Ethereum dApp volumes hit new highs: Can this help ETH rally above $3,200?

- Ethereum has registered the best dApp quantity within the final 30 days.

- ETH’s worth pattern has been much less energetic.

Ethereum’s [ETH] decentralized utility (dApp) ecosystem has witnessed a formidable surge in exercise, with volumes climbing by 38% over the previous month.

This development signaled renewed curiosity in DeFi, NFTs, and gaming sectors. Nevertheless, a crucial query stays—will this on-chain exercise drive a bullish breakout for ETH’s worth?

The Ethereum community seems energetic with rising fuel utilization, growing transaction volumes, and dApp engagement. Nonetheless, worth motion stays cautiously optimistic.

Ethereum dApp volumes on the rise

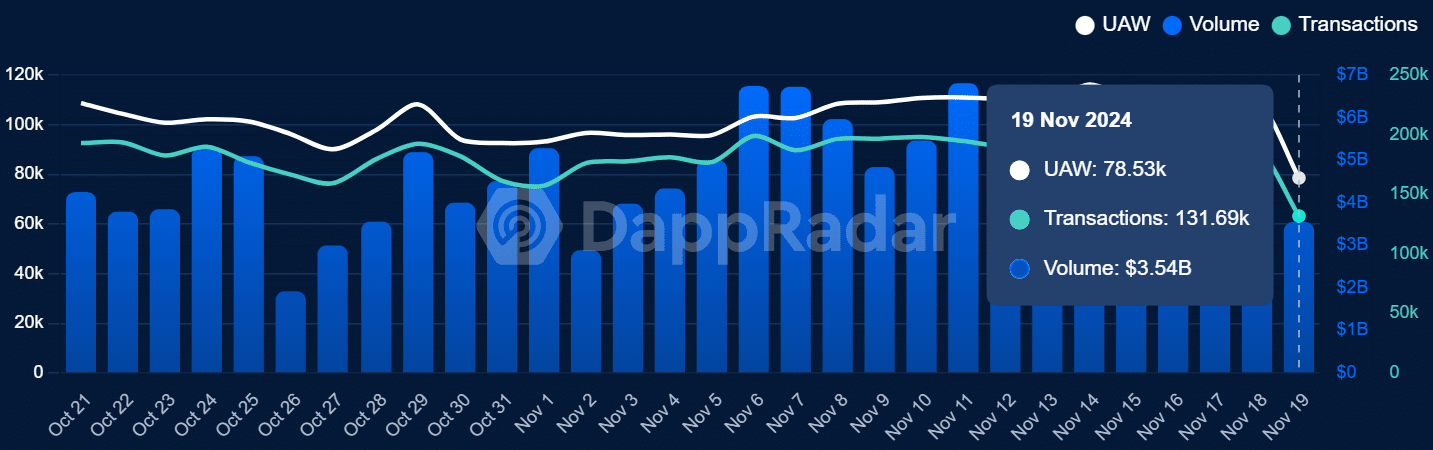

Current knowledge from DappRadar highlighted a gentle improve in Ethereum dApp utilization.

Complete transaction volumes have reached $3.54 billion as of the nineteenth of November 2024, whereas the variety of each day distinctive energetic wallets (UAW) surged to 78.53k, signaling rising participation within the ecosystem.

Supply: DappRadar

Moreover, evaluation reveals that within the final 30 days, its dApp quantity rose to virtually $150 billion, which was the best.

The info additionally confirmed a 37.67% improve within the final 30 days, making its improve essentially the most impactful.

DeFi protocols have been the biggest contributors to this development, benefiting from greater whole worth locked (TVL) as lending and buying and selling actions achieve momentum.

NFT marketplaces and blockchain-based gaming platforms have additionally performed a major function in driving transactions.

On-chain exercise displays elevated demand

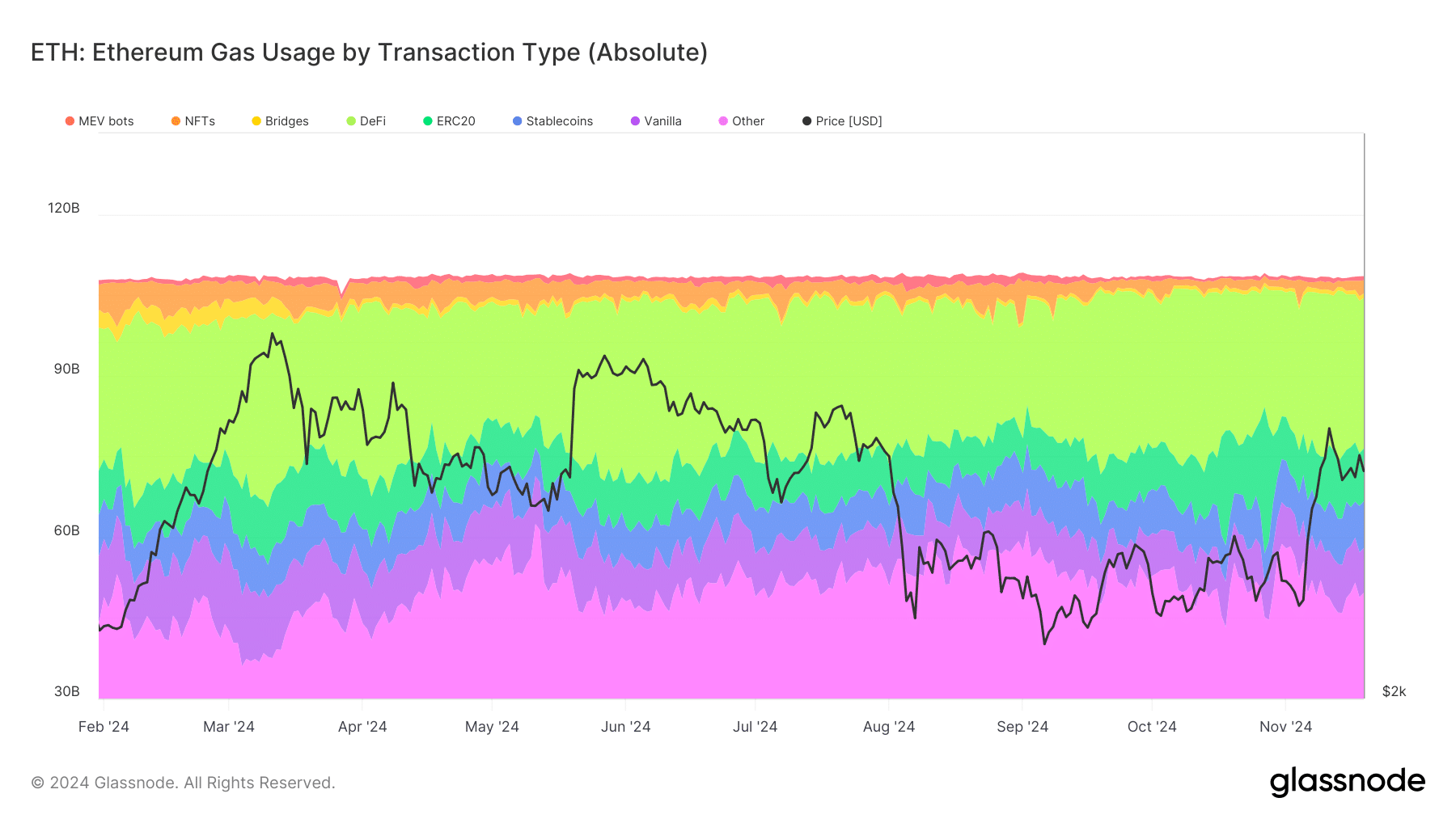

AMBCrypto’s evaluation of Ethereum’s on-chain exercise offered extra context to its rising dApp ecosystem.

Based on Glassnode, fuel utilization has risen throughout numerous transaction sorts, together with DeFi, NFTs, and stablecoin transfers. Additional evaluation confirmed that the DeFi sector dominates fuel utilization on the platform.

Supply: Glassnode

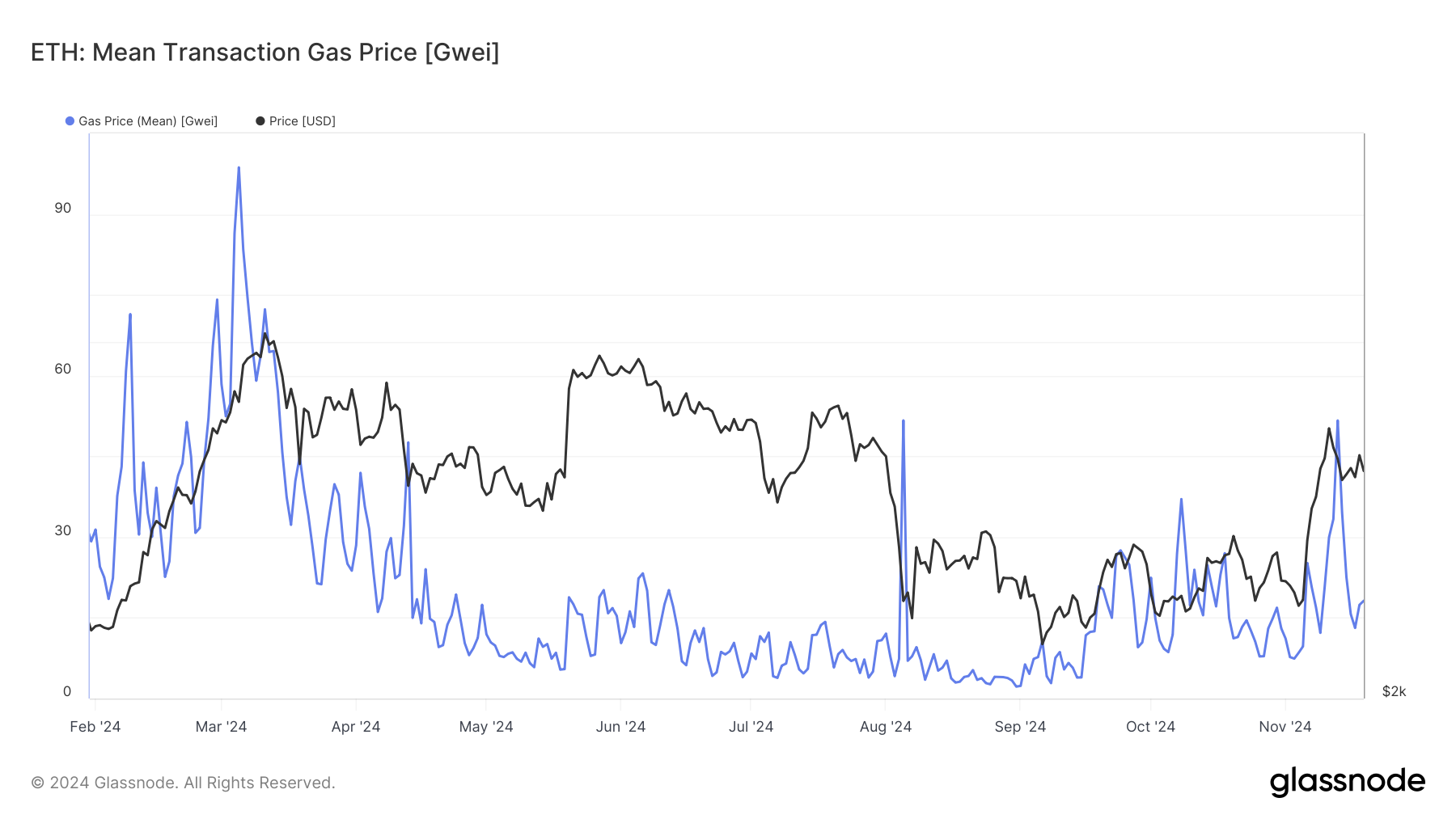

Moreover, the evaluation confirmed a latest spike in fuel charges, averaging 50 Gwei. Traditionally, greater fuel charges have coincided with spikes in on-chain exercise, usually previous important worth actions for ETH.

Supply: Glassnode

Ethereum’s worth motion and technical indicators

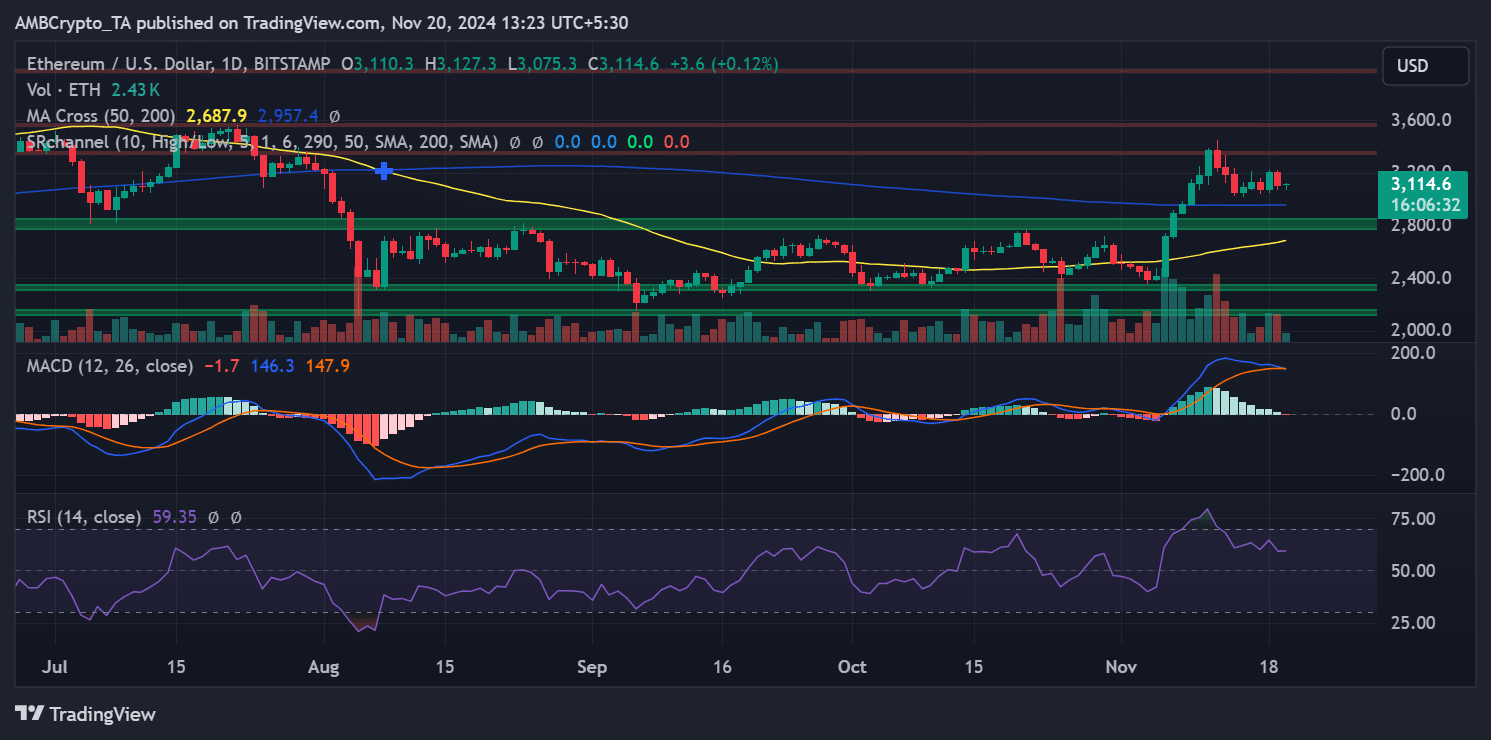

Regardless of the rise in community exercise, Ethereum’s worth motion has remained subdued, buying and selling round $3,114 at press time. The technical outlook revealed combined indicators as effectively.

Notably, the 50-day transferring common of $2,687 sits above the 200-day transferring common at $2,957, indicating an total bullish pattern. The MACD exhibits a slight bearish divergence, pointing to weakening momentum.

In the meantime, the RSI at 59.35 mirrored impartial situations, suggesting that Ethereum’s worth may transfer in both course within the close to time period.

Supply: TradingView

Ethereum should break above crucial resistance at $3,200 to maintain its bullish trajectory.

On the draw back, the $3,000 assist stage is essential, as a breach may result in a protracted consolidation section or perhaps a short-term correction.

Will ETH comply with the dApp quantity surge?

The numerous improve in Ethereum’s dApp volumes underscored robust community demand. Nevertheless, translating this exercise into sustained worth development relies on a number of components.

The continued growth of DeFi and NFT sectors may improve Ethereum’s intrinsic worth, driving investor curiosity.

Moreover, ecosystem upgrades comparable to EIP-4844 (Proto-Danksharding) are anticipated to enhance scalability and community effectivity, probably boosting Ethereum’s attraction.

Learn Ethereum’s [ETH] Value Prediction 2024-25

Nevertheless, challenges stay. Excessive fuel charges may deter additional person participation, limiting the ecosystem’s development.

Broader macroeconomic situations and fluctuations in Bitcoin’s worth may additionally weigh on Ethereum’s skill to capitalize on its community exercise.