Ethereum ETF sends ONDO soaring 13%: Why and what next?

- ONDO skilled important buying and selling exercise as metrics counsel an additional worth improve within the brief time period.

- The TVL of the protocol additionally jumped, suggesting strengthened belief for the challenge.

Instantly after the U.S. SEC introduced that it had accredited eight Ethereum [ETH] spot ETFs, Ondo’s [ONDO] worth rallied. Earlier than the approval, the worth of the token was $0.92.

Nevertheless, ONDO’s worth has elevated by 13.26% within the final 24 hours with the token crossing the $1 psychological space. Nicely, you is likely to be questioning what connection Ondo has with Ethereum such that the impression of the event was intense.

AMBCrypto would clarify. In earlier articles, we talked about how ONDO may very well be an enormous beneficiary of the buzzing tokenization of Actual World Belongings (RWAs) regardless of decoupling from ETH at one level.

Is ONDO and ETH now a pair?

However moreover that, Ondo Finance, the workforce behind the challenge, just lately moved its belongings to BlackRock’s BUIDL tokenization fund. For context, this fund operates on the Ethereum blockchain.

Like Ondo’s choices, BUIDL permits customers to earn yields on their U.S. greenback holdings. Therefore, this not directly makes ONDO which isn’t an Ethereum L2, a beta of the blockchain.

Apparently, it appeared some market members had anticipated the transfer. Six days in the past, on-chain information showed {that a} dealer modified 1,870 ETH for ONDO at a median worth of $0.95.

Additionally, one other participant who bought the token in February still holds the cryptocurrency regardless of a 288% unrealized revenue. An motion like this implies that the token’s worth may prolong larger than $1.08 sooner or later.

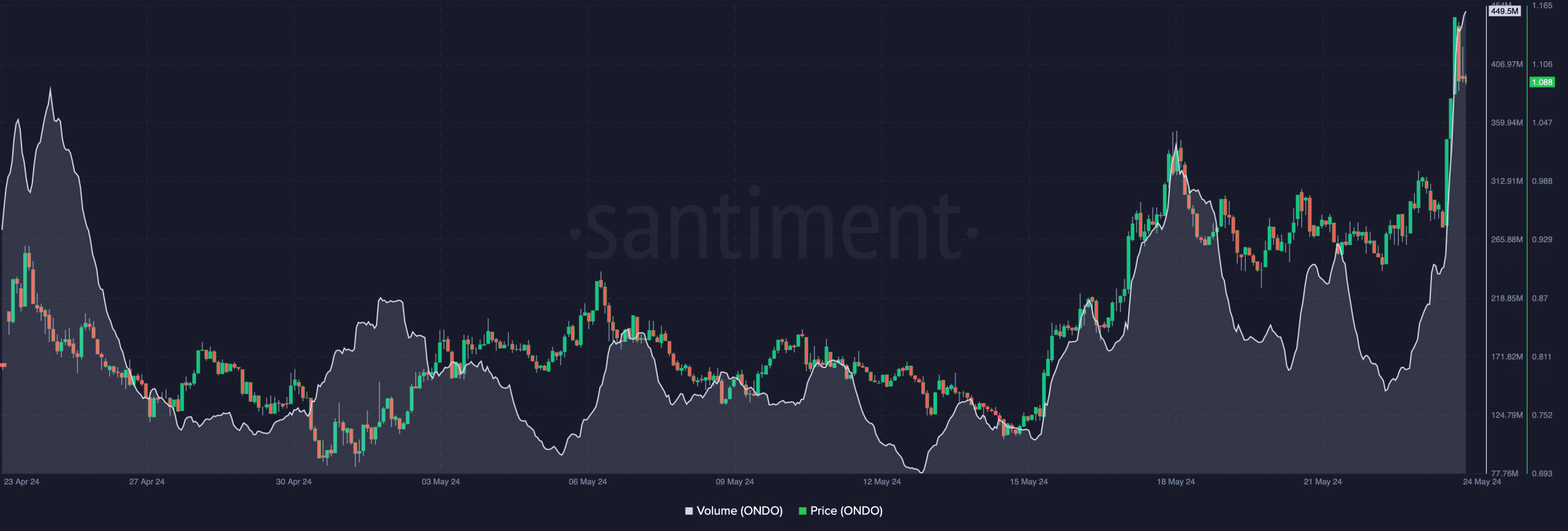

Moreover, AMBCrypto checked out ONDO’s quantity. At press time, information from Santiment confirmed that the metric hit a month-to-month excessive of $449.50 million.

Supply: Santiment

The increase in volume was proof of rising curiosity within the token. When positioned alongside the worth motion, the leap means that the worth of ONDO may rise larger within the brief time period.

Why the worth could also be set to hit $2

If that is so, it may commerce at $1.20 quickly. Nevertheless, if the amount falls whereas the worth rises, ONDO’s uptrend may change into weak. As such, a decline under the $1 mark may very well be subsequent particularly if profit-taking will get intense.

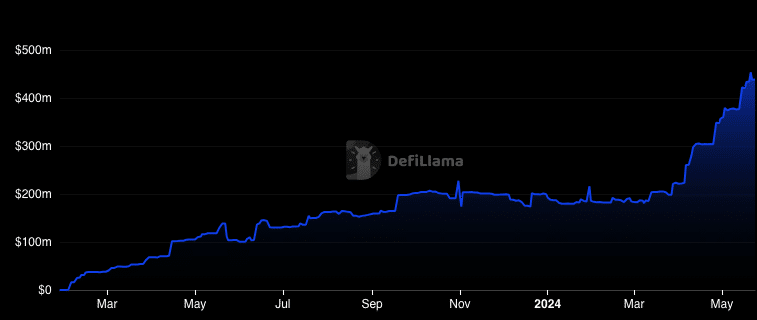

For the long-term potential, the Complete Worth Locked (TVL) may play an essential position. TVL reveals the greenback worth of belongings locked or staked within the challenge.

With this metric, one can measure how healthy the protocol is. If the TVL will increase, it means liquidity added to the protocol is spectacular, indicating a great degree of well being.

In the meantime, a decline indicated in any other case. In keeping with DeFiLlama, Ondo Finance’s TVL has elevated exponentially and was $438.42 million as of this writing.

This improve means that market members discovered the challenge reliable, with excessive expectations of a great yield. Going by the latest improve, the metric may hit $1 billion in a number of months.

Supply: DeFiLlama

Life like or not, right here’s ONDO’s market cap in ETH phrases

Ought to this be the case, ONDO’s worth may additionally profit, and an increase to $2 to $4 may very well be potential.

An evaluation of the challenge’s official web site confirmed that it provides a 5.20% yearly yield on U.S. greenback deposits and 4.96% on. U.S treasuries.