Ethereum dominance struggles at 13% – What’s going on?

- Ethereum’s market dominance has dropped to vary lows at 13%.

- The declining market share comes amid weakening demand, rising provide, and Bitcoin’s rising dominance.

Ethereum [ETH] has been underperforming towards Bitcoin [BTC] over the previous yr. For example, Bitcoin has gained greater than 120% year-on-year (YoY), whereas Ethereum has gained round 50%.

Ethereum’s underperformance has seen its market dominance tank to vary lows. At press time, it stood at 13.85%, a notable drop from a yearly excessive of almost 20%.

Supply: TradingView

A number of components have spurred the declining dominance of the biggest altcoin, and its underperformance towards Bitcoin.

Bitcoin’s rising dominance

Bitcoin has witnessed a big improve in dominance this yr. This metric has been forming greater highs and transferring inside an ascending channel because the begin of the yr.

Supply: TradingView

One key issue triggering an increase in Bitcoin’s dominance is the excessive demand for spot Bitcoin exchange-traded funds (ETFs).

Information from SoSoValue reveals that spot Bitcoin ETFs presently maintain greater than $57 billion value of BTC. This reveals excessive institutional curiosity that’s fuelling optimistic value efficiency.

Whales are promoting Ethereum

The opposite issue inflicting a drop in Ethereum dominance is whale promoting exercise.

On the eighth of October, a big tackle that participated within the 2014 Preliminary Coin Providing (ICO) deposited 5,000 ETH to Kraken, valued at $12M.

This whale has deposited round 50,000 ETH valued at $125M to exchanges within the final two weeks per SpotOnChain.

The Ethereum Basis, which has additionally been on a promoting spree, has contributed to Ethereum’s underperformance. For the reason that starting of the yr, this establishment has offered greater than $10M value of ETH.

An uptick in whale promoting exercise and not using a rise in demand may see ETH proceed buying and selling rangebound if new consumers fail to enter the market.

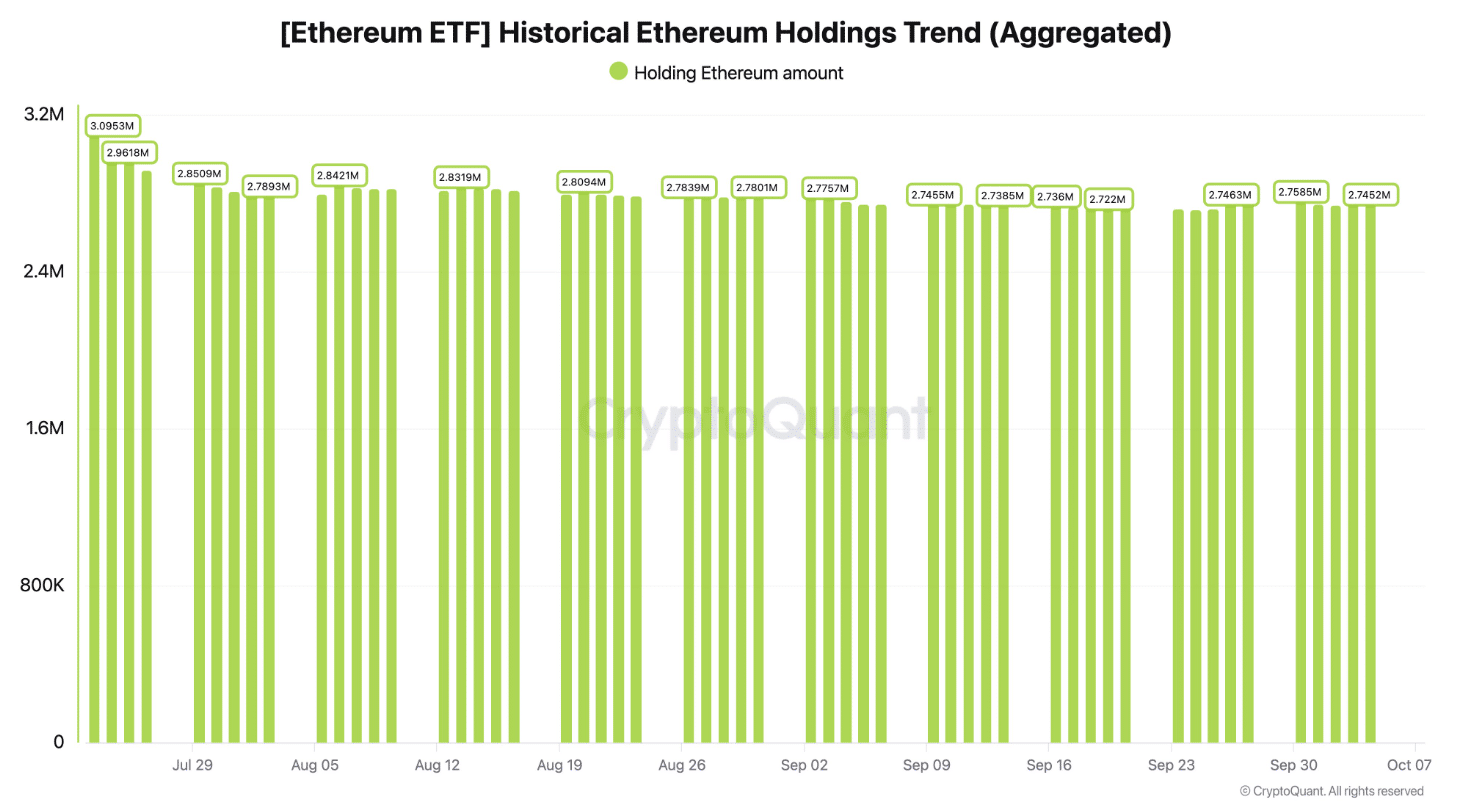

Weak demand for ETH ETFs

Not like Bitcoin, Ethereum has recorded low demand for its spot ETFs. Information from CryptoQuant reveals that since these ETFs launched in July, they’ve recorded $849M in outflows.

Supply: CryptoQuant

The outflows have been spurred by the Grayscale Ethereum Belief. The ETFs are additionally scuffling with an absence of latest inflows.

The BlackRock spot ETH ETF has posted zero inflows within the final two days. On the identical time, the Constancy Ethereum Fund has not seen any optimistic flows this month in keeping with SoSoValue.

This weak demand has didn’t drive positive factors for Ethereum, which has additional contributed to a decline in dominance.

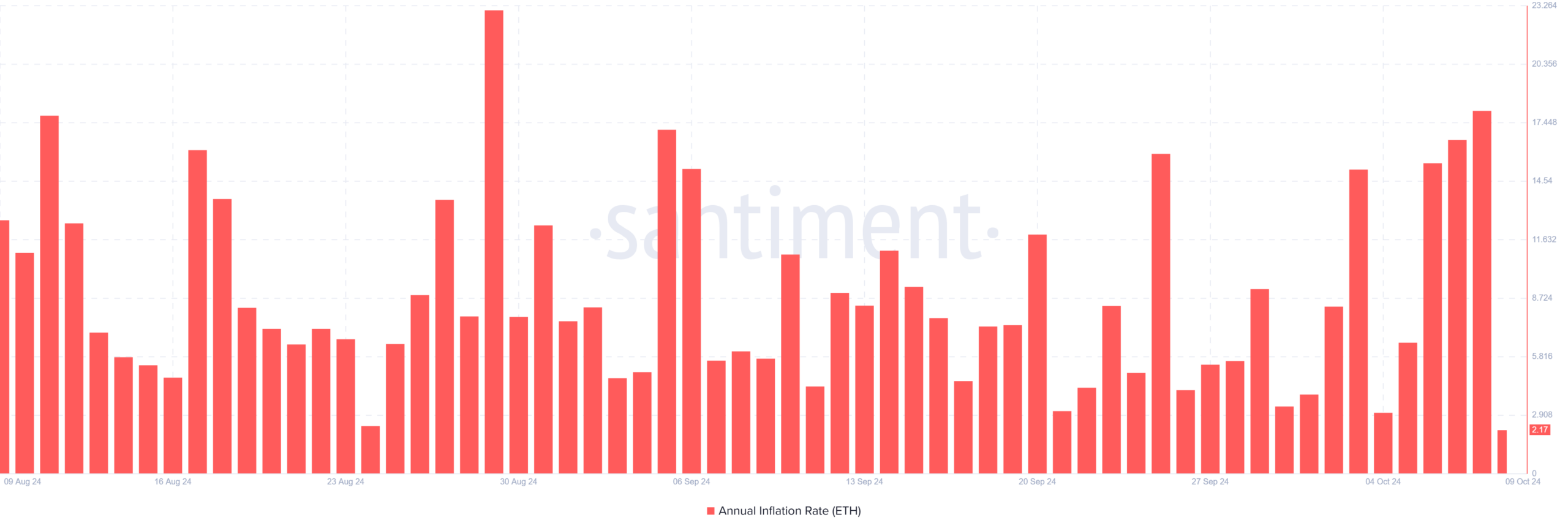

Rising provide

Ethereum can be scuffling with a declining burn price because the coin turns inflationary. Information from Ultrasound Money reveals that within the final 30 days, greater than 43,000 ETH tokens had been added to the circulating provide.

Information from Santiment reveals that Ethereum’s annual inflation price not too long ago reached 18%, the best stage since August.

Supply: Santiment

Learn Ethereum’s [ETH] Worth Prediction 2024–2025

The dearth of recent demand to soak up this rising provide is sure to extend sell-side strain on Ethereum inflicting it to lose its market share to Bitcoin and different altcoins.

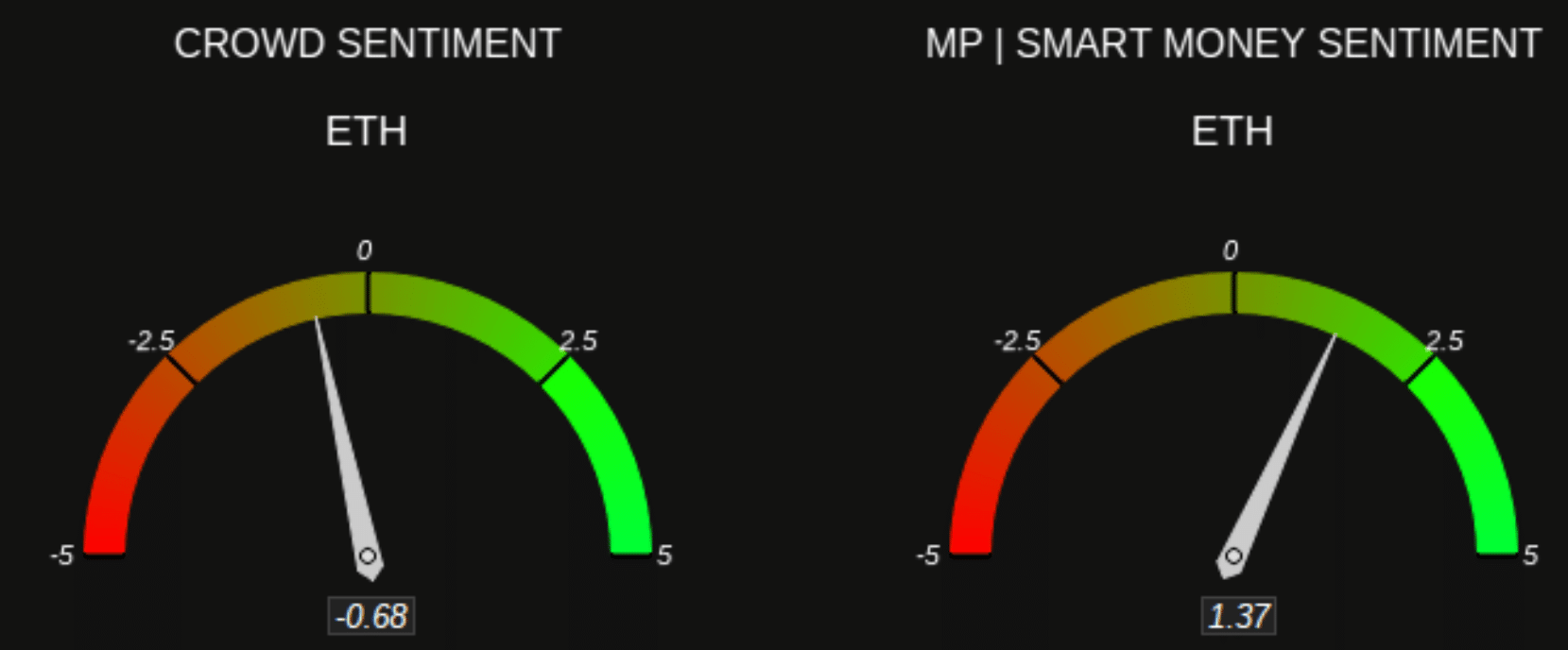

Ethereum’s falling dominance has additionally contributed to weakening market sentiment. Per Market Prophit, most merchants are bearish on Ethereum whereas sensible cash or establishments stay bullish.

Supply: Market Prophit