Ethereum ETF inflows turnaround: ‘ETH is just getting started!’

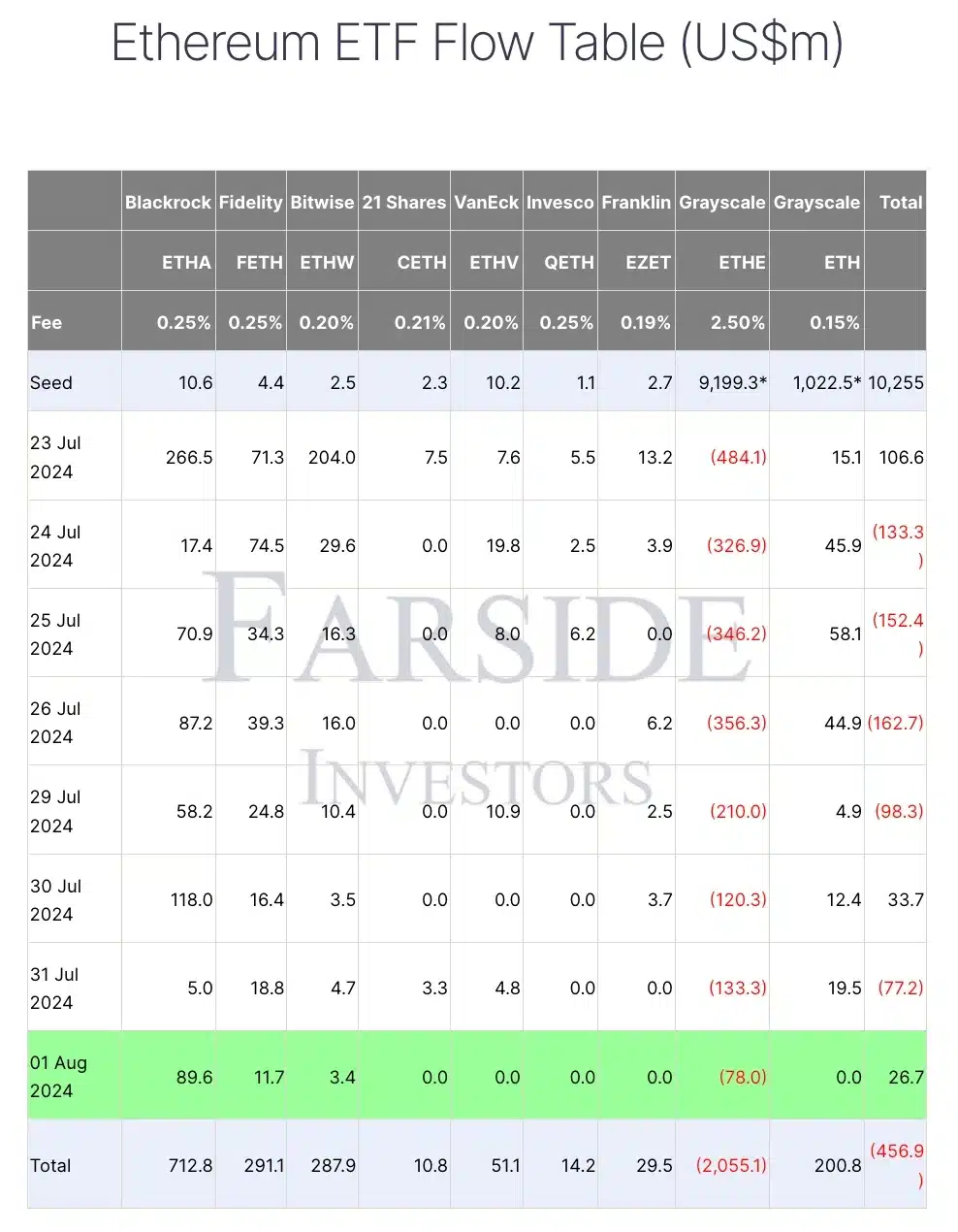

- The first of August noticed a $26.7 million web influx into U.S. Ether ETFs, led by ETHA.

- Grayscale Ethereum Belief (ETHE) confronted $2 billion in outflows, marking a big investor shift.

Regardless of ongoing cumulative outflows from the Grayscale Ethereum Belief (ETHE) surpassing $2 billion, current traits in U.S. spot Ethereum [ETH] exchange-traded funds (ETFs) current a contrasting image.

Ethereum ETF move evaluation

On the first of August, Ether ETFs recorded a notable turnaround with a web influx of $26.7 million.

This optimistic shift was pushed largely by a considerable $89.6 million influx into BlackRock’s iShares Ethereum Belief (ETHA).

Alternatively, ETHE recorded inflows price $78 million, based on information from Farside Investors.

Supply: Farside Buyers

Remarking on the identical, Ted Pillows, a distinguished investor and entrepreneur, took to X and famous,

“Ethereum ETFs had a web influx of $33,700,000. BlackRock purchased $118,000,000 $ETH. ETH is simply getting began, my baggage are prepared.”

Pattern shift

This improvement is especially outstanding provided that Ether ETFs had primarily been recording outflows since their launch on the twenty third of July.

With the exceptions of the twenty third of July, the thirtieth of July, and the first of August, the development had been predominantly unfavourable.

Notably, whereas the Grayscale Ethereum Belief (ETHE) skilled the most important outflows because the inception of ETH ETFs, the inflows across the 1st of August into BlackRock’s iShares Ethereum Belief (ETHA) efficiently surpassed these outflows, marking a big shift within the ETF panorama.

It’s essential to spotlight that, not like the eight-spot Ether ETFs launched as “new child” funds on the twenty third of July, the Grayscale Ethereum Belief (ETHE) was a longtime belief providing institutional publicity to Ether.

Previous to its current conversion, ETHE held a considerable $9 billion in Ether.

Nonetheless, by the first of August, outflows from ETHE had exceeded 22% of its preliminary worth, underscoring a big shift in investor sentiment regardless of the general optimistic motion in Ether ETF inflows.

Dedic’s distinctive perspective on Ether

Regardless of the current optimistic shift in ETH ETF efficiency, not all buyers are glad. Reiterating the identical, Simon Dedic, Founder and CEO of Moonrock Capital, remarked,

“Regardless of the ETF going stay, $ETH has been the worst performing asset MTD of the entire Prime 50.”

However he additional urged that, given the present poor efficiency of ETH, this example would possibly current a compelling shopping for alternative.

“Flip off your feelings for a second after which inform me this isn’t one of many best buys you’ve ever seen.”

On the value entrance at press time, ETH was trading at $3,143.34, reflecting a 1.67% decline over the previous 24 hours.

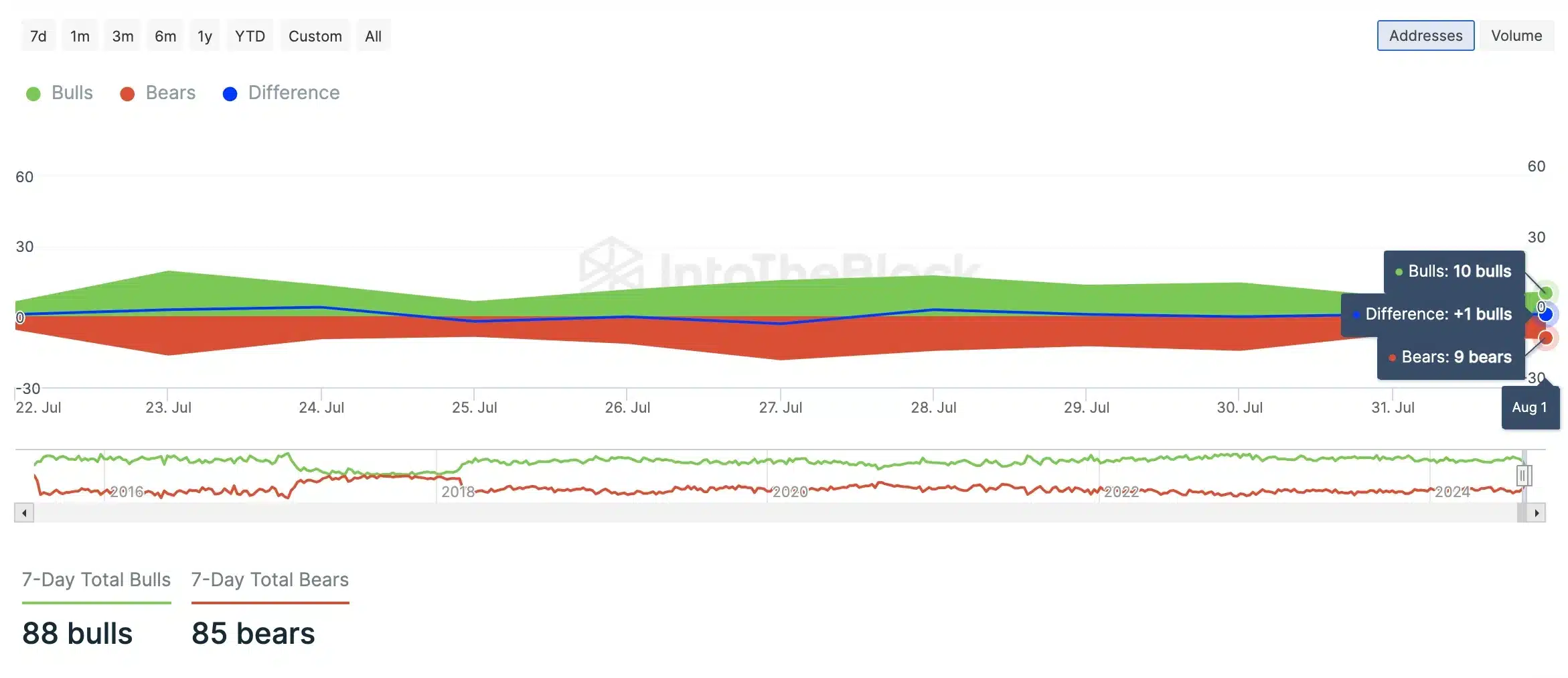

Nonetheless, regardless of this drop, an evaluation by AMBCrypto, utilizing information from IntoTheBlock, indicated that bullish sentiment was outpacing bearish sentiment.

Supply: IntoTheBlock