Ethereum ETF fee wars: Grayscale goes ‘for the jugular,’ drops Mini fees to 0.15%

- Grayscale makes U-turn on Mini Ethereum Belief, drops charges to 0.15%

- Is that sufficient to reduce the potential ETHE outflows and hold ETH above $3K?

The seventeenth of July noticed numerous outrage over Grayscale Ethereum [ETH] ETF’s hefty 2.5% charges, which have been 10X greater than its ETHE rivals.

In actual fact, senior Bloomberg ETF analyst Eric Balchunas had warned that the charges may result in “outrage outflows” from Grayscale.

Moreover, Grayscale Ethereum Mini Belief, which can be spun off from its ETHE after conversion, had charges pegged at 0.25%, much like BlackRock, Constancy and Invesco.

Market observers warned that Grayscale’s transfer to keep up hefty charges on the ETHE and nonetheless fail to undercut charge costs utilizing the Mini Belief was a ‘big miss’ and a disappointment.

It appears the issuer has learn the market temper and up to date its charge construction.

Grayscale drops Ethereum Mini Belief charges to 0.15%

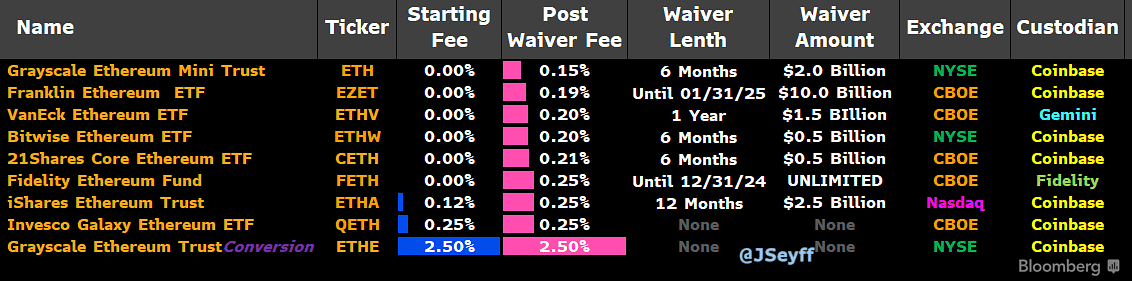

In an up to date S-1 (registrant submitting) on Thursday, Grayscale dropped its Mini Belief (ETH) charges from 0.25% to 0.15%, with a full waiver for the primary $2 billion, making it the most affordable amongst its friends.

Supply: Bloomberg

Balchunas known as the replace a “good catch,” noting,

‘Mini me $ETH charge minimize to 15bps (from 25bps yesterday). Formally the most affordable on mkt now. ought to assist trigger. Good catch.’

On his half, Nate Geraci of ETF Retailer, who scolded Grayscale for its earlier hefty charges, additionally modified his tune and termed the replace a “smart move.”

“Bravo, Grayscale…That is the way you go for the jugular…Good transfer IMO.”

The Mini Belief (ETH) can be a ten% computerized spin-off from the ETHE on twenty third July. As of press time, ETHE had about $10 billion in AUM (property beneath administration).

Nevertheless, the very best charges on the Grayscale Ethereum Belief (ETHE) will stay at 2.5% with no waiver.

However one other analyst from Thanefield Capital believes the Mini charge replace may cut back ‘outrage outflows’.

‘It’s now essentially the most aggressive ETF from a fee-perspective, this may doubtless keep away from AUM leakage from Grayscale and cut back $ETHE outflows. There are rumors the ETHE ->ETH conversion is tax-exempt, which might be much more bullish

Ethereum value motion

Supply: ETH/USDT, TradingView

On the value chart, ETH consolidated beneath $3.5K forward of the ETH ETF closing approval and certain launch subsequent week.

Regardless of the above-average RSI (Relative Power Index) studying, which denoted outstanding shopping for energy, ETH bulls should clear the $3.5K impediment (crimson) to eye the $4K degree.

Nevertheless, if the ETH ETF launch seems to be a ‘promote the information’ occasion, then $3.3K and the demand zone, marked in cyan, above $2.9K, could be essential value ranges to think about.