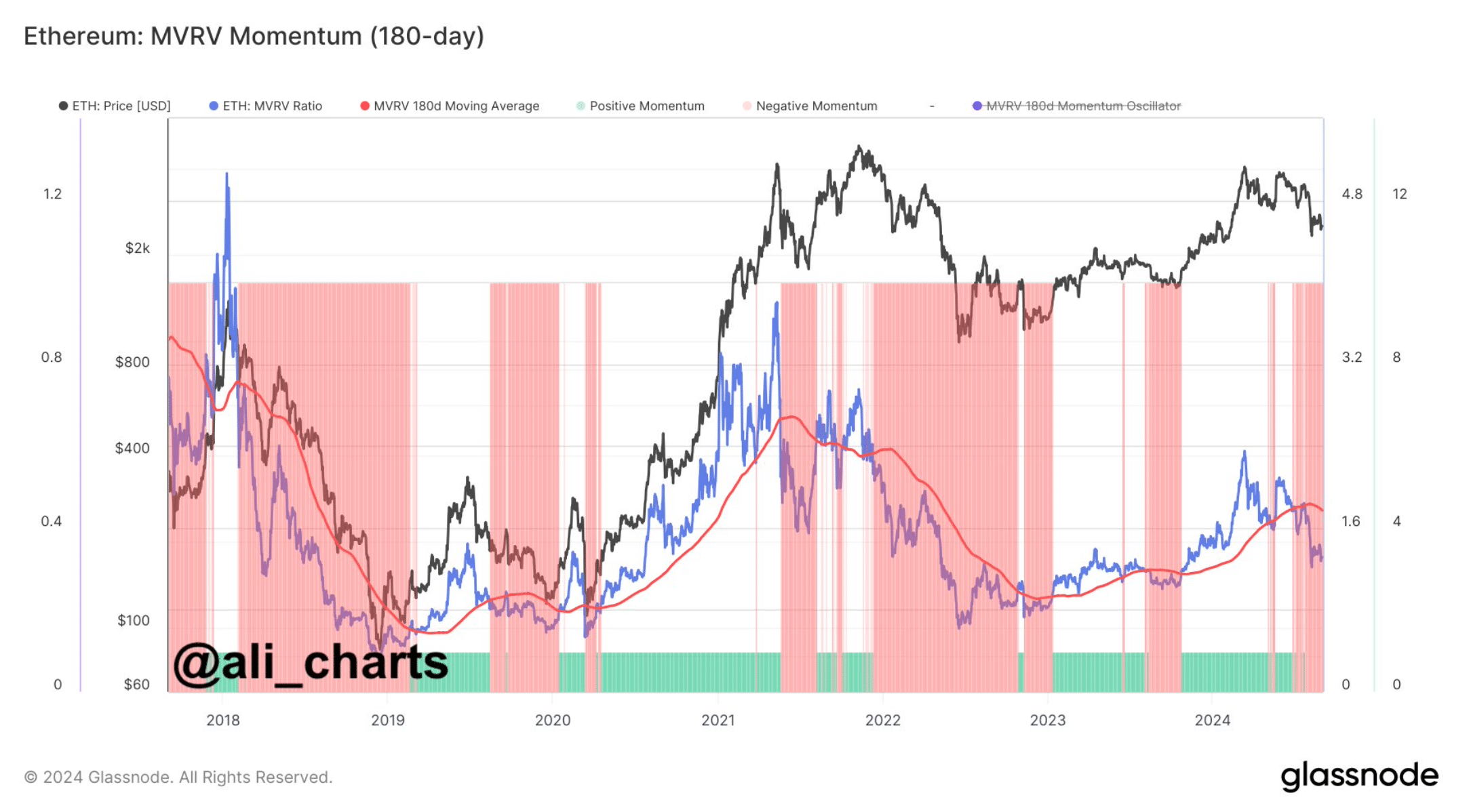

Within the meantime, Ali, a well-liked crypto analyst, posted a tweet highlighting an fascinating improvement. As per the tweet, the MVRV Momentum indicated that Ethereum was nonetheless in a downtrend.

The dangerous information was that there have been no indicators of a development reversal. This clearly steered that traders may witness the king of altcoins drop additional within the coming days.

Subsequently, AMBCrypto deliberate to have a more in-depth take a look at ETH’s state to seek out out what to anticipate.

Supply: X

ETH’s attainable help ranges

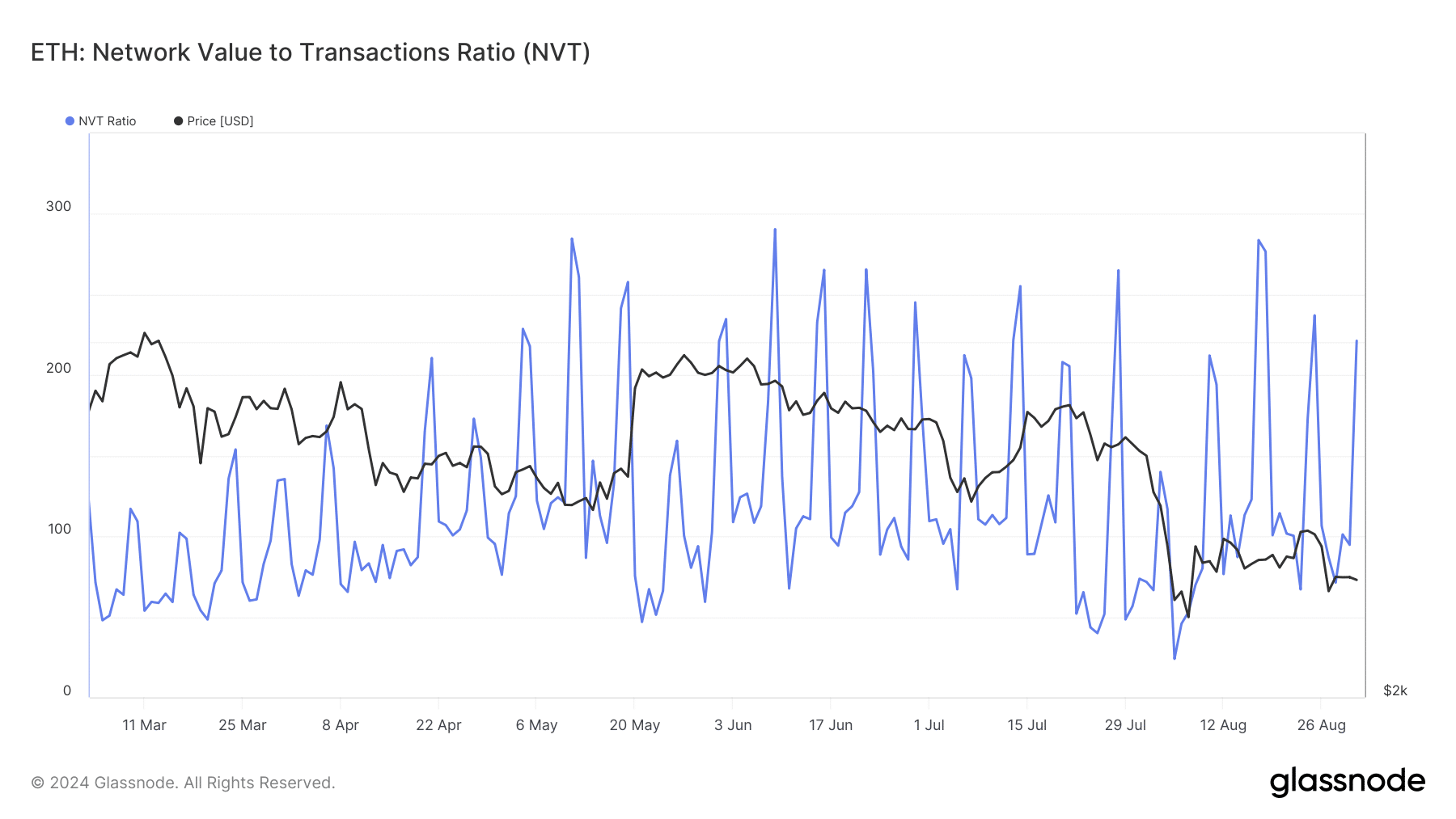

AMBCrypto’s evaluation of Glassnode’s information revealed that Ethereum’s NVT ratio registered a large spike. At any time when the metric will increase, it means that an asset is overvalued, hinting at a worth correction.

Supply: Glassnode

CryptoQuant’s data additionally revealed fairly just a few bearish metrics. For instance, ETH’s alternate reserve was growing, that means that promoting strain was on the rise.

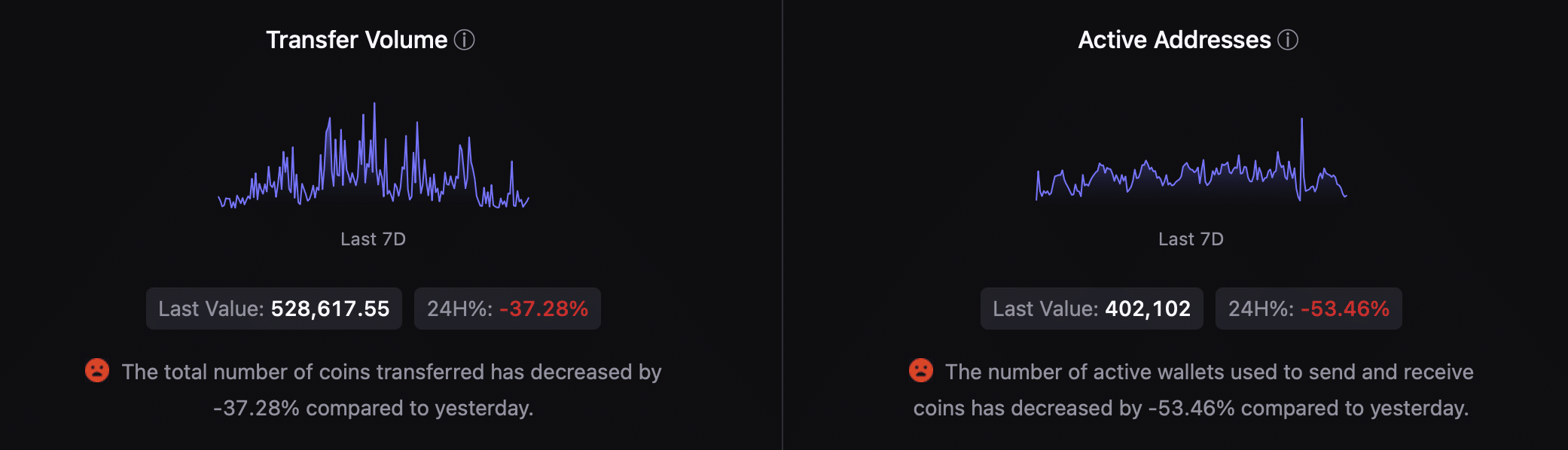

Aside from that, the full variety of cash transferred has decreased by -37.28% in comparison with yesterday. One other bearish metric was the energetic addresses, because it dropped within the final 24 hours.

Supply: CryptoQuant

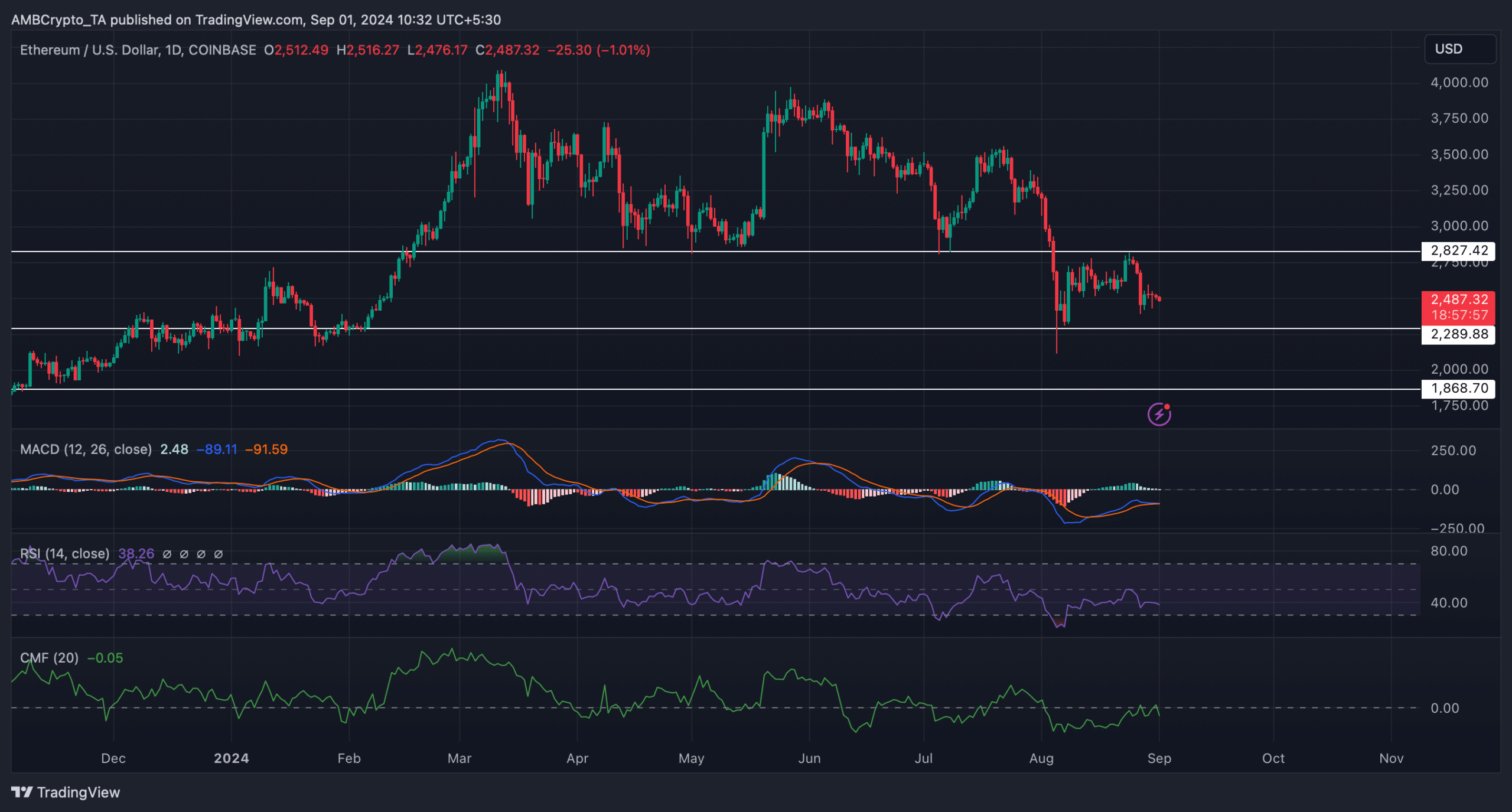

For the reason that aforementioned datasets hinted at a continued worth drop, AMBCrypto checked Ethereum’s each day chart to search for attainable help zones. The technical indicator MACD displayed a bearish c crossover. Ethereum’s Chaikin Cash Circulate (CMF) registered a downtick.

Learn Ethereum’s [ETH] Worth Prediction 2024–2025

The Relative Power Index (RSI) additionally adopted an identical declining route, suggesting that the probabilities of an extra worth drop had been excessive. If that’s true, then it gained’t be stunning to see Ethereum plummeting to $2.28.

A slip below that help stage may push ETH all the way down to $1.86 within the coming days or even weeks if the bulls don’t buckle up.

Supply: TradingView