Ethereum End Of Month Challenge: Can ETH Hit $2,000?

Ethereum (ETH) is poised for a major breakthrough because it inches nearer to the vital psychological barrier of $2,000, mirroring the bullish sentiment sweeping by means of the cryptocurrency market, largely led by Bitcoin (BTC).

Market analysts are optimistic about Ethereum’s potential breakout earlier than October ends, with purchase orders anticipated to gas a considerable 12.25% surge, propelling the worth to $1,958.

As well as, traders have steadfastly held onto their investments in DeFi property throughout the Ethereum ecosystem, demonstrating unwavering confidence even within the face of the enduring crypto market challenges.

Regardless of the tumultuous nature of the crypto market, these traders stay dedicated to the potential and promise of DeFi, believing in its capacity to revolutionize conventional monetary programs.

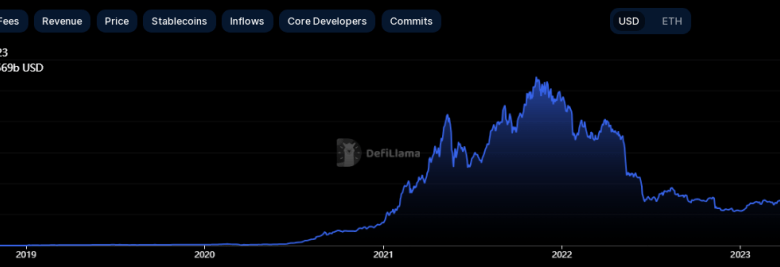

As per insights supplied by DefiLlama, these property collectively characterize a formidable complete worth locked at $21.27 billion, reflecting the substantial belief and monetary dedication positioned within the Ethereum DeFi panorama by the investor group. This information solidifies its place as a cornerstone of the broader crypto monetary panorama.

Ethereum TVL. Supply: DeFiLlama

As merchants eagerly await this upswing, buying and selling quantity is projected to witness a notable spike, reflecting rising investor curiosity in securing publicity to Ether past the present resistance ranges.

Reinforcing the optimistic outlook, the Relative Power Index (RSI) stands at 75, indicating that Ethereum’s upward trajectory is poised to persist. However, warning prevails as oversold situations could set off profit-taking amongst merchants eager on safeguarding their capital.

This twin sentiment of optimism and warning units the stage for a vital juncture in Ethereum’s value motion.

ETH Indicators Of Battle Amidst A Resistance

A separate analytical report underscores Ethereum’s recurring battle with a key resistance stage, evident from the persistent value fluctuations converging round this threshold. Historic information factors to the ramifications of extended resistance, usually leading to sharp value retracements.

For Ethereum, this might suggest a extra pronounced market correction, significantly contemplating the broader market dynamics at the moment at play. Buyers and merchants are suggested to intently monitor these resistance ranges, which may considerably affect short-term market sentiment and value actions.

ETH market cap at the moment buying and selling at $218.356 Billion on the each day chart: TradingView.com

Unveiling Ethereum: Low Community Exercise

Underlying Ethereum’s value fluctuations, an alarming development emerges regarding the platform’s subdued community exercise. Regardless of its status as a thriving ecosystem for decentralized functions, the latest dip in on-chain operations raises issues about waning curiosity or a possible shift of focus in direction of different blockchain platforms.

An energetic community isn’t solely reliant on transaction volumes; it signifies ongoing growth, upgrades, and the launch of latest initiatives. The latest decline in community exercise suggests a possible lull in these vital endeavors, prompting market members to reevaluate the long-term sustainability of Ethereum’s dominance throughout the blockchain house.

ETH seven-day value motion. Supply: Coingecko

As Ethereum’s price hovers at $1,813, notching a 7.0% surge inside 24 hours and a 14% upward development over the previous seven days, market observers stay vigilant because the cryptocurrency continues to navigate by means of vital resistance ranges and grapples with community exercise issues.

Because the cryptocurrency market continues to mature, Ethereum’s future trajectory is intricately linked to its capacity to deal with these challenges and uphold its place as a number one blockchain platform, very important for the broader ecosystem’s progress and stability.

(This website’s content material shouldn’t be construed as funding recommendation. Investing includes danger. If you make investments, your capital is topic to danger).

Featured picture from Distinct As we speak