Ethereum DEX volume loses $2B in 7 days: Bad news for ETH?

- DEX quantity fell to $1.03 billion, nonetheless, indicators revealed that ETH’s value may leap.

- The liquidation ranges urged that the altcoin may go away extra shorts in liquidations.

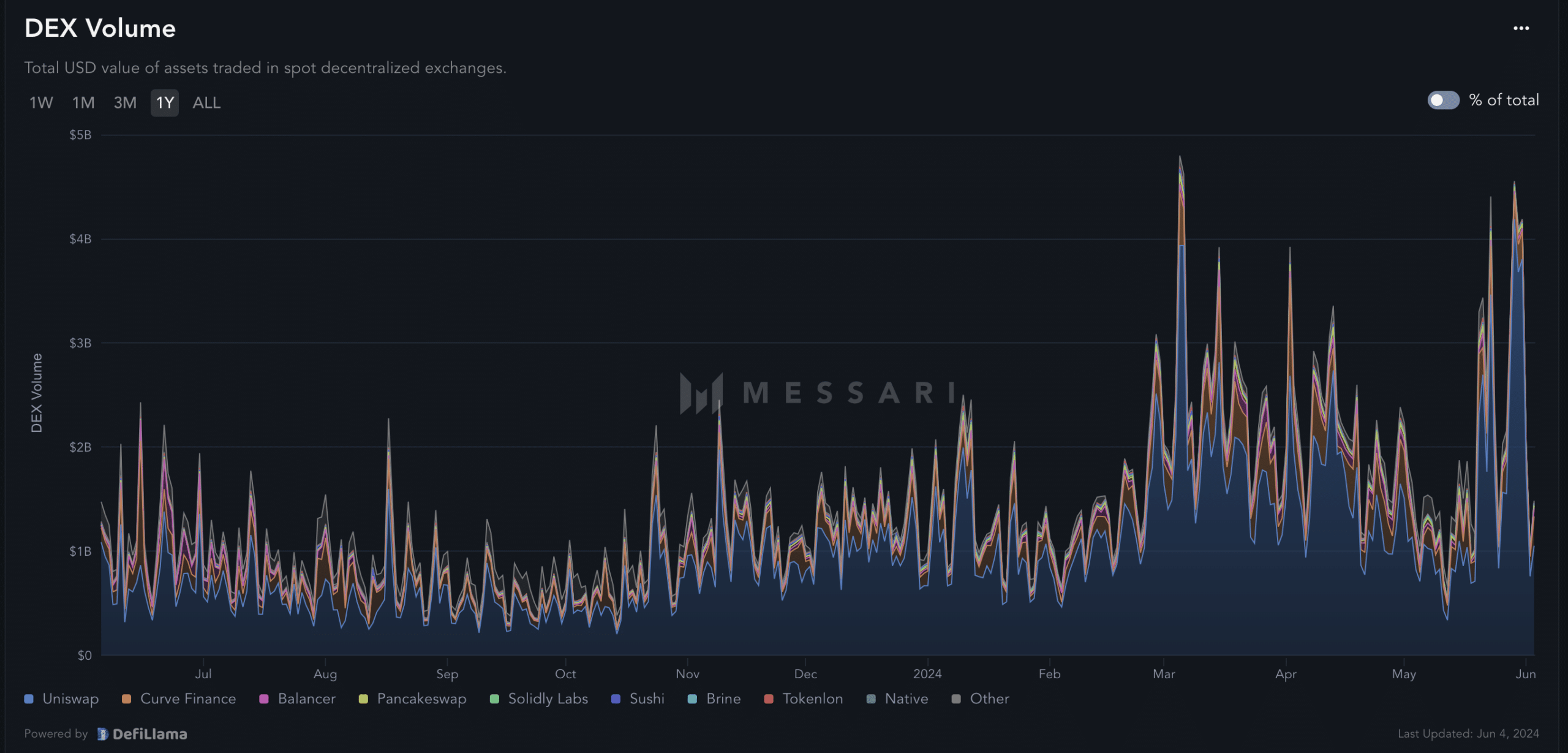

Exercise on Ethereum’s [ETH] Decentralized Exchanges has been declining for the previous seven days, AMBCrypto confirmed. On the twenty eighth of Might, based mostly on knowledge from Messari, the amount was $3.34 billion.

Nevertheless, press time knowledge showed that the DEX quantity was all the way down to $1.03 billion— A $2.21 billion lower. A rise within the quantity on DEXes would have implied extra liquidity for Ethereum.

Because it fell, it implies that on-chain trades involving ETH had been now not as a lot as they had been final week. One other interpretation factors to decreased demand for the altcoin.

Supply: Messari

A “slight” fall shouldn’t be the top

With lowering demand, ETH may discover it difficult to expertise a serious value enhance. At press time, the worth of ETH was $3,763, representing a 3.50% lower throughout the final week.

The underwhelming value motion is likely one of the causes some individuals share the opinion that Ethereum won’t be a major a part of the bull market.

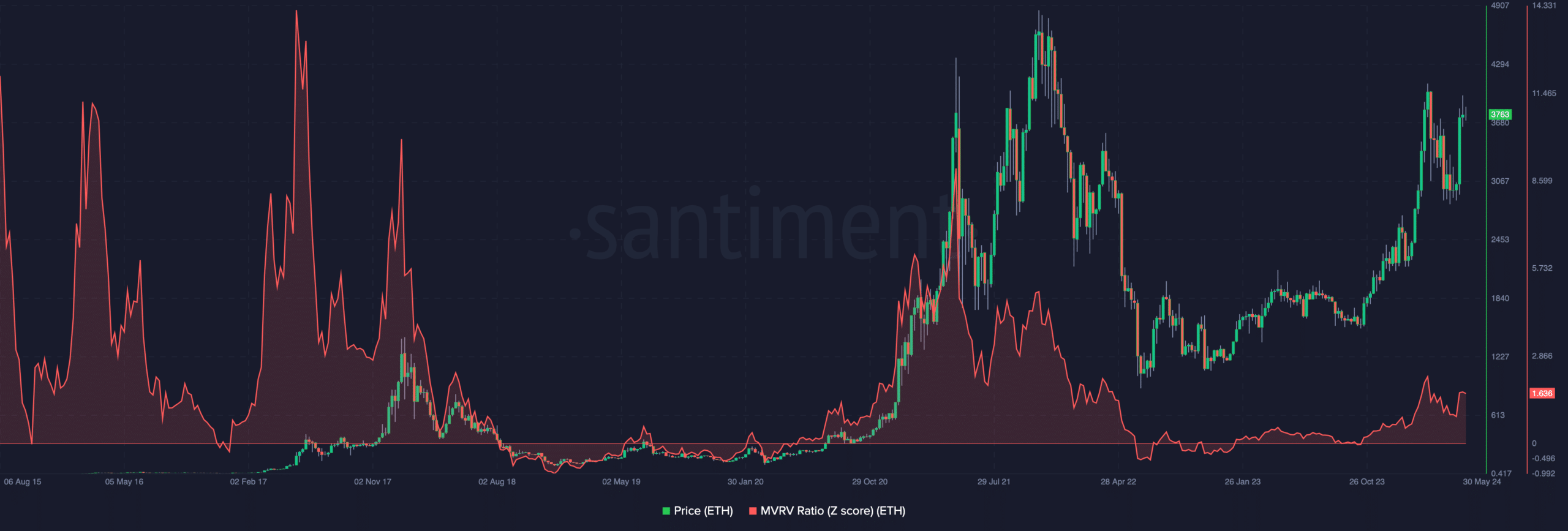

Nevertheless, AMBCrypto discovered that the opinion was not factual. This was due to the indicators proven by the Market Worth to Realized Worth (MVRV) Z Rating. The MVRV has a robust correlation with value.

Because of this, it exhibits when a cryptocurrency is in bearish or bullish section. If the rating if unfavourable, it implies that the asset is in a bear section. From the chart beneath, the final time ETH was in such situation was in October 2023, that means that the token had moved into the bull section.

At press time, the MVRV Z Rating was 1.63. A take a look at the peak of previous bull cycles like in 2017 and 2021 confirmed that the metric hit. 14.19 and 4.76 respectively. If the sample was to repeat itself, then it imply Ethereum’s value may climb increased.

Supply: Santiment

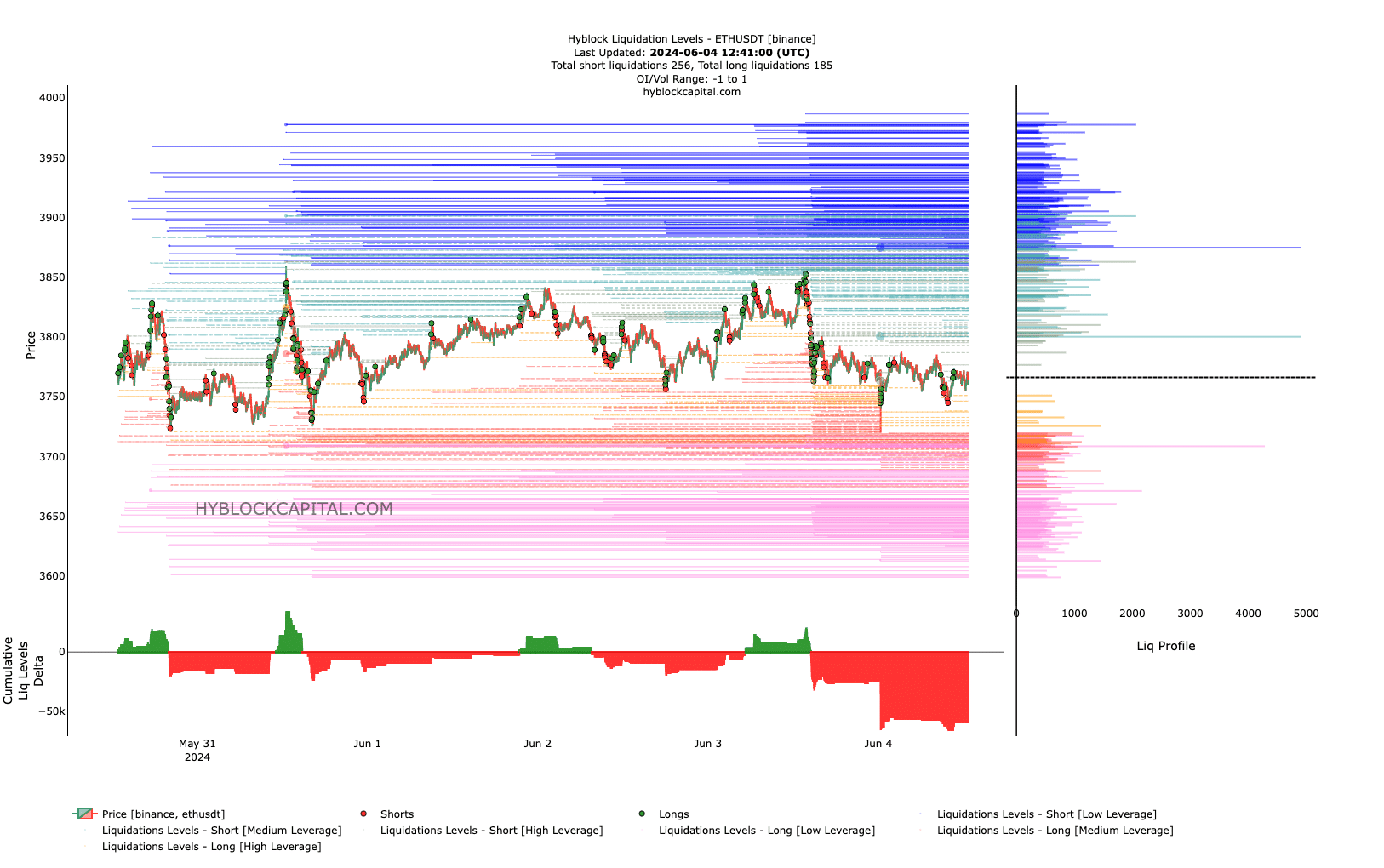

However that’s for the long run. Within the brief time period, AMBCrypto analyzed the liquidation ranges. The liquidation degree is the worth an alternate forcefully shut a dealer’s place.

Bears beware! ETH seems to be able to recuperate

The rationale behind that is to stop additional losses. At press time, Ethereum’s large-scale liquidations may happen between $3,882 as much as $3,946. This implied that value may transfer towards the talked about area.

Moreover, we checked the Cumulative Liquidations Ranges Delta (CLLD). A optimistic worth of this studying implies that there are extra lengthy liquidations. A unfavourable studying means that brief liquidations had been dominance.

Supply: Hyblock

Learn Ethereum’s [ETH] Value Prediction 2024-2025

Trying on the chart, the CLLD was unfavourable, and brief liquidations within the final seven days has been over $59 million.

However regarding the value, the unfavourable CLLD is bullish for ETH as late brief would possibly fail to catch the dip. On this occasion, ETH would possibly recuperate, and the projection to $3,946 could possibly be come to move.