Ethereum drops 36%: Can bulls regain control after historic sell-off?

- ETH weekly recap reveals the sharpest decline since FTX days.

- Leveraged liquidations might have had a powerful hand in ETH’s efficiency.

Ethereum [ETH] has skilled fairly the roller-coaster of unstable worth motion within the final 7 days. The result has crashed the little bullish optimism that had began to manifest on the finish of July, so let’s check out how ETH fared.

ETH was bullish general in July, regardless of the slight pullback noticed within the final week. This was adopted by a short-lived restoration try thwarted by a strong wave of promote strain that prevailed final week.

ETH tanked consecutively for the final 7 days, for an general 36.59% drop.

The final time that ETH skilled such a speedy decline in a brief interval was in June through the FTX collapse in 2022. ETH traded at $2,277 at press time.

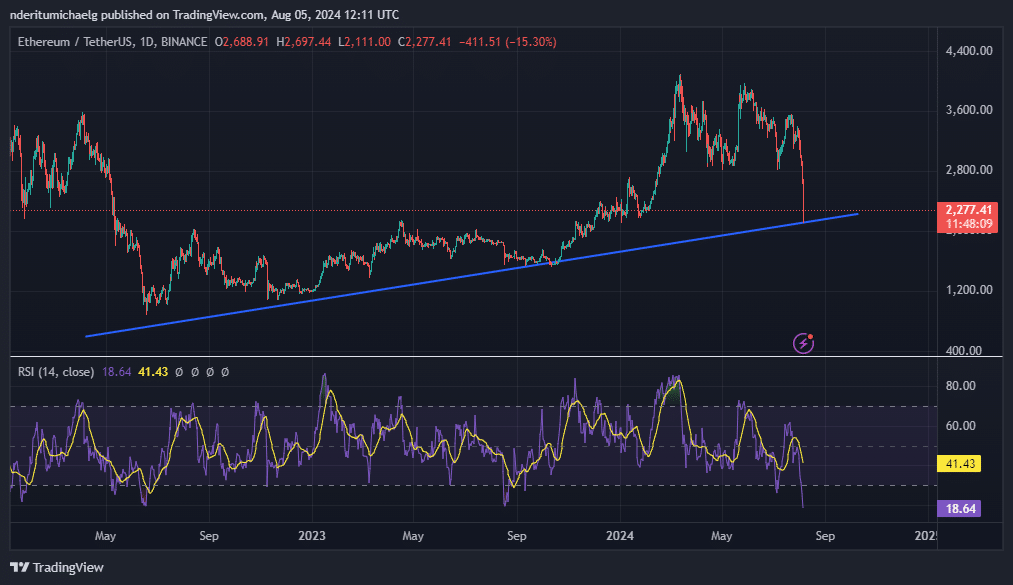

Supply: TradingView

The latest wave of promote strain triggered considerations that we’d witness extra draw back within the subsequent few weeks. Whereas a extra bearish end result is possible, it is usually potential that the bulls might regain management.

In ETH’s case there have been a number of indicators pointing in the direction of a possible restoration. For instance, the value obtained extraordinarily oversold in line with the RSI.

Second, the latest large pullback retested a serious ascending assist degree, triggering some accumulation. ETH had already bounced again by 5% from this assist degree.

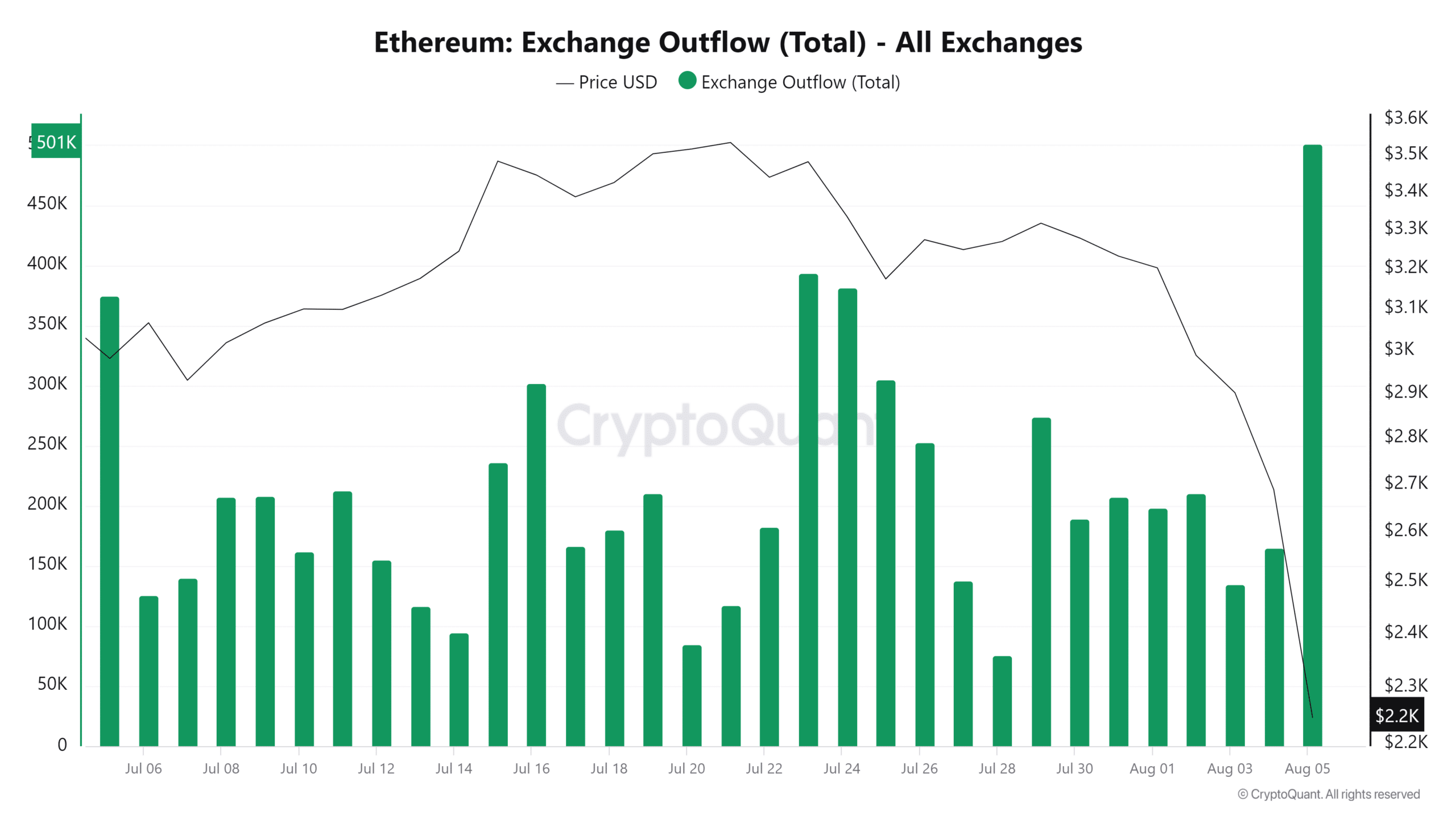

Ethereum trade flows additionally revealed some attention-grabbing findings. Over 501,000 ETH was moved out of exchanges within the final 24 hours. This was the best quantity of ETH that flowed out of exchanges in a single day inside the final 30 days.

Supply: CryptoQuant

For distinction, there was a complete 446,877 ETH in trade inflows that passed off throughout the identical interval. This was additionally the best inflows recorded within the final 30 days.

This implies ETH had greater outflows than inflows by roughly $119 million in greenback worth.

The trade flows knowledge might point out a requirement restoration at discounted costs. ETH might obtain a big bounce again if the promote strain will get hosed down.

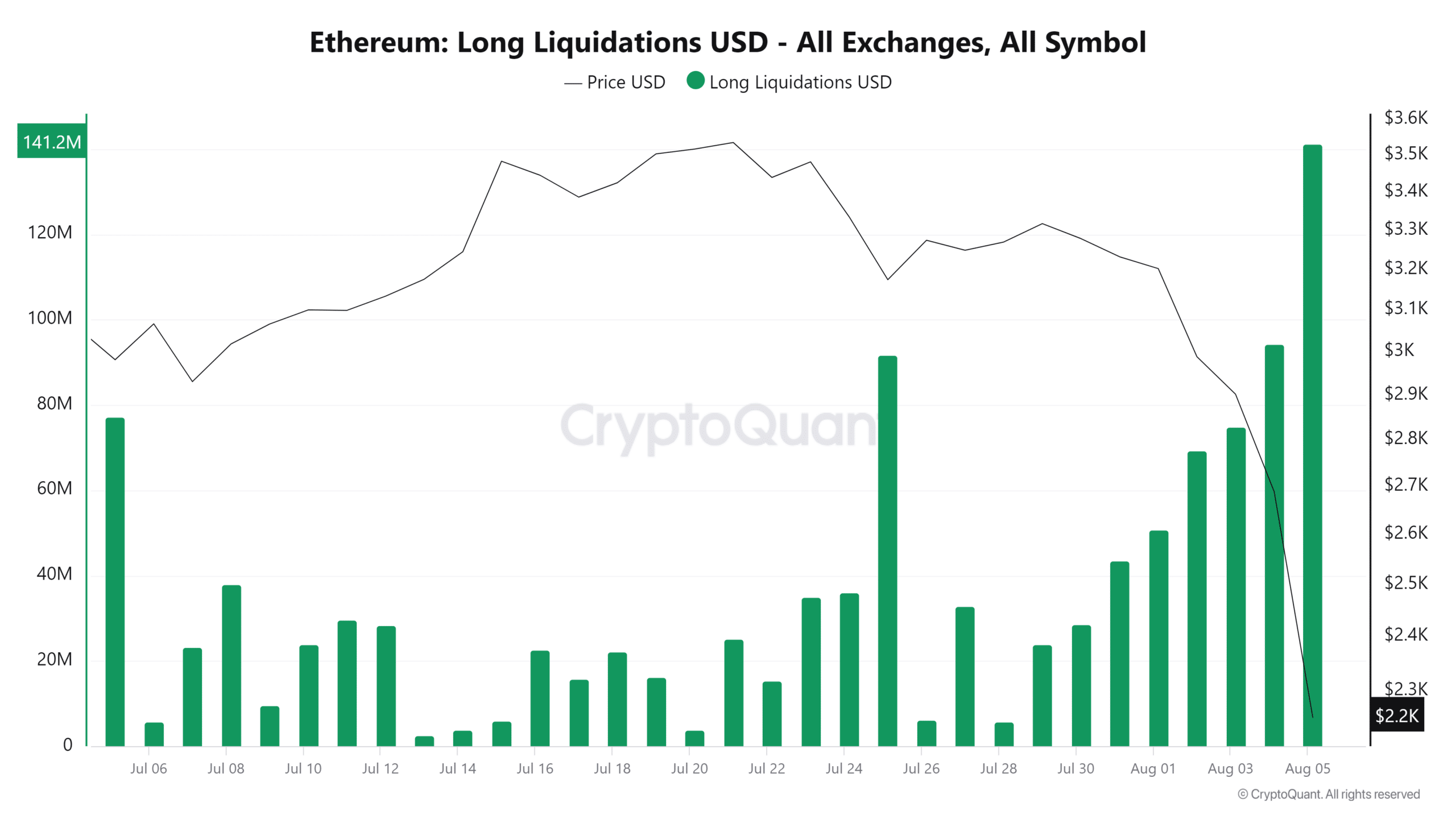

Derivatives knowledge revealed that lengthy liquidations additionally peaked within the final 24 hours. The entire lengthy liquidations amounted to $141.2 million within the final 24 hours. The very best single-day liquidations recorded within the final 30 days.

Supply: CryptoQuant

The entire shorts liquidations within the final 24 hours had been a fraction at $35.5 million. Margin calls of leveraged longs might have contributed to the extra draw back noticed within the final 24 hours.

Learn Ethereum (ETH) Worth Prediction 2024-25

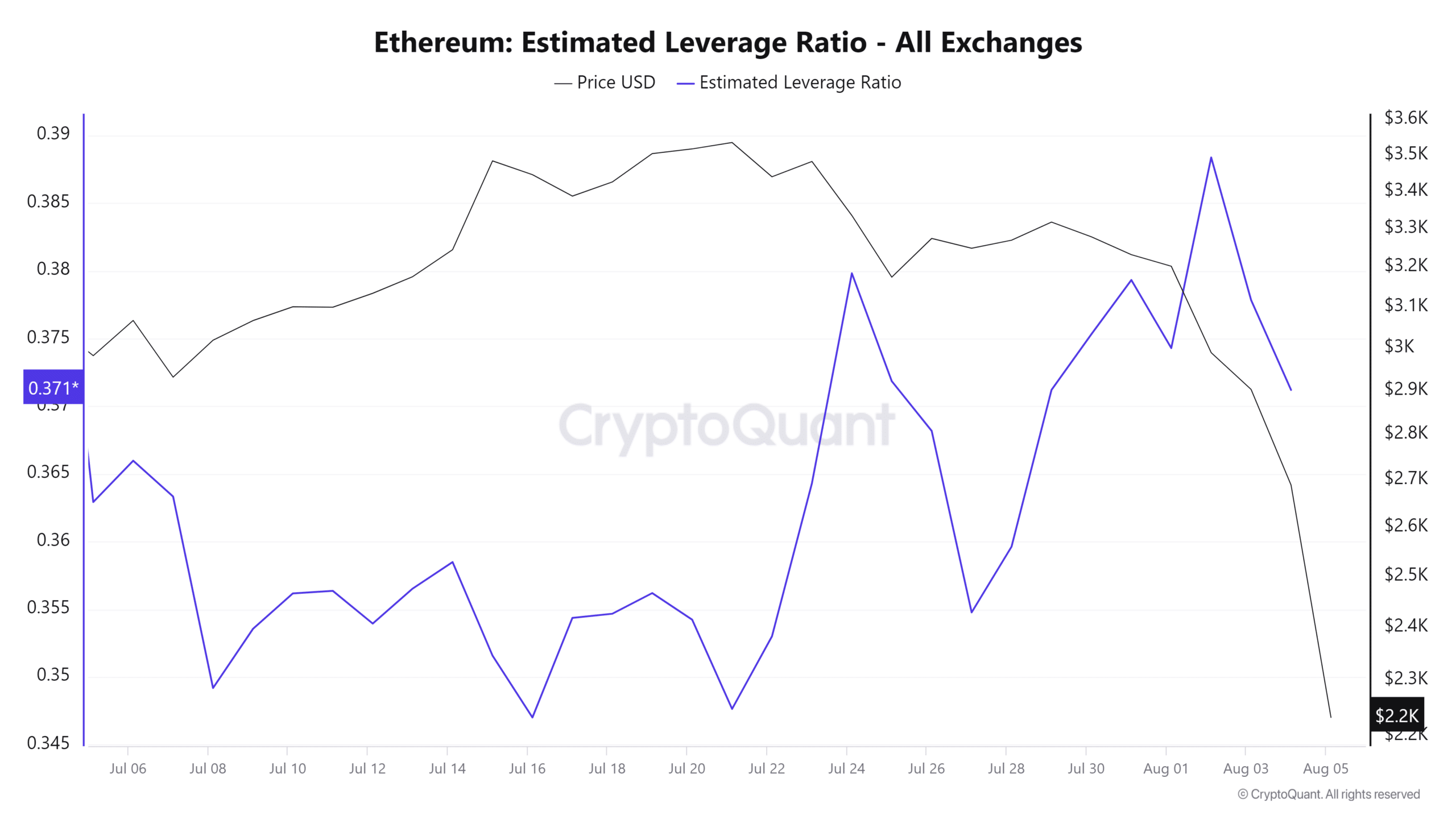

This will have additionally contributed to the extra volatility contemplating that urge for food for leverage went up within the final week, therefore many leveraged positions.

Supply: CryptoQuant

It’s seemingly that volatility will cut back now that the markets have been deleveraged by latest margin calls. Nonetheless, the potential for robust demand or continued promote strain might hinge on exterior market components.