Ethereum ETF approval sparks high sell pressure: Will ETH go below $3K?

- Ethereum ETFs yield promote stress days after approval, signaling a promote the information situation.

- Whales took benefit of ETF liquidity by shorting, triggering lengthy liquidations.

It’s now the third day since Ethereum [ETH] ETFs acquired regulatory approval and the second day of buying and selling. ETH’s value motion to this point confirms that it’s experiencing a “promote the information” response.

We beforehand explored the potential of Ethereum ETFs probably experiencing the same end result to what occurred proper after Bitcoin ETFs have been authorised.

The value launched into a correction from the earlier rally that was noticed days earlier than the approvals. To date Ethereum ETFs have adopted the same sample.

ETH’s value traded at $3,177 on the time of writing, signaling {that a} wave of promote stress was in impact. Its press time value was down by barely over 10% for the reason that ETFs have been authorised.

Previous to that, ETH traded at a 21% premium from its July lows after attaining a strong rally 15 days forward of ETF approvals.

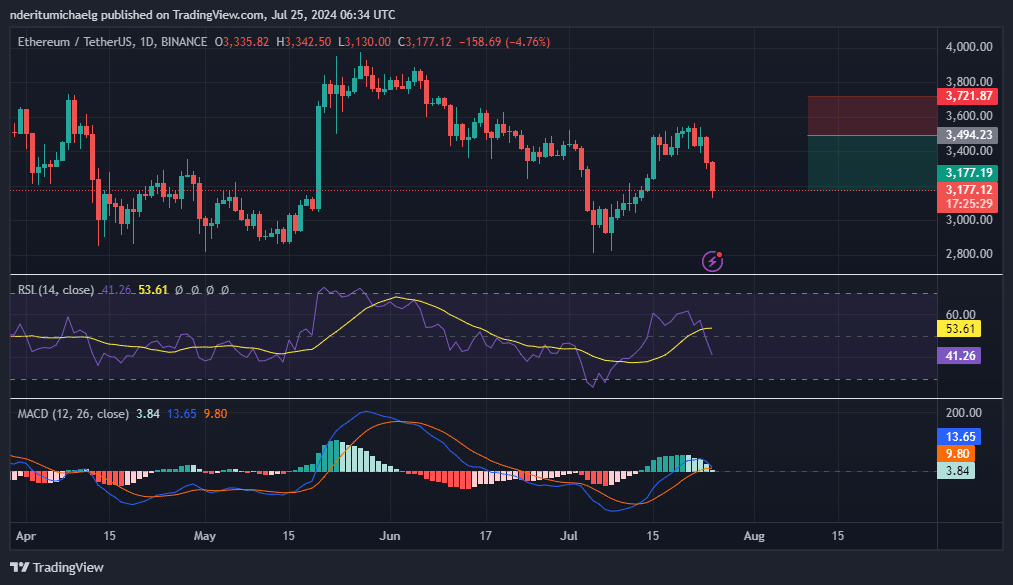

Supply: TradingView

ETH’s indicators, particularly the MACD confirmed that the bulls misplaced their momentum. It was additionally on the verge of flipping to unfavorable. The energy of the volumes that we are going to observe within the subsequent few days will decide whether or not ETH will prolong its bearish momentum.

The RSI indicated that there was some room for extra promote stress because it was not but oversold. Our evaluation additionally confirmed that the subsequent main assist stage for ETH was under the $2,900 stage.

Whales on the hunt

The promote stress that prevailed within the final three days means that whales is perhaps benefiting from incoming Ethereum ETFs liquidity.

Lookonchain data confirmed that Grayscale moved 140,044 ETH to Coinbase Prime within the final 24 hours. An quantity price virtually $500 million. This was a affirmation that whales are contributing to the promote stress.

In the meantime, discounted ETH costs might already be attracting extra buys on the best way down. Looksonchain data also revealed that the BlackRock(iShares) Ethereum ETF added 76,669 ETH price roughly $262 million to its pockets.

Lengthy liquidations intensify

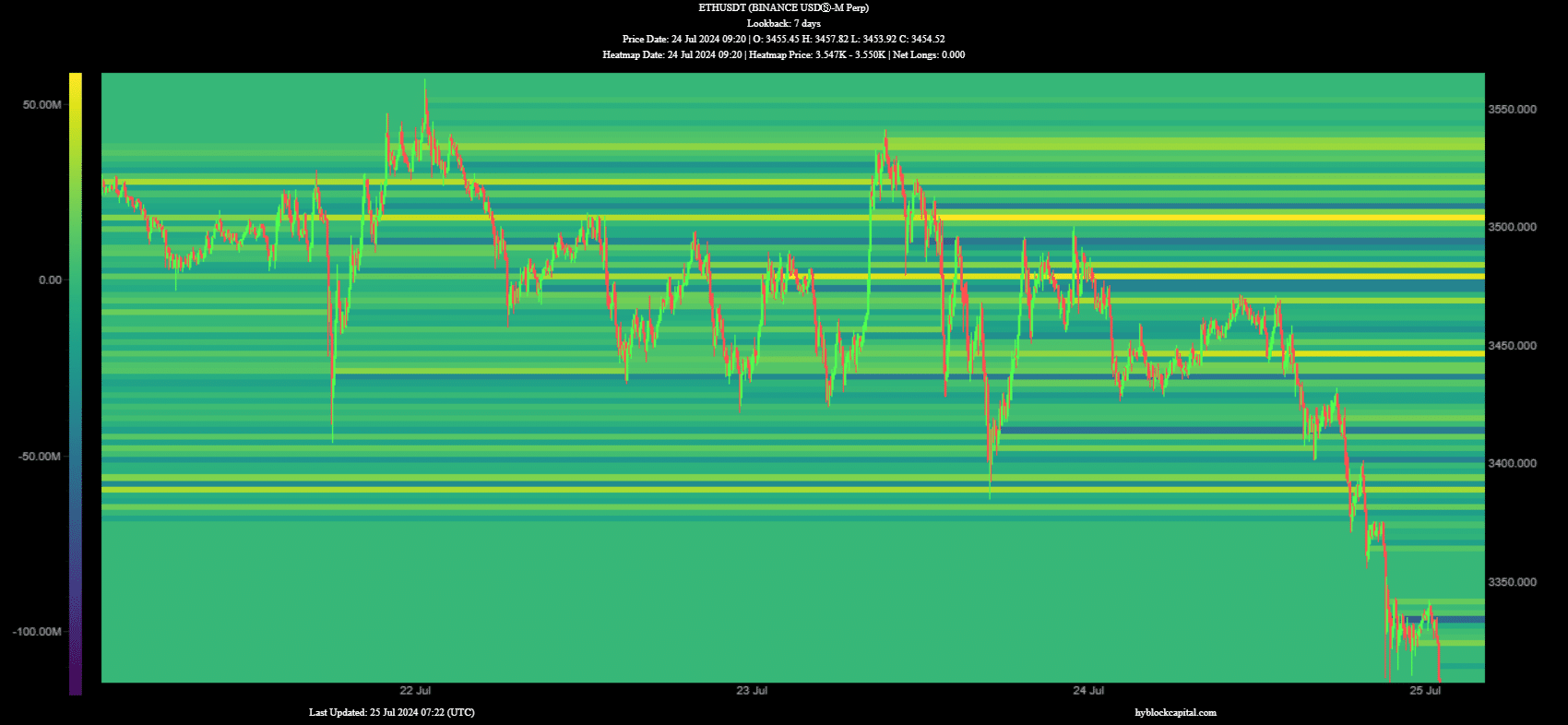

The bearish value motion means that fairly plenty of web longs might have suffered. We confirmed this by evaluating the web longs on HyblockCapital’s heatmaps and right here’s what we discovered.

Web longs peaked at almost 50 million on twenty third July at across the $3,500 value stage. The warmth map signifies robust liquidation at that stage, consequently pushing costs under $3,300 inside the similar buying and selling session.

Supply: HyblockCapital

Learn Ethereum’s [ETH] Value Prediction 2024-25

Roughly 44.76 million longs have been current on the $3455 value stage on 24 July. The subsequent main warmth map zone.

We additionally noticed a spike in longs close to the $3410 value stage, adopted by a warmth map spike suggesting a surge in liquidations close to the $3380 warmth map stage.