Ethereum dips, but demand rises: What’s driving investors to ETH?

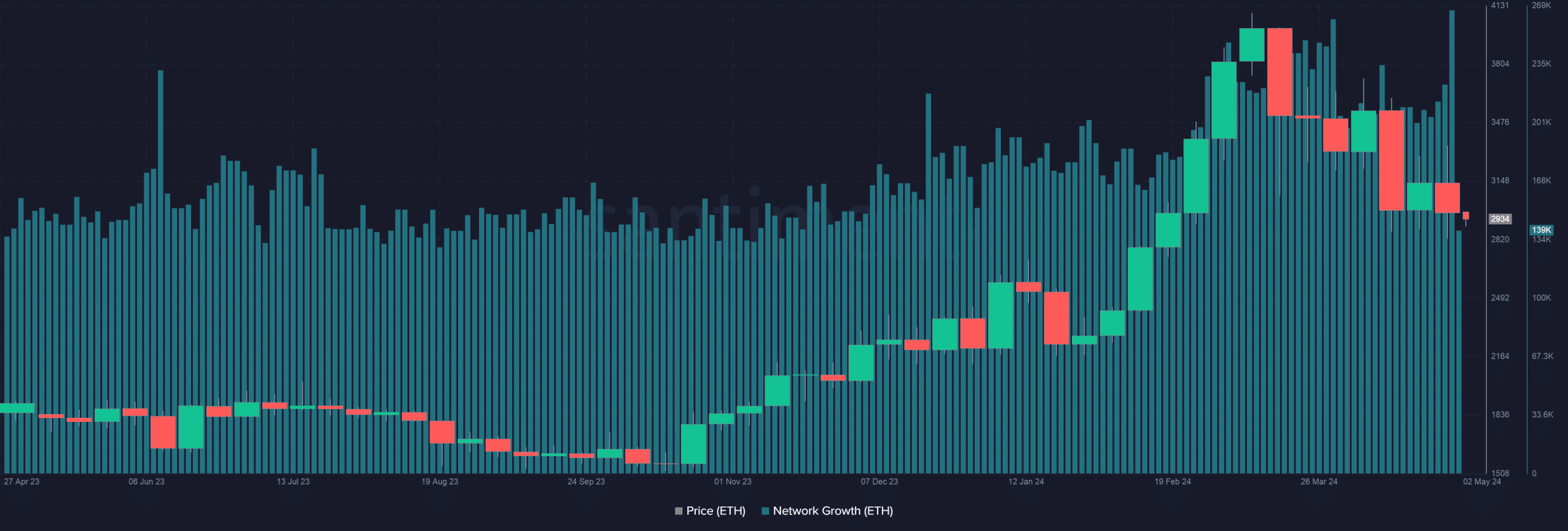

- ETH noticed the most important 2-day stretch of community enlargement since October 2022.

- The addresses holding between 0 and 0.1 models of ETH elevated considerably.

Ethereum [ETH] continued to fall freely, sinking under $3,000 within the final 24 hours following a 3% drop, knowledge from CoinMarketCap confirmed. The second-largest cryptocurrency was buying and selling at $2,914 at press time, reflecting a 13.34% low cost over the month.

The unfavorable value motion, nonetheless, didn’t seem to restrict demand for the asset.

Unfazed customers proceed to snap ETH

In keeping with on-chain analytics agency Santiment, Ethereum noticed a pointy enhance in new customers becoming a member of the community. About 266.6k new wallets had been created on the twenty eighth of April and twenty ninth, the most important 2-day stretch of community enlargement since October 2022.

Supply: Santiment

Community enlargement is among the main measures for figuring out if a cryptocurrency is gaining or shedding traction. The onboarding of latest customers indicated confidence in ETH’s long-term potential, ignoring short-term blips.

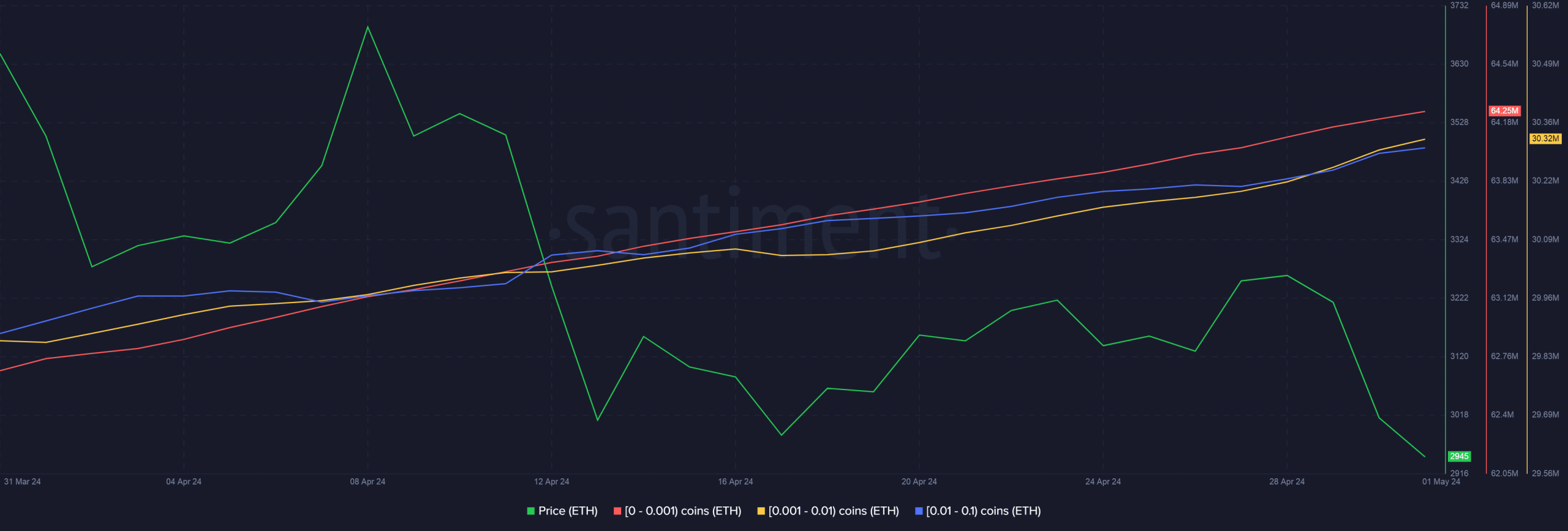

Retail customers enter ETH market

On additional scrutiny, it got here to mild that retail customers had been leaping on the bandwagon. The addresses holding between 0 and 0.1 models of ETH elevated considerably whereas the costs plunged, as per AMBCrypto’s evaluation of Santiment’s knowledge.

Supply: Santiment

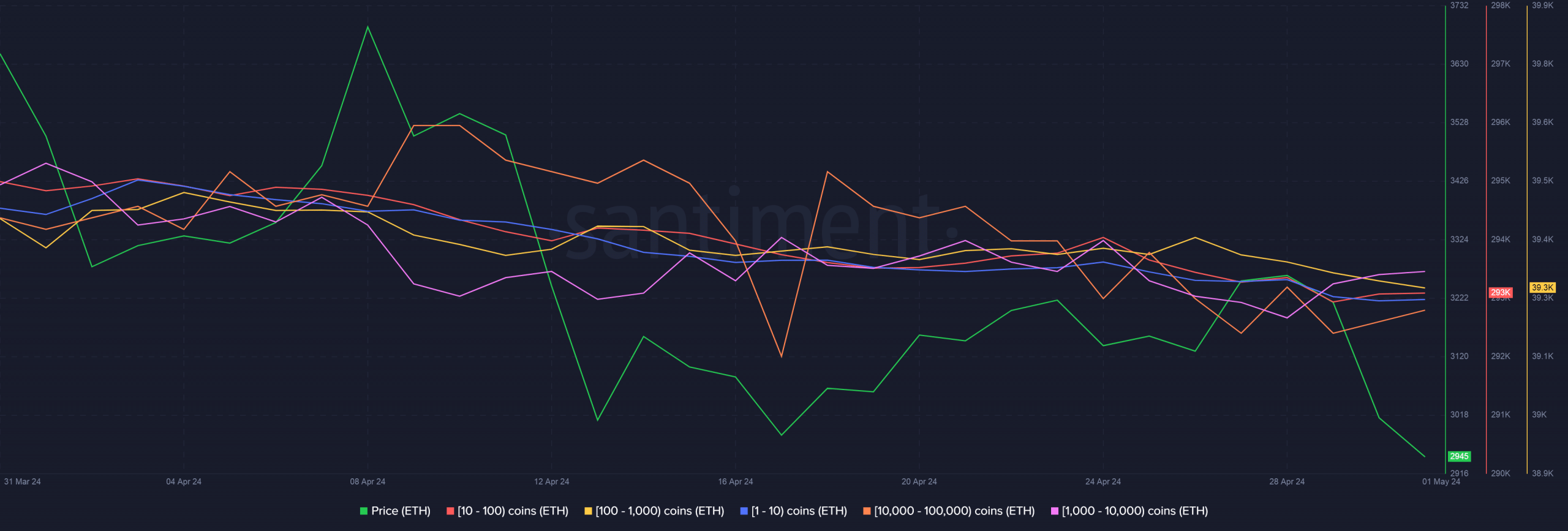

Apparently, the cohorts holding greater than 1 ETH had been promoting off, as evident within the drop of their ETH reserves.

Supply: Santiment

The aforementioned findings urged that retail curiosity was sturdy for ETH and wholesome inflows from this phase may contribute to a reduction rally within the days forward.

Is your portfolio inexperienced? Take a look at the ETH Revenue Calculator

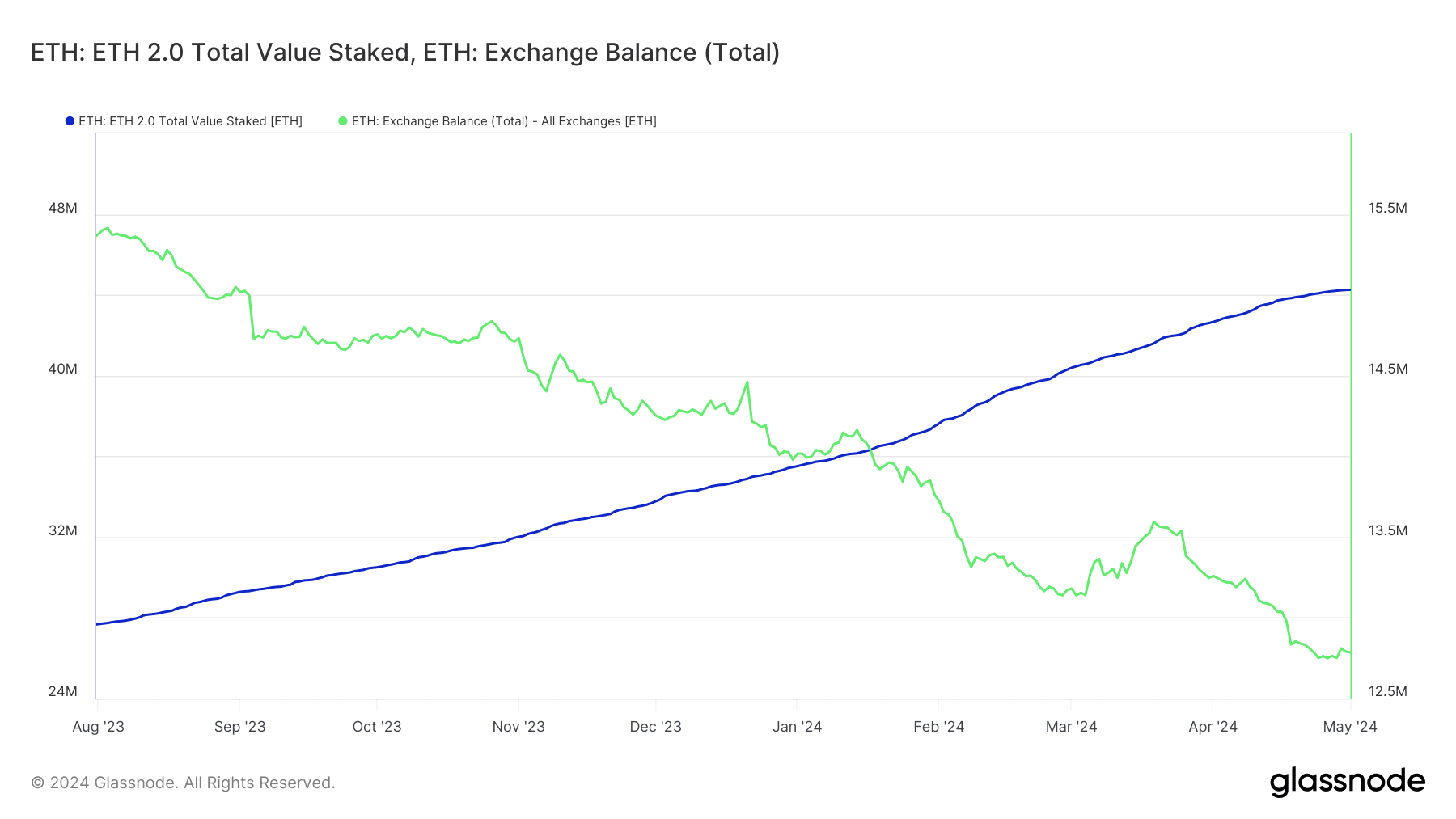

Is staking the driving drive?

Many of those retail prospects shopping for ETH may be lured by the yields provided by ETH staking companies.

The overall ETH staked soared to 44.24 million as of this writing, forming 36% of ETH’s complete circulating provide, AMBCrypto famous utilizing Glassnode knowledge.

On the similar time, the availability of ETH on exchanges continued to shrink, falling to 12.79 million as of this writing, about 10% of complete ETH cash in circulation.

Supply: Glassnode