Ethereum ETF anticipation spurs market buzz, ETH climbs to $3,499

- Rising anticipation surrounds the potential approval of spot Ethereum ETFs on twenty third July.

- ETH value rises by 0.08%, buying and selling at $3,499, with bullish momentum indicators.

Amidst the rising anticipation surrounding the potential approval of spot Ethereum [ETH] Alternate Traded Funds (ETFs) on twenty third July, there was a variety of buzz within the cryptocurrency house.

Impression of Ethereum ETF

It’s also estimated that ETH ETF is probably going to attract vital investor curiosity, probably channeling extra capital into the broader altcoin market.

Shedding mild on the identical, a crypto researcher on X, utilizing the deal with @wacy_time1, stated,

“About $5 billion is predicted to circulate into the ETH ETF inside the first six months.”

This estimate relies available on the market capitalization ratio between Bitcoin [BTC] and Ethereum, which is roughly 75% to 25%.

Since traders have poured $59 billion into the BTC ETF, the proportional estimate for the ETH ETF, after accounting for $10 billion already invested in Grayscale’s ETHE, is round $5 billion.

This inflow of funding is anticipated to have a considerable influence, not solely on ETH however on the broader altcoin market as nicely.

Steps taken by BlackRock

Moreover, asset administration corporations together with BlackRock, are actively making ready for the launch of their ETH ETFs. In its S-1 registration statement filed on seventeenth July, BlackRock detailed the payment construction for its Ether ETF.

“The Sponsor’s Charge is accrued day by day at an annualized charge equal to 0.25% of the online asset worth of the Belief and is payable no less than quarterly in arrears in U.S. {dollars} or in-kind or any mixture thereof.”

This strategic transfer underscores BlackRock’s dedication to establishing a aggressive presence within the rising Ether ETF market, positioning itself alongside different corporations every providing diversified payment constructions to draw traders.

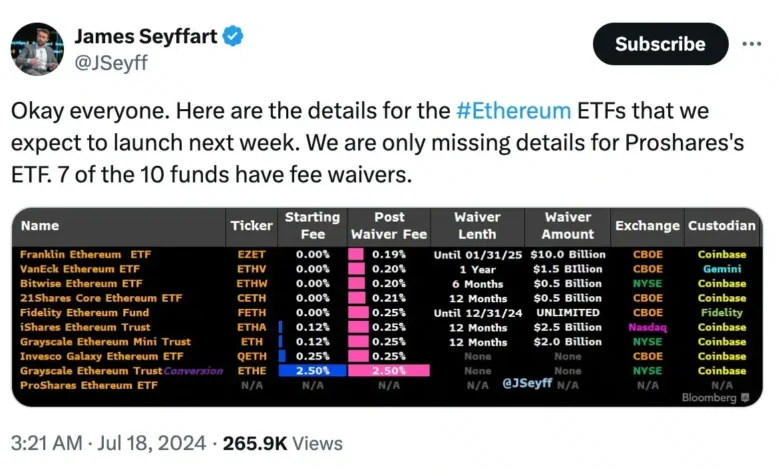

Supply: James Seyffart/X

As per studies, BlackRock has introduced that its spot Ether ETF will cost a 0.12% payment for the primary yr or till it reaches $2.5 billion in internet property.

Different asset managers following go well with

Franklin Templeton’s spot Ether ETF will provide the bottom payment at 0.19%, whereas each the Bitwise and VanEck Ethereum ETFs will cost a 0.20% payment.

The 21Shares Core Ethereum ETF can have a payment of 0.21%. In the meantime, Constancy and Invesco Galaxy ETFs will every provide a 0.25% payment, matching BlackRock’s commonplace charge after the preliminary interval.

Amidst the optimistic developments surrounding ETH ETFs, the worth of Ether has additionally seen a optimistic influence. In keeping with CoinMarketCap, ETH has risen by 0.08% previously 24 hours, buying and selling at $3,499.

Moreover, technical indicators such because the Relative Power Index (RSI) and Chaikin Cash Movement (CMF) recommend that bullish momentum is current, indicating continued optimism available in the market.

Supply: Buying and selling View