Ethereum ETFs approved! ETH prices to hike by 28% now?

- The U.S. SEC has permitted all of the functions for ETH spot ETF filed earlier than it.

- This approval has include a collection of anticipated impacts on the broader cryptocurrency market.

In a shocking flip of occasions, the U.S. Securities and Trade Fee (SEC) approved eight functions for spot Ethereum [ETH] exchange-traded funds (ETFs) on twenty third Could.

The regulator permitted 19b-4 kinds for the ETF functions filed by BlackRock, Constancy, Grayscale, Bitwise, VanEck, Ark, Invesco Galaxy, and Franklin Templeton.

Earlier than this week, it appeared that the SEC was unlikely to approve the Ethereum ETFs as a consequence of an absence of communication with issuers. Nevertheless, this modified earlier this week when the SEC started partaking with issuers and requested the submission of 19b-4 kinds.

This approval doesn’t, nevertheless, imply that spot ETH ETF will instantly develop into tradable. In a post on X (previously Twitter), Bloomberg ETF knowledgeable James Seyffart famous that ETF issuers should get their S-1 kinds permitted.

On the timeline for this, Seyffart mentioned:

“Sometimes, this course of takes months. Like as much as 5 months in some examples, however Eric Balchunas and I believe this shall be not less than considerably accelerated. Bitcoin ETFs have been not less than 90 days. “

Now that Ethereum ETF has been permitted…

Similar to with Bitcoin [BTC] spot ETF, the approval of ETH ETF is anticipated to result in substantial capital inflows.

In response to a Citi analysis, web inflows into BTC spot ETFs totaled $13 billion between 4th January, after they have been permitted, and twentieth Could.

These inflows led to a surge in BTC’s worth, pushing it to a brand new all-time excessive of $73,750 by 14th March. This instructed that the coin recorded a 6% worth enhance per $1 billion influx.

If comparable market-cap-adjusted flows are utilized to ETH, Citi estimates that inflows might vary between $3.8 billion and $4.5 billion, doubtlessly driving ETH costs up by 23%-28%.

In response to CoinMarketCap’s information, ETH exchanged fingers at $3,798 at press time. A 28% rally in worth would trigger it to trade fingers at $4,861.

This may characterize a worth stage nonetheless under its all-time excessive of $4,891, which the main altcoin recorded three years in the past.

Some analysts imagine that the spot ETF approval will push ETH’s worth previous its present all-time excessive.

Ethereum ETF to ship ETH to $10,000?

In a latest interview with Cointelegraph, Andrey Stoychev, the pinnacle of prime brokerage at Nexo, opined that ETF approvals could push ETH’s worth to $10,000 by the top of the yr.

Stoychev mentioned,

“ETH ETFs within the USA and comparable merchandise in Asia may very well be the motive force that helps the asset attain $10,000 by end-2024, catching up with Bitcoin’s efficiency post-ETF.”

Additional, there may be an ongoing debate about whether or not ETH spot ETF approval would end in an uptick in staking rewards on the Ethereum community.

In response to Matthew Sigel, the pinnacle of Digital Property at VanEck, yields throughout staking protocols will soar as ETH strikes from these protocols into these ETFs.

Nevertheless, this shift might have safety implications for the broader Ethereum ecosystem. If ETH stakers proceed to withdraw their beforehand staked cash and transfer them to the newly permitted ETFs, it might weaken the safety of the Ethereum community.

Safety on the Ethereum community depends on staked cash. Much less staked ETH might imply fewer validators securing the community, making it extra susceptible to assaults.

Alternatively, some imagine that this may not be a non-issue, arguing that ETH ETF could not ship sufficient returns to traders to entice stakers to maneuver their cash from staking protocols.

In a lately revealed report, CCData Analysis famous:

“Hypothetically, for those who had opened a 1000 ETH place on January 1st, 2023, with an ETF supplier, as a substitute of holding native Ether, which accrues staking rewards, you’d have missed out on features of over $200,000.”

Relating to the impression of this approval on the final cryptocurrency market, dealer, Bernstein, in a latest report it despatched to its consumer, had opined that the Biden administration may undertake a extra lenient perspective in the direction of crypto in anticipation of the November Presidential Elections.

Therefore, the regulator’s approval of the ETH spot ETF signifies a optimistic shift in its stance on the crypto sector.

Is your portfolio inexperienced? Try the ETH Revenue Calculator

The market up to now 24 hours

After the information of the approval broke, ETH’s worth climbed to a excessive of $3993 earlier than witnessing a 5% correction, inflicting it to trade fingers at $3,798 at press time.

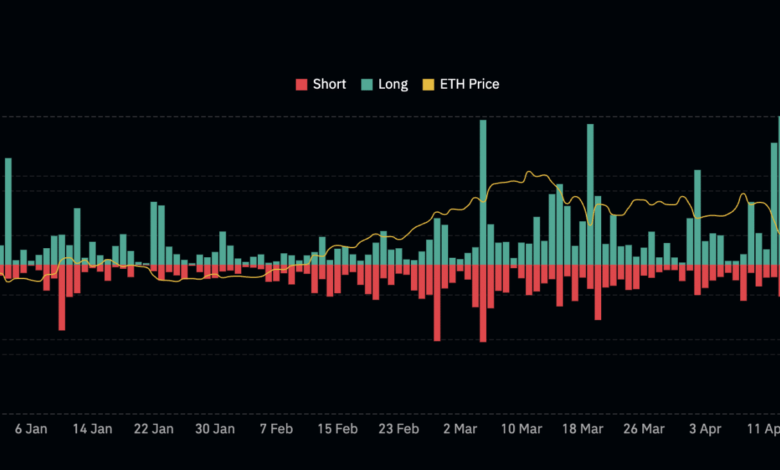

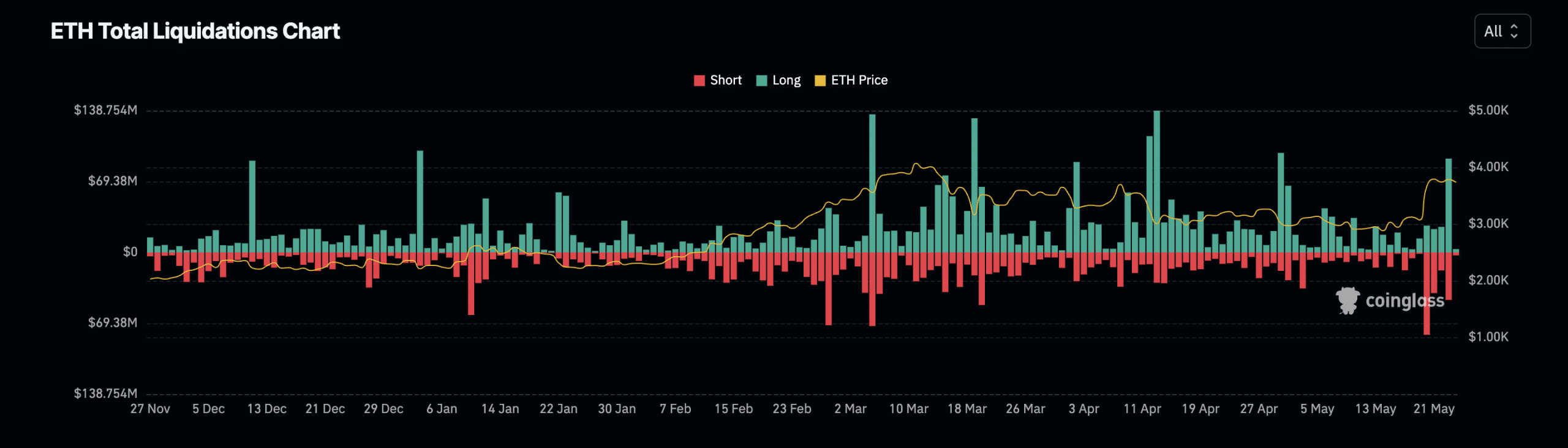

This worth plunge led to important liquidations of lengthy ETH positions, totaling $92 million, according to Coinglass information.

Supply: Coinglass