Ethereum ETF launch date confirmed? As ETH clears $3400, what happens next

- Spot Ethereum ETFs will doubtlessly start buying and selling subsequent Tuesday.

- The SEC is within the technique of gathering closing drafts from potential spot Ethereum ETF issuers.

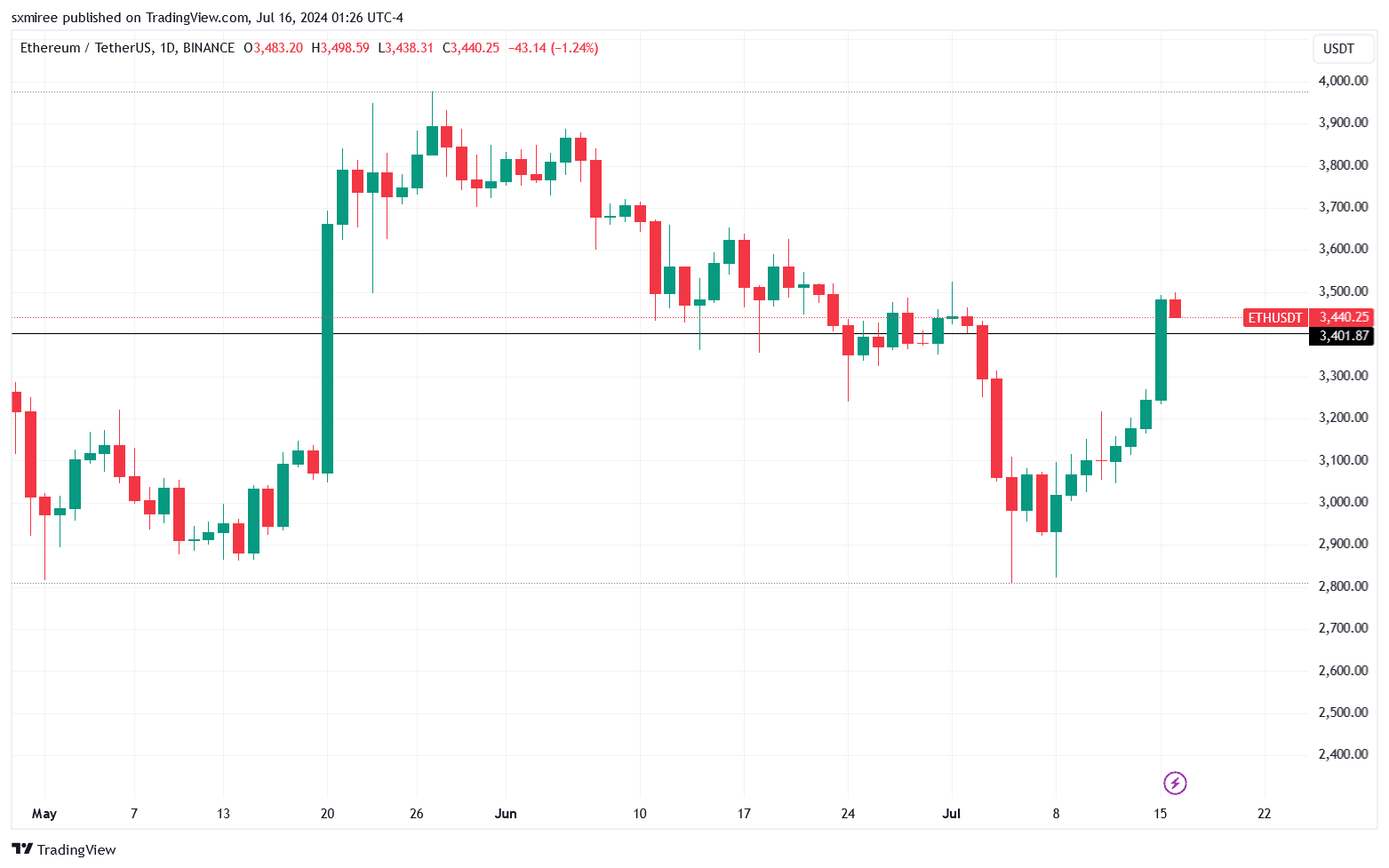

Ethereum [ETH] rose previous $3400 earlier at this time, posting an intraday excessive of $3,498 on CoinMarketCap earlier than the momentum waned. The main altcoin was buying and selling at $3,445 on the time of writing – up 3.64% within the final 24 hours.

Supply: ETH/USDT chart, TradingView

Although ETH bounced again from its journey beneath $3,000 final week and was buying and selling 12.8% increased within the final seven days at press time, it remained down 13.2% from its excessive on the eleventh of March.

The newest positive factors come sizzling on the heels of experiences of an imminent approval of a U.S. spot Ethereum exchange-traded fund (ETF) subsequent week.

Spot Ethereum ETF Replace

ETF market commentator Nate Geraci firmly predicted earlier this week that the US Securities and Alternate Fee (SEC) would approve the resubmitted registration statements quickly.

In a Sunday submit on X (previously Twitter), Geraci wrote,

“Welcome to identify [ETH] ETF approval week. I’m calling it. Don’t know something particular, simply can’t come up [without] good cause for any additional delay at this level. Issuers prepared for launch.”

Bloomberg ETF analyst Eric Balchunas seconded Geraci in a separate submit, including that solely an unforeseeable last-minute setback may delay the launch. He acknowledged,

“Nate’s instincts had been proper, listening to SEC lastly gotten again to issuers at this time, asking them to return FINAL S-1s on Wed (incl charges) after which request effectiveness on Monday after shut for a Tuesday 7/23 Launch.”

Individually, a report from Reuters, relationship the fifteenth of July, cited three sources indicating that the SEC would possible greenlight the purposes of at the least three issuers — BlackRock, VanEck, and Franklin Templeton — to start buying and selling “subsequent Monday.”

This closing approval milestone will depend upon the issuers submitting closing paperwork earlier than the top of the week, in response to the sources within the know.

Market anticipation

Although the precise approval date stays unclear in the mean time, pleasure has been increase out there in the previous few weeks because the SEC permitted candidates’ kinds 19b-4 in Might.

In June, the US SEC delivered suggestions on the filed S-1 kinds, highlighting areas needing evaluate.

Final week, the securities regulator requested the eight asset managers looking for approval for his or her spot Ethereum ETFs to submit amended S-1 registration statements.

The approval of a spot Ethereum ETF is predicted to considerably influence the Ethereum market and the broader crypto trade.

The ETF choices, that are tied to the spot worth of Ether, present traders with a brand new avenue to realize publicity to the altcoin by means of a regulated monetary product.

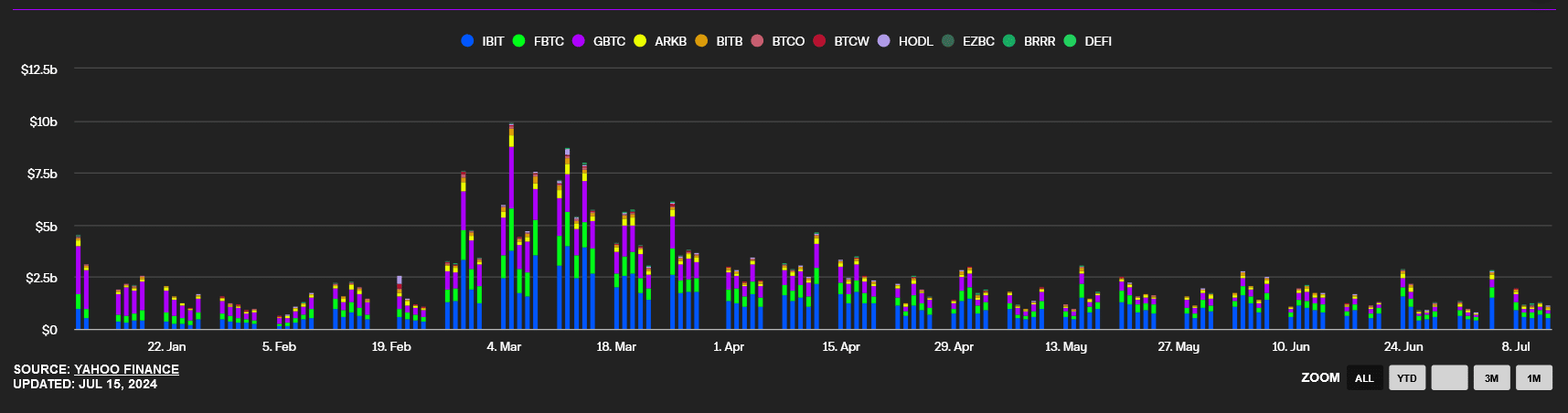

Most market analysts have predicted that the Ether ETFs may appeal to funding flows from institutional traders, doubtlessly replicating the influx of spot Bitcoin ETFs noticed within the first half of the yr.

U.S.-spot Bitcoin ETFs have drawn in $16.12 billion in inflows since their launch earlier this yr, data from Farside’s Bitcoin ETF move desk reveals.

Supply: Yahoo Finance

Learn Ethereum’s [ETH] Value Prediction 2024-2025

Price noting is the truth that the expected launch date coincides with the week of the 2024 Bitcoin convention at Nashville.

The convention, set for the twenty fifth to the twenty seventh of July, will function distinguished audio system, together with MicroStrategy govt chairman Michael Saylor, ARK founder Cathie Wooden, unbiased U.S. Presidential candidate Robert Kennedy Jr, and Republican U.S. presidential candidate Donald Trump.