Ethereum ETF approaches: Comparing ETH and BTC’s states pre-launch

- Ethereum ETFs had been gaining a lot reputation in america.

- ETH was down by 12% final week, however just a few market indicators hinted at a pattern reversal.

Ethereum [ETH] has been dealing with a number of worth corrections over the previous month. This occurred at a time when its much-awaited ETH ETFs launch was drawing in.

Due to this fact, let’s check out what’s happening with ETH to search out out whether or not its launch would profit the king of altcoins and permit it to outshine Bitcoin [BTC] within the coming days.

Ethereum ETF hype isn’t sufficient?

Traders and the crypto market as an entire have been ready patiently for the launch of ETH ETFs. As per the newest information, the potential launch of Ethereum ETFs may be anticipated on the fifteenth of July.

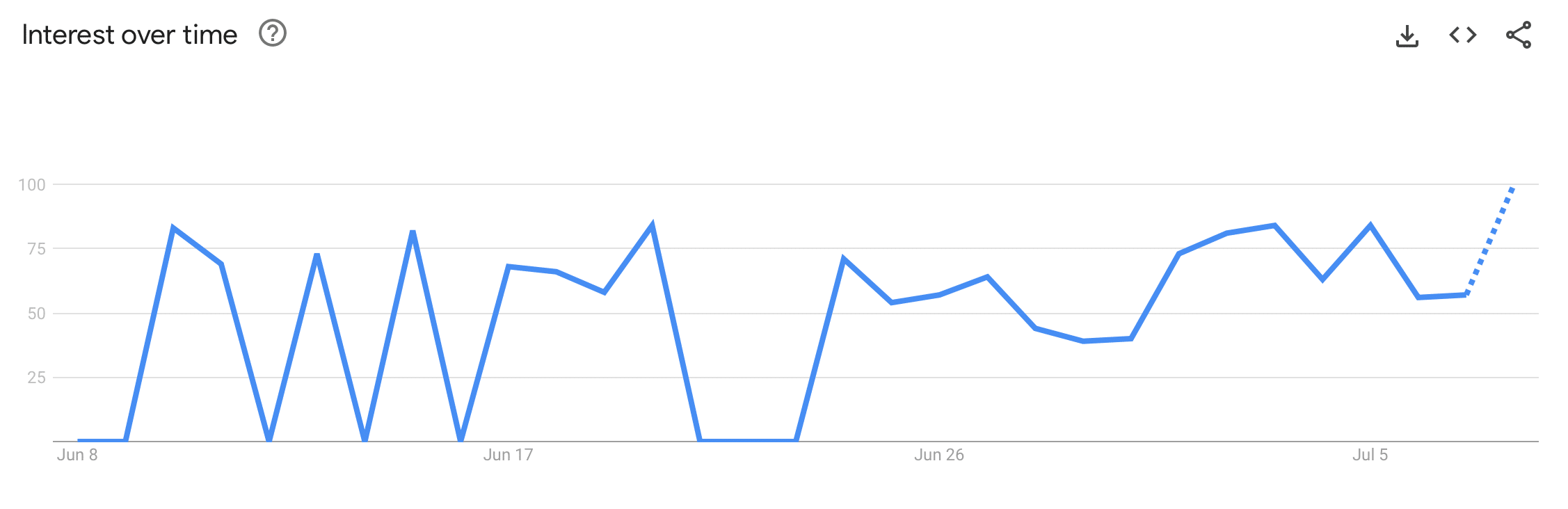

AMBCrypto’s have a look at Google Tendencies’ information confirmed that the recognition of Ethereum ETFs has been constant all through the final 30 days in america, reflecting the hype round them.

Supply: Google Tendencies

Though the launch date was getting nearer and the market appeared excited, Ethereum continued to wrestle to boost its worth.

In keeping with CoinMarketCap, ETH was down by greater than 125 within the final seven days. On the time of writing, the token was buying and selling at $3,045.32 with a market capitalization of over $366 million.

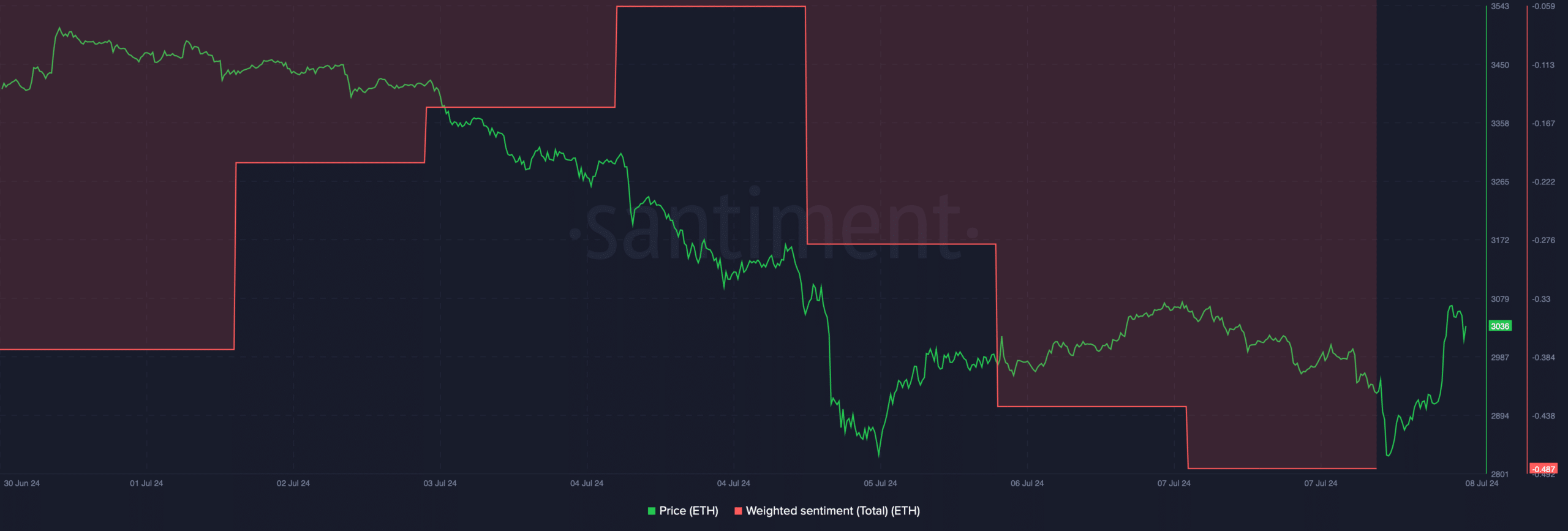

A potential purpose behind this bearish worth motion could possibly be the insecurity in ETH amongst buyers.

AMBCrypto’s evaluation of Santiment’s information revealed that ETH’s Weighted Sentiment moved southward considerably final week. This clearly meant that bearish sentiment across the token was dominant.

Supply: Santiment

Bitcoin vs. Ethereum ETF

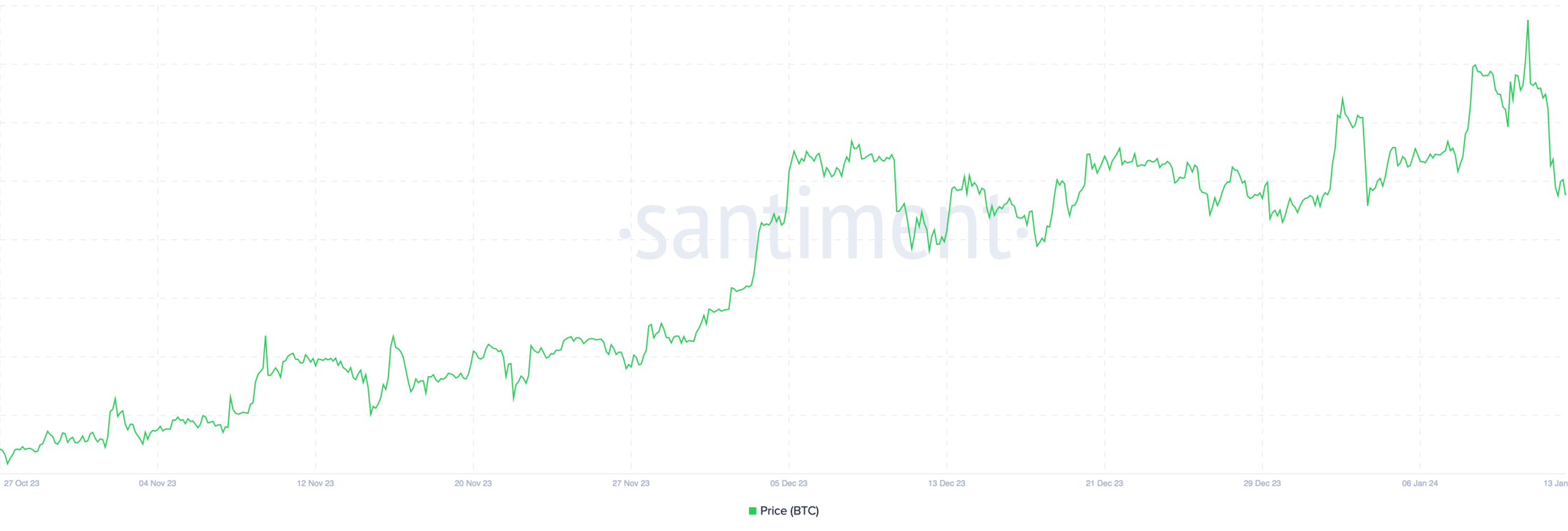

Since ETH remained bearish regardless of the launch getting nearer, AMBCrypto deliberate to check each Ethereum and Bitcoin’s states forward of their ETF launches.

Our evaluation revealed that BTC’s worth began to achieve bullish momentum approach earlier than its ETF launch date.

To be exact, BTC’s worth began to maneuver in November 2023 and peaked throughout the BTC ETF launch on January 10, 2024. Nevertheless, quickly after the launch, BTC’s worth began to say no.

Supply: Santiment

On this entrance, Bitcoin was clearly dominating Ethereum. Nevertheless, to see whether or not ETH was planning one thing bullish every week forward of the ETF launch, we then analyzed ETH’s each day chart.

We discovered that Ethereum’s Relative Power Index (RSI) registered an uptick after touching the oversold zone.

Learn Ethereum’s [ETH] Value Prediction 2024-2025

Moreover, the Cash Move Index (MFI) additionally adopted an identical rising pattern. This indicated that ETH would possibly flip bullish within the coming days.

Nonetheless, the Chaikin Cash Move (CMF) moved southward. The MACD additionally displayed a bearish benefit out there.

Supply: TradingView